Think “business as usual” will cut it in today’s world? Think again.

Investors, regulators, and customers aren’t just looking at your balance sheets anymore. They want answers:

- How are you managing risks like climate change?

- What’s the real impact of your operations on people and the planet?

These aren’t just nice-to-have questions—they’re shaping how businesses are measured, valued, and trusted. Enter double materiality: the framework that puts both sides of the equation in focus:

- How external risks impact your bottom line.

- How your decisions impact the world around you.

Here’s why this matters: In Europe alone, the new Corporate Sustainability Reporting Directive (CSRD) will require 50,000 companies to report on 176 mandatory data points by 2028. Navigating this complexity isn’t just about ticking compliance boxes—it’s about securing long-term business resilience. Sustainability is no longer separate from strategy; it is strategy.

The good news? Double materiality doesn’t have to be overwhelming. With the right approach (and a little help from AI), it’s a roadmap to resilience, trust, and growth.

Let’s break it down.

Why Double Materiality Is Reshaping Business Strategy

For years, businesses treated environmental and societal impacts as side notes—important, but not central. That’s changed. Today, they’re as critical to your strategy as revenue, margins, or customer satisfaction.

The question is how quickly you’re going to adapt to double materiality.

So, what does double materiality mean for your business? To me, it boils down to two questions:

- How do external risks impact your bottom line?

Extreme weather disrupting supply chains. Governance failures scaring away investors. These are risks we’re facing right now. - How does your business impact the world around you?

Carbon emissions, labor practices, waste—they’re public concerns. And stakeholders—whether regulators, customers, or investors—are paying closer attention than ever.

When I look at the business landscape, I see that 69% of organizations are already using double materiality assessments to improve their ESG performance. To me, that says it all: this framework is essential.

But I know it’s not easy to manage both of these focuses.

- Data often lives in silos, making it tough to get a full, clear picture.

- Predicting long-term risks can feel like you’re guessing.

- And just when you think you’ve nailed compliance, the standards evolve again.

Sound familiar? I know it does.

The good news is, double materiality doesn’t have to be just another box to check. To me, it’s an opportunity—a lens for resilience, a tool for strategy. And with AI, it becomes a way to turn complexity into clarity.

So, how can businesses not only comply with double materiality but also leverage it for a competitive edge? By following a structured six-step approach, made significantly more effective with AI.

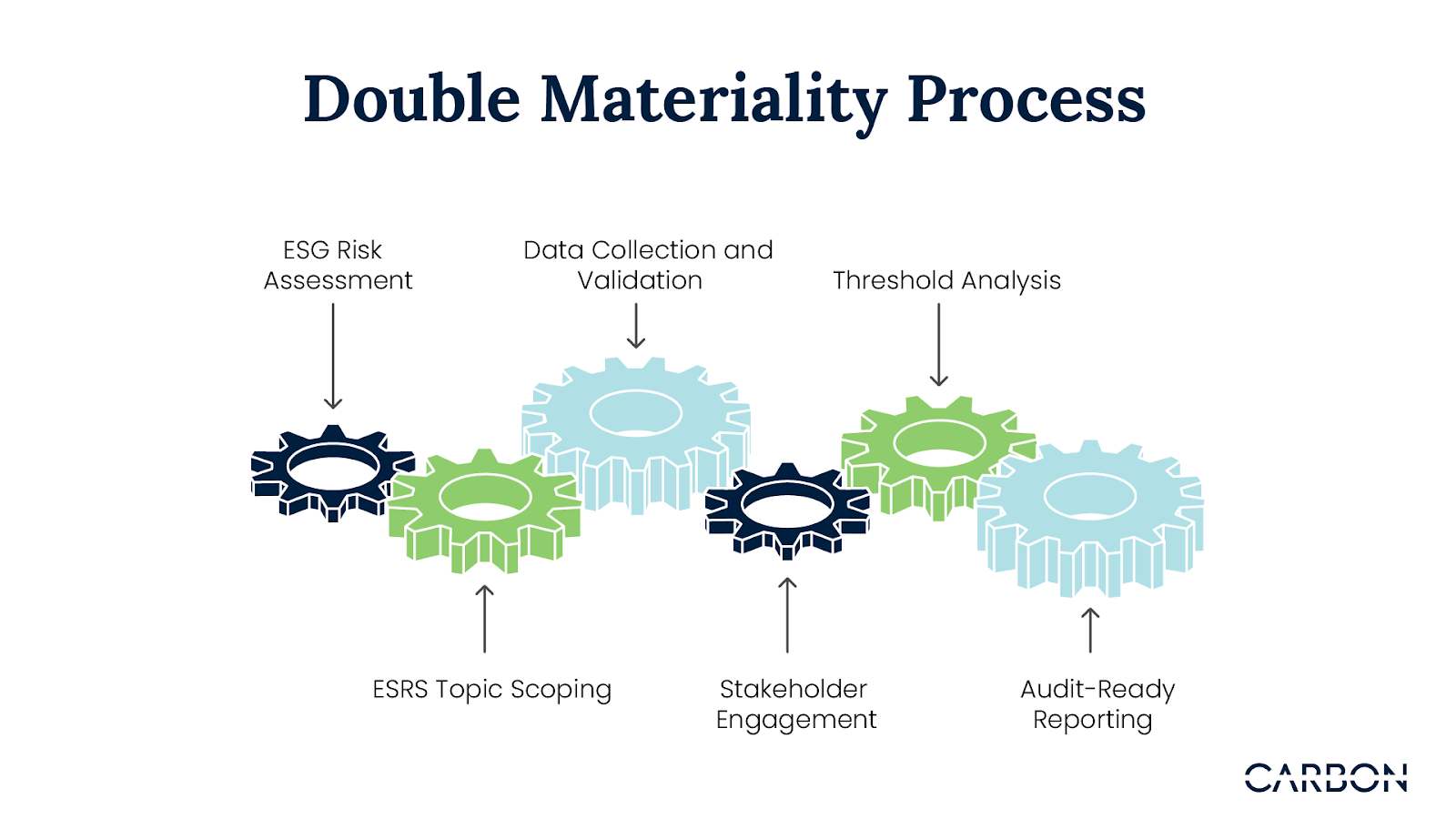

The Six-Step Process—A Strategic Lens

I know double materiality can feel overwhelming. Trust me, I’ve been there. But when you break it down, it’s really just six steps—and with AI, each one becomes far simpler.

Under new regulations, companies are being asked to assess the materiality of 647 additional data points. That’s a huge ask, and trying to manage it manually can feel like chasing shadows. But this is where AI changes the game—it helps you streamline everything from data collection to reporting.

Here’s how the process works:

- ESG Risk Assessment

The first step is spotting the ESG risks that matter most. AI does this by analyzing historical data and identifying trends. Think of it as your crystal ball for predicting business risks—only smarter, because it’s backed by real-time data. - ESRS Topic Scoping

With so many potential ESG issues out there, it’s hard to know where to start. AI mines your supply chain and operational data to pinpoint the topics that truly matter—to your business and your stakeholders. - Data Collection and Validation

Scattered, inconsistent data is one of the biggest roadblocks in ESG reporting. AI aggregates information from across your systems, flags anomalies, and delivers clean, reliable data you can actually work with. - Stakeholder Engagement

Explaining your societal impact doesn’t have to feel like guesswork. AI enhances transparency by providing clear, data-backed insights, allowing businesses to effectively communicate ESG progress to investors, regulators, employees, and customers – reinforcing trust at every level. - Threshold Analysis

How do you know if you’re on track? AI benchmarks your performance against industry standards, giving you a clear view of where you stand—and where you need to improve. - Audit-Ready Reporting

Let’s talk reporting. It’s one of the most time-consuming parts of ESG compliance. AI takes the pain out of this process by generating audit-ready reports tailored to frameworks like CSRD and ISSB, reducing both errors and effort.

When you look at it this way, double materiality is an opportunity. And with AI, it becomes a tool for resilience and growth.

This process is already helping businesses like yours navigate double materiality with confidence. So, let me share how AI is making all the difference.

AI: The Foundation of Double Materiality Leadership

How do you see AI? Because I see it as the foundation of resilience and trust. It helps businesses stay ahead of compliance challenges, unlock efficiencies, and build credibility with stakeholders.

Let’s take the example of a logistics company. Suppose, they are struggling to meet Scope 3 emissions targets. However, they know their supply chain is the issue, but pinpointing inefficiencies feels impossible.

With AI, they can analyse operational data across their network and identify emission hotspots. By optimizing routes and cutting unnecessary fuel usage, they can significantly reduce emissions—and save millions in potential compliance penalties.

And while you might think this is an isolated story, AI does more than solve compliance headaches; it creates tangible advantages:

- Investor Confidence: Transparent, data-backed ESG reporting earns trust with investors who demand accountability.

- Operational Efficiency: AI uncovers inefficiencies, optimizes resources, and transforms sustainability into a measurable business asset.

- Brand Reputation: Leading on ESG sets you apart as a trendsetter, resonating with customers, partners, and stakeholders alike.

And the data backs this up: 63% of top-performing companies are already leveraging AI to meet their ESG goals.

To me, this is the bigger picture: AI turns double materiality from a compliance requirement into a strategic opportunity. It’s how businesses foster trust, and lead with purpose in a world that demands accountability.

But I know adopting AI isn’t always smooth sailing. Let’s look at the biggest challenges businesses face—and how to overcome them.

What’s Holding Businesses Back from Adopting AI?

From high costs to cultural resistance, I’ve seen how easy it is for businesses to feel stuck. But here’s the good news: it doesn’t have to be overwhelming.

Worried About the Costs?

I hear this concern all the time: “AI sounds great, but isn’t it too expensive?” My answer? Start small.

Focus on one or two critical ESG areas—like emissions tracking or data validation—where the impact is immediate and measurable. With AI’s phased adoption model, you can see results early, whether it’s cutting costs or boosting operational efficiency. Once you’ve proven ROI, scaling becomes a no-brainer.

What About AI’s Energy Footprint?

It’s a valid question: how does AI’s energy use fit into sustainability goals? The key is green AI. Tools designed for efficiency and powered by renewable energy are already transforming the landscape.

And here’s the bigger picture: the emissions AI helps reduce often far outweigh the energy it consumes. It’s about ensuring that the tools driving sustainability don’t undermine it—and AI makes that balance achievable.

Struggling with Team Buy-In?

Getting teams on board with AI can feel like an uphill battle. But today’s AI tools are designed to be intuitive, breaking down complex data into clear, actionable insights. You don’t need a technical background to use them.

When tools are easy to understand and implement, resistance fades, collaboration grows, and AI adoption becomes second nature.

Seizing the Opportunity in Double Materiality

What excites me most about double materiality is its potential to redefine leadership. It’s a chance to show what’s possible when innovation meets accountability.

With tools like AI, the complexity becomes manageable, and the outcomes—both for your business and the world—become transformative.

The shift to double materiality is inevitable—and businesses that act now will be the ones defining industry leadership. AI is the key to making ESG reporting both seamless and strategic. In the next article, we’ll explore how AI is revolutionizing ESG data harmonization across global standards.