Key Takeaways

- Over 50% of global GDP depends on nature.

- Nature risk is financial risk—and it’s rising.

- Nature-positive strategies boost resilience, brand, and ROI.

- Investors are backing biodiversity-focused action plans.

- TNFD and GBF are setting the next ESG standards.

- Leaders are restoring ecosystems, not just reducing harm.

Net-zero used to be the goal. Now it’s just the starting line.

As ecosystems collapse and natural systems edge toward irreversible damage, carbon reductions alone won’t cut it. Climate risk doesn’t travel alone, it comes with biodiversity loss, water stress, and supply chain disruption.

The conversation has moved on.

In 2025, just cutting carbon isn’t enough. The pressure is broader now coming from every direction. Regulators. Investors. Customers. They’re not just asking companies to reduce harm. They’re asking what they’re restoring.

That’s what makes nature-positive different.

It’s not about tree-planting for press releases. It’s about reversing damage, rebuilding ecosystems, and protecting the resources your business relies on air, water, soil, biodiversity.

It’s about protecting ecosystems, restoring degraded land, and regenerating natural resources in the places your business touches.

In the same way net-zero redefined carbon accountability, nature-positive is redefining natural capital. And the companies that move early? They will hit their compliance targets and shape new standards, build brand equity, and open doors to capital that’s increasingly flowing toward regeneration.

This blog breaks down why nature-positive strategies matter now, how they translate into business value, and what it looks like to lead, not follow in the next era of ESG.

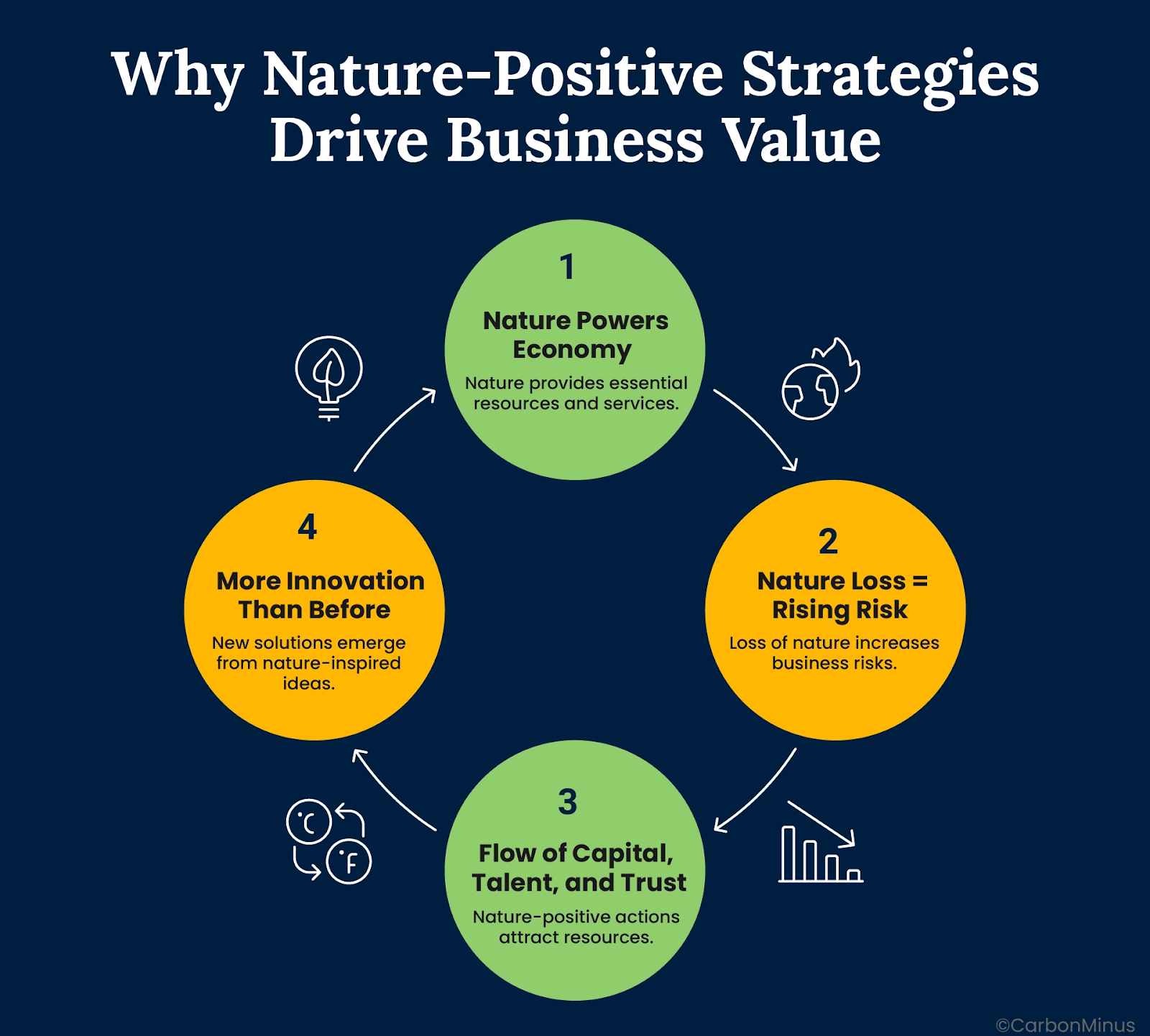

Why Nature-Positive Strategies Drive Business Value

Cutting emissions was step one. Protecting and restoring nature is step two and it’s a business decision as much as an environmental one.

The numbers make that clear.

Nature Powers the Economy

More than half of global GDP about $58 trillion depends on the health of ecosystems. Forests, wetlands, pollinators, clean water all sit upstream from manufacturing, agriculture, logistics, and more.

When nature degrades, costs rise. Supply chains crack. Insurance premiums spike. Regulatory pressure increases.

BCG estimates nature’s total economic value at $179 trillion, that’s not a side issue. It’s foundational capital that most companies still don’t track.

Nature Loss = Rising Risk

Businesses are already feeling it.

Floods, wildfires, and water shortages are driving up insurance costs and disrupting operations. Crop failures linked to biodiversity loss are jeopardizing between $235–$577 billion in annual global production.

One in five companies could face serious operational risks from ecosystem collapse. That includes litigation, supply risk, and stranded assets.

Nature-positive strategies offset risk and actively reduce exposure to these shocks. That’s resilience you can measure.

The Flow of Capital, Talent, and Trust

Sustainability has moved beyond being a report, and into a filter.

- Investors are moving fast. Nature-related risk is on track to become reportable and regulated, as frameworks like TNFD rise to ISSB-level prominence.

- Private funding for nature-positive initiatives jumped from $9.4B to $102B in just four years.

- Customers and Gen Z employees expect companies to protect more than just their profits. Biodiversity is now part of brand credibility.

In a market where brand, trust, and access to capital are competitive levers, nature is becoming a factor in all three.

More Innovation Than Before

Protecting nature pushes businesses to rethink how they operate. The result? New materials, new products, and new revenue models.

- Biotech could supply up to 60% of all physical inputs in the economy via sustainable bio-based alternatives.

- The nature-positive economy is projected to generate over 395 million jobs and $10 trillion in new value by 2030.

In short: this shift doesn’t limit innovation. It demands it.

The takeaway: Treating nature as a balance sheet asset, not an externality, is strategic. It’s measurable and it’s already creating separation between leaders and laggards.

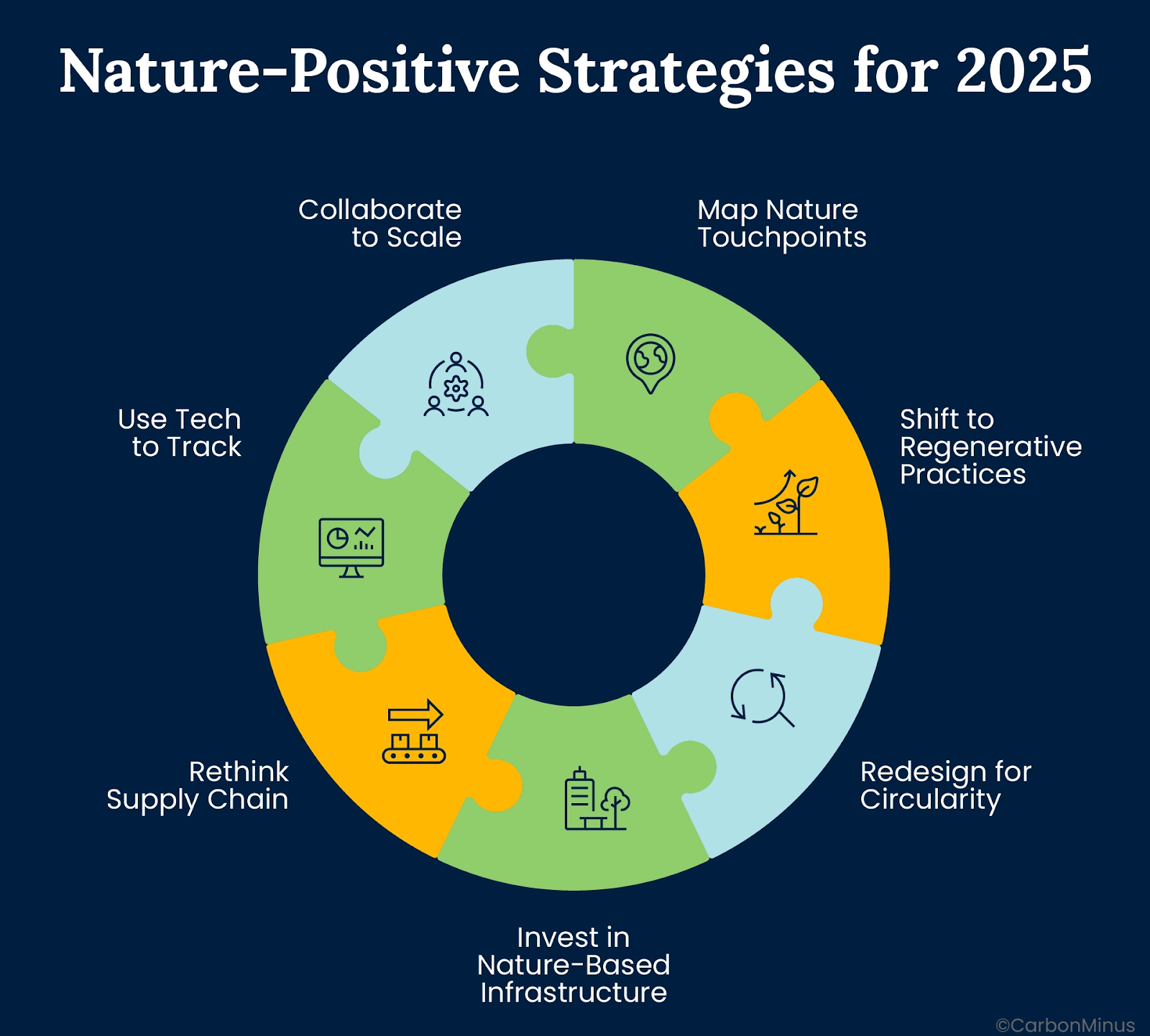

The Nature-Positive Playbook: Strategies for 2025 and Beyond

Understanding the upside is one thing. Building it into the business? That takes structure.

Nature-positive strategies are more operational decisions, than abstract goals. And the companies moving fastest are those turning values into action, system by system.

Here’s what that looks like in practice:

Map Where You Touch Nature

Start by identifying where your business depends on ecosystems and where it puts pressure on them.

That means looking across your value chain, not just your owned operations. Conduct biodiversity assessments. Flag hotspots. Prioritize where high dependency and high impact overlap.

Target 15 of the Global Biodiversity Framework already pushes businesses to disclose these risks. Expect that to become mandatory.

Shift to Regenerative Practices

Regeneration applies across industries.

In farming, that means restoring soil health, reducing chemical inputs, and supporting pollinator ecosystems. In industrial settings, it looks like reforesting around extraction sites, repairing degraded land, or turning wastewater into a resource.

These aren’t edge cases. They’re now strategic requirements.

Redesign for Circularity with Nature in Mind

Sustainability already pushed circularity into product design. The next step is applying that thinking to biodiversity.

- Design for biodegradability

- Eliminate single-use inputs

- Build closed-loop systems where byproducts are repurposed internally

Circular systems reduce waste but more importantly, they reduce the pressure on raw natural inputs.

Invest in Nature-Based Infrastructure

Natural systems can do things engineered systems can’t, and often more efficiently.

Mangroves absorb storm surges. Green roofs cool cities. Wetlands filter water. These are cost-effective, scalable infrastructure solutions.

Nature-based solutions could deliver up to a third of the emissions reductions needed by 2030 and come with co-benefits like biodiversity gains and risk reduction.

Rethink Your Supply Chain

Nature risk is buried deep in supply chains. Most companies can’t see it, let alone manage it.

Set nature-positive procurement standards. Require no-deforestation sourcing. Incentivize ecosystem restoration at the source. Collaborate with suppliers to reduce land-use impact.

Programs like FABRIC are already helping global brands in textiles apply this thinking to biodiversity-sensitive sourcing.

Use Tech to Track What Matters

Nature impact isn’t invisible anymore.

Satellite monitoring, AI-driven habitat modeling, and real-time MRV (Measurement, Reporting, and Verification) tools make it possible to see where damage is happening—and whether recovery efforts are working.

Investment in nature tech reached $2 billion by 2022 and is growing at 52% annually. MRV technologies alone grew over 760% since 2018.

Don’t Go Alone, Collaborate to Scale

Nature restoration is bigger than any one business. But coalitions can move markets.

Join networks like Business for Nature. Align with the TNFD and the Global Biodiversity Framework. Advocate for policies that support nature-positive finance, procurement, and disclosure.

Being early is a good strategy, it’s a chance to shape the rules.

Real-World Examples of Nature-Positive in Action

Nature-positive strategy isn’t theoretical. Leading companies are already building it into supply chains, product design, and land management because the risks are rising, and the upside is real.

Unilever

Unilever is moving beyond low-impact sourcing. It’s committing to regenerative practices across farming, forestry, and land use with a deadline: 2030. That means working directly with producers to rebuild soil, protect ecosystems, and eliminate deforestation from its value chain.

They’re not treating nature as a risk to avoid. They’re building it into the way they grow, manufacture, and deliver.

L’Oréal

L’Oréal is rethinking packaging from the ground up. The focus? Biodiversity. They’re using materials with smaller ecological footprints, designing for end-of-life reuse or breakdown, and linking their sourcing to restoration work in impacted habitats.

This is a side-project. It’s baked into product design and supply chain decisions.

SCGC (Siam Cement Group)

SCGC launched a long-term forest regeneration program called “Plant-Cultivate-Protect.” It focuses on restoring native forests, not just planting trees but maintaining full ecosystems. The initiative includes on-the-ground community involvement, long-term monitoring, and protection of at-risk species.

They’re not calling it a campaign. They’re treating it like critical infrastructure.

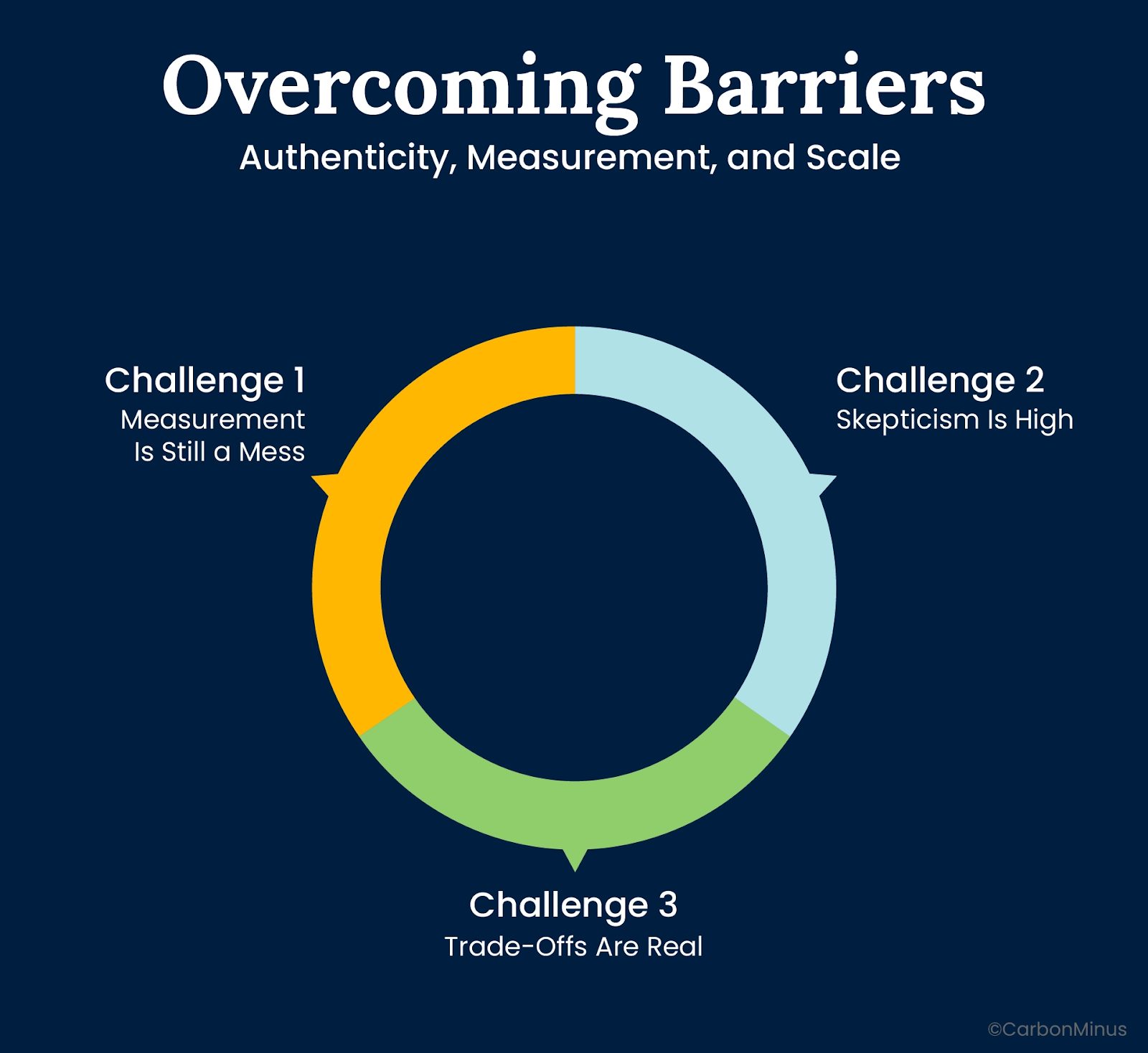

Overcoming Barriers: Authenticity, Measurement, and Scale

The shift to nature-positive isn’t frictionless. Even the companies making real progress are running into some of the same roadblocks: measurement gaps, credibility concerns, and real trade-offs between ambition and quarterly pressure.

But these aren’t reasons to stall. They’re signals that it’s time to build better systems—and get serious about integration.

Challenge 1: Measurement Is Still a Mess

Biodiversity isn’t like carbon. You can’t just plug in a number. It’s location-specific, seasonal, and complex. That’s one reason so many companies stall here.

But there’s movement.

In 2025, over 30 businesses and financial institutions began field-testing a draft set of nature-positive metrics through the Nature Positive Initiative. The final version is expected in 2026. Groups like TNFD, SBTN, and IUCN are already offering frameworks to track species impact, land-use change, and habitat condition in ways that tie back to business decisions.

Start simple. Track what you can: local ecosystem health, supplier land use, restoration area. Don’t wait for a perfect scorecard. You’ll be playing catch-up by the time it arrives.

Challenge 2: Skepticism Is High

Nature-positive is getting airtime, which means it’s also getting scrutiny. Empty pledges are easy to spot and even easier to dismantle.

Investors are asking tougher questions. So are regulators. So are employees.

That doesn’t mean you hold back. It means you build credibility as you go.

Work with verifiers—SBTN, B Corp, science-aligned NGOs

Stick to the mitigation hierarchy: avoid harm first, reduce what you can, restore what’s damaged, offset only where necessary

Disclose clearly. Not everything needs to be perfect. But it does need to be real.

If you can’t explain your plan in plain language—and back it with proof—it’s not ready.

If it can’t be explained in a boardroom—or defended in a press conference—it needs more work.

Challenge 3: Trade-Offs Are Real

Nature-positive often competes with short-term financial goals. Regeneration takes time. Land use can clash with development. And upfront costs aren’t always small.

But long-term value tells a different story.

A growing number of businesses are building full internal ROI models that include avoided regulatory costs, reputational lift, supply chain stability, and access to preferential capital. These are real financial levers, not side benefits.

What to do: Quantify what’s at stake, not just the cost of acting, but the risk of waiting. In nature, the longer you delay, the more expensive recovery becomes.

Nature-Positive Is the Next ESG Frontier

We’ve already seen what happened with net-zero. First, it was a signal of leadership. Then it became standard. Now, it’s table stakes.

Nature-positive is on the same path.

The shift is happening fast. In finance, in policy, and inside supply chains. The Global Biodiversity Framework is aligning public and private action. TNFD is setting the stage for nature risk disclosure. And capital is following: private investment in nature grew from $9.4 billion to over $100 billion in just four years.

The question is will your business be ready when it does.

Nature-positive is a redesign of how companies operate within the systems that keep them alive—soil, water, biodiversity, climate. And just like carbon before it, once the standards are set, the early movers will define the benchmarks everyone else has to chase.

There’s still room to lead. But not for long.

FAQs

What does “nature-positive” actually mean for business?

It means shifting from minimizing damage to actively restoring nature. That includes forests, soil, water systems, and biodiversity. It’s not charity—it’s long-term risk management and value creation.

Is this just a new version of net-zero?

Not exactly. Net-zero focused on carbon. Nature-positive deals with everything carbon doesn’t: ecosystems, land use, species loss. It’s broader and in some sectors, more urgent.

Is nature risk really a financial issue?

Yes. Over half of global GDP depends on healthy ecosystems. When nature breaks down, supply chains get hit, input costs rise, and regulatory risks spike. It’s a financial story as much as an environmental one.

Why is biodiversity harder to measure than carbon?

Carbon is a single metric. Biodiversity is complex and varies by region, species, and ecosystem. But new tools, from TNFD to nature tech, are helping companies track and act with more precision.

How do I avoid greenwashing on nature claims?

Start with science. Follow the mitigation hierarchy. Use third-party standards like SBTN or B Corp. And don’t overclaim, be clear on what’s been done, what’s in progress, and what you’re still figuring out.