Have you heard about oil and gas consolidation?

Surely, you have. But you probably haven’t heard this.

Oil and gas consolidation is not just about financial survival—it’s about seizing the opportunity to invest in a cleaner, more sustainable future.

The obvious question is why should you do it? We aren’t going to bore you with the same tune of “it’s good for the planet,” “we have only one earth,” and so on.

Today, the industry is facing increasing pressure to maintain profitability while meeting growing regulatory and investor demands for sustainability.

Mergers and acquisitions have emerged as a critical strategy for navigating these challenges.

As the energy landscape shifts toward a greener future, oil and gas companies are finding that consolidation goes beyond cost savings. It secures their future by providing a pathway to innovative investments in clean energy technologies.

By pooling resources, expertise, and capital, merged entities can accelerate their transition to sustainable practices. And position themselves as leaders in the evolving energy market.

How Mergers Free Up Capital for Sustainability and Environmental Management

Mergers in the oil and gas industry streamline operations by eliminating redundancies, cutting costs, and improving overall efficiency.

When two companies combine forces, they can optimize their resources and processes, which often leads to significant financial gains. These savings are beneficial for immediate profitability.

Moreover, they free up capital that can be redirected into critical clean energy initiatives.

The capital released through these consolidations is increasingly being reinvested into carbon management systems, renewable energy projects, and low-carbon technologies.

With combined resources and expertise, merged entities are well-positioned to pursue ambitious sustainability goals that may have been previously unattainable as standalone companies.

This strategic shift enhances their market competitiveness, aligning them with the growing demands for environment development and sustainability.

As the oil and gas sector moves toward a more sustainable future, the question arises: Could the capital unlocked by consolidation be the key to accelerating clean energy investments?

Can it position oil and gas companies for future profitability?

Meeting Regulatory and Investor Expectations for Sustainability

The answer is it can.

But it also depends on how oil and gas companies are adapting to the changes in the sector. For instance, as regulatory standards evolve, the role of sustainability tracking software and environmental management systems has become increasingly vital for merged companies.

Compliance with A Difference

These tools help ensure compliance with the latest regulations, enabling organizations to systematically monitor their environmental impact.

Moreover, compliance is not just about avoiding fines. It positions the company for long-term success in a landscape where sustainability is paramount.

If you need help with compliance contact CarbonMinus today. We generate automated reports for greater transparency and accuracy in sustainability reporting, adhering to the latest global standards. Book a demo at www.carbonminus.com.

Attracting Investors

Investors are also prioritizing companies that show a genuine commitment to sustainability.

In the wake of rising environmental awareness, investors are more inclined to support businesses that have robust sustainability practices in place. Mergers can strategically position companies to meet these demands by streamlining operations and improving profitability.

This, in turn, allows them to allocate resources toward cleaner energy investments and sustainability initiatives that attract investment.

In fact, the emphasis on sustainability performance has transformed it into a key factor in attracting and retaining investors.

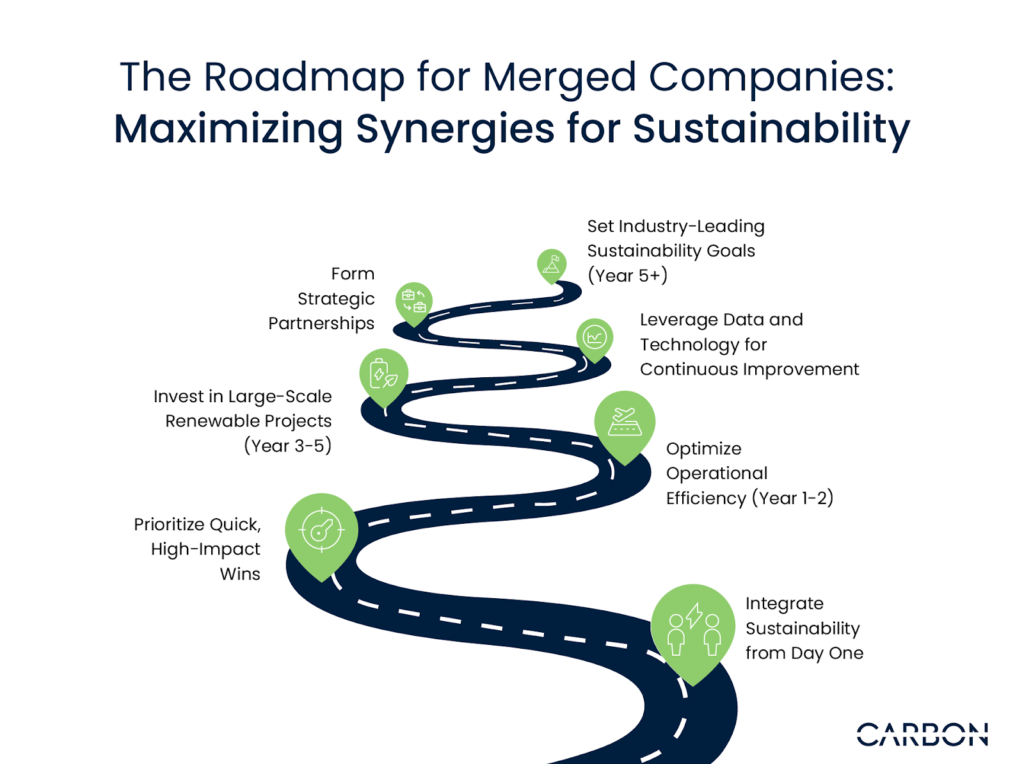

The Roadmap for Merged Companies: Maximizing Synergies for Sustainability

1. Integrate Sustainability from Day One

Oil and gas companies should evaluate sustainability opportunities immediately post-merger, including mapping carbon footprints and identifying operational inefficiencies. Early integration of sustainability as a core business function is key to long-term success.

2. Prioritize Quick, High-Impact Wins

Start with low-cost, scalable initiatives like retrofitting infrastructure for methane capture or deploying digital twins to simulate emissions reductions. These quick wins generate early momentum and provide cost savings that can be reinvested in larger projects.

3. Optimize Operational Efficiency (Year 1-2)

Focus on decarbonizing processes by transitioning to renewable energy and implementing closed-loop systems. AI-driven predictive maintenance helps minimize downtime, leading to reduced emissions and lower operational costs.

4. Invest in Large-Scale Renewable Projects (Year 3-5)

Invest in on-site renewable energy projects, such as solar or wind, and carbon capture technologies to cut long-term emissions. Electrifying fleets and heavy equipment further reduces the company’s carbon footprint and aligns with regulatory goals.

5. Leverage Data and Technology for Continuous Improvement

Use real-time monitoring systems and digital twins to track emissions and predict future environmental impacts. Accurate carbon accounting is essential for regulatory compliance and future-proofing the business.

6. Form Strategic Partnerships

Collaborate with clean-tech innovators and regulators to accelerate technology adoption and improve sustainability performance. Partnerships can reduce financial strain and enhance credibility in the sustainability space.

7. Set Industry-Leading Sustainability Goals (Year 5+)

Establish ambitious goals, such as achieving net-zero emissions or adopting circular economy principles. Pledging science-based targets strengthens the company’s leadership in the energy transition and boosts investor confidence.

The Future of Mergers in the Oil & Gas Industry

Looking ahead, ongoing and future consolidations are poised to significantly shape the oil and gas industry’s transition toward business and environmental sustainability.

As pressure mounts for environmental responsibility, mergers are expected to facilitate increased investment in clean energy and low-carbon technologies. This trend allows companies to pool resources and expertise.

Most importantly, it positions them to respond more effectively to regulatory changes and market demands for sustainable practices.

The consolidation process can act as a catalyst for innovation, enabling companies to adopt and scale sustainable technologies more rapidly. As the industry evolves, those that embrace this shift will likely gain a competitive advantage, leading the charge in the energy transition.

Mergers as a Catalyst for Sustainability

Contact CarbonMinus today at www.carbonminus.com to ensure transparency, compliance, and accountability in your sustainability efforts.

Strategically redirect capital toward ambitious sustainability goals after a merger and stand out in an increasingly competitive sector.

FAQs

How are mergers in the oil and gas industry driving clean energy investments?

Mergers streamline operations, reduce redundancies, and free up capital, which can be redirected into clean energy investments. By consolidating resources and expertise, merged entities are better positioned to invest in renewable energy, carbon capture, and low-carbon technologies, accelerating their transition to sustainability.

What are the environmental benefits of oil and gas consolidation?

Consolidation enables companies to pool resources, adopt best practices for emissions reduction, and scale sustainability projects faster. Merged companies can deploy clean energy technologies, such as carbon capture and renewable energy, more efficiently, leading to reduced environmental footprints and improved sustainability performance.

How can mergers free up capital for renewable energy projects?

Mergers eliminate overlapping operations, reduce costs, and optimize resource use, which frees up significant capital. This capital can then be reinvested into renewable energy projects, such as wind, solar, and hydrogen technologies, helping companies meet sustainability goals while maintaining profitability.

How can merged companies meet regulatory requirements and investor expectations for sustainability?

Merged companies can leverage environmental management software to streamline emissions tracking and ensure compliance with global regulations. By focusing on transparency and using data-driven insights, they can also meet investor expectations for sustainability, demonstrating long-term commitment to reducing their environmental impact.