TL;DR

- Scope 3 emissions represent 70-90% of manufacturing’s total carbon footprint, yet 90% of suppliers lack emissions data.

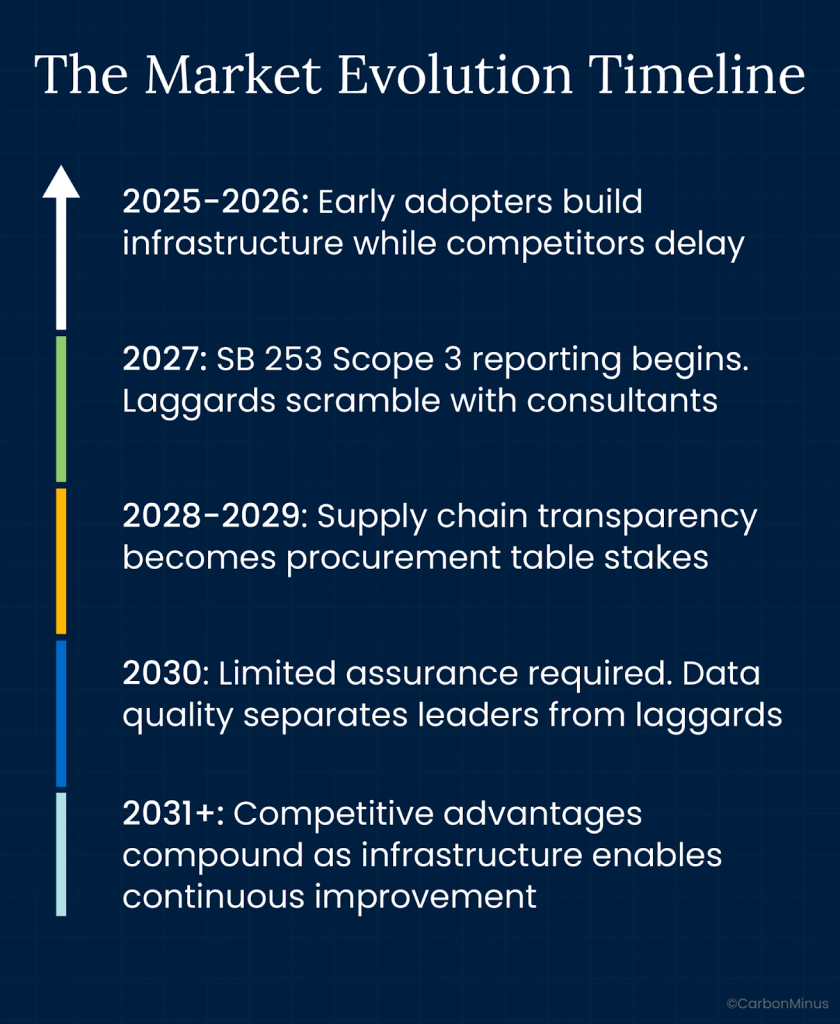

- SB 253 requires Scope 3 reporting starting 2027, but offers safe harbor protection until 2030 for misstatements creating a strategic 3-year window.

- The manufacturers winning this challenge aren’t treating suppliers as data sources to extract from.

- They’re building collaborative partnerships that simultaneously reduce emissions, cut costs, and create competitive moats.

Key Facts

- Scope 3 Deadline: 2027 reporting begins (covering 2026 data)

- Safe Harbor Protection: No penalties for misstatements until 2030

- Emissions Reality: Manufacturing upstream emissions are 26x larger than operational emissions

- Engagement Crisis: Only 28% of companies engage suppliers despite massive impact

- The Opportunity: Early movers transforming regulatory burden into supply chain control

Here’s something that shouldn’t work.

Sixty thousand individuals. No CEO. No org chart. No Slack channels or weekly standups. No managers, no performance reviews, no strategic planning sessions.

Yet somehow, a honey bee colony operates with precision that would make Toyota’s production system jealous.

When a scout bee discovers flowers five miles away, she doesn’t send an email. She doesn’t schedule a meeting. She performs a waggle dance—a figure-eight pattern where the angle relative to vertical indicates direction from the sun, and the duration of the waggle run communicates exact distance.

The other bees watch. They learn. Within minutes, thousands of foragers fly directly to flowers they’ve never seen, located miles away, with near-perfect accuracy.

But here’s what makes it extraordinary: multiple scouts compete. If three scouts find different flower patches, they each perform their waggle dance. The more excited the bee, the more vigorously she dances, trying to convince observers to follow her lead.

Sometimes bees even disrupt each other’s dances or fight to win attention.

It’s a marketplace of ideas performed in motion and the colony collectively decides which opportunity deserves their energy.

“The success of a bee colony doesn’t depend on the extraordinary abilities of the queen, but on the countless small interactions between ordinary workers.”

—Dr. Thomas Seeley, honeybee researcher

The result? A hive of 60,000 bees maintains internal temperature within one degree of precision, constructs mathematically perfect honeycomb, and optimizes resource collection across a five-mile radius—all without anyone in charge.

Now here’s the unexpected connection most supply chain directors miss:

You’re trying to coordinate emissions data from 150 suppliers. The bees coordinate 60,000 individuals. You’re drowning in spreadsheets and survey fatigue. The bees use a language nobody thought possible until 2025 discoveries revealed they’re actually mapping three-dimensional space through dance.

The difference isn’t scale. It’s communication architecture.

The manufacturers mastering Scope 3 compliance aren’t extracting data from suppliers. They’re building waggle dance systems: communication infrastructures where information flows naturally because everyone benefits from participation.

Your 2027 SB 253 deadline? It’s approaching.

Let’s talk about how to build your colony’s communication system before the reporting requirement hits.

The Manufacturing Emissions Iceberg You Can’t See

Let’s break your mental model.

You probably think about emissions like this: your facilities generate carbon, your suppliers generate some too, but your operations are the main event.

Here’s reality: You’re wrong by a factor of 26.

Your $50 million manufacturing facility generates, say, 50,000 tons of CO2 annually from Scope 1 and 2 emissions. Respectable. Measurable. Under your control.

Your supply chain? 1.3 million tons and 90% is completely invisible to you right now.

The 90/90 Problem Nobody’s Solving

Manufacturing, retail, and materials sectors collectively report upstream emissions equal to 1.4 times the entire European Union’s total emissions. Just the upstream categories. Just these sectors.

Yet here’s the crisis: 90% of those emissions come from supply chains where 90% of suppliers lack any emissions data whatsoever.

Most companies can’t even name suppliers beyond Tier 1. Meanwhile, two-thirds of emissions come from Tier 2 and beyond—the suppliers to your suppliers, operating in complete darkness from your perspective.

The Unexpected Advantage Manufacturers Have (But Don’t Use)

Only 28% of companies actively engage suppliers on emissions despite the massive impact.

Think about that. Nearly three-quarters of manufacturers have surrendered to supply chain data chaos.

But here’s what research reveals: Companies engaging suppliers are 6.6 times more likely to have 1.5°C-aligned climate targets.

Why? Because engagement isn’t about data extraction. It’s about creating mutual value that makes information sharing natural rather than forced.

The top 2% of companies collaborate with suppliers to improve operations, reduce costs, and lower emissions simultaneously. The other 98% send annual surveys and wonder why response rates hover at 15%.

SB 253’s Hidden Gift: The 3-Year Strategic Window

Here’s where Scope 3 gets unexpectedly interesting.

2027: Scope 3 reporting begins for 2026 data

2030: Limited third-party assurance becomes required

The surprise: California included safe harbor protection until 2030. No penalties for Scope 3 misstatements if you disclose them with “reasonable basis”.

This isn’t regulatory leniency. It’s recognition that supply chain data transformation takes years to build properly.

Most companies will panic in 2026, scramble with consultants, and produce barely-compliant garbage data for 2027 reporting.

Smart manufacturers are using 2025-2027 to build supplier partnership infrastructure that creates competitive advantages lasting decades beyond compliance.

The question isn’t whether you can collect Scope 3 data. It’s whether you can build communication systems that make suppliers want to share.

Let’s talk about why most approaches fail catastrophically and what the bees can teach us about coordination at scale.

Why Your Annual Supplier Survey Is Doomed (And You Know It)

Let me guess your current approach.

Once a year, procurement sends a detailed emissions questionnaire to 150 suppliers. Twenty-three respond. Twelve provide data so obviously wrong that you discard it. Eleven give you something marginally usable.

Response rate: 15%. Usability: 7%. Frustration: Infinite.

You know this doesn’t work. Your suppliers know it doesn’t work. Yet everyone keeps pretending annual surveys will somehow solve Scope 3 compliance.

They won’t. Here’s why.

The Survey Fatigue Death Spiral

Your suppliers aren’t just getting sustainability questionnaires from you. They’re getting them from every major customer simultaneously.

Each questionnaire asks similar questions in slightly different formats. Each requires hours of manual data compilation. Each promises vague future benefits that never materialize.

Your suppliers are drowning. And your survey is just one more bucket of water.

The Single-Point-in-Time Delusion

Annual surveys capture snapshots. But emissions aren’t static photographs—they’re continuous video streams requiring real-time monitoring.

A supplier’s emissions in January differ dramatically from July due to:

- Production volume fluctuations

- Energy mix changes (seasonal renewable availability)

- Process improvements implemented mid-year

- Equipment replacements and efficiency upgrades

By the time you receive last year’s data, it’s already obsolete for decision-making.

The Tier 1 Blindness

Most manufacturers have reasonable visibility into direct (Tier 1) suppliers. That’s where procurement relationships exist, contracts are negotiated, and quality audits happen regularly.

But 70% of supply chain emissions come from Tier 2 and beyond—the raw material producers, component manufacturers, and logistics providers you don’t directly contract with.

Asking your Tier 1 supplier about their Scope 3 emissions is like asking you about yours: they’re probably sending the same useless surveys downstream, getting the same terrible response rates.

It’s turtles all the way down. Except every turtle is blind.

The Hidden Manufacturing Advantage Nobody Uses

Here’s the unexpected twist: Manufacturers actually have structural advantages for supplier engagement that other industries lack.

1. Long-Term Relationships: Unlike retail or services, manufacturing supply chains involve multi-year partnerships with significant switching costs

2. Procurement Leverage: Volume commitments and contract renewals create natural incentives for cooperation

3. Quality Systems: Existing supplier audit processes and performance monitoring can integrate sustainability metrics

4. Technical Sophistication: Manufacturing suppliers often have better data infrastructure than consumer goods or services suppliers

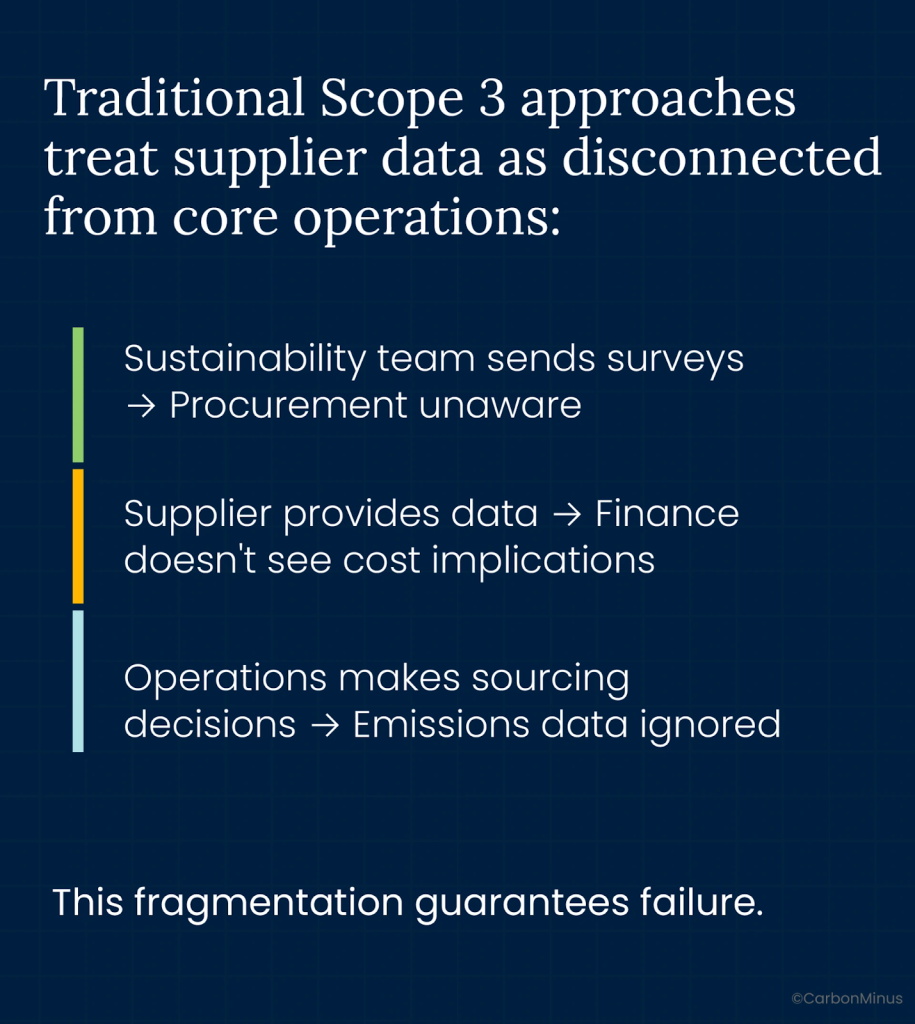

Yet most manufacturers treat sustainability as a separate, disconnected initiative rather than integrating it into existing commercial relationships.

The companies winning Scope 3 aren’t sending surveys. They’re building digital waggle dance systems, communication platforms where suppliers share information because participation creates tangible value.

Let’s see what that looks like in practice.

The Supplier Partnership Revolution: How Automotive Parts Turned Chaos into Advantage

Meet TechForm Manufacturing: a Tier 1 automotive parts supplier with $850 million revenue and 150 Tier 2 suppliers. (Name changed; story real.)

The Challenge: 70% Emissions, Zero Visibility

In early 2024, TechForm’s largest customer (a major OEM) announced new requirements: all Tier 1 suppliers must provide Scope 3 data by Q1 2026 or risk losing preferred supplier status.

TechForm’s Director of Procurement, Jennifer Torres, faced the classic nightmare:

- 150 Tier 2 suppliers across six countries

- Zero emissions data beyond what she could estimate from spend

- 18 months to build compliance capability

- $2.3 million budget approved for consultant-led data collection

She almost hired the consultants. Then she asked a different question.

The Unexpected Approach: What If Suppliers Actually Want This?

Instead of extracting data, Jennifer’s team designed a mutual value partnership model:

Phase 1: Strategic Supplier Segmentation

- Mapped the 150 suppliers by procurement spend and estimated emission impact

- Identified top 25 suppliers representing 78% of emissions

- Prioritized those with existing quality partnerships and multi-year contracts

Phase 2: The Value Proposition Flip

Rather than demanding data, TechForm offered:

- Free energy monitoring assessment identifying efficiency opportunities

- Technical support for implementing energy management systems

- Procurement preference for sustainability performance in future contract negotiations

- Digital platform access for simplified data sharing and benchmarking

Phase 3: The Pilot Program

- Launched with 10 highest-impact suppliers in Q2 2024

- Provided each supplier with energy monitoring tools and technical assistance

- Integrated emissions data collection into existing quality and delivery reporting

- Shared aggregated benchmarking data so suppliers could compare performance

The Results: 85% Engagement, 23% Cost Reduction

By Q4 2024:

- 85% of pilot suppliers actively participating (vs. 15% typical survey response)

- $4.7 million in supplier efficiency improvements identified and implemented

- 23% average reduction in input costs from suppliers’ energy optimization

- Complete Scope 3 visibility for 78% of emissions with continuous monitoring

TechForm’s OEM customer designated them preferred supplier based on supply chain transparency, then awarded $47 million in additional contracts requiring that same visibility.

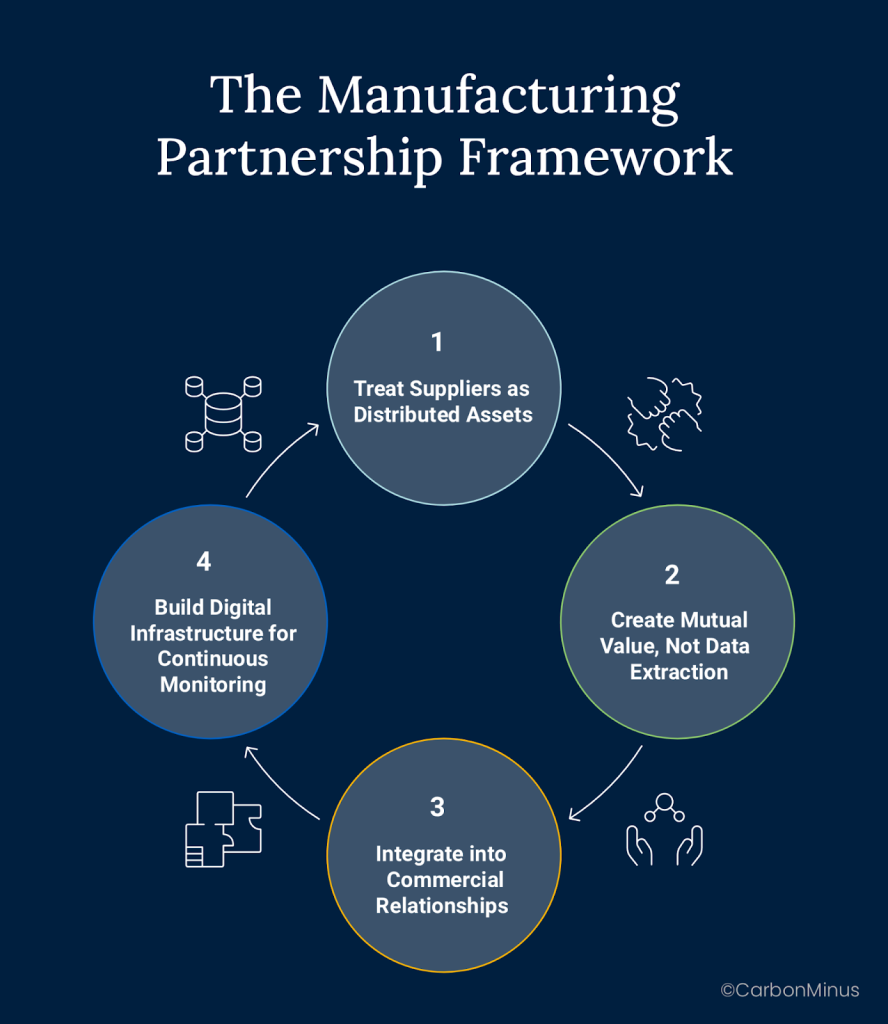

The Manufacturing Partnership Framework

The pattern TechForm discovered works across industries:

1. Treat Suppliers as Distributed Assets

- Frame supplier operations as “extended manufacturing floor” requiring optimization

- Apply same asset management discipline to supplier energy use as internal operations

- Recognize that supplier efficiency improvements directly reduce your input costs

2. Create Mutual Value, Not Data Extraction

- Provide technical assistance identifying efficiency opportunities

- Share benchmarking intelligence across supplier base

- Link sustainability performance to commercial advantages (contract preferences, longer terms)

3. Integrate into Commercial Relationships

- Embed emissions tracking into existing quality, delivery, and cost metrics

- Use procurement leverage to incentivize participation without threats

- Make data sharing seamless through existing communication channels

4. Build Digital Infrastructure for Continuous Monitoring

- Replace annual surveys with real-time data feeds

- Automate validation by cross-referencing energy data, production volumes, shipping records

- Create supplier portals that simplify rather than complicate their reporting burden

This isn’t sustainability theater. It’s supply chain optimization that happens to generate perfect Scope 3 compliance data as a byproduct.

Now let’s talk about the digital infrastructure that makes this possible at scale.

The Digital Waggle Dance: Automated Supply Chain Monitoring

Remember those bees coordinating 60,000 individuals without email?

They’re not magic. They have sophisticated communication architecture evolved over millions of years: pheromone trails, vibration signals, and the waggle dance providing precise directional information.

Manufacturing supply chains need equivalent infrastructure. Here’s what that looks like in 2025.

Beyond Manual Surveys: The Integration Challenge

The integration imperative: Connect supplier emissions data to the systems procurement, operations, and finance already use daily.

Technology Architecture for Scale

API Integrations Available

- Energy management systems (building automation, SCADA platforms)

- Procurement platforms (SAP Ariba, Oracle, Coupa)

- ERP systems (SAP, Oracle NetSuite, Microsoft Dynamics)

- Supplier portals and quality management systems

Data Validation Methodology

- Automated cross-referencing: energy bills × production volumes × shipping weights

- Statistical outlier detection with machine learning algorithms

- Supplier self-certification with audit trail documentation

- Third-party verification readiness built into data architecture

Reporting Automation

- GHG Protocol-compliant Scope 3 calculations across all 15 categories

- SB 253 reporting format generation with CARB requirements

- Customizable dashboards for procurement, operations, and executive leadership

- Drill-down capability from aggregate metrics to individual supplier performance

The Unexpected ROI: Operations Improvement

Here’s what makes digital infrastructure strategic rather than just compliance technology:

The same platform providing Scope 3 data simultaneously identifies:

- Supplier efficiency opportunities reducing your input costs (8-15% average savings)

- Supply chain risk exposure from energy-intensive or high-carbon suppliers

- Strategic sourcing insights for procurement optimization decisions

- Competitive advantages in customer relationships requiring transparency

One chemical manufacturer using integrated supplier monitoring discovered a Tier 2 raw material supplier operating equipment from the 1990s. By financing equipment upgrades (ROI: 22 months), they:

- Reduced supplier’s emissions by 31%

- Lowered raw material costs by 12% through efficiency gains

- Secured long-term supply contracts at favorable pricing

- Gained complete visibility into previously opaque supply chain segment

The compliance data was a bonus. The strategic value was transformational.

Now let’s talk about the 3-year implementation strategy that leverages SB 253’s safe harbor period.

The 3-Year Implementation Strategy: Leveraging the Safe Harbor Window

Most companies will waste the strategic gift California gave them.

SB 253’s safe harbor provision until 2030 creates a 3-year window for building infrastructure without penalty risk. Smart manufacturers are using every month of it.

Here’s the phased approach the early movers are deploying.

Year 1 (2025): Foundation Building

Months 1-3: Strategic Supplier Identification

Objective: Map supply chain tiers and prioritize highest-impact relationships.

Actions:

- Supply Chain Mapping

- Catalog all Tier 1 suppliers with procurement spend analysis

- Identify key Tier 2+ suppliers (70% of emissions live here)

- Map geographic distribution and regulatory exposure (CBAM, etc.)

- Emission Impact Estimation

- Calculate preliminary Scope 3 using spend-based methodology

- Identify categories representing 80%+ of impact (typically purchased goods, capital goods, upstream transport)

- Prioritize suppliers by combined spend, volume, and estimated emission contribution

- Relationship Assessment

- Evaluate supplier relationship strength (contract length, partnership quality)

- Assess technical capabilities (existing energy monitoring, data systems)

- Identify early adopter candidates willing to pilot new approaches

Deliverable: Prioritized supplier list with top 25-30 representing 70-80% of Scope 3 emissions.

Months 4-6: Engagement Framework Development

Objective: Design partnership model creating mutual value.

Actions:

- Value Proposition Design

- Technical assistance programs for supplier energy efficiency

- Procurement preference structure for sustainability performance

- Cost-sharing models for monitoring equipment or system upgrades

- Long-term contract advantages linked to participation

- Digital Platform Specification

- Requirements definition for supplier portal and data integration

- ERP/procurement system integration architecture

- Data validation and quality control methodology

- Reporting automation for internal and regulatory requirements

- Change Management Planning

- Internal stakeholder alignment (procurement, operations, finance, sustainability)

- Supplier communication strategy and materials

- Training program development for both internal teams and suppliers

- Legal review of data sharing agreements and contract language

Deliverable: Complete engagement framework with value proposition, technology specifications, and rollout plan.

Months 7-12: Pilot Program Launch

Objective: Test approach with top 10-15 suppliers before full-scale deployment.

Actions:

- Supplier Selection and Onboarding

- Recruit pilot suppliers representing diverse categories and geographies

- Executive-level engagement explaining mutual benefits

- Technical team training on data collection and platform use

- Baseline data collection establishing starting point

- Platform Deployment

- Supplier portal launch with pilot group

- Integration testing with internal systems

- Data quality validation and process refinement

- Issue resolution and documentation of lessons learned

- Value Delivery Demonstration

- Energy efficiency assessments for each pilot supplier

- Identification of improvement opportunities with ROI calculations

- Implementation support for high-impact projects

- Quantification of cost savings and emission reductions

Deliverable: Validated approach with documented ROI, refined processes, and expansion-ready platform.

Year 2 (2026): Scale and Systematize

Q1-Q2: Platform Deployment at Scale

Objective: Expand to full supplier base with automated systems.

Actions:

- Phased Supplier Expansion

- Wave 2: Next 20-30 highest-impact suppliers

- Wave 3: Remaining material suppliers

- Wave 4: Long-tail suppliers with simplified reporting templates

- Geographic rollout considering language, regulations, and time zones

- Integration Completion

- Full ERP and procurement system connection

- Automated data flows eliminating manual entry

- Quality management system integration

- Financial system linkage for cost-benefit tracking

- Process Systematization

- Standard operating procedures for ongoing monitoring

- Escalation protocols for data quality issues

- Supplier performance review integration

- Contract template updates with sustainability requirements

Deliverable: Comprehensive supplier engagement infrastructure covering 70-80% of Scope 3 emissions.

Q3-Q4: Compliance Preparation

Objective: Generate complete 2026 baseline for 2027 SB 253 reporting.

Actions:

- Data Completeness Validation

- Gap analysis identifying missing data sources

- Estimation methodology documentation for unavailable data

- Quality assurance across all 15 GHG Protocol categories

- Internal audit preparing for third-party assurance

- Reporting Infrastructure

- Generate first complete Scope 3 calculations

- CARB reporting format compliance testing

- Documentation preparation for “reasonable basis” safe harbor protection

- Executive briefing materials for board and investor communications

- Optimization Opportunity Identification

- Supplier performance benchmarking analysis

- High-impact improvement project identification

- Strategic sourcing decision support

- Competitive advantage positioning for customer relationships

Deliverable: Complete 2026 Scope 3 baseline with SB 253-compliant documentation and improvement roadmap.

Year 3 (2027): Compliance and Competitive Advantage

Q1: SB 253 Scope 3 Reporting

Objective: Submit first official report demonstrating compliance readiness.

Actions:

- Regulatory Submission

- Submit Scope 3 report covering 2026 data by required deadline

- Document good faith effort and safe harbor protection rationale

- Comprehensive methodology disclosure for data quality and gaps

- Preparation materials for potential regulatory questions

- Stakeholder Communication

- Customer notification of Scope 3 readiness and data availability

- Investor briefing on supply chain transparency and risk management

- Supplier recognition program for top performers

- Industry leadership positioning through thought leadership

Deliverable: Compliant SB 253 Scope 3 submission with comprehensive stakeholder communications.

Q2-Q4: Competitive Advantage Realization

Objective: Leverage supply chain transparency for market differentiation.

Actions:

- Supply Chain Optimization

- Implement supplier improvement projects identified in 2026

- Track cost savings and emission reductions from efficiency initiatives

- Adjust procurement strategies based on sustainability performance

- Expand technical assistance programs to additional suppliers

- Customer Differentiation

- Position supply chain transparency in sales and marketing materials

- Respond to OEM sustainability requirements with comprehensive data

- Participate in customer supplier sustainability programs

- Leverage CBAM readiness for European export opportunities

- 2030 Assurance Preparation

- Begin limited assurance readiness activities

- Strengthen data quality and validation processes

- Engage third-party verification providers

- Build internal audit capabilities for ongoing compliance

Deliverable: Sustainable competitive advantage through supply chain control, customer preference, and operational excellence.

The Competitive Advantage Playbook: Why Early Movers Win

Simply put, here’s what’s really at stake.

SB 253 Scope 3 compliance is the visible requirement. But the real opportunity is building supply chain control infrastructure that compounds competitive advantages for decades.

Supply Chain Control: The Strategic Asset

Manufacturing companies with real-time supplier visibility gain operational capabilities competitors can’t match:

1. Risk Mitigation

- Early warning systems for supplier sustainability risks

- Geographic and regulatory exposure monitoring

- Supply continuity protection through diversification intelligence

- Climate risk assessment across multi-tier supply chains

2. Performance Optimization

- Data-driven strategic sourcing decisions

- Supplier efficiency improvement identification and support

- Benchmarking intelligence for negotiation leverage

- Continuous improvement tracking and recognition

3. Cost Reduction

- Input cost reduction through supplier energy efficiency (8-15% typical savings)

- Procurement optimization based on total cost of ownership including carbon

- Long-term contract advantages for sustainability leaders

- Shared investment models reducing capital requirements

One automotive manufacturer reported: “We thought Scope 3 was a compliance burden. It became our best procurement intelligence tool. We’ve identified $23 million in supplier efficiency opportunities—and we’re helping them implement improvements that reduce our costs.”

Customer Differentiation: The Procurement Advantage

Major OEMs are making Scope 3 transparency a required capability for preferred supplier status:

The competitive reality

- Tier 1 suppliers without Scope 3 data lose contract renewals

- Supply chain transparency becoming minimum viable supplier requirement

- Sustainability performance factored into procurement decisions

- Long-term partnerships requiring continuous improvement demonstrations

Companies demonstrating Scope 3 readiness are

- Winning competitive bids against larger competitors lacking transparency

- Securing longer contract terms through sustainability partnership positioning

- Gaining preferred supplier status opening additional business opportunities

- Commanding pricing premiums for verified low-carbon products

The companies investing now in supplier partnerships aren’t just preparing for compliance. They’re building operational moats competitors will struggle to replicate for years.

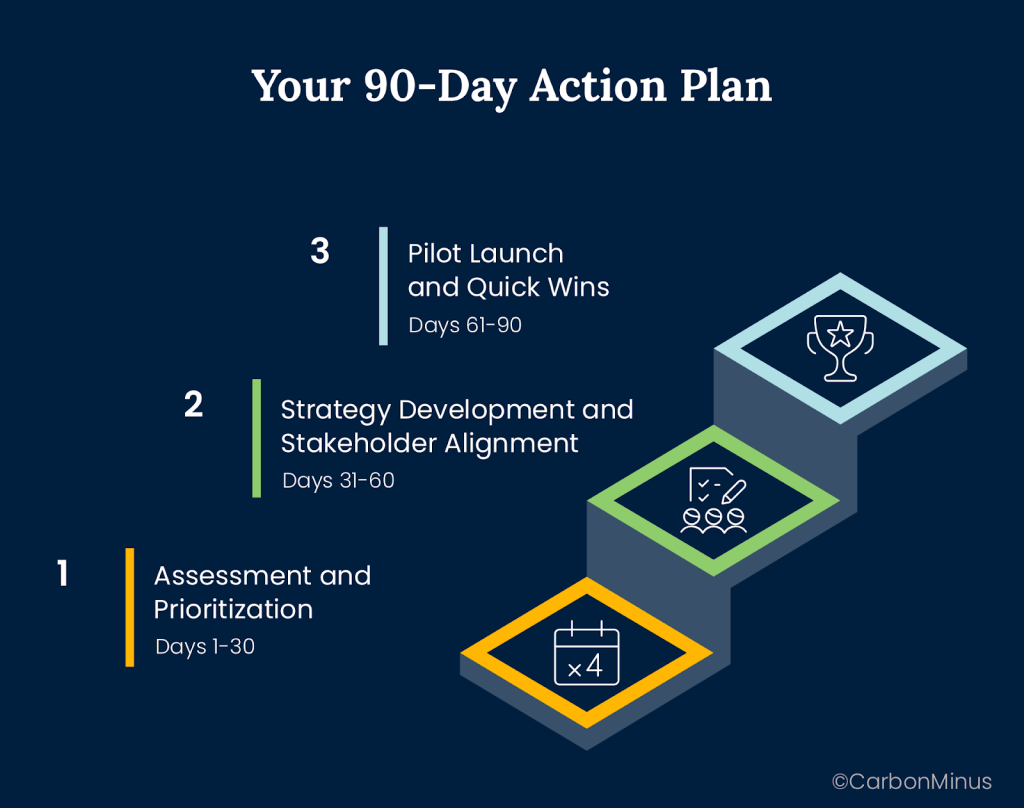

Your 90-Day Action Plan: Start Building the Waggle Dance

You have 455 days until the first Scope 3 report is due (covering 2026 data, submitted in 2027).

That sounds like plenty of time. It’s not.

Building supplier relationships and data infrastructure takes 12-18 months minimum. Here’s how to start immediately.

Days 1-30: Assessment and Prioritization

Week 1: Supply Chain Mapping

Action Items

- Catalog all Tier 1 suppliers with annual procurement spend

- Request Tier 2+ supplier information from top 20 Tier 1 partners

- Map geographic distribution and identify CBAM exposure for EU exports

- Estimate preliminary Scope 3 using spend-based methodology

Deliverable: Supply chain map with estimated emission contribution by supplier.

Week 2-3: Impact Analysis

Action Items

- Calculate which suppliers represent 70-80% of estimated Scope 3 emissions

- Assess relationship strength (contract length, partnership quality, strategic importance)

- Evaluate technical capabilities (existing monitoring, data systems, sustainability programs)

- Identify quick-win opportunities for pilot program recruitment

Deliverable: Prioritized supplier list for engagement with impact and readiness scoring.

Week 4: Technology Evaluation

Action Items:

- Review digital platforms for supplier engagement automation

- Assess integration requirements with existing ERP/procurement systems

- Evaluate internal IT resources vs. external platform providers

- Request demonstrations from top 3 platform candidates

Deliverable: Technology recommendation with integration roadmap and budget estimate.

Days 31-60: Strategy Development and Stakeholder Alignment

Week 5-6: Partnership Framework Design

Action Items

- Design mutual value proposition for supplier participation

- Develop technical assistance program (energy assessments, efficiency support)

- Create procurement preference structure linking sustainability to commercial advantages

- Draft communication materials explaining benefits to suppliers

Deliverable: Complete supplier engagement framework with value proposition and participation incentives.

Week 7: Internal Alignment

Action Items

- Present strategy to executive leadership securing budget approval

- Align procurement team on sustainability integration into sourcing decisions

- Brief operations on supply chain optimization opportunities

- Coordinate with sustainability team on regulatory compliance requirements

Deliverable: Executive approval and cross-functional commitment to supplier engagement program.

Week 8: Pilot Supplier Selection

Action Items

- Identify 10-15 suppliers for pilot program (representing 30-40% of Scope 3)

- Conduct executive-level outreach explaining partnership opportunity

- Schedule kickoff meetings with interested suppliers

- Finalize pilot program timeline and success metrics

Deliverable: Confirmed pilot supplier cohort with committed participation.

Days 61-90: Pilot Launch and Quick Wins

Week 9-10: Platform Deployment

Action Items:

- Deploy supplier engagement platform with pilot group

- Conduct supplier training on data submission and portal use

- Begin baseline data collection for 2025 emissions

- Establish data quality validation and support processes

Deliverable: Operational platform with pilot suppliers actively submitting data.

Week 11-12: Value Delivery

Action Items

- Conduct energy efficiency assessments for pilot suppliers

- Identify improvement opportunities with ROI calculations

- Provide technical support for high-impact projects

- Document cost savings and emission reductions

Deliverable: Demonstrated mutual value with quantified benefits for pilot suppliers.

Week 13: Scaling Preparation

Action Items

- Analyze pilot program results and lessons learned

- Refine processes based on supplier feedback and data quality issues

- Develop expansion plan for remaining suppliers

- Present results to leadership with scaling recommendation and budget request

Deliverable: Validated approach with documented ROI and expansion-ready infrastructure.

Master Your Supply Chain or Watch Competitors Do It First

Let’s return to those bees for a moment.

Sixty thousand individuals coordinating perfectly without central control. It works because the communication system makes information sharing valuable for every participant.

The scouts performing waggle dances aren’t altruists. They’re competing for attention, trying to convince the colony their flower patch is best. The system works because individual success and collective success align perfectly.

That’s the mental model most supply chain directors miss about Scope 3.

You’re not extracting data from suppliers. You’re building a communication architecture where participation creates tangible value for everyone involved.

The Strategic Choice

Path 1: Reactive Compliance

- Wait until 2026, panic about 2027 deadline

- Hire consultants to send surveys, get 15% response rates

- Submit bare-minimum report leveraging safe harbor protection

- Gain zero operational benefit beyond avoiding penalties

- Watch suppliers share data with competitors who offered partnership value

- Lose preferred supplier status with customers requiring transparency

Path 2: Proactive Supply Chain Leadership

- Invest 2025-2027 building supplier partnership infrastructure

- Create mutual value through efficiency improvements and cost reduction

- Generate continuous Scope 3 data as byproduct of operational optimization

- Position supply chain transparency as competitive differentiator

- Win customer contracts requiring sustainability performance

- Build strategic moats competitors can’t replicate quickly

The investment timeline is comparable. The resource requirements are similar. The outcomes are dramatically different.

The Competitive Future

By 2028, Scope 3 transparency will be table stakes, the minimum requirement for sophisticated supply chains.

The companies investing now aren’t just checking compliance boxes. They’re building:

- Supply chain control through real-time visibility and performance monitoring

- Cost optimization through supplier efficiency improvements (8-15% input cost reduction typical)

- Risk mitigation through multi-tier transparency and early warning systems

- Customer preference through demonstrated sustainability leadership

- Export capability for CBAM-compliant European markets

Build Your Waggle Dance System

The bees don’t wait for perfect conditions. They adapt, communicate, and coordinate in real-time because survival depends on it.

Your supply chain visibility challenge is approaching fast. The 2027 deadline is fixed. The safe harbor window closes in 2030.

Here’s how to move forward.

Schedule Your Scope 3 Assessment →

Coordinate Like the Colony

Those 60,000 bees don’t have meetings to discuss the waggle dance. They don’t debate whether communication infrastructure is worth the investment.

They built the system because survival requires coordination at scale.

Your supply chain has 150 suppliers generating 1.3 million tons of CO2 annually, 26 times your operational emissions.

The 2027 deadline isn’t the real challenge. The real challenge is building supplier partnerships that create competitive advantages lasting decades beyond compliance.

The companies that master supply chain coordination first won’t just comply with Scope 3 reporting. They’ll control their supply chains with visibility and influence competitors can’t match.

455 days until Scope 3 reporting begins.

What communication architecture will you build with the suppliers who determine 90% of your emissions?

Schedule Your Scope 3 Assessment →

About CarbonMinus

CarbonMinus transforms manufacturing supply chain complexity into competitive advantage. Our supplier engagement platform integrates with existing procurement systems to deliver real-time Scope 3 monitoring and automated regulatory compliance. We help manufacturers build supplier partnerships that simultaneously reduce emissions, cut costs, and create strategic moats, turning operational excellence into measurable business value.

Learn more at carbonminus.com

FAQs

What exactly are Scope 3 emissions, and why are they so much larger than Scope 1 & 2 for manufacturers?

Scope 3 emissions are all indirect emissions from your value chain both upstream (suppliers, logistics, purchased goods) and downstream (product use, end-of-life). For manufacturers, these are dramatically larger than operational emissions because:

The Scale Reality: Manufacturing upstream emissions are 26 times larger than Scope 1 + 2 combined. Your facility’s direct energy use (Scope 1 & 2) might be 50,000 tons CO2 annually, but your supply chain generates 1.3 million tons.

Why Manufacturing Is Different: Unlike services or retail, manufacturing involves:

- Raw material extraction and processing (energy-intensive mining, refining, chemical production)

- Component manufacturing (multiple tiers of suppliers with their own energy use)

- Capital equipment production (machinery, tooling, facilities)

- Complex logistics networks (multi-tier transportation and warehousing)

The GHG Protocol identifies 15 Scope 3 categories, but for manufacturers, Category 1 (Purchased Goods and Services) typically represents 70-80% of total Scope 3 emissions.

Which Scope 3 categories matter most for manufacturing companies?

Focus your initial efforts on the categories representing 80%+ of your Scope 3 impact:

Highest Impact Categories for Manufacturing:

Category 1 (Purchased Goods and Services): 70-80% of manufacturing Scope 3

- Raw materials, components, packaging materials

- Chemicals, metals, plastics, and other production inputs

- Direct correlation to procurement spend and volumes

Category 2 (Capital Goods): 10-15% typically

- Manufacturing equipment, machinery, and tooling

- Facilities construction and infrastructure

- IT equipment and vehicles

Category 4 (Upstream Transportation & Distribution): 5-10%

- Inbound logistics from suppliers to your facilities

- Warehousing and intermediate storage

- Inter-facility transportation

Category 12 (End-of-Life Treatment): Varies by product

- Product disposal, recycling, or waste treatment

- Particularly significant for durable goods and complex assemblies

The remaining 11 categories typically represent less than 10% combined for most manufacturers. Start with Categories 1, 2, and 4 to address 85-90% of Scope 3 emissions.

What’s the difference between Scope 1, 2, and 3? Can you explain it in manufacturing terms?

Think of it as expanding circles of operational control:

Scope 1 (Direct Emissions): Energy you burn on-site

- Natural gas in your boilers and furnaces

- Diesel in your backup generators

- Process emissions from manufacturing operations

- Company vehicles you own and operate

- Example: Your facility burns 50,000 therms of natural gas monthly = Scope 1

Scope 2 (Indirect Energy Emissions): Energy you purchase

- Electricity from the grid powering your production lines

- Purchased steam or heating for your facilities

- Cooling systems using external energy

- Example: Your plant uses 2 million kWh of grid electricity monthly = Scope 2

Scope 3 (Value Chain Emissions): Everything else in your supply chain and product lifecycle

- Your steel supplier’s energy use making your raw materials

- The trucks delivering components to your facility

- Your Tier 2 suppliers producing components for your Tier 1 suppliers

- Your products’ energy use during customer operation

- Example: The aluminum in your products required mining, refining, and smelting = Scope 3

Manufacturing Reality: If your Scopes 1+2 = 100,000 tons CO2, your Scope 3 is likely 700,000-2,600,000 tons (7-26x larger).

How do I get suppliers to share emissions data when they’re already overwhelmed with sustainability surveys?

Stop sending surveys. Build mutual value partnerships instead.

The Problem with Surveys: Your suppliers receive 15-20 sustainability questionnaires annually from different customers. Each requires hours of manual work. Response rates hover at 15%, and data quality is terrible.

The Partnership Approach That Works:

1. Lead with Value, Not Data Requests

- Offer free energy efficiency assessments identifying cost-saving opportunities

- Provide technical support for implementing energy management systems

- Share benchmarking data so suppliers can compare performance

- Link sustainability performance to commercial advantages (longer contracts, preferred pricing)

2. Make Participation Easy

- Integrate data collection into existing quality and delivery reporting

- Use digital platforms with simple interfaces, not 40-question PDFs

- Automate data pulls from systems suppliers already use

- Provide technical assistance with data collection and validation

3. Create Competitive Advantages for Participants

- Procurement preference for sustainability leaders

- Recognition programs highlighting top performers

- Early access to new business opportunities

- Support letters for their customers requiring sustainability data

Real Results: Companies using this approach see 75-85% supplier participation vs. 15% for traditional surveys.

One procurement director told us: “We stopped asking for data and started helping suppliers save money. Suddenly everyone wanted to participate because we were solving their problems, not creating more work.”

Should I prioritize getting data from all suppliers or focus on high-impact ones first?

Focus on high-impact suppliers first this is a phased approach, not a simultaneous rollout.

The 80/20 Rule for Scope 3:

- Typically, 20-25% of suppliers represent 70-80% of your emissions

- Prioritize these relationships for detailed engagement and data collection

- Use estimation methods for long-tail, low-impact suppliers

Strategic Supplier Prioritization Framework:

Tier 1 (Highest Priority): Top 25-30 suppliers representing 70-80% of Scope 3

- Deep partnership engagement with technical assistance

- Detailed primary data collection and continuous monitoring

- Investment in supplier efficiency improvements

- Long-term strategic relationship building

Tier 2 (Medium Priority): Next 50-75 suppliers representing 15-20% of Scope 3

- Simplified data collection through digital portals

- Basic energy efficiency guidance and support

- Annual data updates with automated validation

- Standard sustainability requirements in contracts

Tier 3 (Low Priority): Remaining suppliers representing <10% of Scope 3

- Spend-based or industry-average emission estimates

- Periodic survey data collection (every 2-3 years)

- Standardized questionnaires and self-certification

- Focus resources on Tiers 1 and 2 instead

Implementation Timeline: Start with 10-15 Tier 1 suppliers in Year 1, expand to full Tier 1 in Year 2, then systematically add Tier 2 suppliers. Perfect data from every supplier isn’t the goal—strategic visibility into high-impact relationships is.

How do I engage Tier 2+ suppliers when I don’t have direct contracts with them?

Leverage your Tier 1 suppliers as intermediaries while building visibility into deeper supply chain tiers.

Multi-Tier Engagement Strategy:

Phase 1: Tier 1 Partnership Development

- Build strong relationships with direct suppliers first

- Include Tier 2+ visibility requirements in Tier 1 contracts

- Incentivize Tier 1 suppliers to engage their suppliers on your behalf

- Provide tools and support making Tier 2 engagement easier for Tier 1

Phase 2: Collaborative Tier 2 Identification

- Work with Tier 1 suppliers to map their highest-impact suppliers

- Identify Tier 2 suppliers serving multiple Tier 1 partners

- Prioritize Tier 2 suppliers representing largest emission contributions

- Assess which Tier 2 relationships justify direct engagement

Phase 3: Direct Tier 2+ Engagement (Selective)

- For critical raw materials or high-emission inputs, establish direct relationships

- Coordinate with other manufacturers sourcing from same Tier 2 suppliers

- Use industry collaboratives (e.g., CDP Supply Chain, sector-specific initiatives)

- Provide value proposition extending benefits beyond single customer

Technology Enablement:

- Digital platforms allowing Tier 2+ suppliers to share data accessible by multiple customers

- Automated data aggregation reducing Tier 1 burden of downstream reporting

- Supplier portals with tiered access for different supply chain levels

Reality Check: You likely won’t have detailed primary data from Tier 3+ suppliers. Focus on:

- Tier 1: Detailed primary data (70-80% of emissions)

- Tier 2: Mixture of primary data for critical suppliers and estimates for others

- Tier 3+: Industry averages and spend-based estimates

SB 253’s safe harbor protection until 2030 explicitly recognizes that perfect Tier 2+ data takes years to develop.

What technology infrastructure do I need for automated Scope 3 data collection?

You need supplier engagement platforms that integrate with existing procurement systems—not standalone sustainability software disconnected from operations.

Core Technology Components:

1. Supplier Data Collection Portal

- Web-based interface for supplier data submission and validation

- Role-based access for different supplier team members

- Multi-language support and localized data formats

- Mobile-friendly for suppliers without desktop infrastructure

- Automated data quality checks and validation rules

2. ERP and Procurement System Integration

- Automatic data pulls from existing supplier management platforms

- Procurement spend correlation with emissions intensity

- Contract management integration for sustainability requirements

- Invoice and payment data linking financial flows to environmental impact

3. Real-Time Data Aggregation Engine

- Continuous monitoring replacing annual survey snapshots

- API connections to supplier energy management systems

- Cross-validation using production volumes, shipping records, utility data

- Anomaly detection flagging data quality issues immediately

4. GHG Protocol Calculation and Reporting

- Automated emission calculations across all 15 Scope 3 categories

- SB 253 and CARB reporting format generation

- Customizable dashboards for different stakeholder audiences

- Third-party assurance documentation and audit trail

Integration Requirements:

- Procurement Platforms: SAP Ariba, Oracle, Coupa, Jaggaer

- ERP Systems: SAP, Oracle NetSuite, Microsoft Dynamics

- Quality Management: Existing supplier audit and performance systems

- Energy Systems: Supplier SCADA, BMS, and metering platforms

Implementation Timeline: 90-180 days for platform deployment and integration, depending on system complexity.

The key insight: Don’t build parallel sustainability systems. Integrate environmental data into commercial workflows procurement and operations already use daily.

Can I use the same platform for SB 253 compliance, CBAM reporting, and other regulations?

Yes and that’s precisely why integrated platforms deliver superior ROI compared to regulation-specific point solutions.

Regulatory Convergence: Multiple frameworks are aligning around similar data requirements:

SB 253 (California): Scope 1, 2, 3 emissions reporting using GHG Protocol

EU CBAM (Carbon Border Adjustment Mechanism): Embedded emissions in products exported to Europe

SEC Climate Disclosure (if reinstated): Material climate risks and GHG emissions

CSRD (EU Corporate Sustainability Reporting): Comprehensive sustainability metrics including supply chain

ISO 50001: Energy management systems and performance improvement

Common Data Foundation: All require variations of:

- Scope 1 & 2 emissions from operations

- Scope 3 emissions from supply chain (particularly purchased goods)

- Energy consumption and efficiency metrics

- Supplier-level data collection and validation

- Third-party assurance and verification

Platform Integration Benefits:

- Single supplier engagement: One data collection process serves multiple regulations

- Consistent methodology: GHG Protocol framework applies across requirements

- Reduced supplier burden: Suppliers submit data once, not separately for each regulation

- Cost efficiency: One platform investment vs. multiple compliance systems

- Operational leverage: Energy management infrastructure serves regulatory and business needs

Strategic Advantage: Companies implementing integrated platforms now are future-proofing against expanding regulations while competitors deploy fragmented, regulation-specific solutions requiring costly integration later.

The manufacturers winning regulatory compliance are those treating it as infrastructure investment rather than compliance expense—building systems that serve business operations, customer requirements, and multiple regulatory frameworks simultaneously.

What is the “safe harbor” protection for Scope 3, and how long does it last?

Safe harbor protection means no penalties for Scope 3 misstatements disclosed with reasonable basis—but only until 2030.

The Protection Details:

What’s Covered:

- Errors or omissions in Scope 3 emissions calculations

- Use of estimation methodologies for unavailable primary data

- Supplier data quality issues beyond your reasonable control

- Methodological uncertainties in complex supply chain accounting

What’s Required:

- Disclosure: Clearly state data limitations, gaps, and estimation methods

- Reasonable Basis: Demonstrate good faith effort to collect accurate data

- Documentation: Maintain records showing compliance attempts and challenges

- Continuous Improvement: Show year-over-year progress in data quality and coverage

Timeline:

- 2027-2029: Full safe harbor protection for disclosed misstatements

- 2030: Protection expires; penalties apply for non-compliance

- 2030+: Limited assurance (third-party verification) required

Strategic Implications:

This creates a 3-year window (2027-2029) for building infrastructure without penalty risk—but you must demonstrate good faith effort:

- Active supplier engagement programs (not just surveys ignored by suppliers)

- Technology deployment for data collection and validation

- Documentation of challenges and improvement plans

- Progressive data quality improvement year-over-year

What This Isn’t: Safe harbor is not a free pass to ignore Scope 3. It’s recognition that supply chain data transformation takes years to execute properly. Companies demonstrating minimal effort won’t qualify for protection.

The Opportunity: Use 2025-2027 to build supplier partnership infrastructure that creates competitive advantages lasting decades beyond the safe harbor period.

How should I prioritize Scope 3 implementation against other sustainability initiatives?

Scope 3 should be your top priority because it delivers regulatory compliance, operational improvements, and competitive advantages simultaneously.

Why Scope 3 Deserves Priority Investment:

1. Regulatory Imperative

- SB 253 Scope 3 reporting mandatory starting 2027

- Customer requirements cascading through supply chains

- EU CBAM affecting exports to Europe

- Growing regulatory pressure across jurisdictions

2. Emissions Magnitude

- Represents 70-90% of total carbon footprint for manufacturers

- Operational efficiency initiatives addressing only 10-30% of total impact

- Supply chain represents largest opportunity for emission reductions

3. Operational Benefits

- Supplier engagement identifies efficiency improvements reducing input costs (8-15% typical)

- Supply chain visibility reduces disruption risks and improves resilience

- Procurement optimization through sustainability performance integration

- Customer relationship enhancement through transparency

4. Competitive Advantage

- Early movers gain preferred supplier status with sustainability-conscious customers

- Supply chain control creates defensible competitive moats

- Market differentiation through demonstrated transparency

- Export capability for regulated markets (EU, others)

Integration Strategy:

Rather than treating Scope 3 as separate from other initiatives, integrate it into existing programs:

- Energy Management: Extend facility efficiency programs to suppliers

- Quality Systems: Add sustainability metrics to supplier audits

- Procurement Optimization: Include emissions in total cost of ownership

- Risk Management: Incorporate climate risk into supply chain assessment

Resource Allocation Recommendation:

- 60% of sustainability budget: Scope 3 supplier engagement and technology

- 30%: Operational efficiency (Scope 1 & 2 improvements)

- 10%: Reporting, communications, and strategy

This allocation reflects both the emissions magnitude and the strategic value of supply chain control.

How are competitors approaching Scope 3? Am I behind or ahead?

Current Industry Reality: Most manufacturers are dangerously behind, creating opportunities for early movers.

The Competitive Landscape:

Laggards (60-70% of manufacturers):

- No active Scope 3 program beyond awareness

- Relying on hope that requirements will be delayed or weakened

- Planning to hire consultants in 2026 for 2027 reporting

- No supplier engagement infrastructure

- Strategic Position: Massive disadvantage, scrambling for compliance

Followers (25-30% of manufacturers):

- Initial supplier surveys with poor response rates (10-15%)

- Fragmented data collection without systematic approach

- Treating Scope 3 as compliance burden, not business opportunity

- Minimal technology investment

- Strategic Position: Bare-minimum compliance, no competitive advantage

Leaders (5-10% of manufacturers):

- Comprehensive supplier engagement programs launched 2024-2025

- Technology platforms for automated data collection and validation

- Supplier partnerships creating mutual value through efficiency improvements

- Integration with procurement and quality systems

- Strategic Position: Competitive moats through supply chain control

Where You Should Be (Q4 2025):

If you’re reading this blog and taking action now, you’re positioning in the top 20-25%. To reach top 10% leadership position:

- Launch pilot supplier engagement program by Q1 2026

- Deploy technology platform by Q2 2026

- Demonstrate measurable supplier efficiency improvements by Q4 2026

- Submit comprehensive 2027 report with high-quality data

- Leverage supply chain transparency for customer differentiation

Competitive Intelligence: Ask your top 5 suppliers which of your competitors have approached them about sustainability partnerships. Their answers reveal who’s building strategic advantages while others delay.

Will Scope 3 compliance become a requirement for maintaining OEM relationships?

It’s already happening and accelerating faster than most suppliers realize.

Current OEM Requirements:

Automotive Industry:

- Major OEMs requiring Scope 3 data from Tier 1 suppliers by 2026-2027

- Supplier sustainability scorecards factoring into contract decisions

- Long-term agreements requiring continuous improvement commitments

- Preferred supplier status linked to supply chain transparency

Aerospace & Defense:

- Government contracts increasingly requiring supply chain emissions disclosure

- Prime contractors cascading requirements to subcontractors

- Lifecycle emissions analysis for major programs

Electronics & Technology:

- Apple, Microsoft, Google requiring supplier emissions reductions

- Science-based targets requiring Scope 3 engagement

- Supply chain decarbonization as procurement requirement

The Cascade Effect: When your customers need Scope 3 data for their compliance, they’ll require it from you. This creates a regulatory cascade through supply chains regardless of whether your company is directly subject to SB 253.

Timeline Acceleration:

- 2024-2025: Early adopter OEMs requesting supplier data

- 2026-2027: Mainstream OEMs making Scope 3 data mandatory

- 2028-2029: Scope 3 transparency becomes minimum viable supplier requirement

- 2030+: Suppliers without robust data lose competitive positioning

The Procurement Reality: One Tier 1 automotive supplier reported: “Three of our top five customers added Scope 3 requirements to 2026 contract renewals. We’re not subject to SB 253 directly, but customer requirements made it mandatory for maintaining business relationships.”

Strategic Response: Don’t wait for customers to require Scope 3 data. Proactively develop capability and use it as a competitive differentiator in sales processes. Early adopters are winning additional business specifically because they offer transparency competitors can’t match.