This year went by in a blur, especially if you were closely following climate change.

More wildfires, more heatwaves, more melting sea ice, and more things to worry about overall. For oil and gas leaders, 2024 wasn’t just another year of navigating regulations—it was a pivotal moment to reshape how the industry operates.

Were they successful? Umm.. let’s skip to the good part. There’s always tomorrow, although tomorrow seems closer and closer with each passing day.

But for oil and gas leaders, the path forward isn’t as simple as replacing fossil fuels with renewables. The reality is far more complex: the energy transition is about integration, not substitution.

For decades, oil and gas have been the backbone of global energy, and that role isn’t disappearing overnight. However, by leveraging emerging opportunities like the Inflation Reduction Act, oil and gas companies can position themselves as leaders in a low-carbon future.

The key is to stop viewing sustainability and profitability as opposing forces and start aligning them as complementary goals. This blog isn’t just about meeting regulations or ticking ESG boxes—it’s about unlocking hidden opportunities to innovate, adapt, and lead.

From lesser-known tax credits to monetizing emissions, 2024 offers a roadmap for balancing profit and planet in ways that few industries can match.

Are you ready to rethink your approach to the energy transition?

The Hidden Gems of the Inflation Reduction Act

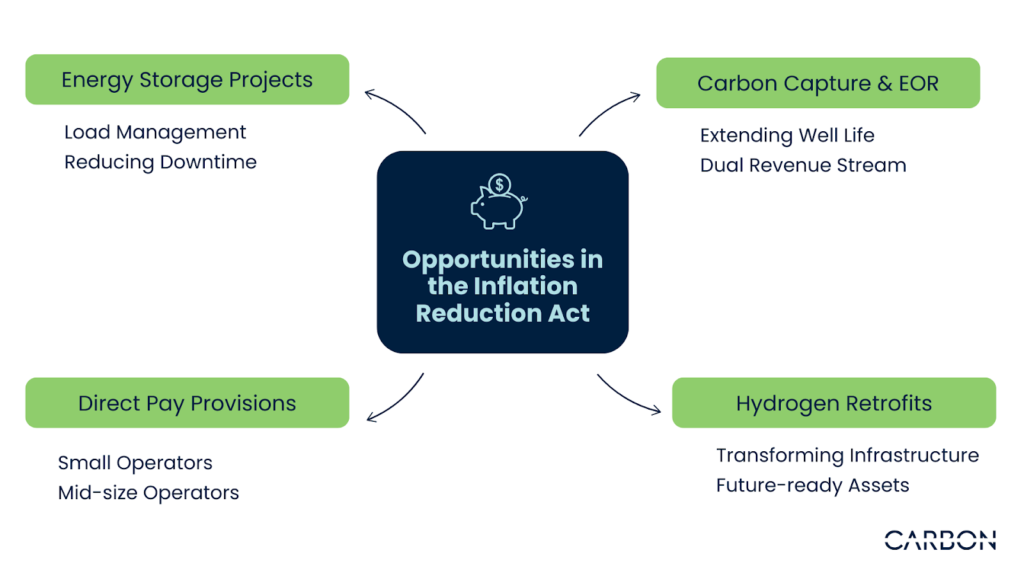

The Inflation Reduction Act (IRA) is often framed as a sweeping push for renewables, but oil and gas leaders who look deeper will uncover opportunities that align perfectly with their operations.

Beyond well-known incentives for solar and wind, the IRA offers hidden advantages tailored to companies ready to innovate within the existing energy ecosystem.

1. Clean Energy Tax Credits for Energy Storage Projects

Energy storage isn’t just for renewables. Oil and gas companies can tap into IRA credits for pairing their facilities with battery systems, enabling better load management and reducing downtime during grid fluctuations. These systems can also support flexible operations, stabilizing energy flow during high-demand periods.

2. Carbon Capture and Enhanced Oil Recovery (EOR)

The IRA provides significant credits for carbon capture, but the overlooked opportunity lies in using captured CO₂ for enhanced oil recovery. This approach not only extends the life of existing wells but also turns emissions into a valuable resource, creating a dual revenue stream.

3. Hydrogen Retrofits for Existing Infrastructure

While the buzz around hydrogen focuses on production, the IRA also incentivizes retrofitting natural gas pipelines and storage facilities to transport hydrogen. For oil and gas leaders, this means transforming legacy assets into future-ready infrastructure without the cost of new builds.

4. Direct Pay Provisions for Small and Midsize Operators

Smaller oil and gas companies can benefit from direct pay options, which allow them to receive cash payments for certain clear energy tax credits. This removes the need to have a large tax liability to claim incentives, making it easier for smaller players to participate in the energy transition.

Key Insight: Bundling Incentives for Maximum ROI

The IRA’s incentives aren’t isolated. Companies that combine multiple provisions—such as pairing carbon capture with renewable energy investments or integrating hydrogen retrofits with energy storage—can significantly amplify their returns. For leaders willing to think holistically, the IRA isn’t just a policy shift; it’s a profitability strategy.

Profit From Carbon: Turning Emissions Into Revenue Streams

For decades, emissions have been seen as an unavoidable cost of doing business in oil and gas. But in 2024, forward-thinking leaders can flip this narrative. Thanks to evolving markets and new technologies, carbon is no longer just a liability—it’s an untapped revenue source.

1. Selling Captured Carbon

Captured carbon has growing demand in industries like manufacturing, where CO₂ is used in producing cement, beverages, and even synthetic fuels. Oil and gas companies investing in carbon capture systems can sell this captured carbon to non-traditional buyers, turning a regulatory requirement into a steady income stream.

2. Carbon Credits for High-Demand Markets

Carbon credits are no longer confined to voluntary markets. Hard-to-decarbonize sectors like aviation and heavy industry are actively seeking offsets to meet their net-zero commitments. Oil and gas companies with robust carbon capture operations can sell credits at a premium, creating a new avenue for profitability.

3. Partnering With Emerging Buyers

Emerging industries like data centers are seeking ways to integrate captured carbon into their operations, such as using CO₂ in advanced cooling systems. Partnering with these unconventional buyers opens opportunities for diversification and positions oil and gas companies as key players in a low-carbon economy.

Outlook of Possibilities: Turning Emissions Into Assets

Consider this – a mid-sized operator in Texas implemented a small-scale carbon capture system and partnered with a regional beverage company to supply CO₂ for bottling. The deal not only offset their compliance costs but also created a profitable new revenue stream. This is just one example of how emissions can transition from a liability to an asset.

CarbonMinus can help you achieve Net Zero for Net Gain. We use AI-powered insights, diving into historical data, visualizing energy grids, monitoring equipment conditions, and helping reduce emissions. Know more at www.carbonminus.com.

Key Insight: Carbon as a Strategic Commodity

The true value of captured carbon lies in its versatility. Companies that view CO₂ as a marketable product rather than waste will lead in an economy increasingly shaped by decarbonization. And the shift from emissions to profits is already happening.

How Flexible Operations Can Keep You Ahead

Now, energy efficiency has always been important, but 2024 demands more. Flexibility—adapting your operations to meet shifting energy demands—is what will set leaders apart.

By rethinking how your assets are used, you can uncover new opportunities to stay profitable and sustainable at the same time.

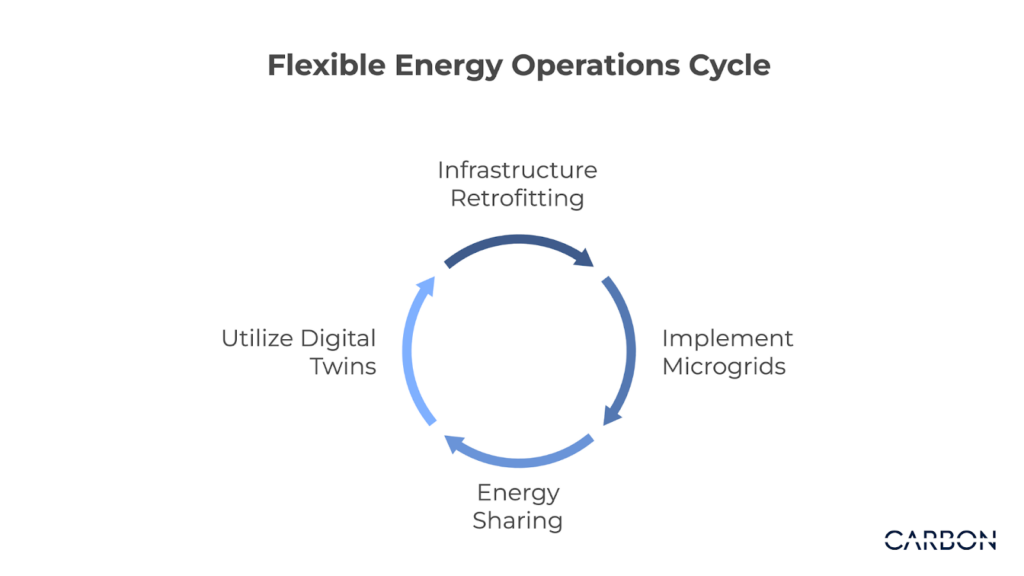

1. Could Your Infrastructure Do More?

Think of your pipelines, storage tanks, and facilities as more than just tools for oil and gas. With a few strategic retrofits, they can also support renewable energy systems or low-carbon fuels like hydrogen. Dual-purpose infrastructure ensures you’re ready for the future without abandoning your core business.

2. What Can Microgrids Do for Remote Sites?

If you’re operating in remote locations, microgrids can help. These systems combine onsite energy generation, like natural gas turbines, with energy storage and demand management. The result? Lower costs, less waste, and improved reliability.

3. Why Share Energy With Renewables?

In regions where oil and gas meet renewables, collaboration is key. Energy-sharing agreements allow you to:

- Store excess renewable energy in underused facilities.

- Sell natural gas during renewable downtime.

This kind of partnership benefits both sides and strengthens your ESG profile.

4. What’s the Role of Digital Twins?

Digital twins—virtual models of your assets—aren’t just futuristic tech. They help predict equipment failures, optimize asset use, and simulate how your operations can evolve for the energy transition. It’s flexibility, powered by data.

Are You Missing Out on IRA Tax Credits?

Flexibility is the new efficiency and that’s very true for the Inflation Reduction Act (IRA). Companies might think it’s just about solar and wind— in reality, it’s full of financial incentives that oil and gas companies can use to offset costs and drive innovation.

But many leaders overlook key provisions that could significantly impact their bottom line. By digging into the details and thinking strategically, you can unlock tax credits that others might miss.

1. Do You Qualify for Clean Fuel Production Credits?

If you’re blending renewable fuels with traditional oil products, the IRA offers incentives designed to offset production costs. This little-known credit rewards companies that embrace hybrid energy solutions, creating new revenue opportunities for forward-thinking leaders.

2. Could Geothermal Be Your Next Revenue Stream?

Did you know the IRA includes grants for exploring geothermal energy? Many oil and gas sites sit atop untapped geothermal resources. Leveraging your existing drilling expertise to co-develop geothermal projects not only earns tax credits but also diversifies your portfolio with a renewable energy source.

3. Are You Overlooking Direct Pay Options?

For smaller operators, direct pay provisions can be a game-changer. Instead of relying on tax liabilities to claim credits, you can receive cash payments for eligible projects like carbon capture or hydrogen infrastructure retrofits. This makes it easier for companies of any size to take advantage of IRA benefits.

4. Can You Maximize Benefits Through Bundling?

The real power of the IRA lies in combining incentives. Pair tax credits for carbon capture with hydrogen retrofits, or match renewable fuel production credits with energy storage incentives. By bundling these benefits, companies can multiply their returns and reduce project costs significantly.

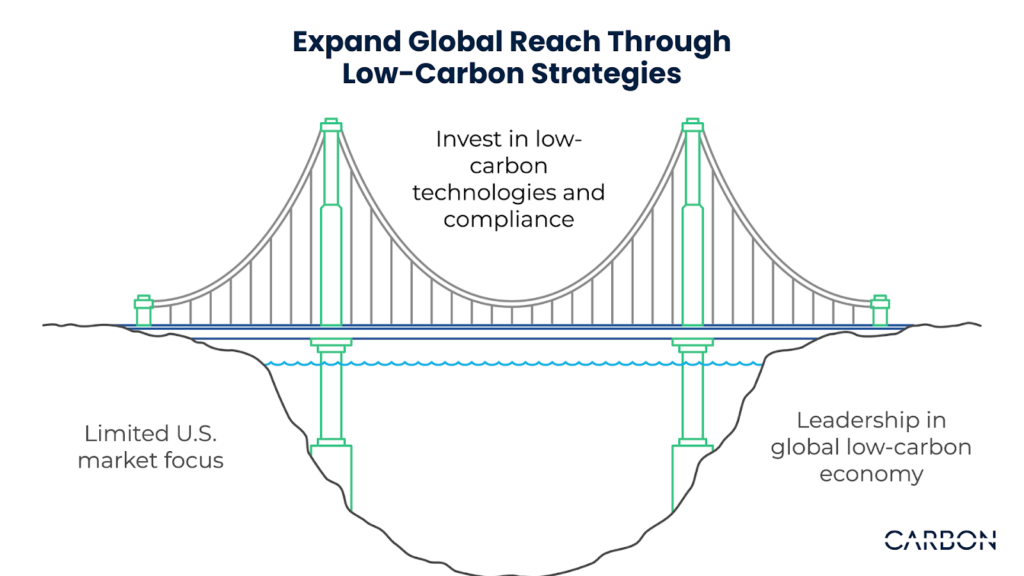

Why Thinking Globally Is the Key to Thriving in 2024

Maximizing IRA tax credits is more than checking boxes because energy transition has now become a global race.

Oil and gas companies that think beyond U.S. borders can position themselves as leaders in the emerging low-carbon economy. By aligning with international markets and standards, you can unlock export opportunities, attract global partners, and future-proof your operations.

1. Could Exporting Low-Carbon Fuels Be Your Next Move?

European nations are increasingly importing low-carbon fuels to meet strict net-zero commitments. By investing in technologies like carbon capture or hydrogen retrofits, U.S. oil and gas companies can position themselves as preferred suppliers in this growing market. The Inflation Reduction Act makes these investments more accessible, giving you a head start in the global competition.

2. How Can Cross-Border Compliance Benefit You?

Adhering to strict U.S. emissions regulations doesn’t just keep you compliant—it sets you up for seamless entry into international markets. Many regions, such as the European Union, have even stricter requirements. By aligning with these standards early, you can avoid costly retrofits and gain a competitive edge in cross-border trade.

3. Are Emerging Markets Your Untapped Opportunity?

Countries in Asia and Africa are rapidly industrializing and seeking partnerships for clean energy development. By collaborating on technologies like hydrogen pipelines or low-carbon LNG exports, oil and gas companies can tap into these high-growth markets while expanding their global footprint.

4. How Can Technology Drive Global Partnerships?

Digital tools like blockchain for carbon accounting and digital twins for asset management make cross-border collaboration more efficient. These technologies help you track emissions, verify compliance, and demonstrate transparency to international stakeholders, building trust and securing long-term partnerships.

The World Is Your Market

By thinking globally, oil and gas leaders can go beyond surviving the energy transition to thriving in a diverse, interconnected energy economy. The key is to leverage domestic policies like the IRA as a launchpad for global growth

2024 Is the Year for Strategic Leadership

The path to success lies in strategic thinking. If you need help managing resources and aligning your sustainable and business goals, book a demo with CarbonMinus today at www.carbonminus.com.

The question is: will you take the lead in this transformation—or let others define your place in the energy future?