Key Takeaways

- AI is being used to flag risks and adjust operations before issues escalate.

- Companies are using blockchain to back up ESG claims with traceable records.

- IoT systems now monitor energy, emissions, and water use in real time.

- ESG tech is no longer a side system—it’s part of the core stack.

- The biggest gains come from teams that can interpret and act on the data.

A few years ago, ESG was mostly about documentation. Reports, audits, frameworks— all important, but slow.

However, that’s not how it works now.

In 2025, technology isn’t just making ESG easier to manage. It’s changing how it operates.

Decisions are more connected. Data moves faster. Verification happens as things happen, not months later. AI, blockchain, and IoT aren’t add-ons anymore. They’re part of how ESG gets done day to day, across functions.

This blog takes a closer look at how that shift is unfolding, and what it means for organizations trying to lead, not just comply.

What’s Powering the Shift in ESG Execution

Companies aren’t waiting for year-end ESG reports to surface problems. In 2025, more of them are tracking performance continuously and adjusting in real time. That shift is being driven by three technologies that now sit closer to the core of business operations: AI, blockchain, and IoT.

Each plays a different role. AI supports faster, better decisions. Blockchain gives ESG claims a verifiable record. IoT turns goals into measurable action at the ground level.

A. AI: From Forecasting to Real-World Adjustments

Instead of just supporting reporting, AI is now helping teams see what’s coming—and act earlier.

Some industrial firms are using it to predict spikes in energy demand or spot changes in emissions before thresholds are breached. Others are mapping climate risk exposure across supply chains and testing mitigation strategies.

Pilot projects have shown that optimizing energy loads with AI has helped cut Scope 2 emissions by 8–15%. Spend in this space is growing fast: by the end of 2025, ESG-focused AI investment is projected to exceed $1.5 billion, growing at more than 25% per year.

B. Blockchain: Making ESG Performance Verifiable

It’s one thing to publish a sustainability target. It’s another to prove it.

That’s why more companies are using blockchain to log the source of materials, verify carbon credit transactions, and store emissions data in ways that can’t be changed after the fact.

This isn’t limited to finance or energy. In 2025, it’s gaining traction in sectors like mining, apparel, and agriculture—where supply chain claims are under heavier scrutiny. For some, it’s now the preferred way to document ESG data that regulators or investors might challenge later.

C. IoT and Smart Systems: ESG’s Operational Layer

AI helps you anticipate risk. IoT shows you what’s happening now.

Across manufacturing, logistics, and infrastructure, connected sensors are tracking emissions, energy use, water discharge, and equipment efficiency. The data feeds in automatically minute by minute, site by site, giving companies a live view of their environmental footprint.

That constant stream of granular data is turning ESG from a lagging indicator into a live system.

By 2025, the number of connected environmental monitoring devices passed 25 billion globally, producing massive volumes of actionable ESG data.

Some companies are going further with digital twins—virtual replicas that simulate ESG interventions before they go live. Use of digital twins for climate scenario planning jumped 40% in 2024 alone.

The results are real. One global beverage company, for example, used IoT-enabled water tracking across its plants and reported a 12% drop in water withdrawal intensity, avoiding penalties in water-stressed markets.

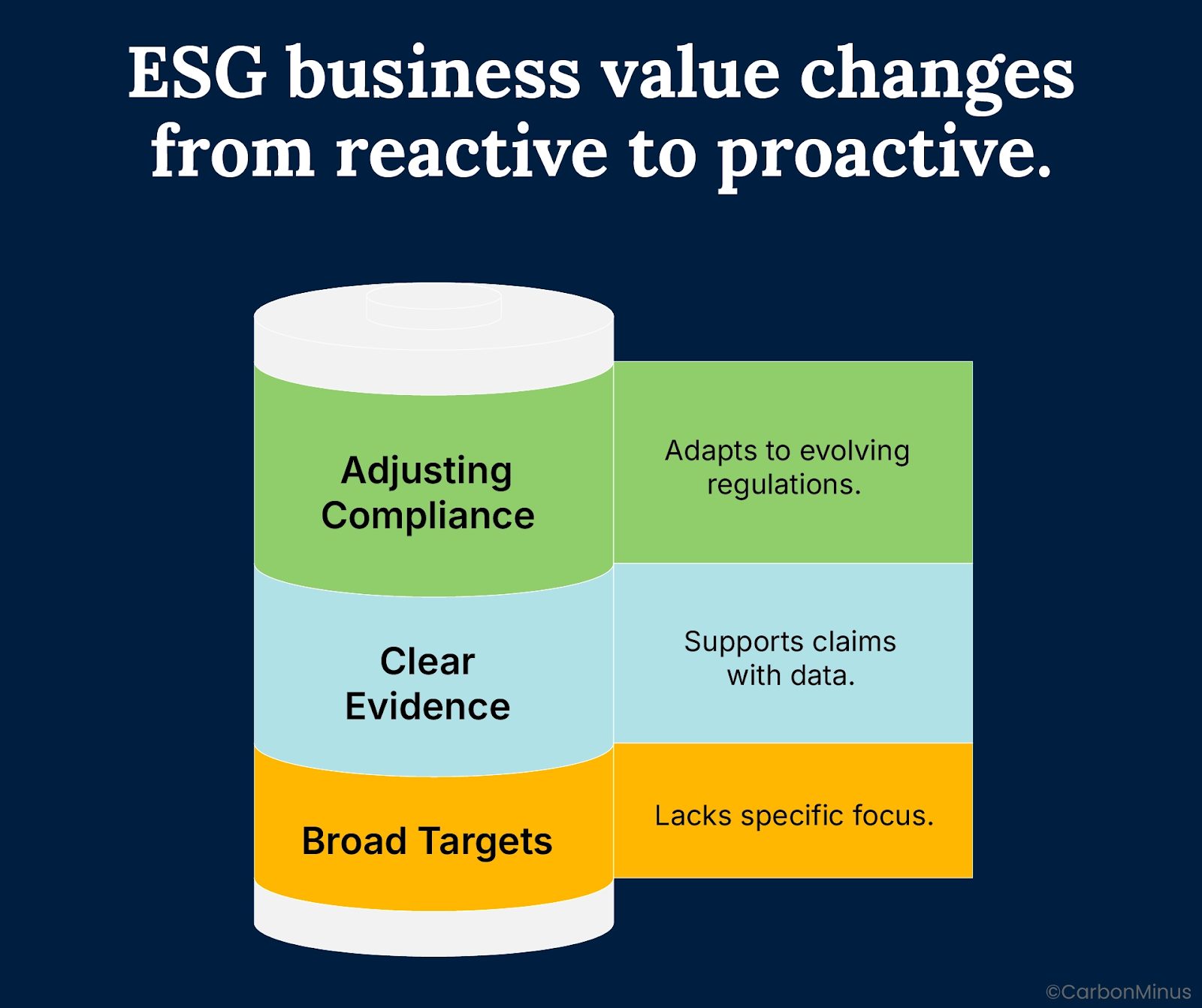

How Technology Is Changing the Business Value of ESG

When ESG data is live, structured, and verifiable, the impact goes beyond reporting. It changes how businesses plan, invest, and respond.

A. Context-Specific Strategy, Not Broad Targets

ESG performance varies by location, but too many strategies still treat every site the same.

That’s starting to change. Some companies are now combining climate models, satellite imagery, and local infrastructure data to design site-specific plans for things like irrigation, energy loads, or waste treatment. These plans often outperform broader policies because they reflect what’s actually happening on the ground.

It’s less about hitting global averages and more about improving outcomes where they’re needed most.

B. Stronger Claims Backed by Clear Evidence

Investor trust has always depended on disclosure. What’s changed is the expectation that ESG claims come with hard data.

Companies using automated tracking, like blockchain for sourcing or IoT for energy use are finding it easier to defend their performance and access capital. A 2024 investor survey showed that more than eight in ten asset managers prioritize disclosures that include time-stamped, independently verifiable data.

This is about proving progress, along with avoiding scrutiny.

C. Compliance That Adjusts as the Rules Change

Regulators are moving fast. CSRD alone brings over 1,000 required data points, and frameworks in the U.S., India, and Asia are evolving quickly.

Manual tracking isn’t scalable. That’s why many companies are now using compliance platforms that monitor new requirements, flag gaps, and push updates into workflows automatically. This reduces the risk of missed obligations and makes reporting less reactive and more integrated.

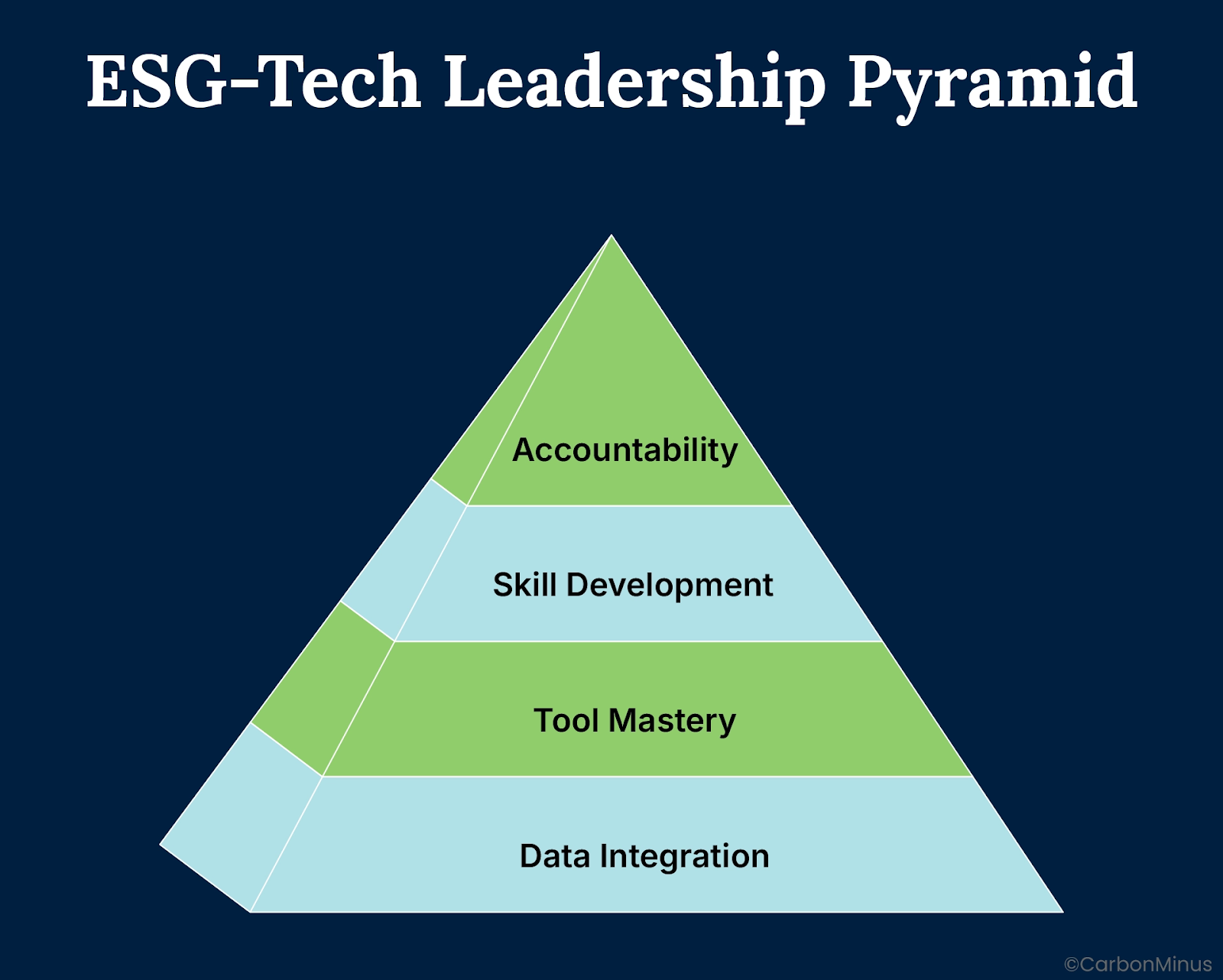

What It Takes to Lead in ESG-Tech Integration

Real-time data and automated systems can raise ESG performance, but only if organizations are equipped to use them well. The technology is here. The gap now lies in execution.

A. Making ESG Data Work Across Systems

Most companies already collect sustainability data. The challenge is bringing it together across business units, suppliers, and formats into something decision-makers can actually use.

Gartner found in late 2024 that over 60% of companies still name ESG data integration as a major barrier. The problem isn’t just volume, it’s structure. Without interoperability between IoT systems, supplier portals, and internal platforms, insight gets lost in translation.

Tools that consolidate and standardize ESG inputs are becoming essential not just for reporting, but for making ESG operational.

B. Getting Smarter About the Tools Themselves

AI models can be powerful, but they don’t run for free. Some require significant energy and computing resources, creating an emissions footprint of their own.

The focus is shifting to efficiency. More companies are now investing in low-impact AI, greener cloud setups, and lighter model architectures. Between 2020 and 2024, compute efficiency in some models improved by over 50x, according to industry benchmarks.

That trend matters. You can’t cut emissions while running carbon-heavy systems in the background.

C. Building Skills for ESG-Tech Roles

As digital tools take on more ESG work, companies are hiring for roles that didn’t exist a few years ago.

People with experience in both sustainability and data systems are in short supply and in high demand. Roles like emissions data analyst, supply chain traceability lead, or sustainability technologist are starting to appear across sectors. Some are pulled from IT. Some from environmental teams. But the best ones blend both.

According to the World Economic Forum, hybrid jobs at the intersection of tech and ESG will be among the fastest-growing categories through 2027. What’s needed isn’t just technical literacy, it’s judgment. Teams need to understand what the data means, when it’s flawed, and how to turn it into action that makes sense locally.

D. Keeping Tech Accountable

When technology is used to support ESG, it also introduces new risks.

AI tools used in hiring or resource planning can reinforce bias if no one checks the logic. Algorithms that analyze communities or social trends can miss context or flag the wrong signals. And when decisions rely on personal data, privacy gets complicated.

By 2025, more companies are stepping in. Over 40% of large enterprises have set up internal ethics boards to review how AI is being used in areas that affect people—not just emissions.

If ESG performance depends on these systems, so does trust. Yes, Governance is about the data, but it’s also about the tools behind it.

ESG Systems Are Becoming Smarter and So Must We

Sustainability strategy in 2025 looks different than it did even two years ago. It’s faster. More connected. Less about looking back and more about responding in real time.

That shift is being driven by infrastructure, not just intent. Companies that treat AI, IoT, and blockchain as core systems, not side projects, are now making better decisions, avoiding risk, and building trust in ways static ESG programs can’t match.

And the impact is growing. Global spending on ESG tech is expected to exceed $10 billion by the end of 2025, driven by compliance demands, investor pressure, and a rising standard for operational accountability.

Tech adoption alone won’t close the ESG gap. What sets the leading companies apart is how they structure the work around it. They’re training teams, reviewing how decisions are made, and adjusting systems when goals shift.

That’s what turns new tools into real progress.

FAQs

What role does technology play in ESG today?

It’s how companies stay ahead. Tools like AI and IoT help track performance, manage risks, and respond faster when things change. Most teams can’t do that manually anymore.

What kinds of data are companies using?

Emissions, energy use, water, supplier practices, workforce data. Some of it comes from sensors. Some from finance systems. What matters is bringing it together in one place.

Why are companies using blockchain in sustainability?

To prove what they’re reporting. Blockchain keeps a permanent record, so it’s being used to track things like where materials come from or whether carbon offsets are valid.

Isn’t there a risk of relying too much on these tools?

There is. That’s why companies are also hiring people who know how to question the data, spot errors, and make judgment calls when things don’t add up.

What should companies focus on first?

Start with visibility. You can’t improve what you can’t see. Then build systems that connect teams and track what matters without overcomplicating the work.