Key Takeaways

- GEI targets are mandatory for cement, aluminium, paper, and chlor-alkali from FY 2025–27.

- FY 2023–24 was the baseline year. Backfill data if needed.

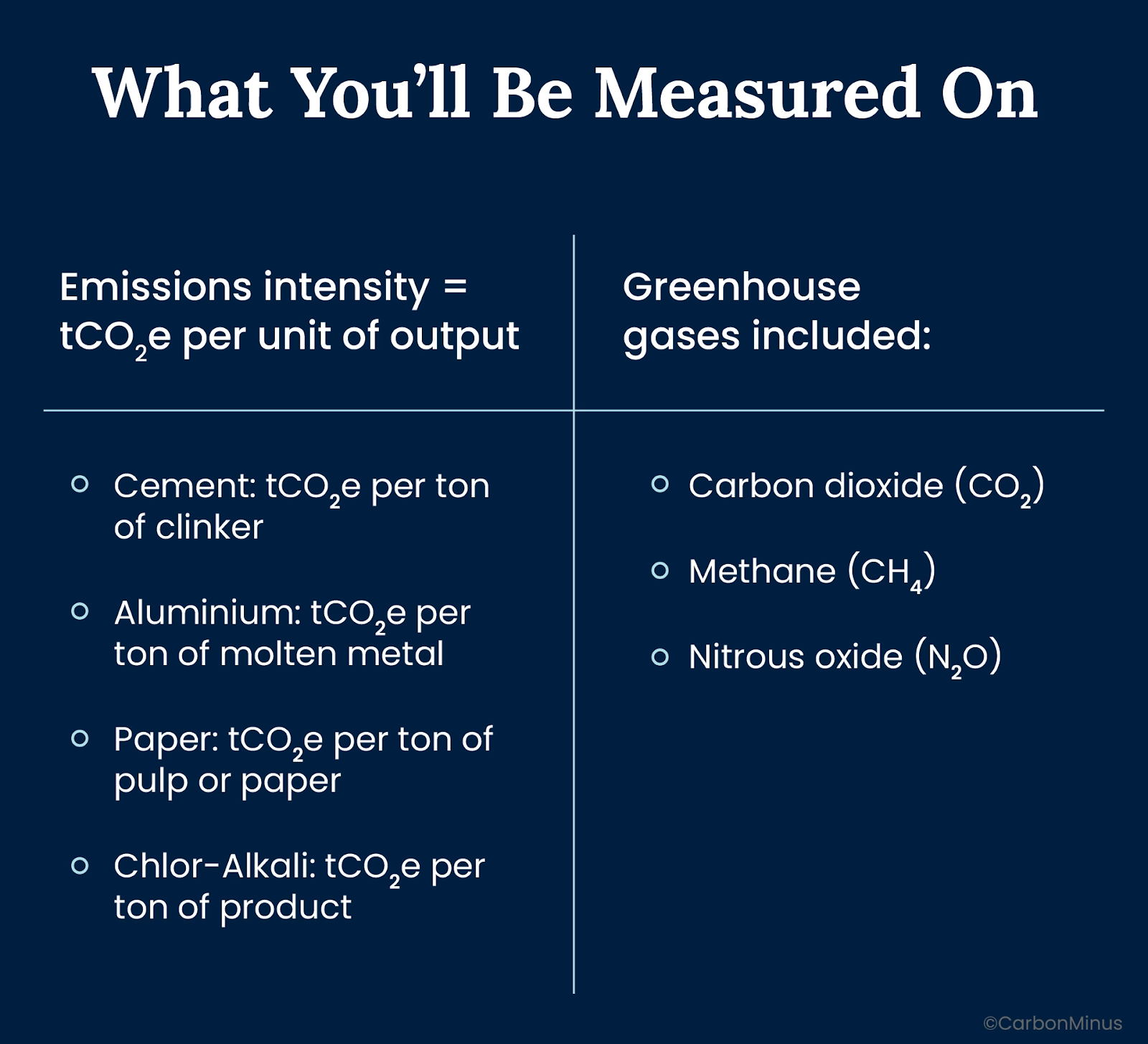

- GEI = tCO₂e per unit of output. Precision matters.

- Performance ties to carbon credit trading under CCTS.

- Manual reporting won’t hold. Real-time, auditable data is essential.

- Plants that track, optimize, and verify now will lead on cost, compliance, and carbon.

The countdown has already started.

India’s new Greenhouse Gas Emissions Intensity (GEI) Target Rules were quietly introduced in 2024. But for over 280 industrial facilities across cement, aluminium, paper, and chlor-alkali sectors, the implications are anything but quiet.

These rules don’t ask for net-zero pledges or voluntary disclosures. They mandate actual performance—measured in tonnes of CO₂ equivalent per unit of output. And they back it with government oversight, reporting obligations, and a direct link to India’s new Carbon Credit Trading Scheme (CCTS).

The baseline year? Already closed—FY 2023–24.

The target years? Coming fast—FY 2025–2027.

For plant heads, compliance officers, and sustainability teams, the question is no longer “Should we act?”

It’s “How do we prove what we’ve already done?”

This isn’t just policy. It’s the start of a carbon accounting regime that puts data at the center of industrial strategy.

Because from here on out, it’s not enough to reduce emissions. You need to prove how efficiently you produce—and make every molecule of carbon count.

What the GEI Target Rules Actually Say

The Greenhouse Gas Emissions Intensity Target Rules, 2025 mark a turning point for emissions regulation in India. They don’t just focus on how much you emit—they ask how much you emit per unit of what you make.

Who’s Covered (So Far)

- Cement

- Aluminium

- Pulp and Paper

- Chlor-Alkali

Each of these sectors has been issued emissions intensity targets through the Ministry of Environment, Forest and Climate Change (MoEFCC), with oversight by the Central Pollution Control Board (CPCB).

More sectors are expected to follow. This is Phase 1.

Timeline That Matters

- Baseline year: FY 2023–24

(Data collection should already be complete.) - Target compliance period: FY 2025–2027

Plants will be evaluated on how much they reduce emissions intensity relative to their 2023–24 baseline.

These are weighted using their Global Warming Potential (GWP) and reported as CO₂ equivalent (CO₂e).

Regulatory Linkage

GEI performance is tied directly to the Carbon Credit Trading Scheme (CCTS) under India’s carbon market framework. That means:

- Overperformance may lead to tradable surplus credits

- Underperformance could result in carbon cost exposure

Why This Isn’t Just Another Reporting Mandate

Most reporting frameworks stop at transparency.

The GEI rules go further. They tie emissions intensity directly to cost, opportunity, and regulatory consequence.

This is performance-based policy.

GEI isn’t about total emissions—it’s about how efficiently you operate. Two plants with identical output but different emissions per ton will land on opposite sides of the compliance line.

You can’t offset inefficiency by growing your way out of it.

This is market-linked enforcement.

The GEI program is woven into India’s new Carbon Credit Trading Scheme (CCTS)—not as a side note, but as a core mechanic. It creates a market for carbon performance:

- Underperformers may need to buy carbon credits to meet their targets.

- Overperformers can generate surplus credits—and monetize efficiency gains.

That means your plant’s emissions data isn’t just a compliance requirement. It’s now a financial instrument.

This is verifiable by design.

GEI compliance isn’t a trust-based system. It’s built for:

- Audits

- Verification by CPCB

- Third-party MRV (Measurement, Reporting, Verification)

Your numbers need to match your footprint—down to the asset level.

This isn’t a spreadsheet game. It’s a system where accuracy, transparency, and traceability determine whether you pay a penalty, stay neutral, or create value.

The First Challenge: Getting the Numbers Right

Every GEI target starts with a ratio.

But that ratio is only as strong as the data behind it.

Plants often track energy. Some track emissions. Fewer track both with the consistency, granularity, and traceability required for GEI compliance. Even fewer link that data directly to output.

And that’s the gap.

What You Need to Track Precisely

1. Scope 1 emissions

- Fuel combustion (kilns, furnaces, boilers)

- Process emissions (e.g., calcination in cement)

- On-site vehicles

- Refrigerants

2. Scope 2 emissions

- Purchased electricity

- Imported steam or chilled water

3. Output

- Measured in consistent, verifiable units:

- Tonnes of clinker

- Tonnes of pulp

- Tonnes of molten aluminium

- Tonnes of chlor-alkali products

- Tonnes of clinker

4. Time-aligned intensity

- GEI = tCO₂e per unit output

- That means your emissions and production data must align—by day, shift, or batch, not just by month or quarter

Measurement, Reporting & Verification (MRV) Must Be Built-In

To avoid disputes and rework:

- Use auditable emissions factors (national defaults or approved custom values)

- Calibrate sensors and meters for accuracy

- Maintain change logs and data lineage—so every number can be traced

If your baseline year data is off, your entire compliance trajectory will be wrong.

Industrial Realities That Make GEI Hard

On paper, emissions intensity is just a formula.

In practice, it’s a tangled web of mismatched data, disconnected systems, and assumptions that don’t hold under audit.

Reality #1: Plants run on averages. Compliance doesn’t.

Energy use is often rolled up monthly. Production is tracked by shift or line. GEI reporting needs both—accurate, aligned, and timestamped.

A 1-day mismatch can throw off your ratio. A 10-day mismatch can sink your baseline.

Reality #2: Data lives in silos.

- Operations tracks output.

- Utilities track consumption.

- Sustainability handles reporting.

But emissions intensity lives in the intersection—and without integration, no one sees the full picture.

Reality #3: Not all load is productive.

A boiler or compressor drawing power on standby still emits, but doesn’t count toward output.

If you don’t catch that idle drift, your GEI creeps up silently.

Reality #4: Asset-level visibility is rare.

Knowing your plant’s total emissions isn’t enough. GEI performance depends on knowing which systems drive what emissions, and which ones are drifting, degrading, or operating inefficiently.

Reality #5: GEI math is only as good as your inputs.

If you’re relying on default emissions factors, rough production estimates, or manual reconciliations, you’re building your compliance profile on guesswork.

Auditors won’t just ask what your emissions were. They’ll ask how you know.

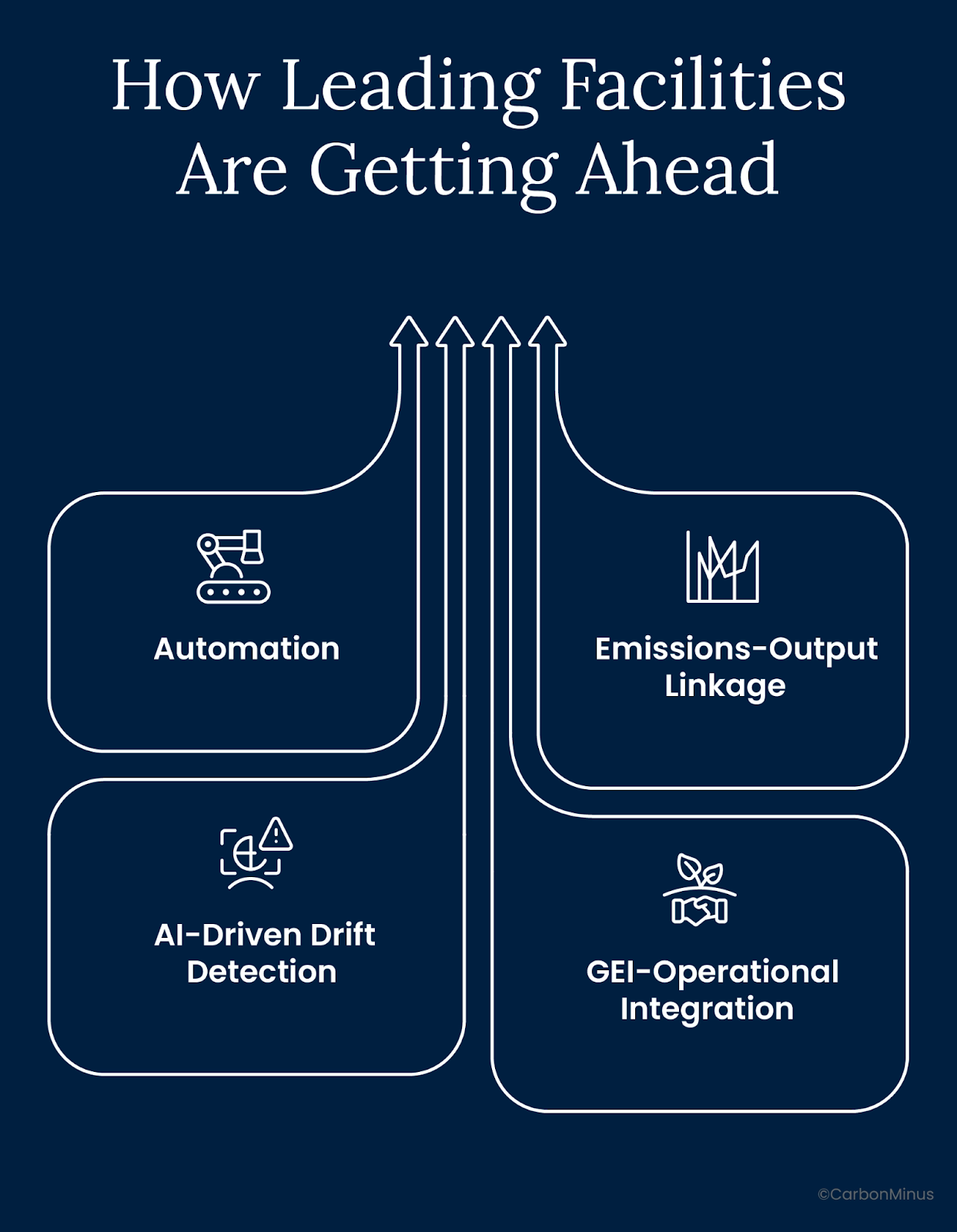

How Leading Facilities Are Getting Ahead

The difference between scrambling in 2025 and seizing the advantage starts now with how you collect, connect, and act on your data.

1. Automate Your MRV, Don’t Just Document It

Compliance-ready facilities don’t rely on spreadsheets. They use integrated systems that:

- Pull live data from power meters, fuel flow meters, and emission sensors

- Align energy, emissions, and output by timestamp

- Normalize units across shifts, batches, and asset classes

- Auto-generate audit logs and change histories

Why it matters: Manual MRV is slow, error-prone, and hard to defend. Automation builds trust—and saves months when verification starts.

2. Tie Emissions Directly to Output

GEI isn’t about emissions in isolation. It’s about emissions per ton.

That means you need:

- Output tracking by product type and production line

- Emissions tagging by time, not just by source

- Cross-mapped data that reflects real operational sequences—not just monthly totals

3. Use AI to Flag Drift Early

The most accurate GEI plans still fall apart without runtime feedback.

High-performing sites are using AI to:

- Spot load anomalies that increase Scope 2 intensity

- Detect idle assets consuming without output

- Flag underperforming systems (e.g. a kiln using 8% more fuel per ton than baseline)

- Learn patterns across shifts, products, or demand profiles

This isn’t about futuristic tech. It’s about not being surprised during verification.

4. Link GEI to Operational Decisions

If your energy, emissions, and output data sit on three dashboards, no one will own your GEI.

The leading plants:

- Put GEI feedback into daily reviews

- Tie emissions performance to maintenance and operations—not just sustainability

- Track per-ton CO₂e daily, not monthly

Because what gets measured hourly can be managed in time.

GEI Isn’t Just Compliance. It’s Currency.

In most plants, emissions data is treated like paperwork.

But under the GEI framework, it’s something else entirely: tradable performance.

Overperformance Earns. Underperformance Costs.

GEI targets are now embedded in India’s Carbon Credit Trading Scheme (CCTS). That means:

- If your plant beats its GEI target, you can generate surplus credits—which may be tradable on the national carbon market.

- If you miss the target, you may need to purchase credits to close the gap—or face regulatory and reputational risk.

This flips the equation.

Carbon intensity isn’t just a metric—it’s a financial position.

Future-Proofing Your Business

Beyond trading, low GEI scores help you:

- De-risk your supply chain as carbon border measures expand (like CBAM)

- Unlock ESG-linked finance that prioritizes traceable, intensity-based metrics

- Build audit-proof transparency for BRSR, ISO 14064, CSRD, and investor disclosures

Efficiency Becomes Strategy

When every tonne of CO₂e avoided can generate credits, energy optimization becomes a revenue stream—not just a cost-saving measure.

And when emissions per unit drop below baseline, your plant becomes a net asset in India’s carbon economy.

2025 Is Here. But It’s Not Too Late.

The baseline year is already over.

The targets are locked in.

Verification is coming.

But this isn’t a scramble moment. It’s a strategy moment.

Plants that treat GEI as a reporting formality will lose time, money, and credibility.

Plants that treat it as a live operational metric will move faster, run leaner, and gain advantage—in compliance, in carbon trading, and in the trust economy.

GEI compliance isn’t just about doing less harm.

It’s about proving how efficiently you create value and building systems that can prove it on demand.

FAQs

What if we didn’t track GEI data during FY 2023–24?

It’s still possible to build a usable baseline. Many facilities are piecing it together from shift logs, production SCADA exports, energy bills, and any meter data they did collect. It’s not perfect—but it’s better than letting regulators assign a generic benchmark, which may not reflect your actual performance. Even partial data, if it’s timestamped and traceable, can help anchor your GEI trajectory.

We make multiple product types. How do we calculate a single GEI?

Don’t. Blending emissions across dissimilar product lines muddies the picture. If you make OPC and white cement, or multiple paper grades, treat each as a separate line item. Use line-level energy mapping and production logs to keep the math clean. That way, you can spot which processes are drifting—and avoid compliance penalties tied to over-averaging.

Does using renewable power improve our GEI?

Yes, but only if it displaces carbon-heavy grid electricity. GEI includes Scope 2 emissions, so solar or wind inputs can lower your intensity. That said, the benefit shows up only if you track both production and power sources consistently. If your base load emissions are still high—think kiln fuel or thermal oil—the impact from renewables might be smaller than expected.

How do these rules interact with the Perform, Achieve, Trade (PAT) scheme?

PAT focuses on energy efficiency at the facility level (measured in specific energy consumption), while GEI targets emissions intensity. They’re complementary—but not interchangeable. A plant may meet its PAT target and still fall short on GEI if emissions aren’t decoupled from energy use. Expect convergence in reporting frameworks in future.

Is third-party verification mandatory for GEI reports?

The draft rules anticipate a strong role for third-party MRV (Measurement, Reporting, Verification), particularly under the Carbon Credit Trading Scheme. Even if not yet mandatory, having verifiable data will reduce audit friction, improve credit eligibility, and protect against target disputes.

What kind of tech actually helps with GEI tracking?

You don’t need a full plant overhaul. What helps most is modular visibility—systems that pull real-time data from existing meters and production systems without forcing new infrastructure. Think asset-level metering for high-emission equipment, timestamped outputs, and software that tags emissions by batch or shift. Bonus if the reports match CPCB or ISO formats out of the box. That’s what makes it operational—not just informational.