TL;DR

- Carbon credit market projected to reach $16.38 trillion by 2034, growing at 37.68% CAGR from $933B in 2025

- High-quality carbon credits hit record prices in late 2025: $24/tonne for nature-based credits (up 71%), $170-$500/tonne for tech-based removals

- India’s CCTS transforms compliance into revenue: Companies beating emissions intensity targets earn tradable credits, those missing targets must buy or pay penalties

- MRV infrastructure is the competitive moat: Real-time IoT monitoring + AI auditing + blockchain tracking enables credit verification and monetization

- Dual ROI business case: Energy efficiency projects deliver 15-25% cost savings PLUS carbon credit revenue ($15-$500/tonne)

- Real revenue examples: Tesla earned $1.78B in 2023, CarbonCure shared $5M with partners, 1,000-tonne reductions = $15K-$24K annual revenue

- Manufacturing projects eligible: Energy efficiency upgrades, fuel switching, waste heat recovery, process optimization all generate tradable credits

- Timeline to monetization: 12-24 months from project start to first credit issuance, faster with digital MRV systems

- CarbonMinus advantage: Hardware-agnostic platform provides real-time emissions monitoring, automated MRV-ready reporting, and carbon trading module

- Strategic timing: Early movers capture premium pricing and first-mover market positioning while carbon prices rise

At 19 years old, Jessica Matthews attended her aunt’s wedding in Nigeria and watched diesel generators sputter to life when the power went out. The fumes were suffocating. The noise was unbearable. But what struck her most was the waste—all that human energy on the soccer field outside, just dissipating into thin air.

So she invented a soccer ball that captures kinetic energy from every kick and converts it into electricity. Thirty minutes of play generates three hours of LED light. What everyone else saw as children playing, Matthews saw as untapped power.

Her company, Uncharted Power, now converts kinetic energy from playgrounds, sidewalks, and even shopping carts into renewable energy. The insight? Energy isn’t created or destroyed—it’s either captured or wasted.

The same principle now applies to carbon emissions in manufacturing.

For decades, manufacturers treated carbon reductions as pure cost—compliance checkboxes that drained budgets without return.But in 2025, the global carbon credit market is projected to reach $16.38 trillion by 2034, and manufacturers who reduce emissions can now sell verified carbon credits like financial assets. This acceleration marks the beginning of a carbon credit boom, where early adopters stand to benefit the most from rising demand and tightening global regulations.

Every tonne of CO₂ you cut can now generate $15 to $500 in revenue, depending on credit quality and market conditions. Under India’s Carbon Credit Trading Scheme, this CCTS revenue model has turned emissions reduction from a regulatory burden into a powerful P&L strategy..

The question isn’t whether carbon has value. The question is: do you have the infrastructure to capture it?

This is the manufacturing playbook for turning emissions data into tradable revenue—with real numbers, real infrastructure, and real ROI.

The $16.4 Trillion Carbon Market: From Compliance Burden to Financial Asset Class

Most CFOs still categorize carbon under “regulatory risk.” Smart ones are moving it to “revenue opportunity.”

Here’s why: The global carbon credit market was valued at $933 billion in 2025 and is projected to reach $16.38 trillion by 2034, growing at a 37.68% compound annual growth rate. To put that in perspective, that’s larger than the entire global oil and gas industry.

The compliance carbon market alone, covering mandatory emissions trading systems was worth $113.1 billion in 2024 and is expected to hit $458.4 billion by 2034. The voluntary carbon market, where companies buy credits to offset emissions beyond regulatory requirements, is projected to reach $23.99 billion by 2030, growing at 35.1% annually.

This isn’t speculative growth. This is policy-driven infrastructure.

Three Forces Turning Carbon Into Currency

1. Carbon Pricing Is Now Policy, Not Choice

Carbon pricing revenues exceeded $100 billion globally in 2024, covering 28% of global greenhouse gas emissions in economies representing two-thirds of global GDP. That’s not a niche market—that’s mainstream economic infrastructure.

There are now 80 carbon pricing instruments operating worldwide, up from 75 in 2024. This includes 38 active Emissions Trading Systems (ETS) with more than 20 additional schemes in development.

When governments generate over $100 billion annually from carbon pricing, they’re not walking that policy back. The financial infrastructure is permanent.

Carbon pricing covered 24% of global emissions in 2023, generating $104 billion in government revenue. By 2025, that figure exceeded $100 billion and continues climbing.

2. India’s CCTS Changes the Manufacturing Economics

India launched its Carbon Credit Trading Scheme (CCTS) under the Energy Conservation Act, targeting industrial sectors including cement, aluminium, iron and steel, paper, and chlor-alkali.

Here’s how it works: The government sets emissions intensity targets for each sector. Companies that beat those targets earn tradable carbon credits. Companies that miss targets must buy credits from outperformers or pay penalties.

This flips the entire sustainability business case. Energy efficiency investments aren’t just cost-avoidance anymore, they’re revenue-generating assets.

For Indian manufacturers, CCTS creates a direct financial incentive for every tonne of CO₂ reduced. Early movers who build measurement infrastructure now position themselves to sell credits while competitors scramble to avoid penalties.

3. Corporate Net-Zero Commitments Create Premium Demand

Thousands of companies have legally binding net-zero targets with 2030-2050 deadlines. They can’t all eliminate 100% of emissions immediately, so they need high-quality carbon offsets to bridge the gap.

But here’s the constraint: supply of verified, high-integrity credits is limited. When demand outpaces supply, prices rise. And in 2025, that’s exactly what happened.

High-Quality Carbon Credits Hit Record Prices in Late 2025

Not all carbon credits are created equal. And in 2025, the market started pricing that distinction aggressively.

Nature-based removal credits (like afforestation and reforestation projects) hit $24 per tonne in September 2025, up from $14 per tonne earlier in the year, a 71% increase. Technology-based removal credits from Direct Air Capture (DAC) and Bioenergy with Carbon Capture and Storage (BECCS) command $170 to $500 per tonne.

EU Emissions Trading System (ETS) compliance credits trade around $98 per tonne. Even mid-tier nature-based credits range from $7 to $24 per tonne depending on verification standards and co-benefits.

Why are prices rising?

Buyers demand high-integrity credits with verified additionality (the reduction wouldn’t have happened anyway), permanence (the carbon stays out of the atmosphere), and measurable co-benefits like biodiversity or community development.

The market has matured. Average carbon project quality scores rose from B/BB ratings in 2020 to above BB by 2024. Credits with robust Measurement, Reporting, and Verification (MRV) systems and co-benefit certification command a 78% price premium over baseline credits.

What it means for CFOs: Credits backed by rigorous data infrastructure sell for more money.

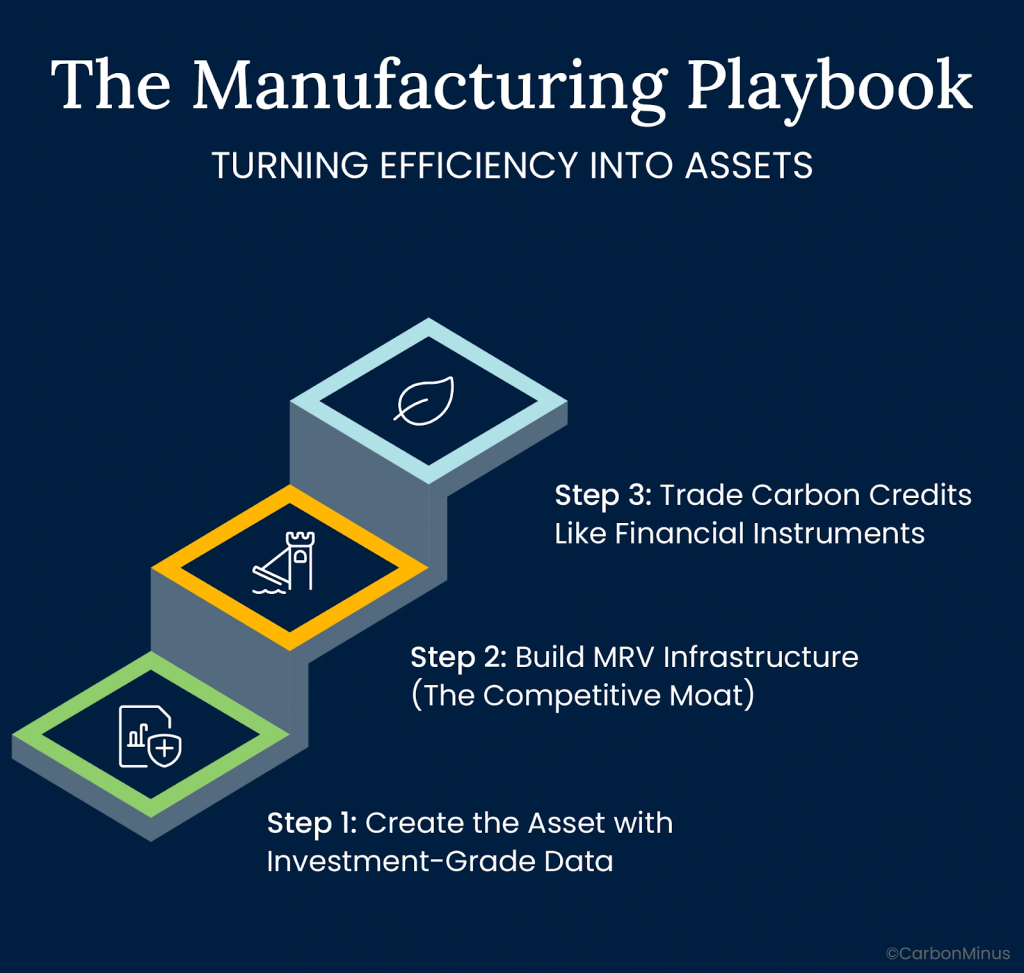

The Manufacturing Playbook: Turning Efficiency Into Assets

Here’s the disconnect most manufacturers face: You’re already reducing emissions through energy efficiency projects, but you’re leaving money on the table because you don’t have the infrastructure to verify, certify, and sell those reductions as carbon credits.

Building that infrastructure requires three steps. Think of it as the Data-to-Dollar Pipeline.

Step 1: Create the Asset with Investment-Grade Data

Carbon credits are only as valuable as the data behind them. Manual spreadsheets and quarterly utility bills don’t cut it in 2025.

You need real-time, IoT-powered emissions monitoring across your entire operation, timestamped, machine-generated, third-party-verifiable data that tracks emissions at the asset, process, and facility level.

This means:

- Continuous measurement across Scope 1 (direct emissions), Scope 2 (purchased electricity), and Scope 3 (supply chain) emissions

- Granular visibility down to individual equipment and production lines

- Automated data capture that eliminates manual reporting gaps

Why this matters: Verification bodies won’t certify carbon credits based on estimates or back-of-the-envelope calculations. They need audit-ready data with clear baselines, methodologies, and continuous monitoring. The precision and granularity of your data infrastructure directly determines whether your reductions qualify as tradable assets.

Manufacturers with real-time monitoring systems can immediately quantify the carbon impact of every efficiency improvement from upgrading motors to optimizing HVAC to capturing waste heat. Those without it are flying blind.

Step 2: Build MRV Infrastructure (The Competitive Moat)

MRV, which is Measurement, Reporting, and Verification is the backbone of carbon credit integrity. Without MRV, you have claims. With MRV, you have tradable assets.

MRV is a multi-step process to measure greenhouse gas emission reductions, report those reductions transparently, and have them verified by independent third parties. It’s what separates legitimate carbon credits from greenwashing.

Here’s how technology is enabling scalable MRV:

AI-Powered Auditing

Artificial intelligence systems audit emissions data in real-time, flagging anomalies, verifying additionality (that reductions are real and wouldn’t have happened anyway), and ensuring data integrity. AI can process millions of data points across facilities, identifying patterns human auditors would miss.

Blockchain for Transparency

Blockchain technology creates an immutable ledger recording every carbon credit’s journey from issuance to trading to retirement. This eliminates double-counting, fraud, and opacity that plagued earlier carbon markets.

Smart Contracts for Automation

Smart contracts on blockchain platforms automate carbon credit transactions, reducing friction, administrative costs, and settlement times. When emissions reductions meet verification thresholds, credits are automatically issued and available for trading.

Digital MRV Platforms

Modern platforms integrate with existing energy management systems, pulling real-time data, applying appropriate carbon accounting methodologies, and generating verification-ready reports. This turns what used to be a months-long manual process into continuous, automated monitoring.

MRV is the difference between a sustainability claim and a tradable asset. Manufacturers with MRV-ready infrastructure can monetize emission reductions. Those without it can’t.

The strategic insight: MRV capability is becoming a competitive moat. Companies that build this infrastructure in 2025 can respond immediately to carbon market opportunities. Those waiting will spend 18-24 months and millions of dollars retrofitting systems while competitors capture first-mover revenue.

Step 3: Trade Carbon Credits Like Financial Instruments

Once you have verified emission reductions, carbon credits function like financial assets. You can sell them, bank them for future use, or retire them depending on your business strategy.

Here’s how the trading ecosystem works:

Registries and Standards

Carbon credits are issued through recognized registries like Verra (Verified Carbon Standard), Gold Standard, Climate Action Reserve, and for Indian manufacturers, the Carbon Credit Trading Scheme (CCTS). Each registry has methodologies for specific project types like energy efficiency, fuel switching, renewable energy, etc.

Market Participation

Credits can be sold on compliance markets (mandatory for regulated entities like those under CCTS or EU ETS) or voluntary markets (companies buying offsets to meet net-zero commitments). Compliance credits typically command higher prices due to regulatory demand.

Credit Lifecycle Management

Modern platforms track vintage (the year emissions were reduced), expiry dates, and status (issued, sold, retired). You manage credits across multiple registries in a single dashboard, optimizing when to sell based on market conditions.

Exchange Integration

Carbon credits trade on exchanges with price discovery mechanisms similar to commodities. Manufacturers can plug into these exchanges for liquidity, transparent pricing, and immediate settlement.

What Manufacturers Can Actually Monetize

Let’s get concrete. What emission reduction projects generate sellable carbon credits for manufacturers?

Energy Efficiency Upgrades

Lighting retrofits, HVAC optimization, motor upgrades, compressed air system improvements, and building insulation. Each improvement generates 0.25 to 2 carbon credits depending on project scale and baseline emissions.

Fuel Switching

Replacing coal or diesel with renewable energy sources like solar, wind, or sustainable biomass. Industrial electrification of heat processes. These projects typically generate credits based on the emissions intensity difference between old and new fuel sources.

Waste Heat Recovery

Capturing thermal energy from industrial processes and reusing it for heating, power generation, or other applications. This simultaneously reduces fuel consumption and emissions, creating dual savings.

Process Optimization

Equipment upgrades, automation, and predictive maintenance that reduce energy consumption per unit of production. Industry 4.0 technologies are making these improvements measurable and verifiable at scale.

Real ROI Example

Consider a mid-sized manufacturing facility that implements comprehensive energy efficiency measures, resulting in 1,000 tonnes of verified CO₂ reductions annually.

At a conservative $15 per tonne (low end of current nature-based credit prices):

1,000 credits × $15 = $15,000 annual revenue

At $24 per tonne (September 2025 ARR credit prices):

1,000 credits × $24 = $24,000 annual revenue

This revenue compounds as you scale improvements across facilities and as credit prices continue rising.

For larger industrial operations reducing 10,000 to 50,000 tonnes annually, you’re looking at $150,000 to $1.2 million in potential annual carbon credit revenue—from reductions you were making anyway.

Who’s Already Winning: Real Revenue Examples

This isn’t theoretical. Companies across industries are already monetizing carbon reductions at scale.

Tesla: The $1.78 Billion Carbon Credit Business Model

Tesla earned $1.78 billion in 2023 from selling regulatory carbon credits to legacy automakers who failed to meet emissions standards.

They didn’t invent carbon credits. They built the infrastructure to generate, verify, and monetize them at scale—then structured their entire business model around treating carbon as a revenue line, not a compliance cost.

CarbonCure: $5 Million Shared with Concrete Producers

CarbonCure Technologies, which injects captured CO₂ into concrete during production, has shared $5 million in carbon credit revenue with producer partners over three years.

This demonstrates scalability in heavy industry—traditionally seen as “hard-to-abate” sectors—where carbon monetization seemed impossible.

Manufacturing at Scale: The 1,000-Tonne Scenario

A manufacturing operation that implements energy efficiency projects removing 1 tonne of CO₂ per “acre” of production (scaling metaphor) across 1,000 units of production:

1,000 credits × $15/tonne = $15,000 annual profit

As credit prices rise and production scales, this compounds. The key insight: ROI improves over time as carbon markets mature and prices increase.

India’s CCTS Early Movers

Cement and aluminium manufacturers in India who beat their Government Energy Intensity (GEI) targets under CCTS are now generating tradable credits. First-movers gain competitive advantage not just through regulatory compliance, but through dual revenue streams of operational cost savings plus carbon credit sales.

The Strategic Positioning: Future-Proof Infrastructure

The key differentiator isn’t just what the platform does today, it’s how it positions manufacturers for the next decade of carbon market expansion.

Companies with MRV infrastructure can respond immediately to new carbon pricing policies, voluntary market opportunities, and customer requirements for verified low-carbon products. Those without it are perpetually 18-24 months behind, retrofitting systems while competitors capture value.

CarbonMinus clients aren’t just achieving compliance. They’re building long-term carbon revenue streams that compound as markets mature and credit prices rise.

Why 2025 Is the Year to Build Carbon Infrastructure

Timing matters in emerging markets. And three factors make 2025 the inflection point for manufacturing carbon monetization.

Market Timing: Record Prices, Expanding Demand

High-quality carbon credit prices hit record highs in late 2025, with ARR credits jumping 71% from early 2025 to September. Market analysts project continued price appreciation as supply constraints tighten and corporate net-zero deadlines approach.

India’s CCTS is now fully operational, with cement, aluminium, and other industrial sectors required to meet emissions intensity targets. The compliance market is live and companies are buying and selling credits today.

Globally, carbon pricing now covers 28% of emissions and generated over $100 billion in revenue in 2024. This is mainstream economic infrastructure.

Early movers capture premium pricing and first-mover market positioning. Waiting means entering a mature market where infrastructure costs haven’t changed but credit prices and competitive advantages have already been claimed.

Infrastructure as Competitive Moat

MRV capability is rapidly becoming a defensive competitive requirement, not just an offensive opportunity.

Why? Because major buyers from multinational corporations to government procurement agencies increasingly require suppliers to provide verified carbon footprint data for products. If you can’t measure and verify emissions, you can’t participate in these RFPs.

Companies building MRV infrastructure now gain:

- Revenue generation from carbon credit sales

- Cost savings from energy efficiency improvements

- Market access to customers requiring verified low-carbon supply chains

- Risk mitigation against regulatory penalties and carbon taxes

Those waiting lose on all four dimensions.

The Dual ROI Business Case

CFOs evaluating sustainability investments in 2025 can now justify projects with dual ROI:

ROI #1: Operational Savings

Energy efficiency improvements deliver 15-25% cost reductions with 18-24 month payback periods. Industrial energy monitoring systems cut manufacturing costs by up to 25%. These savings are immediate and compound annually.

ROI #2: Carbon Credit Revenue

The same improvements that reduce costs also generate tradable carbon credits worth $15-$500 per tonne depending on quality and market. This creates a second revenue stream from the same capital investment.

Example Business Case:

A manufacturing plant invests $500,000 in energy efficiency upgrades –

- Energy cost savings: $150,000/year (30% reduction)

- Carbon credits generated: 2,000 tonnes/year × $20/tonne = $40,000/year

- Total annual benefit: $190,000

- Payback period: 2.6 years

- 10-year NPV: $1.4 million+

Without carbon credit monetization, the same project shows $150K/year benefit and 3.3-year payback. The carbon revenue shortens payback by 7 months and increases 10-year value by $400K+.

This is how CFOs justify sustainability investments in 2025: not as CSR initiatives, but as dual-revenue capital projects.

The Choice: Cost Center or Revenue Stream?

Here’s the reality: you’re going to reduce emissions either way. Regulatory compliance, customer requirements, and operational efficiency all push in that direction.

The only question is whether you’ll capture the financial value of those reductions or leave that money on the table.

Manufacturers with MRV infrastructure treat carbon as a tradable asset. They monetize every tonne reduced, participate in carbon markets, and position themselves for the next decade of carbon pricing expansion.

Manufacturers without MRV infrastructure treat carbon as a compliance cost. They make the same improvements but can’t verify, certify, or sell the reductions as credits. They pay for emission reductions but don’t get paid back.

The infrastructure you build in 2025 determines which category you’re in for the next 10 years.

Calculate Your Energy Savings Potential

Want to see how much potential savings your operations could be worth? CarbonMinus offers an ROI calculator that models:

- Your current energy consumption

- The industry you belong to

- Potential reductions from efficiency improvements

Calculate Your Energy Efficiency Potential →

See the Platform in Action

Book a 30-minute demo to see how CarbonMinus turns energy waste into profits.

The $16.4 trillion carbon market is here. The manufacturers who built infrastructure in 2025 will monetize emissions reductions for the next decade.

The question is: will you be one of them?

FAQs

Is the $16.4 trillion carbon market projection realistic?

Yes. Multiple market research firms project the global carbon credit market reaching $16.38 trillion by 2034, growing at a 37.68% CAGR from its 2025 valuation of $933 billion. The compliance market alone is expected to grow from $113.1 billion in 2024 to $458.4 billion by 2034. This growth is driven by expanding carbon pricing policies (now covering 28% of global emissions), corporate net-zero commitments, and regulatory frameworks like India’s CCTS.

What makes a carbon credit “high-quality” and why does it matter?

High-quality carbon credits meet strict criteria: additionality (reductions wouldn’t have happened without the project), permanence (carbon stays out of the atmosphere long-term), real and measurable impact, and third-party verification. Quality matters because high-integrity credits command premium prices—credits with co-benefit certification sell for 78% more than baseline credits. Average project quality scores have risen from B/BB in 2020 to consistently above BB by 2024 as buyers reject low-quality offsets.

What’s the difference between compliance and voluntary carbon markets?

Compliance markets are mandatory—regulated entities must participate to meet legal emissions caps (like EU ETS or India’s CCTS). These markets are highly regulated by governments and typically offer higher, more stable prices. Voluntary markets operate outside regulatory requirements—companies buy credits voluntarily to meet corporate sustainability goals or net-zero targets. Voluntary markets are less regulated and controlled by multiple standard-setting organizations like Verra and Gold Standard.

How long does it take to get carbon credits verified and issued?

The timeline varies by project type and registry, but generally:

- Registration and validation: 6-12 months for project approval

- Monitoring period: Ongoing (typically 1-year minimum before first issuance)

- Verification and issuance: 3-6 months after monitoring data is submitted

Total timeline: 12-24 months from project start to first credit issuance. However, with real-time digital MRV systems, verification cycles are significantly faster because data is continuously collected and audit-ready.

What manufacturing projects are eligible for carbon credits?

Energy-intensive manufacturing improvements are prime candidates, including:

- Energy efficiency upgrades: HVAC, lighting, motors, compressed air systems

- Fuel switching: Coal/diesel to renewables or lower-carbon alternatives

- Waste heat recovery: Capturing and reusing thermal energy

- Process optimization: Equipment upgrades reducing energy per unit of production

- Renewable energy installation: On-site solar, wind, or biomass

Projects must demonstrate additionality (wouldn’t have happened in business-as-usual scenarios) and follow approved methodologies from registries like Verra, Gold Standard, or India’s CCTS.

How does India’s Carbon Credit Trading Scheme (CCTS) work?

India’s CCTS is an intensity-based baseline-and-credit system covering nine energy-intensive sectors including cement, steel, aluminium, paper, and chemicals. Here’s how it works:

- The government sets emissions intensity targets (tCO₂e per unit of product) for each sector with six-year trajectory periods

- Companies exceeding targets earn tradable Carbon Credit Certificates (CCCs)—one certificate equals 1 tonne CO₂e

- Companies missing targets must surrender/purchase CCCs to ensure compliance

- Credits trade on a centralized registry and trading platform

CCTS transforms emissions performance into a direct P&L impact—efficiency gains become revenue, inefficiency becomes cost.

Can small and mid-sized manufacturers participate in carbon credit markets?

Absolutely. While large corporations like Tesla generate billions in carbon credit revenue, smaller manufacturers can still monetize reductions profitably. A facility reducing 1,000 tonnes annually can generate $15,000-$24,000 in revenue at current market prices. Projects generating as few as 250 carbon credits can be economically viable. The key is having MRV infrastructure that makes verification cost-effective at scale.

What is MRV and why is it critical for carbon credits?

MRV stands for Measurement, Reporting, and Verification, the multi-step process that validates greenhouse gas emission reductions. MRV is the backbone of carbon credit integrity and without it you have sustainability claims, not tradable assets.

Modern MRV uses:

- IoT sensors for continuous, timestamped emissions data

- AI systems to verify additionality and data accuracy

- Blockchain for transparent, immutable record-keeping

- Third-party verification bodies for independent certification

Companies with robust MRV infrastructure can verify credits faster and sell at premium prices.

Do we need to replace our existing energy monitoring systems?

No. CarbonMinus is hardware-agnostic, meaning it integrates with your existing energy meters, PLCs, SCADA systems, and IoT devices. The platform connects to current infrastructure via APIs and standard protocols, eliminating the need for complete system replacement. This reduces deployment time, upfront costs, and operational disruption while preserving past investments.

What happens if carbon credit prices drop?

Carbon credits add a second revenue stream on top of energy cost savings—they don’t replace operational benefits. Even if credit prices decline, manufacturers still capture:

- 15-25% energy cost reductions (the primary ROI driver)

- Regulatory compliance avoiding penalties under CCTS, CBAM, or other frameworks

- Market access to buyers requiring verified low-carbon supply chains

Additionally, long-term carbon pricing trends are upward—driven by tightening regulations, expanding ETS programs, and corporate net-zero deadlines. High-quality credits hit record prices in late 2025 and are projected to continue appreciating as supply constraints tighten.

How do I know if my emission reductions will qualify for carbon credits?

Your reductions must meet four core eligibility criteria:

- Additionality: Reductions wouldn’t have occurred without the project (i.e., not business-as-usual)

- Real and measurable: Based on verifiable data, not estimates

- Permanent: Carbon stays out of the atmosphere long-term

- Verified: Third-party audited according to approved methodologies

Projects must also comply with temporal rules—for non-forestry industrial projects, registration typically must occur within 2 years of project implementation start date. This is why building MRV infrastructure early is critical—delayed registration can disqualify otherwise eligible projects.

Can we generate carbon credits from past energy efficiency improvements?

Generally, no. Carbon credit registries require projects to be registered within 2 years of commercial operation for non-forestry projects. This ensures additionality—that the carbon credit incentive influenced the investment decision. However, if you implemented improvements recently (within eligibility windows), you may still qualify. Moving forward, installing MRV infrastructure now ensures all future improvements automatically qualify for credit generation.

What’s CarbonMinus’s role in the carbon credit process?

CarbonMinus provides the data infrastructure and platform that enables carbon credit monetization. Specifically:

- Real-time emissions monitoring that generates MRV-grade data across Scope 1, 2, and 3

- Automated reporting aligned with carbon credit methodologies and registry requirements

- Carbon trading module to manage credit lifecycle, track registries, and participate in markets

- Integration with existing systems for seamless deployment

CarbonMinus doesn’t replace verification bodies or carbon registries—it provides the technology infrastructure that makes verification faster, cheaper, and continuously scalable.

What if I’m not ready to sell carbon credits yet should I still build MRV infrastructure?

Yes, for three strategic reasons:

- Regulatory compliance: CCTS (India), CBAM (EU), and SEC climate disclosure increasingly require audit-grade, timestamped emissions data. Building infrastructure now avoids scrambling when regulations tighten

- Market access: Major buyers require verified carbon footprint data from suppliers. Without MRV capability, you can’t respond to these RFPs

- Optionality: MRV infrastructure gives you the option to monetize credits when market conditions are favorable. Companies without infrastructure can’t participate regardless of prices

The infrastructure you build in 2025 determines competitive positioning for the next decade. Not just for carbon credits, but for regulatory compliance and supply chain participation.