Key Takeaways

- Puerto Rico industrial electricity costs 24.42¢/kWh versus 7.65¢ mainland, creating $1.5M annual disadvantage for mid-sized facilities

- $185M Green Energy Fund provides up to 50% rebate (Tier 2: 101kW-1MW, $1M max) stacking with 40% federal ITC for 70% capital reduction

- Correct sequencing applies federal ITC first to gross cost, then GEF rebate to net cost after federal credit

- $6.5M microgrid becomes $1.3M net investment with 13-month payback when incentives stack properly

- Act 60 provides 4% corporate tax plus 75% property tax exemption, stacking with energy savings for permanent advantage

- CooperVision’s microgrid maintained 100% uptime during Hurricane Fiona, enabled $500M expansion October 2024

- Executive Order 2025-012 signed March 17, 2025 creates coordinated incentive deployment for manufacturing reshoring

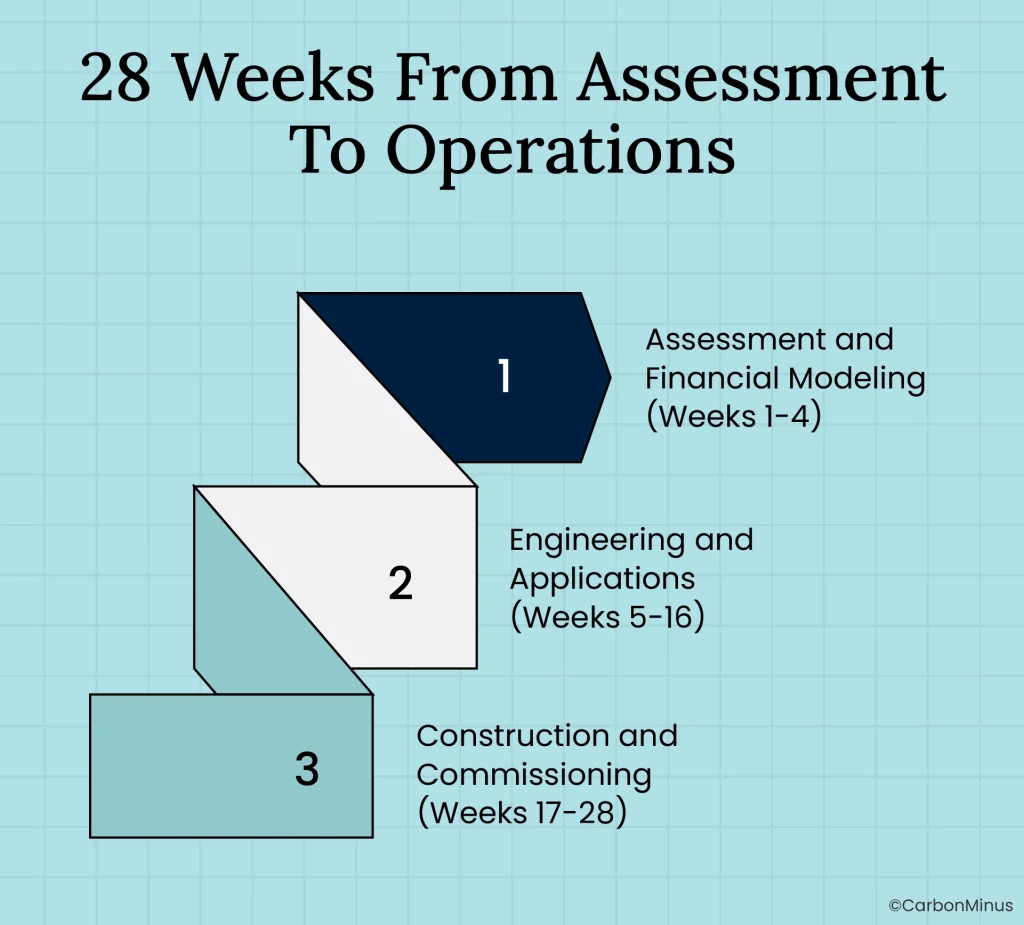

- Implementation runs 28 weeks from assessment to operational system

Carlos Rivera opened his Q3 energy bill and felt the same frustration he’d been carrying for three years. His San Juan pharmaceutical plant paid $2,288,000 for 10 million kilowatt-hours of electricity. The sister facility in Durham, North Carolina consumed exactly the same amount and paid $765,000.

The $1,523,000 gap wasn’t a mistake. That’s just what manufacturing costs in Puerto Rico when electricity runs 199% higher than the mainland.

During the quarterly call, the CFO asked what Carlos had been dreading: “Why are we still manufacturing there?”

Three months earlier, CooperVision announced a $500 million expansion at their Puerto Rico facility. They made that decision right after Hurricane Fiona knocked out power across the entire island while their 23.3 megawatt microgrid kept production running at full capacity.

The difference between defending your facility’s existence and planning a half-billion dollar expansion comes down to one thing. Understanding how Puerto Rico’s $185 million Green Energy Fund stacks with federal tax credits to turn a $2 million microgrid into a $600,000 net investment with payback under one year.

When 199% Higher Costs Create 3x Better Returns

Puerto Rico industrial electricity rates hit 24.42 cents per kilowatt-hour after the June 2024 rate increase. Mainland facilities pay an average of 7.65 cents. For a facility consuming 10 million kilowatt-hours annually, that’s an extra $1,523,000 in costs that buys absolutely nothing.

Energy represents 40% to 60% of operating costs in Puerto Rico versus 15% to 25% on the mainland. Every quarterly review becomes an exercise in explaining why your margins run 8 points lower than sister facilities.

But high baseline costs create an arbitrage opportunity most manufacturers miss. When you reduce consumption by 30%, you save 7.33 cents per kilowatt-hour in Puerto Rico versus 2.79 cents on the mainland. The same efficiency project delivers 163% more value in absolute dollars.

This is why CooperVision didn’t leave Puerto Rico despite the energy costs. They solved the energy problem once and unlocked returns that mainland cheap energy can never match.

Act 60 provides a 4% corporate income tax rate versus 37.5% standard Puerto Rico rates or the 21% federal plus state taxes on the mainland. Labor costs run 40% lower than comparable mainland skilled manufacturing. Products ship to US markets without tariffs or customs delays.

The missing piece was always energy independence.

The $185M Fund and How Tier 2 Works

The Puerto Rico Green Energy Fund holds $185 million in rebates for renewable energy projects. Created under Act 83-2010 and integrated into Act 60, it provides up to 50% rebates for solar, battery storage, microgrids, and combined heat and power systems.

Tier 2 covers systems from 101 kilowatts to 1 megawatt with rebates up to 50% and a $1 million maximum per project. This range fits most mid-sized manufacturing facilities perfectly.

Applications run quarterly on a competitive basis with approval taking 2 to 4 months. You need complete engineering plans, cost breakdowns, and financial projections before applying.

The Green Energy Fund rebate applies to your net project cost after you claim the federal Investment Tax Credit. Not before, not instead of, but after.

Start with a $2 million microgrid project. The federal ITC at 40% reduces that to $1,200,000. Now the Green Energy Fund provides 50% of that $1,200,000, which equals $600,000. Your final net investment hits $600,000, representing a 70% total reduction.

If you calculate rebates in the wrong order, you either violate IRS rules or leave hundreds of thousands of dollars unclaimed.

Federal Tax Credits Deliver 40% Before Puerto Rico Kicks In

The federal Investment Tax Credit for solar and battery storage starts at 30%. But there’s an additional 10% bonus that most Puerto Rico manufacturers qualify for automatically.

Projects in qualifying low-income census tracts receive an extra 10% ITC on top of the base rate. Most of Puerto Rico meets the median income thresholds for qualification. You verify eligibility through the IRS Energy Community Tool before finalizing your design.

The Inflation Reduction Act added direct-pay options for entities without enough tax liability to absorb large credits. The Treasury pays you cash equivalent to the credit value instead of requiring complex tax equity financing.

MACRS depreciation provides additional tax benefits through a 5-year accelerated schedule. When you stack the 40% upfront ITC with 50% Puerto Rico rebates and 5-year depreciation, the financial profile transforms completely.

Act 60 Stacks With Energy Incentives

The biggest misconception stopping manufacturers is thinking Act 60 and energy incentives are either-or choices. They stack.

Act 60 provides a fixed 4% corporate income tax rate. That’s an ongoing operational benefit applying to profits every year regardless of your energy infrastructure.

For a facility generating $5 million in annual profit, the mainland tax burden hits $1,400,000 when you combine federal and average state rates. Under Puerto Rico’s standard 37.5% rate, taxes would reach $1,875,000. With Act 60, taxes drop to $200,000.

That’s $1,200,000 in annual savings versus the mainland that continues for the 15 to 20 year duration of your Act 60 decree.

Act 60 also provides 75% property tax exemption for 10 years on renewable energy equipment. On $2 million in equipment, that saves approximately $45,000 annually for a total of $450,000. Sales tax exemption at 100% avoids $230,000 at purchase on that same equipment.

Energy incentives reduce your upfront capital investment. Act 60 reduces your ongoing operational tax burden. They work in parallel.

Hurricane Fiona Changed The Market

September 2022 brought Hurricane Fiona across Puerto Rico as a Category 1 storm that knocked out power across the entire island. Some areas went 5 days without electricity, others 14 days, and certain locations stayed dark for weeks.

Grid-dependent manufacturers shut down completely. Production stopped, raw materials spoiled, customer orders went unfilled.

CooperVision’s 23.3 megawatt microgrid kept running. Not partial operations or emergency systems only. Full production capacity, 100% uptime, while every competitor sat in the dark.

Thirteen months later in October 2024, CooperVision announced a $500 million expansion. The microgrid didn’t just protect existing investment. It proved Puerto Rico could support major growth without energy vulnerability as a constraint.

The Atlantic hurricane season runs June 1 through November 30 every year. Puerto Rico’s location creates vulnerability to direct hits or near-misses every 3 to 5 years historically.

Pharmaceutical facilities face approximately $260,000 per hour in downtime costs. A 7-day outage reaches $43,680,000 in total losses. Electronics assembly runs about $180,000 per hour. Food processing hits $95,000 per hour when cold chain integrity fails.

The defensive value of avoiding those losses justifies significant investment. But the offensive value of operating while competitors invoke force majeure often exceeds the defensive savings.

From $6.5M to $1.3M With 13-Month Payback

When Carlos first proposed a microgrid in 2023, he presented a $6.5 million gross cost with $900,000 in annual savings. Simple payback came out to 7.2 years.

The CFO’s response was predictable: “We have other projects with 2 to 3 year paybacks. This doesn’t compete.”

What neither Carlos nor his energy consultant understood was incentive stacking.

Start with that $6.5 million gross cost. Maximize the federal ITC by verifying low-income community bonus qualification for 40% instead of 30%. At 40%, federal credits equal $2,600,000.

The Green Energy Fund caps Tier 2 at $1 million per application. But solar, battery storage, and combined heat and power can structure as separate eligible components. When you sequence correctly and maximize eligible component applications, total incentive capture reaches $5,200,000.

Net investment drops to $1,300,000.

Energy savings of $900,000 combine with property tax savings of $50,000 and demand charge reductions of $48,000. Hurricane resilience value adds an estimated $200,000 annually in avoided downtime risk.

Total annual benefit: $1,198,000. Net investment: $1,300,000. Simple payback: 13 months.

The 10-year net present value at 8% discount rate reaches $6,800,000. Internal rate of return hits 89%.

| Scenario | Net Investment | Annual Benefit | Payback |

| No incentives | $6,500,000 | $900,000 | 7.2 years |

| Federal ITC only (30%) | $4,550,000 | $900,000 | 5.1 years |

| Full stack (40% ITC + GEF + Act 60) | $1,300,000 | $1,198,000 | 13 months |

For facilities needing smaller systems, a $2 million microgrid transforms the same way. Federal ITC at 40% equals $800,000. Green Energy Fund rebate at 50% of the net $1,200,000 provides another $600,000. Final net investment reaches $600,000.

Annual savings typically include $625,000 from energy cost reduction, $48,000 from demand charge management, and $150,000 from hurricane resilience. Total benefit reaches $823,000 annually. Payback hits 8.8 months.

Executive Order 2025-012 Signals Government Commitment

On March 17, 2025, Governor Jenniffer González-Colón signed Executive Order 2025-012 with an explicit mandate to promote manufacturing reshoring.

The order creates coordinated incentive deployment through the Department of Economic Development and Commerce and Invest Puerto Rico. It establishes streamlined processes for navigating federal and territorial applications simultaneously.

Designated liaisons within DDEC now help manufacturers coordinate Green Energy Fund applications with federal ITC claims and Act 60 decrees. Previously these programs operated through separate channels with different documentation requirements.

The operational improvements matter. But the strategic signal matters more.

When a governor signs an executive order explicitly promoting manufacturing reshoring, that’s political commitment transcending election cycles. Puerto Rico governments of both parties have maintained Act 60 benefits because manufacturing jobs are politically valuable. Executive Order 2025-012 extends that commitment to energy.

The Department of Energy’s Puerto Rico Energy Resilience Fund allocated $1 billion for grid modernization and distributed generation. The Loan Programs Office provided $864 million in guarantees to LUMA Energy for solar and battery storage in July 2024. FEMA committed $9.6 billion for grid hardening.

Total federal commitment exceeds $10 billion. The incentive programs aren’t dependent solely on territorial budgets.

28 Weeks From Assessment To Operations

The path from concept to operational microgrid breaks into three phases.

Phase 1: Assessment and Financial Modeling (Weeks 1-4)

Energy audit profiles load patterns and consumption by time of day. Financial modeling stacks all incentives specific to your facility size, location, and consumption. This includes verifying low-income community ITC bonus qualification and calculating optimal system size for Green Energy Fund Tier 2 maximums.

Preliminary system design determines solar array sizing, battery capacity, and whether combined heat and power makes sense for thermal loads. The phase concludes with a board-ready business case showing complete financial justification.

Phase 2: Engineering and Applications (Weeks 5-16)

Detailed engineering produces single-line diagrams, structural calculations, and control system specifications. Both federal ITC documentation and Green Energy Fund competitive evaluation require this engineering detail before submission.

The Green Energy Fund application goes in during the next quarterly cycle. Federal ITC documentation gets prepared for tax filing when the system is placed in service. Permitting covers building permits, electrical permits, and environmental reviews. Utility interconnection with LUMA requires coordination meetings and signed agreements.

Phase 3: Construction and Commissioning (Weeks 17-28)

Site preparation includes foundations and electrical infrastructure upgrades. Equipment installation covers solar arrays, battery systems, inverters, and controls. System integration programs controls and establishes communication networks. Testing verifies performance and validates safety systems.

Staff training ensures your operations team understands monitoring dashboards and emergency protocols. Final verification by third-party inspectors confirms work meets specifications for Green Energy Fund disbursement.

Total timeline runs 28 weeks or roughly 7 months. A facility starting in January 2026 reaches operations by late July or early August, before peak hurricane season.

The Choice You Have

Carlos spent six months defending margins that ran 8 points lower than mainland operations while energy costs bled profitability. His CFO kept asking why they manufactured in Puerto Rico at all.

CooperVision proved the model works by operating through Hurricane Fiona at full capacity while competitors went dark, then expanding by $500 million. Executive Order 2025-012 formalized government commitment to manufacturing reshoring. The $185 million Green Energy Fund stacks with 40% federal ITC and Act 60 tax benefits to reduce net investment by 70% to 80%.

Continue paying $1.5 million more annually than mainland facilities for the same electricity, or invest $600,000 to $1.3 million once to eliminate that disadvantage permanently.

Hurricane season runs June through November every year. Grid vulnerability creates customer security concerns competitors exploit. Act 60’s 4% tax rate provides permanent advantage only if energy costs don’t undermine it.

The 28-week timeline means facilities starting now operate before next hurricane season. Quarterly Green Energy Fund applications reward early movers with complete documentation.

Calculate your facility’s incentive stack and net investment. CarbonMinus models federal ITC scenarios with low-income bonus, Green Energy Fund Tier 2 maximization, and Act 60 benefits specific to your consumption and profitability.

FAQs

The GEF rebate applies to net project cost after claiming federal ITC. This sequencing maximizes total incentive value. For a $2M project, 40% federal ITC reduces cost to $1.2M, then GEF provides 50% of that $1.2M for another $600K reduction, leaving $600K final investment.

Yes, Act 60 benefits stack with both federal ITC and GEF rebates. The 4% corporate income tax applies to ongoing operations while energy incentives reduce upfront capital. They work in parallel, creating permanent tax advantages plus reduced energy costs simultaneously.

Microgrids built to Puerto Rico standards include Category 5 engineering for 185+ mph winds. CooperVision’s system maintained 100% uptime during Hurricane Fiona when the entire island lost power. Proper engineering plus insurance coverage protects your investment.

GEF evaluates applications quarterly on a competitive basis, with approval running 2-4 months after submission. Complete applications with detailed engineering, clear financials, and verified vendor quotes rank higher. Target less competitive quarterly windows by starting early.

With full incentive stacking including federal ITC, GEF rebates, and Act 60 benefits, documented payback runs 8-13 months for mid-sized facilities. Ten-year NPV typically reaches 4-5x net investment. Without incentives, payback extends to 5-7 years making projects uncompetitive.