Key Takeaways

- ₹1,000 crore ADEETIE: 3-5% interest subsidies through March 2028

- Small enterprises save ₹35 lakh; medium enterprises save ₹2+ crore

- 14 sectors. ₹10L-₹15Cr loans. Free audits require 10% savings

- Stacking ISO 50001, carbon credits multiplies value 5-10x. ₹2-3cr potential

- First-come basis. 2-3 month process. Apply early before funds deplete

While Rajesh Patel sleeps at 2 AM in his Pune office, the electricity meter spins outside his foundry. Another ₹15,000 gone by morning. Another month where energy costs eat 28% of his revenue. Another time he wonders if his grandfather’s business will survive until his son graduates.

Three hundred kilometers away in Ahmedabad, Rajesh’s competitor just installed energy-efficient furnaces using a ₹25 lakh loan. The interest rate? Five percent lower than what banks usually charge. The energy savings? Twenty-three percent in the first quarter. The government program that made it possible? Something called ADEETIE.

Rajesh has never heard of it.

He is not alone. While 354 Indian MSMEs have already tapped into a ₹435 crore project pipeline, thousands of business owners like Rajesh continue paying full interest rates on equipment loans and watching energy bills climb. The government allocated ₹1,000 crore for this exact problem, yet most MSMEs remain unaware the money exists.

This gap between available support and business awareness costs Indian manufacturers roughly ₹35 lakh per enterprise over five years. For medium-sized units, that number crosses ₹2 crore. The scheme runs only until March 2028, which means the window is closing while the meter keeps spinning.

Here is everything you need to know about accessing this subsidy before your competitors capture what remains in the pool.

What the Government Just Put on the Table

On July 15, 2025, the Ministry of Power launched the ADEETIE scheme through the Bureau of Energy Efficiency. The full name is Assistance in Deploying Energy Efficient Technologies in Industries and Establishments, but what matters is the ₹1,000 crore budget allocated through fiscal year 2027-28.

Where the Money Goes

The money breaks down into three buckets. The largest chunk, ₹875 crore, goes directly to interest subvention for MSMEs taking loans to install energy-efficient equipment. Another ₹50 crore covers free energy audits so you know exactly where your factory bleeds energy. The remaining ₹75 crore funds implementation support and monitoring, which means technical assistance when you actually install the equipment.

₹875 crore for interest subsidies. ₹50 crore for free energy audits. ₹75 crore for implementation support. Total allocation: ₹1,000 crore through March 2028.

The government expects this ₹1,000 crore to mobilize ₹9,000 crore in total investment, with ₹6,750 crore coming from MSME lending. Think of it as a lever. Every rupee the government puts in pulls nine rupees of private capital into energy efficiency upgrades.

Who Already Captured Their Share

Right now, 354 projects worth ₹435 crore have already entered the pipeline across 36 states. The question is whether your business will be among the next hundred or among the thousands who discover this scheme after the funds run dry.

The Math That Changes Everything

Let’s say you run a small foundry in Maharashtra. You need ₹20 lakh for an energy-efficient induction furnace. Your bank quotes 10% interest, which is standard for MSME loans.

Small Enterprise Example: The ₹20 Lakh Loan

Under ADEETIE, micro and small enterprises receive a 5% interest subsidy. Your effective interest rate drops to 5%. That single change saves you ₹1 lakh every year for five years. Your total interest savings over the loan period hit ₹5 lakh.

But the interest subsidy is only the beginning. The new furnace reduces your energy consumption by at least 10%, which is the minimum required to qualify for the scheme. If your annual energy bill runs ₹50 lakh and you achieve even a conservative 20% reduction, you save ₹10 lakh every year on electricity alone.

Year One Benefit: ₹11 lakh (₹1 lakh interest savings + ₹10 lakh energy savings)

Five-Year Cumulative: ₹55 lakh

Add those two numbers together. In year one, you pocket ₹11 lakh between interest savings and energy cost reduction. Over five years, assuming energy costs remain flat (they won’t, they will rise), your cumulative benefit reaches ₹55 lakh. That’s nearly three times your initial investment returning to your bottom line.

Medium Enterprise Example: The ₹1 Crore Investment

Now consider a medium-sized chemical unit borrowing ₹1 crore for HVAC and compressor optimization. Medium enterprises receive a 3% subsidy instead of 5%. At a 10% base rate, that subsidy saves ₹3 lakh annually or ₹15 lakh over five years.

If this unit spends ₹1.5 crore yearly on energy and achieves a 25% reduction, the annual energy savings hit ₹37.5 lakh. First-year benefit totals ₹40.5 lakh. Five-year cumulative benefit exceeds ₹2 crore.

Medium Enterprise Five-Year Benefit: ₹2+ crore from interest savings and energy reduction combined

These are not theoretical projections. They reflect the same calculation methodology that 354 approved projects used when applying. The numbers work because energy costs in Indian manufacturing typically consume 10% to 30% of total production expenses. Even modest efficiency gains translate to substantial savings.

Who Gets In and Who Gets Left Out

The 14 Eligible Sectors

The scheme targets 14 energy-intensive MSME sectors where efficiency improvements deliver maximum impact. The list includes brass, bricks, ceramics, chemicals, fishery, food processing, forging, foundry, hand tools, iron and steel, non-ferrous metals, pulp and paper, textiles, and wood products.

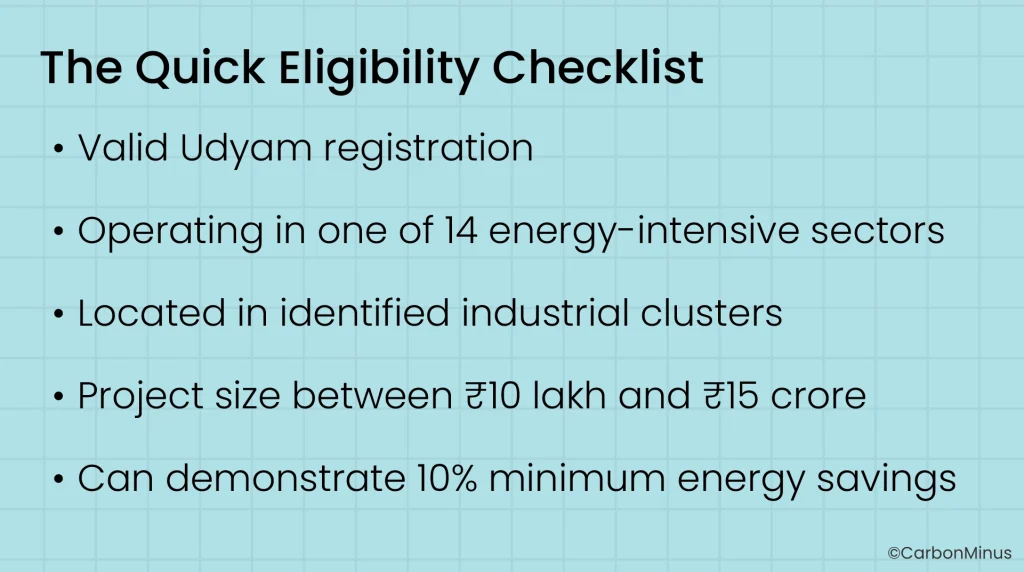

What You Need to Qualify

To qualify, your enterprise needs valid Udyam registration, which most MSMEs already have for accessing government programs. Your project size must fall between ₹10 lakh and ₹15 crore. You must operate in one of 60 identified industrial clusters in Phase 1, with 100 additional clusters coming in Phase 2.

The technical requirement is straightforward. Whatever technology you choose to install must demonstrate at least 10% energy savings compared to your current baseline. The Bureau of Energy Efficiency provides free Investment Grade Energy Audits to establish that baseline and identify which upgrades will hit the 10% threshold.

Where the Action Is Happening

Here is where uptake concentrates right now. Gujarat leads with 13 projects representing ₹74.8 crore in investment potential. Tamil Nadu also has 13 projects worth ₹55 crore. Andhra Pradesh has the highest project count at 39, though at a lower per-project investment of ₹44.2 crore. Telangana shows 14 projects worth ₹38.9 crore, while Maharashtra has 39 projects totaling ₹37.5 crore.

| State | Projects | Investment Potential |

| Gujarat | 13 | ₹74.8 crore |

| Tamil Nadu | 13 | ₹55.0 crore |

| Andhra Pradesh | 39 | ₹44.2 crore |

| Telangana | 14 | ₹38.9 crore |

| Maharashtra | 39 | ₹37.5 crore |

Notice the pattern. States with strong industrial clusters and active MSMEs associations show higher awareness and uptake. States where information flows through peer networks see more applications. The scheme is available nationwide, but knowledge of its existence remains concentrated.

If you operate in one of these 14 sectors and your state appears on the uptake list, your industry peers are already moving. If your state shows low numbers despite having eligible industries, you face either an information gap or a first-mover advantage, depending on how quickly you act.

Why You Never Heard About This Until Now

The Awareness Gap Is Real

Research from the Council on Energy, Environment and Water shows that most MSMEs remain unaware of effective energy monitoring methods and do not participate in energy efficiency workshops. Only 16% of Indian MSMEs access formal banking systems where relationship managers might mention such schemes. The India MSME credit gap stands at ₹20 to ₹25 trillion, which means most businesses operate outside the formal financial channels where information about government programs typically flows.

Only 16% of Indian MSMEs access formal banking systems where they might learn about schemes like ADEETIE. The remaining 84% operate in an information vacuum.

Three Layers of the Information Problem

The awareness problem has three layers. First, government schemes lack formal dissemination mechanisms that reach MSMEs directly. Announcements happen through press releases and official portals, but few business owners monitor these channels daily.

Second, MSMEs lack technical expertise to evaluate which energy-efficient technologies actually work, creating hesitation even when they hear about available support.

Third, financial institutions perceive energy efficiency investments as high risk, so banks lack incentive to actively promote these loans despite the government subsidy.

The Documentation Barrier

Add the documentation burden and institutional capacity issues. Most MSME owners wear multiple hats as CEO, CFO, and operations manager simultaneously. Applying for government schemes requires dedicated personnel and time that small businesses simply do not have. Previous negative experiences with delayed approvals or rejected applications create skepticism about whether new programs will actually deliver.

The result is a gap between policy and practice. The government allocates ₹1,000 crore, yet thousands of eligible businesses continue struggling with energy costs because they never learned the support exists. Industry associations help, but information spreads slowly through peer networks. By the time awareness reaches critical mass, early movers have already captured significant portions of the allocated funds.

This explains why 354 projects entered the pipeline while you are reading about ADEETIE for the first time. The information traveled through specific channels that reached them but not you. Until now.

The 5% Solution Everyone Misses

Most MSMEs who learn about ADEETIE focus entirely on the interest subsidy. They calculate the ₹1 lakh or ₹3 lakh in annual savings, run the numbers past their chartered accountant, and make a decision based on that single benefit.

They miss the multiplier effect.

Layer One: Interest Subsidy (The Obvious Part)

Start with that ₹20 lakh loan for a small enterprise. The 5% interest subsidy saves ₹1 lakh annually or ₹5 lakh over five years. That’s layer one.

Layer Two: Energy Savings (The Required Part)

Layer two comes from the energy savings themselves. The 10% minimum requirement for ADEETIE eligibility is just the floor. Bureau of Energy Efficiency data shows that implementing energy-efficient technologies in these 14 sectors typically delivers 30% to 50% energy reduction. Even if you hit only 20% savings on a ₹50 lakh annual energy bill, you pocket ₹10 lakh every year. Over five years, that’s ₹50 lakh returning to your business.

BEE data shows 30% to 50% energy reduction is achievable. The 10% minimum requirement is just the floor, not the ceiling.

Layer Three: ISO 50001 Certification (The Export Unlock)

Layer three involves ISO 50001 certification. European buyers increasingly require this energy management certification for export contracts. The government provides MSME subsidies covering 75% of certification costs up to ₹75,000, which means ₹56,250 in direct support.

More importantly, foundries with ISO 50001 certification access $4 million more in financing because banks view certified operations as lower risk.

Layer Four: Carbon Credits (The Hidden Revenue Stream)

Layer four taps into carbon credits. Energy efficiency projects generate verifiable emission reductions that qualify for carbon credit trading. The PAT Cycle I scheme generated ₹100 crore in ESCert trading. Under the new CCTS framework, compliant industrial units have potential to earn ₹2 to ₹3 crore annually from carbon credits.

Layer Five: ESG Financing (The Capital Advantage)

Layer five opens ESG financing channels. Banks and financial institutions increasingly offer sustainability-linked loans at preferential rates for businesses demonstrating measurable environmental improvements. Energy-efficient MSMEs with proper monitoring infrastructure qualify for these instruments, further reducing their cost of capital.

The Total Value Stack

Add them up. Year one delivers ₹1 lakh in interest savings, ₹10 lakh in energy savings, and ₹56,250 from ISO subsidy, totaling roughly ₹11 lakh. By year five, you accumulate ₹55 lakh just from the first two layers. Factor in carbon credits over a five-year horizon and the total value creation approaches ₹65 lakh or more.

The Value Multiplication:

- Interest subsidy alone: ₹5 lakh over 5 years

- Add energy savings: ₹55 lakh over 5 years

- Add ISO certification: ₹56,250 one-time

- Add carbon credits: ₹2-3 crore potential over 5 years

- Total possible value: ₹65 lakh to ₹3+ crore

For a medium enterprise borrowing ₹1 crore with higher energy consumption, the multiplier effect becomes even more dramatic. The stacking strategy can generate ₹10 to ₹30 crore in total value over five years when carbon credits and ESG financing benefits fully materialize.

ADEETIE is not a standalone subsidy. It is a gateway that unlocks access to an entire ecosystem of financial support for energy efficiency and sustainability.

The key insight is that ADEETIE is not a standalone subsidy. It is a gateway that unlocks access to an entire ecosystem of financial support for energy efficiency and sustainability. Treating it as just an interest rate reduction captures maybe 20% of the available value. The other 80% sits waiting for businesses sophisticated enough to see the full picture.

Your 5-Step Path From Awareness to Approval

Step One: Verify Your Eligibility Today

Check your Udyam registration status at udyamregistration.gov.in. Confirm your sector appears in the 14 eligible categories. Identify whether your enterprise classification falls under micro, small, or medium. Verify that you operate in one of the 60 Phase 1 clusters, though Phase 2 will expand this to 100 additional locations.

Time required: 20 minutes

This step takes 20 minutes and determines whether you can proceed. If your Udyam registration lapsed, renewal should be your immediate priority. If you operate outside the current 60 clusters but Phase 2 will cover your location, you can prepare your application now for faster processing when your cluster opens.

Step Two: Request Your Free Energy Audit This Week

The Bureau of Energy Efficiency provides Investment Grade Energy Audits at no cost to participating MSMEs. These audits establish your baseline energy consumption and identify which technologies will deliver the required 10% savings minimum.

Time required: 2-3 weeks from application to completed audit

Submit your Expression of Interest through adeetie.beeindia.gov.in. BEE-empaneled auditors will visit your facility and conduct a detailed assessment. This typically takes two to three weeks from application to completed audit report.

What the audit gives you:

- Your exact current energy consumption by equipment

- Which specific upgrades will qualify under ADEETIE

- Realistic projections for total energy savings (often 20-30%)

Step Three: Identify Your Technology Investments Within Two Weeks

Based on audit findings, shortlist eligible equipment. Common options include energy-efficient motors and drives, HVAC optimization systems, LED lighting upgrades, waste heat recovery systems, variable frequency drives, and high-efficiency compressors. The specific choices depend on your sector and current equipment age.

Focus on the highest ROI technologies first. A ₹20 lakh furnace upgrade that cuts energy consumption 25% typically pays back faster than a ₹5 lakh lighting retrofit that saves 8%. Your audit report will include ROI calculations for different scenarios.

Make sure your selected project falls within the ₹10 lakh to ₹15 crore loan range. If you need ₹18 lakh, you can structure the project to include related equipment that brings the total above ₹20 lakh, as long as everything contributes to the 10% energy savings target.

Step Four: Secure Your Detailed Project Report Within One Month

The Bureau of Energy Efficiency provides support for developing Detailed Project Reports. Your DPR must include baseline energy consumption, projected energy savings with supporting calculations, technology specifications, investment requirements, and financial viability analysis.

This document serves two purposes:

- Proves to BEE that your project meets ADEETIE requirements

- Gives your bank the data needed to approve the loan

A well-prepared DPR significantly improves approval rates because it removes uncertainty about projected outcomes. Most MSMEs engage consultants to prepare DPRs because the technical documentation requires specific formatting and calculations. The ₹75 crore allocated for implementation support covers this technical assistance.

Step Five: Apply Through Participating Banks

With your DPR complete, approach BEE-empaneled financial institutions. Submit your loan application along with the DPR, audit report, and proof of ADEETIE eligibility. Explicitly mention that you are applying under the ADEETIE scheme for interest subvention benefits.

Processing time: 4-8 weeks depending on lender and loan size

Banks process these applications like standard equipment loans but with additional documentation requirements for BEE reporting. Processing typically takes four to eight weeks depending on the lender and loan size. Smaller loan amounts often move faster through approval cycles.

Once approved, the bank disburses funds and you proceed with equipment installation. After installation, you enter the Monitoring and Verification phase where BEE tracks whether your project achieves the projected 10% energy savings. This M&V requirement continues throughout the subsidy period.

Complete timeline from Expression of Interest to loan approval: 2-3 months for straightforward projects

The complete timeline from Expression of Interest to loan approval averages two to three months for straightforward projects. More complex installations requiring multiple technology integrations may take four to five months. Starting now positions you to have equipment operational and delivering savings before the next fiscal year.

Why Three Months From Now Might Be Too Late

The Fund Depletion Math

The ₹875 crore interest subvention pool is finite. As of December 2025, 354 projects representing ₹435 crore have already entered the pipeline. Simple math shows that roughly half the allocated funds remain available for new applicants.

BEE processes applications on a continuous basis rather than in fixed rounds. First come, first served until funds exhaust. This creates a scenario where the scheme can reach capacity before its official March 2028 end date if application volume accelerates.

The Awareness Tipping Point

Consider what happens when awareness spreads. Industry associations will eventually circulate information about ADEETIE to all members. Banking relationship managers will start actively promoting these subsidized loans once they understand the program. Articles and case studies will multiply as early adopters share their success stories. Each of these information channels will trigger new applications from previously unaware MSMEs.

The tipping point where demand exceeds supply could arrive in mid-2026 or early 2027 if uptake accelerates. Once that happens, the scheme effectively closes even though the official deadline remains distant. Late applicants receive rejection notices stating that allocated funds have been fully committed.

The Monthly Cost of Hesitation

Beyond the fund depletion risk, consider the opportunity cost of delay. Every month you wait means another ₹8,333 in interest savings lost on that ₹20 lakh loan example [Section 8 outline]. You continue paying full energy bills while more efficient competitors reduce their cost per unit produced.

The cost of waiting:

- 6 months delay = ₹50,000 permanently lost

- 1 year delay = ₹1 lakh+ gone forever

- 2 years delay = ₹2 lakh+ with compounding

The scheme also provides maximum benefit to early implementers. Your subsidy runs for five years from loan disbursement. Starting in late 2025 gives you the full five-year window. Starting in 2027 might mean the subsidy ends in 2028 when the overall scheme closes, giving you only one or two years of benefit instead of five.

The Competitive Dynamics Shift

Early adopters gain an additional strategic advantage. They reduce their cost structure before competitors, allowing them to either price more aggressively for market share or maintain current pricing while improving margins. By the time late movers install similar equipment, the competitive dynamics have already shifted.

When your customer compares your quote against a competitor who already cut energy costs by 20%, you lose on price even if both businesses have similar capabilities.

Industrial procurement works through long-term contracts. When your customer compares your quote against a competitor who already cut energy costs by 20%, you lose on price even if both businesses have similar capabilities. The competitor who moved first locks in orders. You fight for scraps in the remaining market.

The math is straightforward. Three hundred fifty-four MSMEs recognized the opportunity and acted. Thousands more remain unaware or undecided. Half the funds still sit available. But as information spreads and application volume grows, that runway shortens daily.

The question is whether you capture this opportunity while it still exists or explain to your CFO next year why competitors access subsidies that you missed.

The Implementation Gap No One Talks About

What ADEETIE Provides vs. What You Actually Need

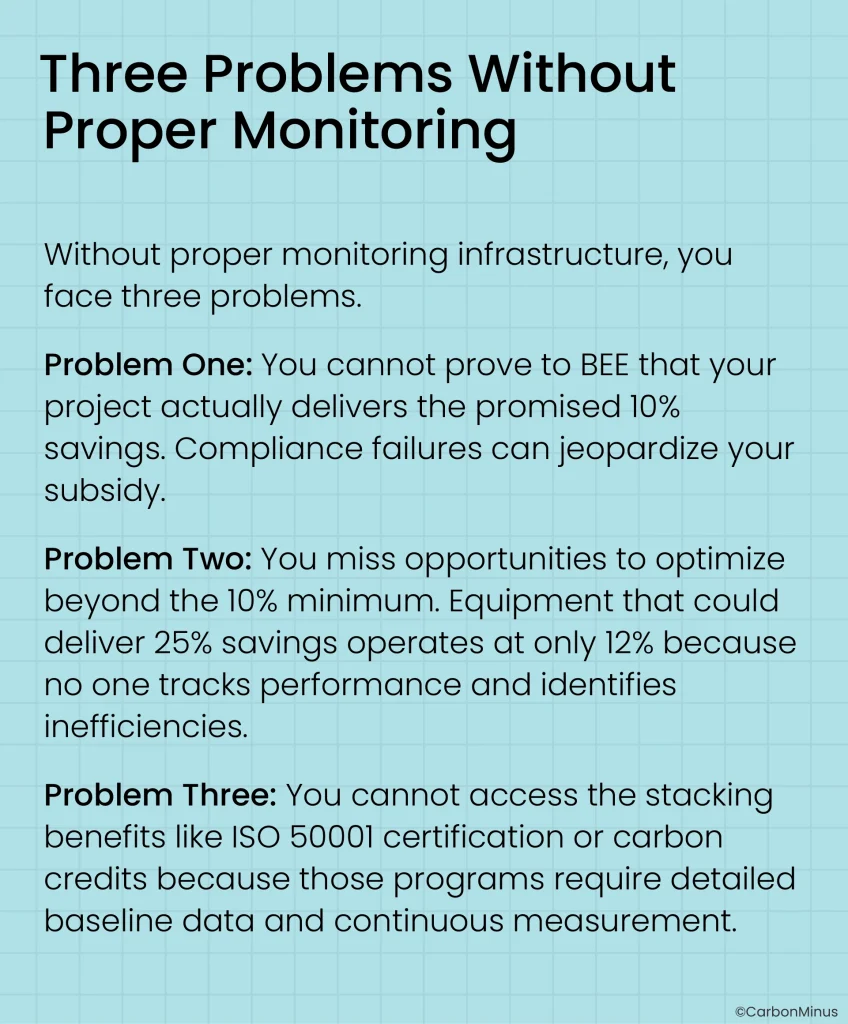

ADEETIE provides interest subsidies, free audits, DPR support, and monitoring frameworks. What it does not provide is the ongoing infrastructure needed to maximize the value of your energy-efficient equipment after installation.

The scheme requires proof of 10% energy savings to maintain compliance. That means continuous monitoring, data collection, and verification throughout the subsidy period. Most MSMEs lack the systems to track energy consumption in real time or generate the automated reports that M&V demands.

The gap between securing ADEETIE approval and maximizing its implementation is where most MSMEs leave substantial value uncaptured.

The Infrastructure Solution

The solution requires energy management platforms that integrate with installed equipment to provide real-time visibility, automated compliance reporting, and continuous optimization recommendations. Hardware-agnostic systems work with whatever energy-efficient technology you install through ADEETIE, collecting data from meters, sensors, and control systems.

These platforms address the M&V compliance requirement automatically, generating the reports BEE needs without consuming weeks of staff time. They also identify further optimization opportunities that push your savings from 10% toward 30% or beyond. Most importantly, they create the documented baseline required for ISO 50001 certification and the verified emission reductions needed for carbon credit eligibility.

Real Implementation Results

CarbonMinus has implemented energy management infrastructure for over 70 MSMEs across manufacturing sectors. These implementations average 15% to 30% energy savings while providing automated compliance documentation.CarbonMinus-Sales-Deck-V1-1.pdf

Case Example: One chemical manufacturer reduced electric distribution losses by 60%, saving 604,928 kWh annually with monetary benefits of ₹94 lakh. These outcomes exceed ADEETIE minimum requirements because continuous monitoring enables continuous improvement.CarbonMinus-Sales-Deck-V1-1.pdf

The platform approach transforms ADEETIE from a one-time subsidy into a sustained transformation. You capture the interest savings, achieve the required 10% energy reduction, maintain M&V compliance, stack ISO 50001 certification, qualify for carbon credits, and access ESG financing. The infrastructure costs less than three months of energy savings but unlocks five to ten times more total value over the project lifecycle.

Minimum Viable vs. Maximum Value

Without this infrastructure layer, you risk treating ADEETIE as a standard equipment loan with slightly better interest rates. The legal minimums get met. The full potential remains unrealized.

With proper implementation support, the same initial investment delivers outcomes that transform your cost structure and competitive position.

The choice is whether you implement ADEETIE at the minimum viable level or at the maximum value level. Both options satisfy the program requirements. Only one captures the full ₹35 lakh to ₹2 crore opportunity that proper implementation enables.

What Happens Next

Three hundred fifty-four MSMEs have already started their ADEETIE journey. Your competitors in neighboring states or industrial clusters may be among them. Each passing month reduces the ₹875 crore pool available for new applicants. Each quarter you delay permanently forfeits interest savings and energy cost reductions that competitors capture.

The Barrier Is Not What You Think

The barrier is not eligibility. If you operate in one of 14 energy-intensive sectors with valid Udyam registration, you likely qualify.

The barrier is not complexity. Bureau of Energy Efficiency provides free audits, DPR support, and implementation assistance specifically to help MSMEs navigate the process.

The barrier is awareness and action. Now you have awareness. What remains is action.

Your Starting Point

Start by verifying your Udyam registration today. The 20 minutes you invest checking eligibility determines whether ₹35 lakh in cumulative benefits over five years is accessible or theoretical. Tomorrow, submit your Expression of Interest through adeetie.beeindia.gov.in to request your free energy audit.

If you need support understanding which technologies deliver 10% savings in your specific operation, schedule a consultation to review your facility’s energy profile. If you need infrastructure to ensure M&V compliance and capture stacking benefits, explore energy management platforms designed for MSME implementation.

The Resources Are Already Allocated

The government allocated ₹1,000 crore to solve the exact problem that keeps you awake at 2 AM watching electricity meters spin. The application process is open. The funds remain available. The support systems exist to help you navigate from awareness to implementation.

What separated the 354 approved projects from thousands of other eligible MSMEs was not capability or qualification. It was information and timing. They learned about ADEETIE early enough to act while funds remained abundant. They moved from awareness to application before hesitation turned into delay.

The Decision Point

You now have the same information they had. The question is whether you make the same decision they made or the decision that thousands of eligible businesses will regret in 2027 when they discover that ₹1,000 crore existed but no longer remains available.

Your competitors are moving. The clock runs until March 2028 or until funds deplete, whichever comes first. Every kilowatt-hour consumed at current rates represents value left uncaptured.

Your competitors are moving. The clock runs until March 2028 or until funds deplete, whichever comes first. The meter outside your facility continues spinning. Every kilowatt-hour consumed at current rates instead of reduced rates through energy-efficient equipment represents value left uncaptured.

The choice is whether Rajesh Patel’s story ends with him reading about ADEETIE for the first time in 2027 after his competitor already cut energy costs by 25%, or whether it ends with him submitting his Expression of Interest this week while half the allocated funds still sit waiting for smart MSMEs to claim them.

The ₹1,000 crore exists. The question is who captures it.

Take Action Today

Ready to explore how your facility qualifies for ADEETIE and what energy savings you can realistically achieve?

Schedule a free 30-minute energy assessment to review your baseline consumption, identify eligible technologies, and map your path from application to implementation.

FAQs

1. How do I know if my business qualifies for ADEETIE?

You need valid Udyam registration, operate in one of 14 energy-intensive sectors (foundry, chemicals, textiles, etc.), fall within the ₹10 lakh to ₹15 crore loan range, and be located in identified industrial clusters. Your project must demonstrate minimum 10% energy savings through BEE’s free audit.

2. What is the actual interest subsidy I will receive?

Micro and small enterprises receive 5% interest subsidy for five years. Medium enterprises receive 3% subsidy. On a ₹20 lakh loan at 10% base rate, small enterprises save ₹1 lakh annually or ₹5 lakh over five years.

3. Do I have to pay for the energy audit?

No. The Bureau of Energy Efficiency provides Investment Grade Energy Audits completely free to ADEETIE applicants. The ₹50 crore allocated for audits covers this cost. You submit an Expression of Interest and BEE-empaneled auditors assess your facility.

4. How long does the application process take?

From Expression of Interest to loan approval typically takes two to three months. The energy audit takes two to three weeks. DPR preparation takes three to four weeks. Bank processing takes four to eight weeks depending on loan size and lender.

5. What happens if my project does not achieve 10% energy savings?

The Monitoring and Verification process tracks your actual savings. If you fail to meet the 10% minimum, your subsidy could be jeopardized. This is why proper implementation with real-time monitoring infrastructure is critical to ensure compliance throughout the subsidy period.

6. Can I apply if funds have already been allocated to 354 projects?

Yes. The ₹875 crore interest subsidy pool is processed on a first-come, first-served basis. As of December 2025, ₹435 crore has been committed, leaving roughly half the funds available for new applicants until March 2028 or until depletion.

7. Which energy-efficient technologies are eligible?

Any technology that demonstrates 10% minimum energy savings qualifies. Common options include energy-efficient motors, HVAC systems, LED lighting, waste heat recovery, variable frequency drives, high-efficiency compressors, and furnace upgrades. Your free BEE audit identifies the best options for your facility.

8. Can I stack ADEETIE with other government schemes?

Yes. ADEETIE works alongside ISO 50001 certification subsidies (75% covered up to ₹75,000), carbon credit programs (potential ₹2-3 crore annually), and ESG financing. This stacking multiplies total value from ₹5 lakh to ₹35 lakh or more over five years.

9. What if my state or cluster is not in Phase 1?

Phase 2 will expand coverage to 100 additional clusters beyond the current 60. You can prepare your application now by verifying Udyam registration and requesting a preliminary energy assessment so you’re ready when your cluster becomes eligible.

10. Do I need consultants to apply or can I do it myself?

BEE provides free audits and DPR support as part of the ₹75 crore implementation budget. However, many MSMEs engage consultants for documentation preparation and to ensure M&V compliance. The choice depends on your internal capacity and technical expertise.