You’ve seen the headlines. New regulations. New acronyms. And, of course, new deadlines. If you’re feeling overwhelmed, you’re not alone. Across industries, businesses are grappling with a growing web of climate disclosure requirements—TCFD, CSRD, SEC Climate Disclosure Rule—the list goes on.

It’s not just the names that blur together; it’s the demands behind them. Each framework comes with its own reporting standards, its own timelines, and its own complexities. And when these overlap, it feels impossible to keep up.

But here’s the real challenge:

- How do you reconcile conflicting requirements when TCFD is reinterpreted under CSRD or SEC?

- How do you standardize emissions data across operations that span multiple countries, each with different methodologies?

If you’ve been there, you know how time-consuming and costly these tasks can be. And you’re not alone in wondering: Is this just another regulatory hurdle, or is there a better way to approach compliance?

The Regulatory Landscape: A Global Shift

Regulations, regulations, regulations. The alphabet soup of climate frameworks—CSRD, SEC, TCFD—is enough to make any sustainability team’s head spin. Each one comes with its own rules, requirements, and timelines, and businesses are stuck juggling them all. From managing overlapping demands to reconciling inconsistent methodologies, it’s no wonder so many companies feel like they’re drowning in compliance chaos.

But here’s the thing: understanding these frameworks shouldn’t be a box-ticking exercise. It’s an opportunity to streamline your reporting, future-proof your operations, and take a leading role in sustainability. Let’s unpack the big three.

CSRD: What’s This “Double Materiality” Everyone’s Talking About?

The Corporate Sustainability Reporting Directive (CSRD) is rewriting the rules of sustainability reporting. It doesn’t just ask, “What risks does climate pose to your business?” It demands that companies answer, “What risks does your business pose to the climate?” That’s the essence of double materiality—evaluating both financial and ecological impacts.

And then there’s the elephant in the room: Scope 3 emissions. These are the emissions you don’t directly control but are responsible for through your supply chain. Think about it—everything from your suppliers’ factories to the trucks delivering your goods. Most companies fail here, overwhelmed by opaque supplier data and manual processes.

SEC Climate Rule: Is Your Bottom Line at Risk?

On the other side of the Atlantic, the SEC Climate Rule takes a different approach. It zeroes in on financial materiality—what risks do climate impacts and emissions pose to your bottom line? It’s a narrower focus, but one with significant implications for public companies.

The challenge? These risks aren’t always obvious. They’re buried in operational inefficiencies, missed opportunities, or hidden vulnerabilities that traditional reviews overlook.

TCFD: The Glue That Holds It All Together

If CSRD and SEC Climate Rule are puzzle pieces, the Task Force on Climate-Related Financial Disclosures (TCFD) is the blueprint. Its global acceptance makes it the foundation for climate reporting frameworks across regions. It’s why nearly 5,000 organizations worldwide have adopted TCFD’s recommendations.

But TCFD is more than a compliance framework. It’s a tool for looking ahead. Scenario planning—a key feature of TCFD—allows businesses to model future risks and opportunities. From predicting the impact of rising carbon prices to assessing climate-related disruptions in supply chains, TCFD offers a window into the future.

Overlapping Frameworks: A Nightmare or a Roadmap?

At first glance, these frameworks look like a maze of overlapping requirements. But with the right tools, they’re not. They’re a roadmap. The key is integration.

Here’s how: AI-driven systems can aggregate data for CSRD, SEC, and TCFD all in one place. Instead of treating each report as a separate task, businesses can use a single source of truth to generate insights that meet multiple frameworks simultaneously. It’s like hitting three targets with one arrow.

Think of it like meal prepping. Instead of cooking every meal from scratch, you prep once and use the same ingredients in different ways. Artificial intelligence does the same.

AI in compliance takes the heavy lifting off your plate and serves up what you need, exactly when you need it.

What This Means for Your Business

The global shift in climate regulations isn’t slowing down. Businesses that succeed will manage to keep up, adapt, and thrive. By embracing AI-driven compliance solutions, you’ll move past juggling frameworks and start focusing on what really matters: building a sustainable future.

Because here’s the truth: compliance doesn’t have to be a burden. With the right approach, it’s your biggest opportunity yet.

Streamlining Compliance: The AI Advantage

So, what’s the way out of this compliance maze? It starts with rethinking your approach—and AI might just be the key.

Let’s Start with the Problem: Juggling Flaming Swords

Let’s face it: keeping up with CSRD, SEC, and TCFD is like trying to juggle flaming swords. You’re managing a dozen moving parts—emissions data, supplier disclosures, regional regulations—and trying to make it all fit into one cohesive report. Sound familiar?

And while you’re doing all that, the risks are piling up. A missed data point here, a misaligned metric there—it’s all a ticking compliance time bomb. Each misstep could mean penalties, reputational damage, or worse, losing the trust of investors and stakeholders.

If that’s not overwhelming enough, there’s the time factor. Compliance teams are stuck in endless cycles of data collection and validation. Instead of focusing on strategic initiatives like decarbonization or supply chain optimization, they’re bogged down in spreadsheets and endless manual processes.

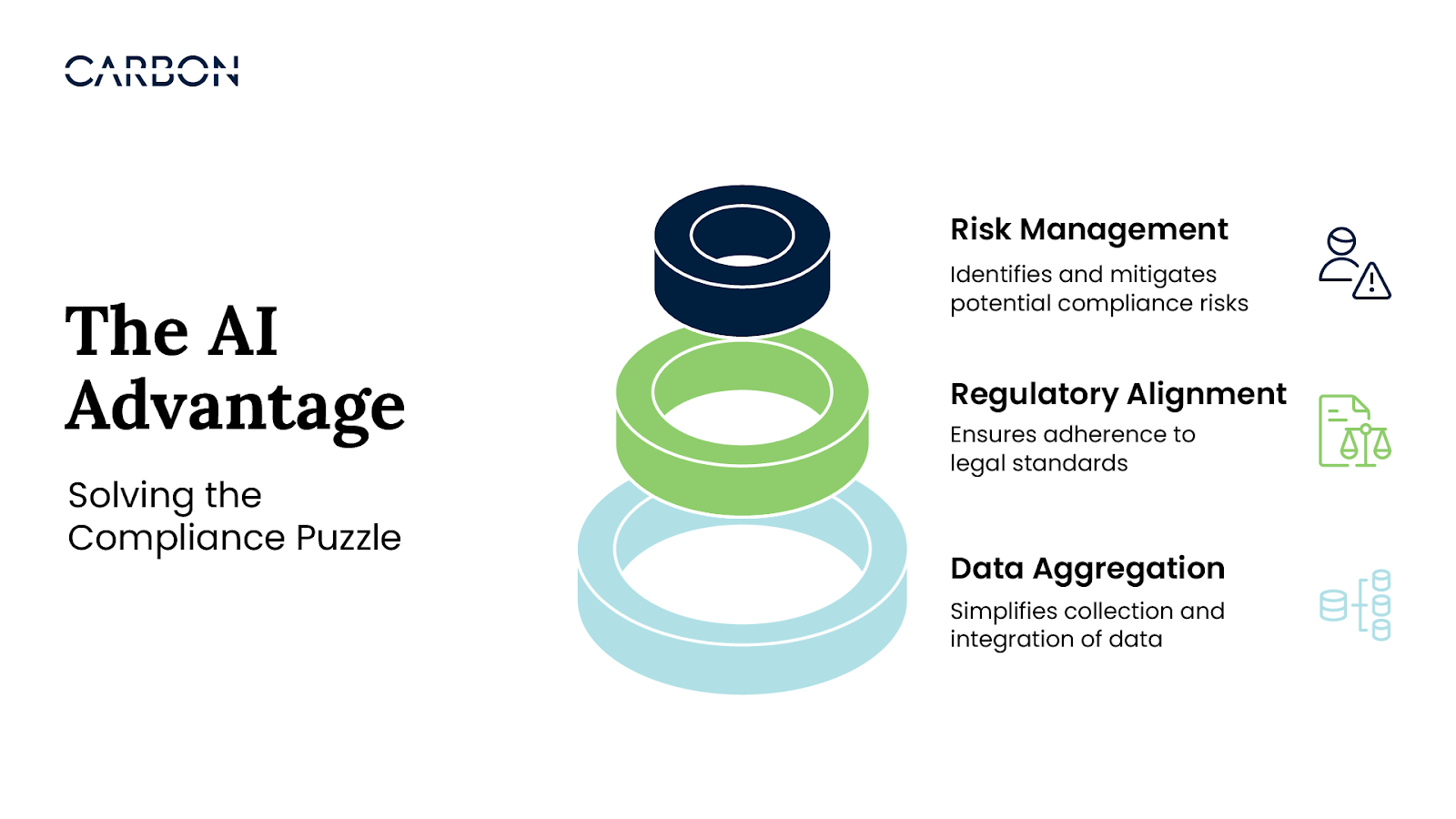

The AI Advantage: Solving the Compliance Puzzle

But what if you didn’t have to juggle? What if there was a way to bring all those moving parts together—smoothly, seamlessly, and in real time? That’s where AI comes in.

AI-powered compliance tools transform how businesses navigate climate regulations. Here’s how:

- Data Aggregation Made Simple: AI collects and consolidates emissions data from multiple sources, giving you a single, clear picture of your environmental footprint. No more chasing numbers across departments or geographies.

- Built-In Alignment with Regulations: AI ensures your reports meet CSRD, SEC, and TCFD standards by automatically aligning data to the requirements of each framework. It’s like having a built-in compliance expert.

- Proactive Risk Management: AI doesn’t just monitor data—it analyzes it. Predictive tools highlight potential compliance gaps or risks before they turn into costly mistakes.

The Real-World Impact: Efficiency and Trust

This is how businesses using AI in compliance systems are already seeing results.

For example, companies adopting AI for emissions reporting have reduced the time spent preparing regulatory reports by up to 30%. That’s time they’ve reinvested into strategic initiatives, like achieving net-zero targets or building partnerships with low-emission suppliers.

And it’s not just about time. It’s about trust. When your data is accurate, verifiable, and aligned with global standards, you show regulators, investors, and stakeholders that you mean business. Transparency isn’t just a compliance requirement—it’s a competitive advantage.

More Than Compliance: A Strategic Transformation

Here’s the real win: AI helps you keep up with regulations but it also helps you get ahead. By turning compliance data into actionable insights, you’re building a strategy. One that:

- Cuts inefficiencies across operations.

- Drives better, data-informed decision-making.

- Strengthens your sustainability narrative, turning it into a core business advantage.

Think of AI in compliance as the GPS for your sustainability journey. Instead of struggling with maps and road signs, it gives you the clearest, fastest route to your destination—no wrong turns, no unnecessary detours. It’s not just about getting there. It’s about getting there smarter.

To know more, book a demo with CarbonMinus and see how our AI-powered insights and energy management will help you stay on the right side of compliance, while reducing costs. Visit www.carbonminus.com.

What’s Next? Bringing AI into Real-World Scenarios

So, how does this all come together in real-world scenarios? Let’s look at how businesses are using AI to streamline their operations and redefine compliance as a competitive edge.

Industry Applications and Success Stories

AI-powered solutions are revolutionizing the way businesses tackle emissions management, strategic planning, and stakeholder engagement. Let’s explore three potential use cases that show how industries can put these tools to work.

1. Use Case: Supply Chain Transparency

- Situation:

Supply chains are notorious for their complexity. Under regulations like CSRD, companies need to account for Scope 3 emissions—those from their suppliers. This isn’t just challenging; it’s often the reason companies fail to meet reporting standards. - Question:

How can businesses ensure transparency across a diverse, multi-regional supply chain without sinking endless time and resources into manual processes? - Complication:

Many suppliers lack standardized reporting practices or provide incomplete data. This creates bottlenecks, delays, and risks of non-compliance. - Answer:

With AI-powered emissions monitoring, businesses could:- Aggregate data from suppliers worldwide, normalizing it into consistent formats.

- Automatically flag missing or inaccurate data for follow-up.

- Prioritize suppliers with the highest emissions for targeted decarbonization efforts.

Potential Impact:

By implementing such a system, a company could reduce reporting time significantly and present verified, auditable data to regulators and stakeholders, building trust and securing compliance.

2. Use Case: Predictive Scenario Planning

- Situation:

An energy-intensive company faces increasing uncertainty with fluctuating carbon pricing and tightening emissions caps. Long-term investments—like renewable energy adoption or operational decarbonization—require strategic clarity. - Question:

How can businesses make informed decisions when future variables like carbon taxes and regulatory policies are constantly changing? - Complication:

Without clear data, businesses risk overspending on ineffective solutions or underinvesting in critical areas, leading to higher costs and missed opportunities. - Answer:

AI could help businesses to:- Simulate multiple carbon pricing scenarios.

- Model the ROI of various strategies, such as renewable energy adoption versus carbon offset purchases.

- Identify the most cost-effective pathways to meet emissions reduction targets.

Potential Impact:

Such a system could reveal that early investments in renewables would save 15% in costs over five years, compared to reliance on offsets. This clarity enables smarter, faster decision-making, ensuring businesses remain competitive.

3. Use Case: Beyond Regulations – Real-Time Sustainability Marketing

- Situation:

Consumer expectations are shifting. Customers now care about the environmental impact of the products they buy. Companies with robust sustainability reporting tools and stories have a clear advantage. - Question:

How can businesses leverage their emissions data to strengthen customer loyalty and stand out in competitive markets? - Complication:

Without accurate and timely data, sustainability messaging can backfire, leaving businesses open to accusations of greenwashing. - Answer:

By integrating AI-powered emissions tracking with customer-facing dashboards, businesses could:- Provide real-time updates on their carbon reduction efforts.

- Highlight the environmental impact of individual products, showing customers how their choices contribute to broader goals.

- Build trust by offering full transparency into their AI and sustainability journey.

Potential Impact:

With this approach, businesses could see a significant boost in customer loyalty and sales. For instance, a company could increase sales by aligning with consumers who prioritize environmental responsibility.

What This Means for Your Business

These use cases are achievable. With the right tools, businesses can turn challenges into opportunities, compliance into a competitive edge, and data into action. AI is both solving problems and redefining what’s possible.

Best Practices for Implementing AI in Climate Compliance

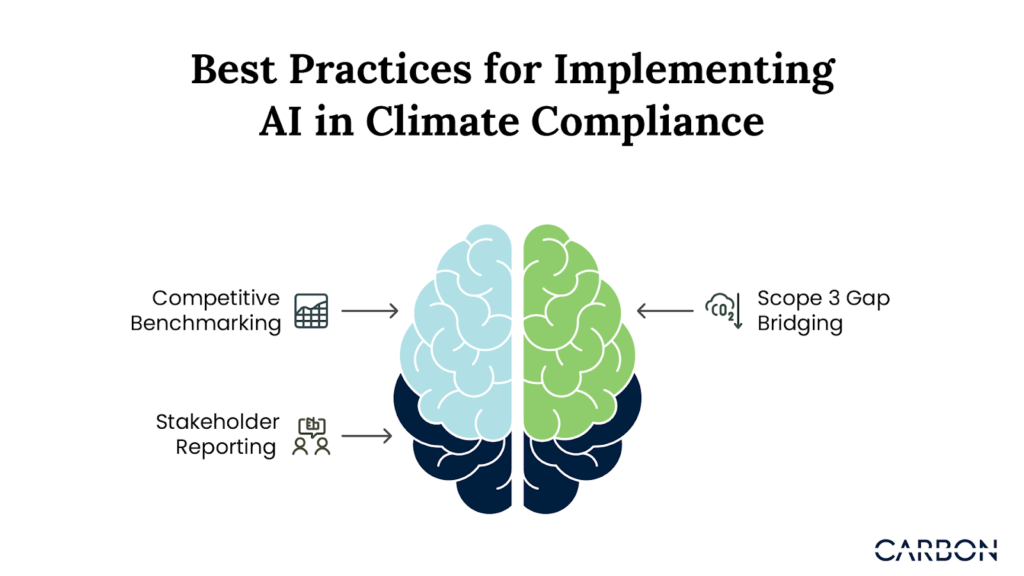

We’ve seen how AI is transforming compliance and driving real results for businesses. But success doesn’t happen by accident. Here are three best practices to help you unlock the full potential of AI in climate compliance—and gain a competitive edge.

1. Leverage AI for Competitive Benchmarking

- Stay ahead of the competition by benchmarking your performance against industry leaders.

AI-powered tools analyze vast amounts of data to provide a detailed view of your climate performance relative to peers. This isn’t just about meeting regulations; it’s about standing out.

How it works:

For example, an industrial manufacturer could use AI to:

- Compare its emissions intensity with industry averages.

- Identify leaders in its sector and analyze their strategies.

- Align disclosures with emerging best practices, ensuring compliance and demonstrating leadership.

By understanding where they stand and how they measure up, businesses can make ESG reporting more compelling, address operational inefficiencies, and anticipate regulatory shifts before they become obstacles.

Potential Impact: This not only enhances your reputation with regulators and investors but also helps you identify opportunities to optimize operations and stay ahead of the curve.

2. Bridge the Scope 3 Gap

- Solve the toughest compliance challenge: Scope 3 emissions.

Scope 3 emissions—those generated across your supply chain—are notoriously difficult to measure. Yet, they’re a major component of regulations like CSRD and a critical factor for investors assessing your sustainability profile. AI bridges this gap by cross-referencing supplier datasets, industry averages, and real-time data streams.

How it works:

Here’s how AI tackles Scope 3 reporting challenges:

- Filling in the blanks: When supplier data is incomplete, AI models emissions based on industry benchmarks and patterns.

- Highlighting priorities: AI identifies high-emission suppliers, helping businesses focus decarbonization efforts where they’ll have the most impact.

- Staying accurate over time: AI-powered systems update emissions estimates as new data comes in, ensuring compliance reports reflect the most current information.

Potential Impact: By making Scope 3 reporting manageable, AI enables businesses to meet stringent standards while identifying decarbonization opportunities across their supply chains.

3. AI-Powered Stakeholder Reporting

- Customize your message for every audience—effortlessly.

Different stakeholders need different information. Investors are looking for ROI metrics and risk mitigation, regulators want standardized emissions data, and internal teams need actionable insights. AI simplifies this complexity by tailoring reports to meet the specific needs of each audience.

How it works:

With AI, a single dataset can generate multiple reports, each aligned with the specific KPIs and narratives stakeholders care about most. For instance:

- For investors: AI creates summaries that highlight long-term ESG reporting, performance, and ROI potential.

- For regulators: It generates precise compliance reports with auditable, standardized data.

- For internal teams: AI-powered dashboards track real-time emissions, providing actionable insights to improve daily operations.

Potential Impact: This level of customization not only saves time but also builds trust with all your stakeholders, from the boardroom to the factory floor. When everyone gets the information they need, your entire organization—and your reputation—benefit.

Turning Best Practices into Action

Implementing AI in climate compliance isn’t just about meeting requirements—it’s about setting the standard. By benchmarking performance, bridging data gaps, and customizing stakeholder engagement, you’re not playing catch-up, but leading the charge.

The tools are here, and the opportunities are clear. The next move? It’s yours.

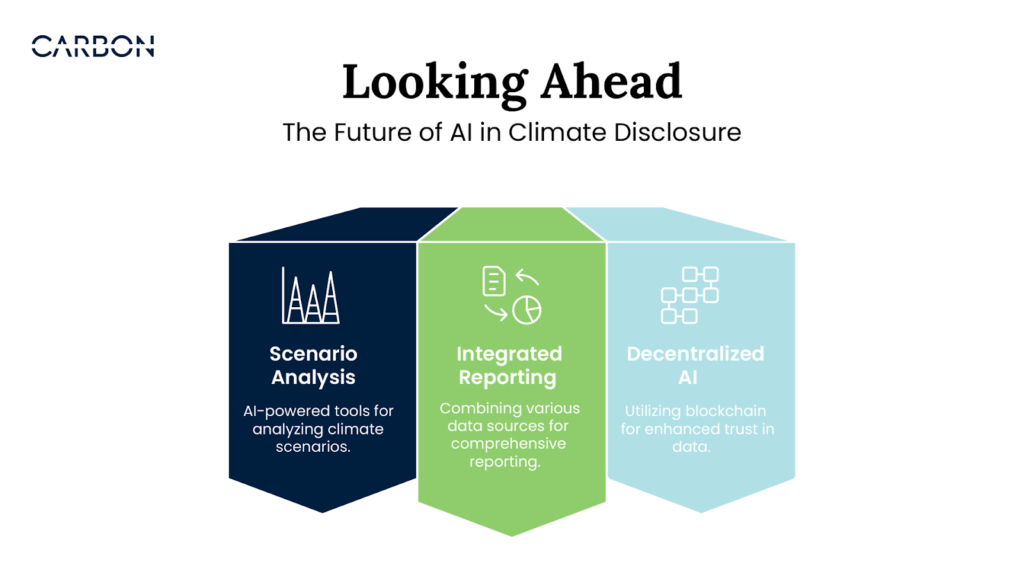

Looking Ahead: The Future of AI in Climate Disclosure

AI is already transforming the way businesses manage climate compliance. But what comes next? The future of AI in climate disclosure promises not only greater accuracy but also deeper integration, more transparency, and smarter decision-making. Here’s what’s on the horizon.

AI-Powered Scenario Analysis: Planning for the Unknown

Imagine being able to simulate the impact of carbon taxes or emissions regulations on your finances before they even happen. AI-powered scenario analysis is making that a reality.

How It Works:

Predictive tools analyze historical data, current policies, and market trends to model potential outcomes. For instance:

- Regulatory Impact: A manufacturing company could simulate how stricter emissions caps would affect its operations, from production costs to energy needs.

- Strategic Planning: These tools enable businesses to explore multiple scenarios—tightening regulations, fluctuating carbon pricing—and make proactive decisions.

Why It Matters:

Instead of reacting to policy changes, businesses can prepare for them. Predictive scenario analysis empowers companies to:

- Mitigate risks before they materialize.

- Identify cost-saving opportunities through early investments in renewable energy or decarbonization strategies.

- Maintain competitiveness in evolving markets.

The Bottom Line: When you can see what’s coming, you can make better choices—faster.

Integrated Reporting Ecosystems: Breaking Down Silos

What if your emissions data didn’t just live in a spreadsheet? What if it connected seamlessly with your financials, supply chain, and operations in a single, integrated reporting ecosystem?

How It Works:

Next-generation platforms will:

- Aggregate data from emissions, financial, and operational systems into a centralized hub.

- Deliver real-time integrated reports, showing how sustainability efforts impact profitability and operational efficiency.

- Automate collaboration across departments, ensuring everyone—from finance to operations—has the insights they need to act.

Why It Matters:

Integrated systems eliminate silos, allowing companies to:

- Align AI and sustainability with business goals, making it a core driver of strategy.

- Provide stakeholders with a 360-degree view of how emissions reductions translate into tangible outcomes.

- Save time and resources by automating cross-functional processes.

The Bottom Line: Integrated ecosystems don’t just improve compliance—they redefine how businesses operate, aligning sustainability with success.

Decentralized AI and Blockchain: Building Trust and Transparency

In an era where trust is paramount, decentralized AI and blockchain are set to revolutionize climate disclosures, like the SEC Climate Disclosure Rule.

How It Works:

- Tamper-Proof Reporting: Blockchain technology creates immutable records, ensuring that emissions data cannot be altered after submission.

- Decentralized AI: These systems maintain data integrity across global operations, standardizing reporting for multinational corporations.

For example, a company operating in multiple regions could use blockchain to ensure that its emissions reports are consistent and verifiable, no matter where the data originates.

Why It Matters:

As scrutiny around ESG reporting metrics increases, trust becomes non-negotiable. Blockchain-integrated AI enables businesses to:

- Build credibility with investors, regulators, and customers.

- Streamline audits by providing transparent, tamper-proof data trails.

- Foster global collaboration with standardized, trustworthy reporting systems.

The Bottom Line: Trust is the currency of sustainability leadership, and technologies like blockchain and decentralized AI are key to earning it.

From Compliance to Competitive Advantage

The future of AI in climate disclosure goes beyond better compliance, as it’s about redefining how businesses operate. From predicting the financial impact of carbon taxes to creating fully integrated reporting ecosystems and tamper-proof audit trails, these advancements will help businesses to lead with transparency, trust, and innovation.

The question now is how quickly you’ll embrace AI. The future is closer than you think.

Book a demo with CarbonMinus to know more – www.carbonminus.com