Key Takeaways

- ESG reports are no longer enough. Real-time, auditable data is the new standard.

- Regulations like CSRD demand machine-verified, externally assured ESG reporting.

- Spreadsheets create risk. IoT, AI, and blockchain create trust.

- A true ESG platform unifies data, enables automation, and eliminates rework.

- Building the right tech stack turns ESG from liability to strategic advantage.

You’ve seen the scene a hundred times. It’s December. The sustainability team’s in triage mode digging through spreadsheets, begging departments for last-minute data, rewriting the same paragraph on emissions intensity for the fifth time.

And then comes the PDF.

Dozens of pages. Glossy charts. A few nice photos from the last tree-planting event.

But here’s the truth: that once-a-year report? It’s already obsolete.

Regulators aren’t asking for narratives anymore. They’re demanding evidence.

Real-time. Auditable. Digitally tagged. The kind of data that holds up under scrutiny, rather than just looking good.

The EU’s CSRD is the clearest example, but it’s not the only one. Global standards are shifting fast. And the gap between what’s expected and what most companies can deliver is growing.

In this blog we will talk about what’s changing, and most importantly about what you need to do now.

We’ll walk you through why traditional ESG processes no longer cut it, and break down the technology stack that turns ESG from a compliance burden into a governance asset.

Also, if you’re already thinking that this sounds expensive, you’re not alone. That’s why we built a simple ROI calculator to show you what this shift can actually return.

Spoiler: After reading this blog it will be easier to stay compliant, while running leaner, faster, and smarter business operations.

Let’s dig into why the static ESG report is dead and what’s replacing it.

Why is this suddenly so urgent?

For years, ESG reporting was like a polite handshake. You shared what you could, when you could.

No one looked too closely. The expectations were soft. The timelines were loose.

And spreadsheets? They were good enough.

Not anymore.

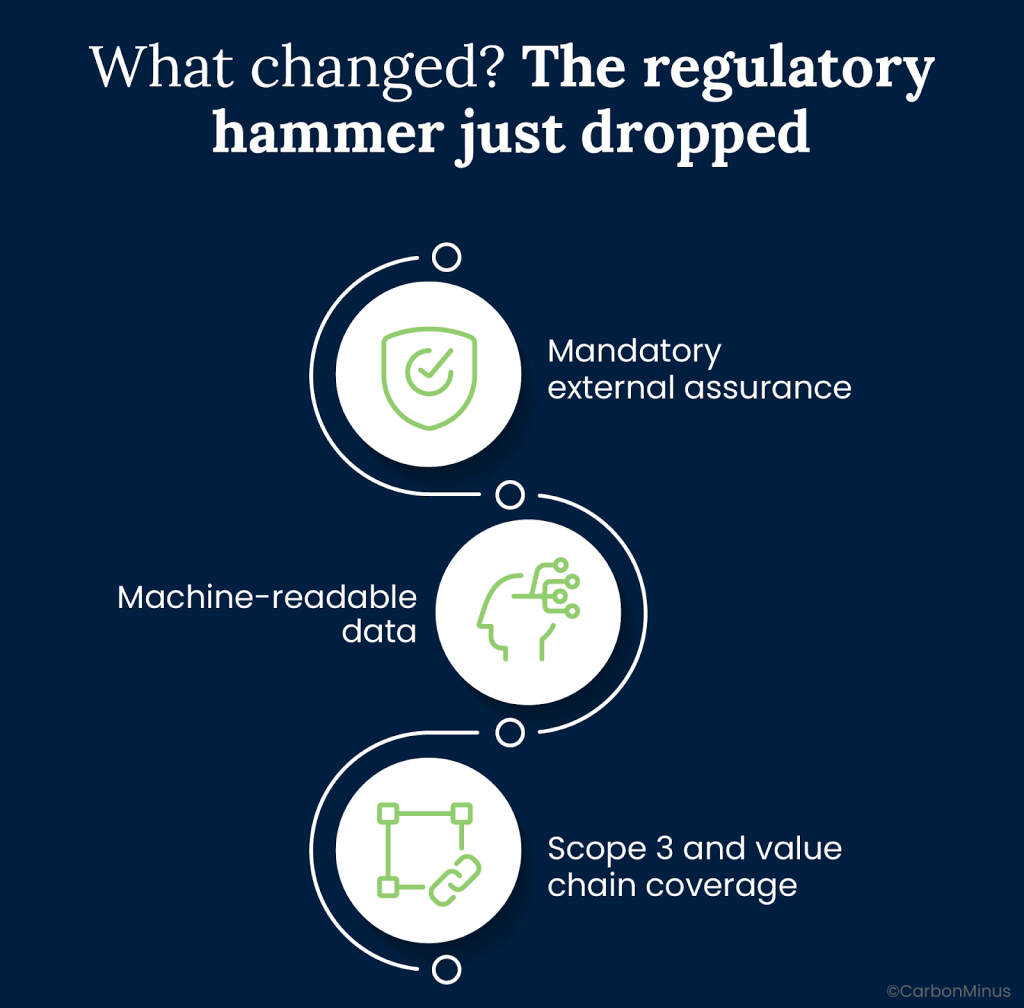

What changed? The regulatory hammer just dropped

The EU’s Corporate Sustainability Reporting Directive (CSRD) has changed the rules permanently. Over 50,000 companies, including non-EU firms with operations or revenue in the bloc, now fall under its scope.

But it’s not just about who’s affected. It’s about how they’re expected to report:

- Mandatory external assurance. Think audited financials, but for your emissions.

- Machine-readable data. No more burying metrics in pretty PDFs.

- Scope 3 and value chain coverage. That’s right, you’re now accountable for emissions you don’t directly control.

The message is clear: ESG data is now being held to the same standard as financial data. Which means the systems behind it better be just as solid.

Why “mostly accurate” ESG data no longer cuts it

Investors are watching. So are regulators and watchdogs. The rise in greenwashing scandals has created a trust deficit that can’t be smoothed over with nice copy or vague promises.

And here’s the kicker: nearly 47% of companies still use spreadsheets as their primary ESG data tool.

That’s like managing your books in Notepad. It’s prone to:

- Typos

- Version mismatches

- Human error

- Zero audit trail

If your ESG disclosures are wrong or unverifiable, you’re risking fines, shareholder lawsuits, failed audits, delayed funding rounds, and reputational damage you can’t walk back.

What used to be a PR issue is now a boardroom liability.

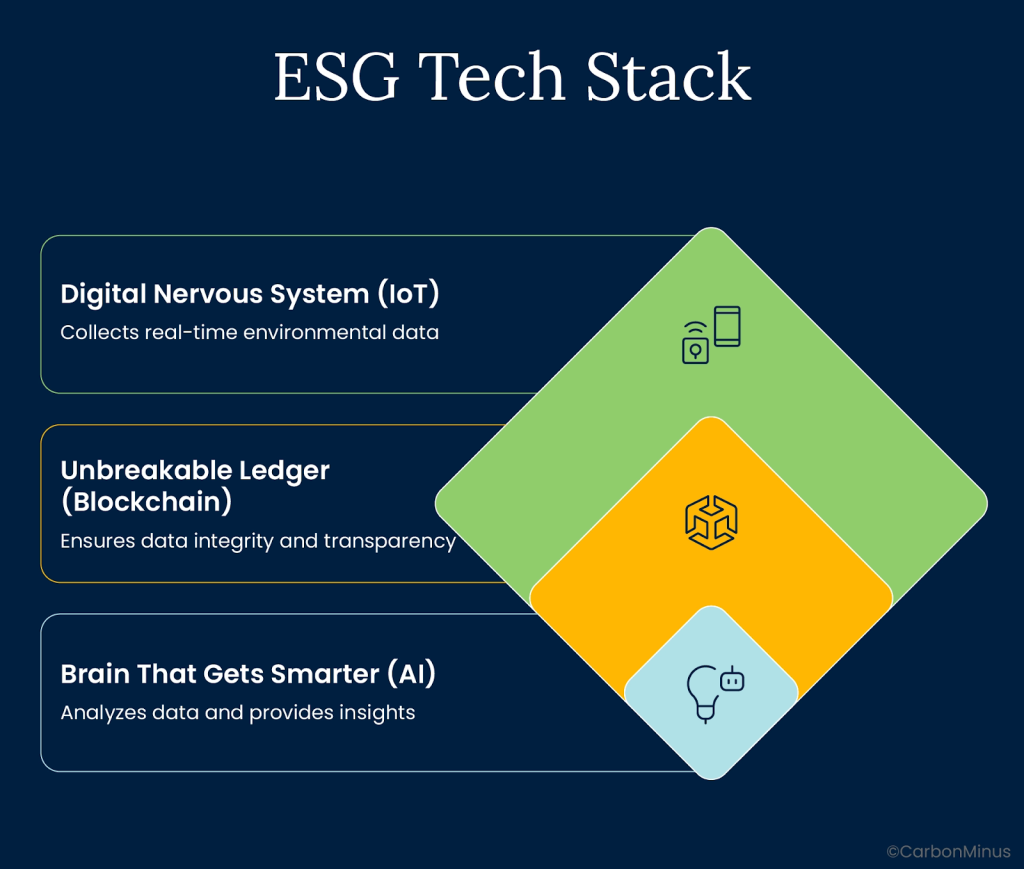

What does a real ESG tech stack look like?

If the old ESG report was a scrapbook, the new one’s a living system.

It updates in real time. It connects across departments. And, most importantly, it holds up under audit.

So how do you build that kind of system?

You don’t buy a “reporting tool.” You build a stack that connects physical reality (what’s happening in your operations) to digital accountability (what you’re telling the world).

Here’s what that looks like.

Step One: You Need a Digital Nervous System (IoT)

It starts on the ground.

IoT sensors are how you get raw, timestamped, unfiltered truth. They track electricity, fuel, water, steam, emissions across every site, every process.

The magic lies in more than the data. It’s the fact that it’s machine-generated.

No human copy-paste errors or retroactive guesstimates. Just verifiable, continuous input from your actual operations.

This becomes the base layer of ESG credibility. If you don’t have that, everything above it is guesswork.

Step Two: You Need a Brain That Gets Smarter (AI)

Now that you’ve got the raw signals, you need something to make sense of them.

That’s where AI steps in. It crunches the numbers and learns from them. A smart platform can:

- Flag anomalies before they become audit issues

- Detect abnormal energy use or system leaks

- Predict equipment failures before they disrupt operations

- Recommend optimizations that cut waste and emissions

Need a benchmark? Google’s DeepMind AI system achieved a 40% reduction in energy used specifically for cooling at their data centers.

What you get is more than compliance. You get control.

Step Three: You Need an Unbreakable Ledger (Blockchain)

Here’s the trust layer.

Blockchain gives you an immutable, time-stamped record of every ESG data point. Once it’s written, it can’t be edited.

That’s how you turn a carbon credit claim, a supplier’s Scope 3 data, or a facility’s emissions log into something that regulators and investors can trust.

No more version control hell or “we’ll send an updated file.” Just traceable, tamper-proof records, ready for audit at any moment.

What should you look for in an ESG platform?

Let’s say you’ve bought in. You know static reports won’t cut it and that you need real-time data, not reactive summaries.

But now the big question is: what should the platform actually do?

Forget feature lists. Here’s what really matters when the audit comes and when the board starts asking tough questions.

Does it give you one unified source of truth?

You can’t prove what you can’t trace.

A serious ESG platform needs to ingest data from everywhere like IoT sensors, utility bills, ERP systems, procurement logs, even supplier spreadsheets and harmonize it into one clean, centralized hub.

That’s how you create a verifiable audit trail. One system and one record.

No more conflicting reports from different departments or late-night email chains trying to find the “final-final” version.

This is what auditors and investors want: clarity, not chaos.

Does it go beyond reporting to actually help you operate smarter?

Most ESG tools look backwards. That’s fine for a museum.

But the right platform uses AI to go forward. It should:

- Spot inefficiencies in real time

- Trigger alerts when energy waste spikes

- Recommend ways to hit emissions targets faster

- Schedule predictive maintenance before things break

This is where compliance turns into competitive advantage. ESG becomes more than risk mitigation, as it becomes a lever for performance.

Can it handle every framework from one dataset?

If your team has to reformat data every time a new regulation drops, the system’s broken.

The best platforms generate automated, audit-ready reports for any global standard including CSRD, BRSR, ISO 14064, SEC with zero duplication.

One dataset, many outputs.

This acts as a time-saver, while also helping you stay agile in a world where standards change faster than fiscal quarters.

From Reactive Reporting to Proactive Leadership

Here’s the shift: ESG is no longer a side project. It’s infrastructure.

What used to be a once-a-year scramble is now a real-time, high-stakes function of corporate governance.

The regulators expect it. The markets demand it. And your stakeholders won’t accept anything less.

If your ESG data is built on spreadsheets, delayed inputs, and unverifiable claims, you’re exposed.

- To audits

- To greenwashing accusations

- To credibility loss

But if your data is automated, AI-driven, and locked into an immutable record? You’re ready to lead.

Is Your ESG Data Audit-Ready?

The standards have changed. The expectations have changed. Now it’s your move.

Use the CarbonMinus ROI calculator to see how much money you could save. Just enter your industry and annual energy bill to get the result.

Want to talk through your specific landscape? Book a strategy call and let’s map out how this shift applies to your tech, your team, your targets.

The ESG report is dead. Let’s build something stronger.

Frequently Asked Questions

Why are spreadsheets such a problem for ESG reporting?

Look, spreadsheets were fine when no one was really looking. But now? They’re a liability. There’s no version history you can trust. No real audit trail. You change one formula and the whole thing falls apart. And when regulators show up asking, “Where did this number come from?” you can’t say, “Give me an hour while I check with procurement.” That’s not compliance, but a panic button.

What exactly does “audit-ready” mean in this context?

It means you don’t flinch when someone asks to see the data. It means the numbers are traceable back to a sensor, a timestamp, a real event. No edits. No “best guesses.” Just clean, defensible, machine-logged records. If your ESG data can’t be audited like your financials, you’re exposed.

We already publish a nice ESG report every year. Isn’t that enough?

Ten years ago? Sure. Today? Not even close. The days of glossy PDFs and vague metrics are over. Investors want proof. Regulators want real-time data. And if you’re still wrapping up your story at year-end, you’ve already missed the plot. ESG should be part of your infrastructure.

Is building a tech stack for ESG really worth the money?

Let’s put it this way: what’s the cost of a failed audit? Or an investor walking because your numbers don’t hold up? Or burning your team out every year doing compliance gymnastics? This isn’t overhead. It’s operational resilience. Run the numbers through our ROI calculator and it spells out the upside in black and white.

Why does blockchain matter here? Isn’t that overkill?

We understand the skepticism. But hear us out because blockchain’s not about hype here. Think of it as a means to build trust. When you log ESG data like supplier info, carbon credits, and emissions you need a record that can’t be messed with. No backdating. No creative edits. That’s what blockchain does. It locks the truth in.

What if we’re reporting to multiple frameworks? Will one system work?

It has to. CSRD, BRSR, ISO, SEC are all different flavors of the same thing: prove it. A real platform pulls from one clean dataset and spits out reports tailored to each standard. If your team’s reworking the same numbers four times, you’re wasting time and inviting mistakes.

Do we need to replace everything we already use?

Nope. In fact, if someone tells you to rip and replace your existing systems, that’s a red flag. A good ESG platform plugs into your existing stack like sensors, meters, ERPs, whatever you’ve already invested in. It should extend your capabilities, not bulldoze them.