Key Takeaways

- 2025 marks a shift: ESG is now strategic.

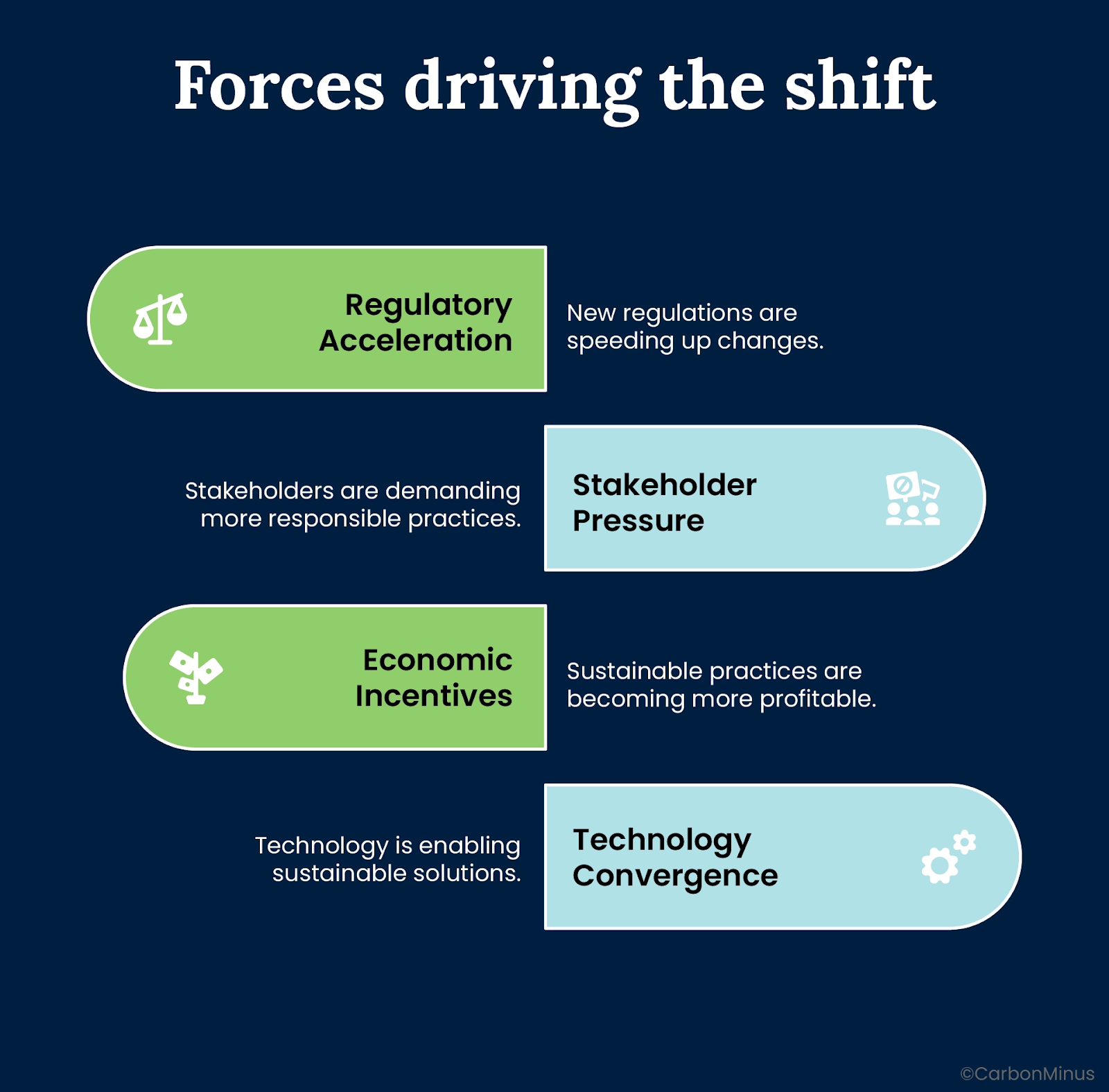

- Four forces are driving adoption, including regulation, pressure, cost, tech.

- Companies are climbing the sustainability maturity ladder fast.

- ESG performance now links directly to ROI and risk reduction.

- Winning strategies connect data, operations, and business goals.

- Cross-functional alignment is essential as ESG is everyone’s job.

- The opportunity is clear: lead the shift or fall behind.

Ask any COO in 2025 what’s keeping them up at night. You won’t hear “carbon footprint” or “compliance report.”

You’ll hear: “What’s our plan?”

Because sustainability isn’t a side project anymore. It’s core to how businesses operate, compete, and grow.

This didn’t flip overnight. It’s been coming — slow, then sudden. Laws got stricter. Costs went up. Investors started asking sharper questions. And technology caught up.

So, what now? The pressure’s not easing off. It’s compounding.

You can feel it in the boardroom. You see it in RFPs. You hear it in customer conversations.

Sustainability is not a checklist anymore. It’s a business lever. And the companies treating it that way are staying out of trouble, saving money, winning deals, and future-proofing faster than the rest.

This post breaks down what’s behind the shift, what it means for your business, and how to get in front of it before someone else does.

The Four Forces Driving the Shift

What’s driving the urgency around sustainability in 2025? It’s not a single trigger. It’s a stack of pressures that build on each other—legal, financial, social, and technological. Miss one, and you’re already behind.

Picture it like a pyramid. The wide base is built on big, external shifts — regulations, public expectations, rising costs. As you move up, the impacts hit closer to home: internal systems, operations, decision-making.

These four forces compound together and they’re moving fast.

a. Regulatory Acceleration: The New Rulebook

The age of voluntary disclosures is over. ESG rules now come with teeth.

In the EU, the Corporate Sustainability Reporting Directive (CSRD) covers about 50,000 companies including non-EU firms with significant operations there. That means mandatory ESG reporting across roughly 1,100 data points, with audit-level assurance and a hard look at Scope 3 emissions.

Global momentum is building fast. ISSB’s IFRS S1 and S2 are already being adopted across jurisdictions from Canada to Nigeria, creating a de facto global baseline for climate and sustainability reporting.

Add in double materiality and mandatory data assurance, and the message is clear: If you can’t measure it, verify it, and report it you’re out of step, and potentially out of market.

b. Stakeholder Pressure: The Unignorable Voice

Regulators aren’t the only ones watching. Everyone is.

Investors are channeling trillions into ESG-linked assets—$50 trillion by 2025, according to Bloomberg. Over 85% of institutional investors now factor ESG into their decisions.

Customers, both consumers and B2B buyers, are demanding proof, not promises. Surveys show 60–70% of consumers will pay more for sustainable products. Large buyers are baking ESG into supplier scorecards.

Employees want alignment too. Up to 70% of millennial and Gen Z workers say they’re more likely to join companies with a strong environmental stance. That affects recruitment, retention, and morale.

Greenwashing won’t cut it. People want receipts.

c. Economic Incentives: Sustainability Pays

The numbers are finally working in sustainability’s favor.

More than 2,000 companies globally use internal carbon pricing, assigning a real dollar value often $25–35 per tonne of CO₂e to emissions. That shapes investment, procurement, and operational decisions.

Governments are catching up. Over 70 carbon pricing schemes now exist worldwide, covering about 25% of global emissions, a figure that’s only rising.

There’s real money on the table. Firms aligned with the Science Based Targets initiative (SBTi) are already seeing gains from energy savings to supply chain efficiency.

And capital is flowing: sustainability-linked loans and bonds now top $1.5 trillion annually, with financial rewards tied directly to hitting ESG goals.

d. Technology Convergence: The Execution Engine

Scaling sustainability used to feel impossible—too much data, too many systems, not enough time. That’s changed.

Now, AI can sift through massive ESG datasets in seconds, spotting patterns no human analyst could find. In heavy industries, it’s already optimizing how factories use power, cool buildings, and ship goods.

IoT sensors give you eyes on everything, including energy use, emissions, and water waste in real time. No waiting for monthly reports. No blind spots.

And with automation, companies are ditching the spreadsheet chaos. Reporting gets faster. Audits get cleaner. Teams get to focus on action, not admin.

The tools exist. The edge comes from using them well. And the payoff goes far beyond compliance. ESG data is now fuel for predictive analytics, climate risk modeling, and new revenue opportunities.

Spending on ESG data platforms is expected to pass $5 billion by the end of 2025. The leaders are already invested.

How Leading Companies Operationalize Sustainability in 2025

By now, most companies get that sustainability matters. The pressure is loud and constant. But knowing it matters and knowing how to deliver are two very different things.

That’s the real gap in 2025.

A lot of organizations have made commitments. Some even built whole teams around them. But under the hood? Still messy. Still manual. Still fragmented.

You’ve seen it:

- Spreadsheets scattered across departments.

- Reports built in a panic just to meet a deadline.

- Sustainability goals that live in slide decks, not operations.

It’s not a lack of intent. It’s a lack of systems.

What separates leaders from everyone else is execution. And that doesn’t happen overnight, it’s a progression. We call it the Sustainability Maturity Ladder. Most companies are somewhere on it.

The smart ones are climbing.

Level 1: Ad-hoc and Reactive

This is where most companies started in the early 2020s. A few isolated pilot projects. Passionate individuals doing their best without much support. ESG data tracked in Excel—if at all. Efforts were mostly reactive, focused on checking the compliance box or easing investor pressure.

Level 2: Coordinated and Aware

Things began to click. Teams started collaborating. Companies picked up frameworks like CDP or GRI. But the data stayed siloed. Systems didn’t talk to each other. Ownership was fuzzy. Sustainability was part of the conversation but never the priority.

Level 3: Integrated and Strategic

This is where leading companies are today. Sustainability isn’t just aligned with business goals—it’s embedded in them. ESG metrics are tied to KPIs. Reporting is automated. Decisions are backed by real-time insights.

Verdantix estimates ESG data platform investment will hit $5 billion globally by the end of 2025. That’s not window dressing. It’s infrastructure.

Platforms like CarbonMinus give companies the edge, centralized data, predictive analytics, and operational visibility that goes far beyond compliance.

Level 4: Embedded and Driving Value

At this stage, sustainability isn’t an initiative—it’s how the company runs.

Product teams use ESG data to design smarter, more efficient offerings. Finance uses it to unlock better loan terms. The brand wins loyalty because people can see the difference. And the board isn’t asking for updates, they’re using sustainability insights to shape strategy.

These companies don’t react to regulation. They’re already two steps ahead.

What CarbonMinus Brings to the Table

If your data’s scattered, your reporting’s slow, or your teams are guessing instead of knowing—you’re not alone. That’s exactly what we fix.

Here’s how we help:

- We pull your data into one place—clean, connected, and reliable.

- We show you what’s happening in real time, not weeks later.

- We automate the stuff that drags your teams down, like audit trails and compliance reports.

- And we give you the tools to spot risk, find savings, and plan your next move with clarity.

You don’t have to overhaul everything at once. But you do need to stop working in the dark.

We’ll help you move faster with structure, insight, and zero guesswork. Know more at https://carbonminus.com/contact-us/.

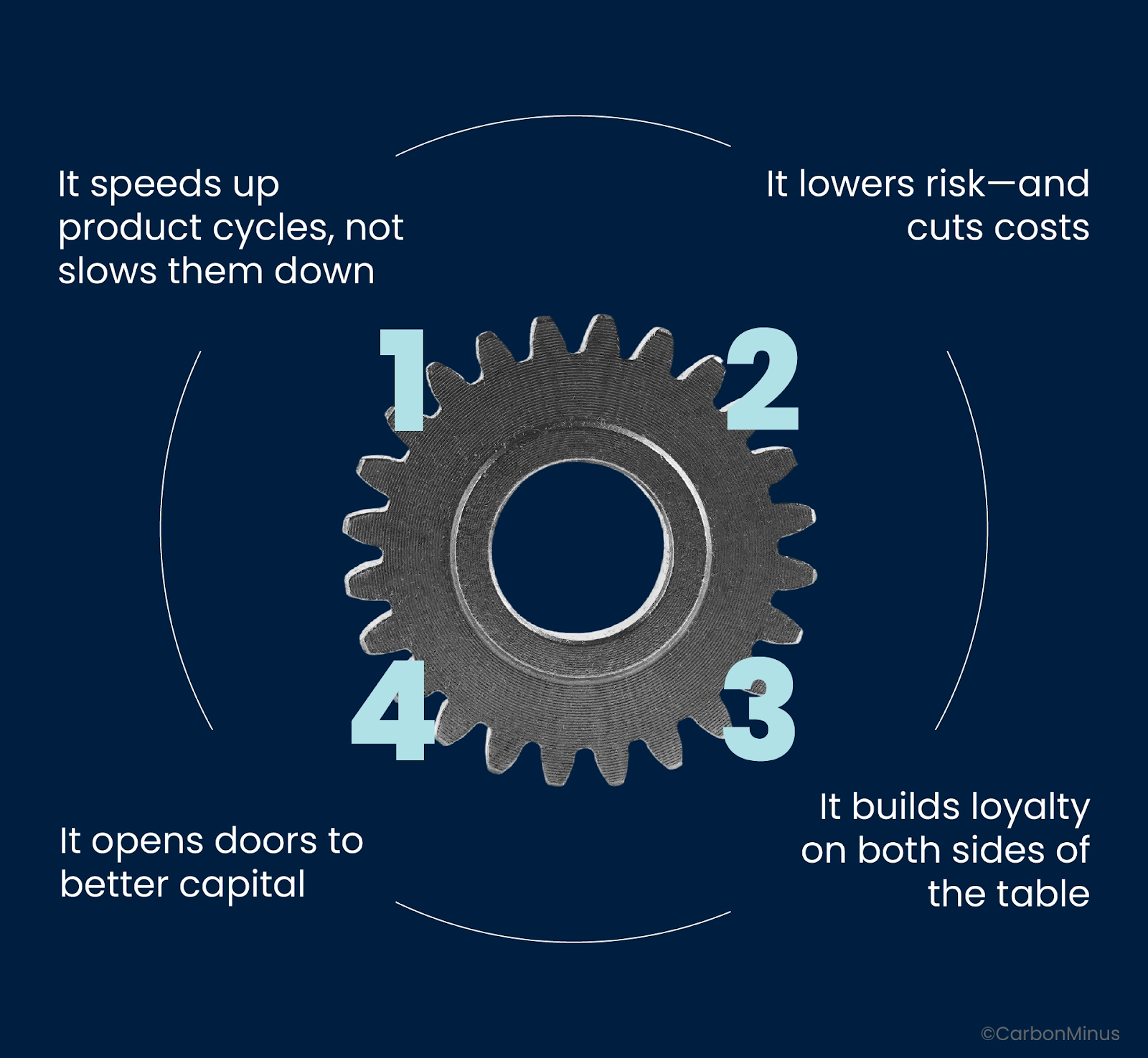

How Sustainability Drives Real Business Value

By this point, one thing is clear: companies aren’t investing in sustainability just to look good. They’re doing it because it works.

The old narrative—“do the right thing for the planet”—isn’t gone. But in 2025, it’s not the primary driver. What’s moving the needle now is economics.

And for business leaders, it’s not about whether sustainability has value. It’s where, how fast, and how much.

Compliance is the baseline. Strategic sustainability is the edge.

A meta-analysis from NYU Stern found that 58% of academic studies show a positive link between ESG performance and financial returns. It’s no longer a leap of faith. It’s a trackable advantage.

Here’s how companies are turning sustainability into value:

1. It speeds up product cycles, not slows them down

Some still think ESG slows down innovation. It doesn’t. When sustainability gets baked into R&D, teams build products that are cleaner, more efficient, and easier to market. Faster cycles. Higher margins. Less waste. That’s not idealism—it’s just better business.

2. It lowers risk—and cuts costs

Wasted energy? Lost margin.

Inefficient materials? That’s money out the door.

The World Economic Forum puts the upside of resource efficiency in the trillions. And the downside? Moody’s warns climate risks could cost the global economy $69 trillion by 2100. That’s not next century, that’s your lifetime.

Add in regulatory fines, disrupted supply chains, and unpredictable energy prices, and the risk math gets even clearer.

3. It builds loyalty on both sides of the table

Customers want receipts, not promises. Brands that prove their sustainability commitments are pulling ahead on reputation, retention, and revenue.

And it’s not just consumers. B2B buyers are now screening suppliers on ESG performance. If you can’t show progress, you’re off the shortlist.

4. It opens doors to better capital

ESG performance is now a financial lever.

Over 75% of CFOs say it helps lower the cost of capital (Deloitte).

ESG-linked loans and bonds have passed $1.5 trillion a year and they come with rate discounts for companies hitting their targets.

And the big investors, managing $50 trillion+ are building ESG into how they allocate funds.

If you’re serious about growth, ESG isn’t just a report. It’s a qualifier.

How to Make Sustainability Actually Work in 2025

So the value’s clear. The pressure’s real. Now what?

Most businesses aren’t short on ambition. They’re short on structure. The next step isn’t about making another commitment, it’s about building a system that delivers.

Here’s how forward-thinking companies are turning ESG pressure into performance and how you can do the same.

1. Start with clarity: Audit your sustainability posture

You can’t fix what you can’t see.

Begin with a hard look at your current state. Where’s your data coming from? What’s missing? Are you covering Scope 1, 2, and 3 emissions or just scratching the surface?

Regulations like CSRD and ESRS require you to report across 1,100+ data points. Scope 3 alone can represent up to 90% of total emissions. If your data is incomplete or unverifiable, you’re already exposed.

2. Integrate tools: Stop relying on spreadsheets

Manual reporting doesn’t scale. Neither does chasing teams for updates.

Leaders are moving to centralized platforms that automate ESG data collection, track metrics in real time, and generate audit-ready reports without the scramble.

CarbonMinus makes this practical. Our platform connects to your existing systems and devices, no rip-and-replace needed. You get a single source of truth across energy, emissions, water, waste, and asset performance.

Know more at https://carbonminus.com/contact-us/.

3. Link ESG metrics to real business goals

Sustainability in a silo doesn’t last. Tie it directly to what the business already cares about cost control, risk reduction, capital access.

Set targets that show up in OPEX savings, improved margins, regulatory scorecards, and supply chain compliance. ESG isn’t a separate track because it’s part of how the company wins.

The most effective firms track ESG the same way they track performance: with KPIs, dashboards, and measurable ROI.

4. Build cross-functional alignment

Sustainability isn’t only the CSO’s job anymore.

It’s operations. Finance. Procurement. Legal. IT. Each function touches the data and owns part of the outcome.

The companies that are ahead in 2025 have ESG woven into the day-to-day. They’ve trained teams. Clarified roles. And set clear incentives.

Over 2,000 companies globally now use internal carbon pricing to shape investment decisions.

5. Shift from reporting to foresight

Compliance is just the start. Leading companies use ESG data for more than box-ticking.

They’re modeling climate risk. Forecasting supply chain disruption. Finding efficiency gaps before they become costs. The companies investing in ESG data platforms (expected to hit $5B+ globally by end of 2025) aren’t doing it for optics, but they’re doing it to move faster, smarter, and with less risk.

Stop Treating ESG Like a Burden. Start Treating It Like a Strategy

You’ve seen the shift. You’ve felt the pressure. And you know what to do.

Sustainability isn’t limited to reporting or compliance anymore. It’s about building a business that can withstand volatility, attract capital, and stay ahead of rising expectations from regulators, customers, and your own boardroom.

2025 isn’t a waiting game. It’s a sorting moment.

The companies that act now, who build the systems, unify the data, and link ESG to real business performance, are the ones who’ll lead. The rest will be catching up, explaining missed targets and lost contracts.

The upside is real:

- Trillions in efficiency gains, according to the World Economic Forum

- Access to $1.5T+ in sustainability-linked finance

- Lower operational risk and stronger brand value

- Better retention, faster innovation, and cheaper capital

FAQs

Why is 2025 such a big deal for sustainability?

Because the game changed. ESG isn’t a checkbox anymore, as it’s tied to investment, regulation, and risk. If you’re not tracking it properly, you’re exposed. If you are, you’re ahead.

What’s actually different now?

For starters, regulations got real. CSRD alone affects 50,000 companies and expects audit-ready ESG data. Stakeholders are louder. Tech caught up. And Scope 3 reporting? It’s no longer optional in many industries.

What’s behind the shift?

Four things, working together: tighter laws, rising expectations, financial pressure, and tech that finally makes ESG doable at scale. They’re not isolated and they reinforce each other.

How can you tell where your company stands?

Ask yourself: Is sustainability owned by one team or integrated across the business? Are you tracking in spreadsheets or using real data? If you’re still chasing down reports each quarter, you’re behind. If your ESG metrics show up in board meetings, you’re likely ahead.

Is this really about money or just image?

It’s about money. Cost savings from efficiency. Lower risk. Better loan terms. More contracts won. ESG isn’t window dressing anymore—it’s a qualifier for access and growth.

What should you focus on first?

Fix the basics. Get your ESG data in order. Figure out what you’re missing. Stop relying on patchwork systems. And make sure your metrics tie back to business goals—otherwise, it won’t stick.