TL;DR

- ISO 50001 certification unlocks 5-25 basis points lower interest rates on sustainability-linked loans

- Government subsidies cover 60-75% of implementation costs: Canada offers up to $200,000, India provides ₹75,000 MSME subsidy

- Certified facilities access green bonds and preferential financing that competitors without certification can’t touch

- Foundries achieve 10-20% energy reduction within first year of ISO 50001 implementation

- Typical foundry spending ₹2.8 crore annually on energy saves ₹28 lakh/year from 10% reduction

- Automated platforms compress certification timeline from 18-24 months to 8-12 months

- Implementation costs ₹50 lakh-₹1.65 crore but ROI typically achieved within 18-36 months

- Tier-1 automotive OEMs increasingly require supplier ISO 50001 certification in RFPs

- Energy-efficient facilities command 3-15% asset valuation premiums

- Banks view energy management certification as credit risk mitigation, improving overall lending terms

In 1968, Dr. Spencer Silver was trying to create the world’s strongest adhesive for 3M, the kind that could hold airplane wings together. Instead, his experiment produced exactly the opposite: a super-weak glue that barely stuck to anything. For most scientists, this would be called a failure. Silver spent five years trying to convince colleagues at 3M that his “mistake” had value, but nobody could figure out what to do with an adhesive that didn’t really adhere.

Then Art Fry, another 3M engineer, got frustrated with bookmarks falling out of his church hymnal. He applied Silver’s weak adhesive to paper strips, and suddenly the “failure” made sense: Post-it Notes were born. Today, they’re one of the best-selling office products of all time.

The lesson? Sometimes what looks like the wrong answer is actually the right solution to a different question.

That’s exactly what’s happening with ISO 50001 energy management certification in the foundry industry. Most manufacturers think it’s about environmental compliance, a bureaucratic burden that costs money without generating returns. They’re asking the wrong question.

The right question is this: Why are certified foundries accessing millions more in preferential financing, lower interest rates, and government incentives that their competitors can’t touch?

Two foundries in the same cluster. Same production capacity, same equipment needs, both applying for ₹5 crore equipment financing. One has ISO 50001 certification. The other doesn’t. The certified foundry secures a sustainability-linked loan at 5-10 basis points lower interest rate. Over a 7-year loan term, that’s ₹17,500-₹35,000 in direct interest savings.

But that’s just the visible savings. The real advantage runs deeper with access to government incentive programs covering up to 60% of implementation costs, enhanced asset valuations commanding 3-15% premiums, and customer contracts increasingly requiring supplier energy management certification.

This isn’t about saving the planet. It’s about saving money while your competitors pay full price for everything, financing, energy, compliance, and market access.

Let’s break down why the financial world suddenly cares about your foundry’s energy management system, and how certification translates into bottom-line advantages most manufacturers haven’t discovered yet.

The Certification-to-Capital Pipeline Nobody Talks About

Your bank isn’t asking about your sustainability initiatives because they care about polar bears. They’re asking because energy inefficiency has become a credit risk indicator.

Financial institutions increasingly view unmanaged energy consumption as a red flag. Facilities without systematic energy management face higher default probability as carbon taxes rise and energy costs climb. ISO 50001 certification signals the opposite, you’ve installed systems to control one of your largest operating expenses.

That distinction unlocks four financing advantages most foundry operators don’t know exist.

Government Incentive Programs: Direct Capital Infusion

Canada offers $40,000-$200,000 per building portfolio for ISO 50001 implementation, covering up to 60% of eligible costs for for-profit organizations. India provides MSME subsidies covering 75% of ISO certification expenses up to ₹75,000 per unit. US facilities access federal tax credits specifically for energy efficiency improvements tied to systematic management.

These aren’t loans. This is free money reducing your implementation costs by half or more before you generate a single kilowatt-hour of savings.

Sustainability-Linked Loans: Cheaper Capital for Certified Operators

Here’s where certification becomes a competitive weapon. Sustainability-linked loans (SLLs) adjust interest rates based on achieving pre-defined Sustainability Performance Targets (SPTs). Interest rate reductions typically range from 5-25 basis points.

Harvard Business School research shows sustainability spread adjustments averaging 4.8-8.5 basis points in the corporate lending market. For a ₹5 crore equipment loan, every 10 basis points of rate reduction saves ₹50,000 annually with ₹3.5 lakh over a 7-year term.

The Loan Market Association’s Sustainability-Linked Loan Principles provide standardized frameworks that lenders across India and the US now follow. ISO 50001 certification provides the verifiable, auditable energy performance data that qualifies you for these programs.

Your competitor without certification? They’re paying the standard rate. Every time.

Green Bonds: Accessing Purpose-Built Capital Markets

Green bonds specifically finance energy-efficient operations and equipment upgrades. The global green bond market demonstrates resilience with energy efficiency projects as a primary use case, providing capital at lower yields compared to conventional bonds.

India’s municipal green bond market alone could mobilize up to $2.5 billion for climate-resilient infrastructure. Industrial facilities with ISO 50001 certification qualify for these purpose-built capital pools that non-certified competitors can’t access.

Enhanced Creditworthiness: Better Terms on Everything

ESG-linked institutional lending increasingly incorporates energy performance into credit risk assessment models. Companies with stronger ESG profiles, including energy management certification, improve their overall credit ratings.

This doesn’t just affect equipment loans. It influences working capital facilities, supplier payment terms, and insurance premiums. Financial institutions view certified energy management as evidence of operational governance quality.

The 10-20% Energy Reduction Nobody Believes Until They See It

Let’s address the skepticism head-on. You’ve heard efficiency promises before. Consultants who talk big and deliver small. So here are the numbers from facilities that actually implemented ISO 50001, with their names attached.

Manufacturing Facilities With Skin in the Game

Changshin Inc. (Indonesia footwear manufacturer): Achieved 13% energy efficiency improvement over 3 years. Total energy savings: 11,720 MWhe. Financial impact: $808,382 cumulative savings. Not projections. Actual money that stayed in the company instead of going to the utility.

Watts S.A. (Chile food processing): 8.8% energy performance improvement in one year. Total energy savings: 4,997 MWh. Financial impact: $363,801 annual savings. Their ISO 50001 certification process identified specific equipment upgrades that paid for themselves in under 18 months.

Marelli Motherson Automotive Lighting (Pune, India): 22% energy intensity improvement over 4 years. Total energy savings: 2,349 MWh. Cost savings: $248,524. CO₂ emissions reduction: 1,965 metric tons. Their COO’s quote says it all: “EnMS provided a systematic approach for energy conservation activities at our plant and helped to reduce carbon footprint while enhancing efficiency with continual improvement”.

Schneider Electric (France): 26% energy cost reduction through systematic EnMS implementation tied to ISO 50001 protocols. When a company that manufactures energy management equipment uses ISO 50001 for their own operations, that’s a signal.

Industry-Wide Validation

U.S. Department of Energy research confirms ISO 50001-certified organizations achieve 10-20% energy consumption reductions within the first few years of implementation. Clean Energy Ministerial projections estimate ISO 50001-certified facilities could collectively avoid 100 million metric tons of CO₂ emissions by 2030. The International Energy Agency calculated that global ISO 50001 implementation could save $600 billion in energy costs by 2030.

Energy savings across implementations range from 5-30% during the initial phase. The variance depends on baseline efficiency foundries starting with poor energy management see larger improvements.

Where Foundries Bleed Money Without Knowing It

Specific Energy Consumption (SEC) in foundries fluctuates from 625 to over 900 kWh/MT. That 275 kWh/MT difference represents pure waste for facilities operating at the high end. For a 5,000 MT annual production foundry, that’s 1,375,000 kWh of unnecessary consumption.

At ₹7/kWh industrial rates, that’s ₹96 lakh ($115,000) burning up annually for no production value.

ISO 50001’s systematic approach standardizes performance at the efficient end of that range by identifying and eliminating these specific waste sources:

- Idle equipment accounts for 15-25% of total foundry energy consumption. Machines running during lunch breaks, weekends, and shift changes with nobody operating them.

- Compressed air leaks cost foundries ₹3,900+ annually per 1/8-inch leak, with 20-30% of compressor output typically lost to leaks nobody bothered measuring.

- Melting process inefficiency: Medium frequency furnace optimization can reduce specific power consumption by 95 kWh/ton compared to conventional operations. When melting consumes 70%+ of your facility energy, small efficiency gains produce massive cost reductions.

Energy costs represent approximately 15-20% of foundry production expenses. A 10% reduction translates directly to improved margins in an industry where 8-12% profit margins are typical.

The question isn’t whether ISO 50001 delivers energy savings. The question is whether you can afford to keep bleeding 15-25% of your energy budget while certified competitors capture that money as profit.

The ROI Math Foundry Owners Actually Care About

Enough case studies. Let’s talk about your facility specifically.

What You’ll Actually Spend

ISO 50001 implementation costs range from $40,000-$200,000 ($50,000-₹1.65 crore) depending on facility size and complexity. For commercial buildings, third-party certification costs approximately $7,500-$9,000 plus 0.3-0.5 FTE-year of internal resources per building. Industrial facilities typically require $18,000-$34,000 in external costs plus 0.3-1.7 FTE-year internal labor per site.

Changshin Inc.’s footwear manufacturing facility in Indonesia invested $488,697 in EnMS implementation, including consultancy, training, and monitoring equipment. Their $808,382 cumulative energy savings over 3 years generated $319,685 net profit from the certification investment, a 65% return on capital deployed.

How Fast You Get Paid Back

ROI typically occurs within 6 months to 3 years depending on energy intensity. Energy-intensive operations like foundries achieve faster payback, often within the first year.

Industrial facilities participating in the U.S. DOE’s 50001 Ready Enterprise-wide Accelerator program saved an average of $600,000 annually in energy costs per site. Implementation using the enterprise-wide approach reduced costs to $19,000 external plus 0.8 FTE-year per site, with timelines of 4-18 months.

Let’s model this for a mid-sized foundry:

Baseline Scenario:

- Annual production: 5,000 MT

- Current SEC: 800 kWh/MT (mid-range)

- Annual energy consumption: 4,000,000 kWh

- Industrial electricity rate: ₹7/kWh

- Annual energy cost: ₹2.8 crore ($340,000)

Post-ISO 50001 Implementation:

- Conservative 10% energy reduction: 400,000 kWh saved

- Annual cost savings: ₹28 lakh ($34,000)

- Implementation investment: ₹75 lakh ($90,000)

- Payback period: 2.7 years from energy savings alone

But that’s only counting one benefit stream.

The Multi-Benefit Value Stack

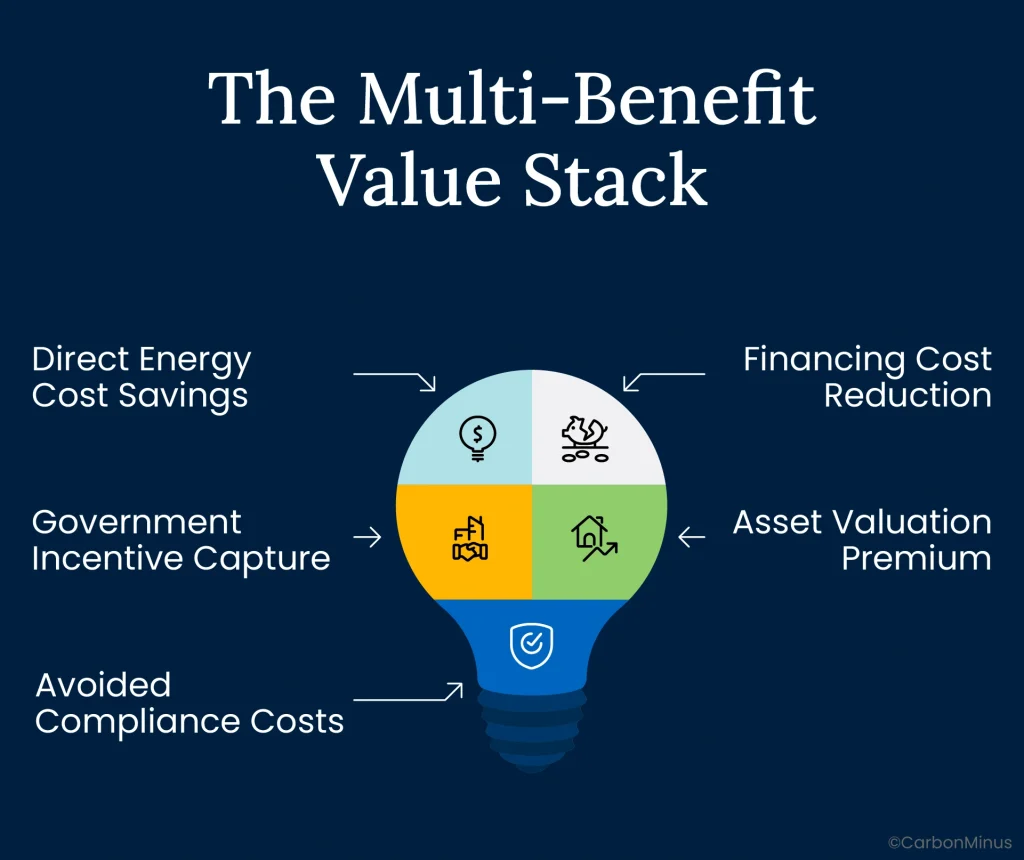

Smart foundry operators don’t evaluate ISO 50001 on energy savings alone. They calculate the cumulative financial advantage across five value streams:

1. Direct Energy Cost Savings: ₹28 lakh annually from 10% reduction

2. Financing Cost Reduction: 10 basis points on ₹5 crore equipment loan = ₹50,000 annual savings × 7-year term = ₹3.5 lakh total

3. Government Incentive Capture: 75% subsidy on certification costs = ₹56 lakh immediate capital return

4. Asset Valuation Premium: Energy-efficient industrial facilities command 3-15% premiums in commercial markets. For a ₹20 crore facility valuation, that’s ₹60 lakh – ₹3 crore in enhanced asset value.

5. Avoided Compliance Costs: Systematic documentation reduces PAT scheme compliance burden, saving ₹2-3 lakh annually in consultant fees

Total first-year financial impact: ₹28 lakh (energy) + ₹50,000 (financing) + ₹56 lakh (subsidy) + ₹2.5 lakh (compliance) = ₹87 lakh

Against a ₹75 lakh implementation investment, that’s immediate positive ROI in Year 1. Every subsequent year, the ₹30+ lakh in ongoing savings drops straight to the bottom line.

Why Your Bank Suddenly Cares About Your Furnace Efficiency

The financial industry’s interest in your energy management isn’t philosophical. It’s mathematical.

Risk Mitigation Through Verification

ISO 50001 creates verifiable, auditable energy performance data that transforms you from “high-risk energy user” to “actively managed energy performer” in lending risk models. Third-party certification removes the “trust me” factor that banks hate.

Continuous monitoring and reporting requirements built into ISO 50001 align perfectly with lender covenant structures. Banks want monthly or quarterly proof that your operations remain stable. ISO 50001 generates exactly that documentation automatically.

ESG Integration Isn’t Optional Anymore

Sustainability-linked loans now represent significant portions of corporate lending markets globally. The Loan Market Association’s Sustainability-Linked Loan Principles provide standardized frameworks that lenders across India and the US now follow.

Financial institutions increasingly incorporate ESG metrics into credit risk assessment models. Harvard research analyzing lending data shows that sustainability-linked features in loan agreements have become commonplace, not exceptional.

For foundries, this matters because your industry carries an “energy-intensive” label in banking algorithms. ISO 50001 flips that perception from liability to asset.

Future-Proofing Against Carbon Costs

Rising carbon taxes and energy costs create default risk for unmanaged facilities. Banks see climate transition risk as credit risk. Facilities without energy management systems face higher probability of payment default as operating costs climb unpredictably.

Certified facilities demonstrate resilience to regulatory changes and energy price volatility. You’ve installed systems that automatically adjust to cost pressures instead of absorbing them as margin compression.

That difference shows up in your lending rates, whether you notice it or not.

Energy CFOs must power the green transition. Financial institutions view certified energy management as demonstrating operational governance quality that extends beyond environmental considerations.

Boston Consulting Group, Energy CFO Report 2025

Transparency Creates Capital Access

ISO 50001 requires regular KPI reporting verified by third parties. This transparency enables easier comparison and benchmarking for lenders evaluating multiple facilities.

Standardized metrics mean banks can evaluate your facility against industry benchmarks instantly. When your Specific Energy Consumption sits at 650 kWh/MT while the cluster average runs 800 kWh/MT, that 19% efficiency advantage translates to predictable cost advantage and operational excellence.

Lenders pay for predictability with lower rates.

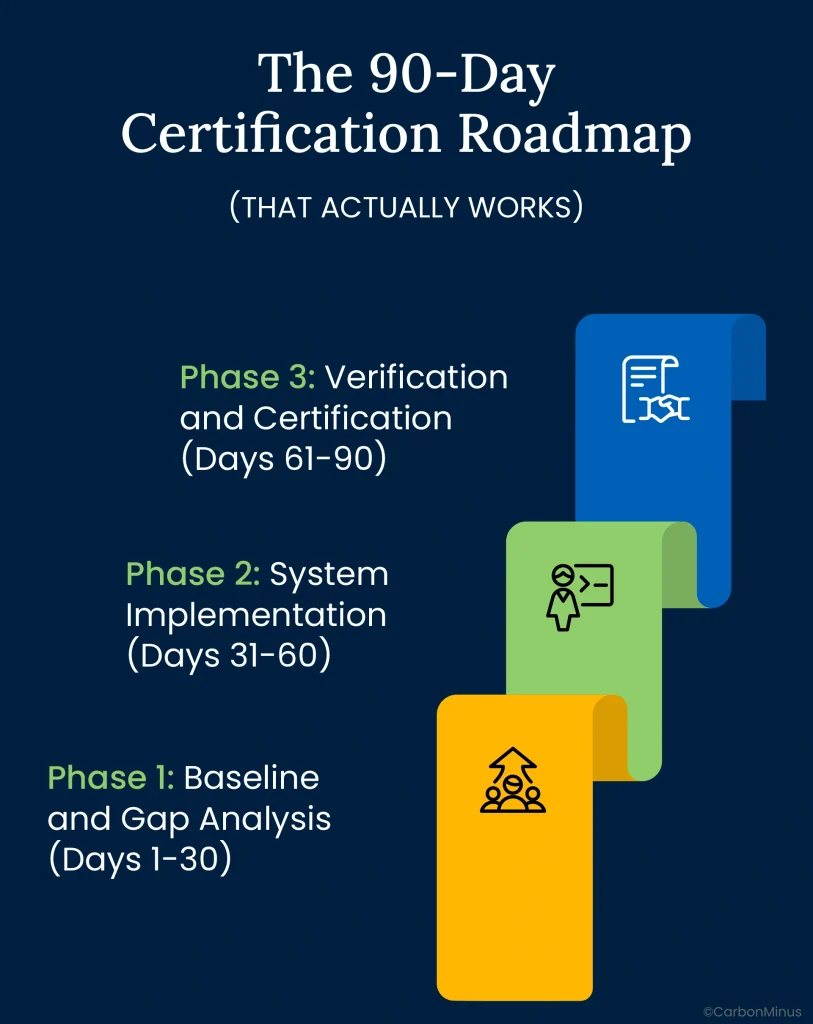

The 90-Day Certification Roadmap (That Actually Works)

Most foundries avoid ISO 50001 because they imagine an 18-24 month bureaucratic nightmare. That timeline applies to facilities doing everything manually with paper spreadsheets and quarterly consultant visits.

Automated energy management platforms compress implementation to 8-12 months by eliminating manual data collection and documentation bottlenecks. Here’s the phased approach that minimizes production disruption while maximizing speed to financing benefits.

Phase 1: Baseline and Gap Analysis (Days 1-30)

Week 1-2: Focused Energy Audit

Target the three major consumption areas in foundries: melting furnaces (70%+ of total consumption), compressed air systems, and idle equipment. Don’t audit everything. Audit what matters.

Establish your Specific Energy Consumption (kWh/MT) baseline for each production process. This becomes the metric you’ll improve and report to lenders for sustainability-linked loan qualification.

Week 3: Identify Significant Energy Uses (SEUs)

ISO 50001 requires identifying equipment and processes accounting for substantial energy consumption or offering significant improvement potential. For foundries, this typically includes:

- Induction furnaces (melting operations)

- Compressed air generation and distribution

- HVAC systems in casting areas

- Idle production equipment during shift changes

Week 4: Data Collection Systems Mapping

Map existing sensors, meters, and SCADA systems. Identify gaps where you’re blind to consumption. Modern energy management platforms integrate with existing hardware, so you’re not replacing functional equipment, you’re connecting it.

Set initial Energy Performance Indicators (EnPIs) aligned with production metrics such as kWh per ton of casting, compressed air efficiency ratios, and furnace thermal efficiency. As these baselines evolve, integrating thermal energy storage can help stabilize load profiles, reduce peak energy demand, and improve the overall accuracy and impact of your EnPI strategy.

Phase 2: System Implementation (Days 31-60)

Week 5-6: Install or Integrate Monitoring Systems

Hardware-agnostic platforms connect existing meters without requiring wholesale replacement. Installation happens during nights and weekends to avoid production disruption.

Implement automated data collection for continuous monitoring. This eliminates the Excel spreadsheet nightmare that kills most manual ISO 50001 attempts.

Week 7: Address “Quick Wins”

These generate immediate savings while certification progresses:

- Compressed air leak repairs: 20-30% typical savings from fixing leaks that cost ₹3,900+ annually per 1/8-inch opening

- Idle equipment scheduling: Program automatic shutdowns during lunch breaks and shift changes instead of leaving equipment running

- Power factor correction: Eliminate utility penalties costing thousands monthly

These quick wins often generate enough savings in 30 days to cover the first month of implementation costs.

Week 8: Training and Procedure Documentation

Train operators and maintenance staff on ISO 50001 procedures and KPI ownership. Document energy management policies, procedures, and responsibilities per ISO 50001:2018 requirements.

Automated platforms reduce documentation burden by 93% through template-based compliance tracking. What used to require 40+ hours monthly now takes 2-3 hours.

Phase 3: Verification and Certification (Days 61-90)

Week 9-10: Internal Audits

Conduct internal audits against ISO 50001:2018 standard requirements. Identify documentation gaps and procedural inconsistencies before the certification body arrives.

Establish continuous improvement protocols using the PDCA (Plan-Do-Check-Act) cycle required by the standard.

Week 11-12: External Certification

Engage accredited certification bodies like NABCB-accredited in India, ANAB in the US. The certification process involves:

- Stage 1 audit: Document review to verify your EnMS meets ISO 50001 requirements

- Stage 2 audit: On-site assessment of implementation effectiveness

Many foundries fail Stage 1 because their documentation doesn’t match actual practices. Automated platforms prevent this by generating documentation directly from operational data.

Week 13: Financing Applications

With ISO 50001 certification in hand, prepare financing applications highlighting:

- Certification status (copy of certificate)

- Energy performance data (12 months trending if available, baseline if newly certified)

- Sustainability Performance Targets (SPTs) for sustainability-linked loans

- Projected energy savings and carbon reduction metrics

Banks and financial institutions increasingly have dedicated green finance teams handling these applications.

The Automation Advantage

Traditional manual implementation: 18-24 months

Automated platform implementation: 8-12 months

That 6-12 month difference means certified foundries access financing windows competitors miss. In capital-intensive industries where equipment lead times extend 6-9 months, the facility that secures financing first captures market share first.

India vs. US: Regional Financing Advantages

ISO 50001’s financial benefits play out differently depending on your location. Both markets offer substantial advantages, but through different mechanisms.

India: Regulatory Alignment + Emerging Green Finance

PAT Scheme Integration

The Perform, Achieve, Trade (PAT) scheme mandates energy intensity reduction for designated consumers, exactly what ISO 50001 delivers systematically. Energy Conservation Act 2001 requires energy audits; certification demonstrates compliance while generating operational savings.

ISO 50001 provides the structured approach for achieving PAT targets without scrambling during audit periods.

MSME Financial Support

MSME subsidies cover 75% of ISO certification costs up to ₹75,000. For a ₹1 lakh certification investment, that’s ₹75,000 immediate capital return. Many foundries qualify under MSME classification based on equipment investment thresholds.

Green Bonds and Development Finance

Indian banks increasingly offer preferential rates for green-certified operations aligned with RBI’s sustainable finance guidelines. SIDBI and state-level programs support energy efficiency financing specifically for MSMEs.

India’s green bond market is mobilizing capital for energy-efficient industrial projects, with municipal green bonds alone potentially raising $2.5 billion. Power Finance Corporation and REC Limited have established green finance frameworks specifically targeting energy efficiency improvements.

Real Example: Foundry Cluster Impact

Kolhapur foundry cluster shows baseline SEC of 1,000-1,200 kWh/ton with significant optimization potential. World Bank-GEF/SIDBI projects demonstrated energy conservation measures across 120+ foundry units in clusters. These cluster-based approaches reduce individual implementation costs through shared learning and bulk equipment procurement.

US: Mature Green Finance + Federal Incentives

Federal Tax Credits

Energy-efficient equipment tax credits through federal programs directly reduce tax liability. The U.S. Department of Energy’s 50001 Ready Program provides self-guided implementation tools that reduce external consultant costs.

Better Buildings Program provides recognition for certified energy management systems, improving visibility to customers requiring supplier sustainability credentials.

State-Level Incentive Stacking

Various states offer additional incentives beyond federal programs for certified energy management systems. Utility companies provide rebates and technical assistance for efficiency improvements, effectively subsidizing equipment upgrades identified during ISO 50001 implementation.

California, New York, and Massachusetts have particularly robust programs with substantial capital support.

Established SLL Market

The US sustainability-linked loan market is more mature with standardized terms and established precedent. Commercial lending routinely incorporates ESG-linked pricing for industrial borrowers.

Energy service companies (ESCOs) offer performance contracting aligned with ISO 50001, where the ESCO finances efficiency improvements and gets repaid from energy savings. This eliminates upfront capital requirements entirely for qualified facilities.

Case Example: Midwest Manufacturing Advantage

Industrial facilities under DOE’s Superior Energy Performance (SEP) program, which builds on ISO 50001 saved an average of $600,000 annually in energy costs per site. Midwest foundries benefit from high industrial electricity rates ($0.08-$0.12/kWh) that make energy efficiency improvements pay back faster than low-rate regions.

Beyond Compliance: The Strategic Advantages Nobody Discusses

ISO 50001 certification delivers financial benefits through capital access and energy savings. But three strategic advantages create competitive moats that compound over time.

Supply Chain Requirement Becoming Market Entry Barrier

Large OEMs increasingly require supplier energy management certification for bid qualification. This isn’t a future trend, it’s happening now. Automotive tier-1 suppliers face sustainability questionnaires during RFP processes asking specifically about ISO 50001 status.

Facilities without certification don’t get disqualified immediately. They get deprioritized against certified competitors offering equivalent quality and pricing. When an OEM can choose between two foundries with identical capabilities, they choose the one reducing their Scope 3 emissions reporting burden.

Export markets with strict carbon regulations favor certified suppliers. European Union’s Carbon Border Adjustment Mechanism (CBAM) creates financial penalties for carbon-intensive imports. ISO 50001 provides the documentation infrastructure for proving reduced carbon intensity.

Green procurement policies prioritize energy-managed operations. Government contracts and large private sector buyers increasingly evaluate supplier sustainability as a scored criterion, not just a checkbox.

Premium Pricing for “Green Castings”

Differentiation drives pricing power. Foundries demonstrating systematic energy management can charge 8-12% premiums for “sustainably produced” castings to customers with aggressive ESG targets.

This isn’t charity pricing. Customers pay premiums because your certification reduces their reporting burden and improves their ESG metrics. You’re selling documentation as much as you’re selling castings.

Companies in sustainability-sensitive industries (electric vehicles, renewable energy equipment, LEED-certified construction) actively seek certified suppliers. Your ISO 50001 status becomes a customer acquisition tool, not just an operational improvement.

Operational Excellence Culture That Extends Beyond Energy

The systematic approach required by ISO 50001 creates a culture of continuous improvement that extends beyond energy management. Data-driven decision making replaces operational guesswork.

Marelli Motherson’s COO specifically credited EnMS with providing “a systematic approach for energy conservation activities” that “helped enhance efficiency with continual improvement”. The discipline of measuring, monitoring, and methodically improving translates to quality systems, maintenance protocols, and production scheduling.

Predictive maintenance capabilities reduce downtime and emergency repairs. Power quality monitoring identifies equipment degradation early, allowing planned maintenance instead of catastrophic failures that shut down production lines.

Facilities with visible performance metrics engage employees more effectively. Operators see real-time feedback on their process efficiency, creating ownership and accountability that manual systems never achieve.

The Certification Decision: Pay Now or Pay Forever

Let’s bring this full circle.

For foundries spending ₹2-5 crore annually on energy, ISO 50001 certification represents a strategic financial decision, not environmental compliance. The multi-benefit value stack with 10-20% direct energy savings, preferential financing rates, enhanced asset valuation, and improved market access, creates compelling ROI within 18-36 months.

The financing advantage alone generates six-figure savings over equipment loan lifetimes. Sustainability-linked loans offering 5-25 basis points rate reduction on ₹5-10 crore financing save ₹2.5-12.5 lakh over 7-year terms. Combined with ₹28-70 lakh annual energy cost reductions for mid-size operations, the business case becomes undeniable.

But here’s what actually drives the decision: competitive positioning.

While you’re reading this, a foundry in your cluster is implementing ISO 50001. They’re capturing the government subsidies you’re leaving on the table. They’re securing sustainability-linked loans at rates you can’t access. They’re winning bids from OEMs who prioritize certified suppliers.

Most importantly, they’re operating with 10-20% lower energy costs while you pay full price for every kilowatt-hour.

Every month you delay certification, your competitors compound their cost advantage.

The Automation Accelerator

Traditional 18-24 month manual implementation timelines historically created barriers. Automated platforms like CarbonMinus compress this to 8-12 months through hardware-agnostic integration, real-time monitoring, and audit-ready documentation.

This acceleration means you capture financing advantages and energy savings faster than competitors still operating on assumptions rather than data.

Hardware-agnostic integration connects existing foundry systems without requiring expensive equipment replacement. Real-time energy performance tracking translates kilowatt-hours into financial impact, giving operations teams visibility they’ve never had. Automated compliance documentation reduces manual workload by 93%, eliminating the resource constraint that kills most certification attempts.

The result: audit-ready reporting for both certification bodies and financial institution requirements without dedicated staff.

The Question Isn’t Whether….

To pursue ISO 50001 certification, it’s whether you can afford to let competitors access better financing terms, lower operating costs, and stronger market positioning while you maintain status quo energy practices.

Spencer Silver’s “weak” adhesive wasn’t weak. It was solving a problem nobody had articulated yet. ISO 50001 isn’t environmental compliance. It’s financial engineering disguised as energy management.

Your competitors figured this out. The question is whether you’ll figure it out while there’s still a competitive advantage to capture, or after it becomes table stakes and the financing premium disappears.

Start Your 90-Day Journey

The foundries accessing millions in preferential financing aren’t running different equipment. They’re running different data systems that prove efficiency to lenders, customers, and regulators.

Book a demo to see how CarbonMinus compresses ISO 50001 implementation timelines while reducing costs or watch competitors capture the financing advantages you’re leaving on the table.

FAQs

How much does ISO 50001 certification actually cost for a mid-sized foundry?

Implementation costs range from ₹50 lakh-₹1.65 crore depending on facility size. However, government subsidies dramatically reduce net investment: India’s MSME program covers 75% of costs up to ₹75,000, while Canada offers up to $200,000 per building portfolio (60% of eligible costs). With subsidies, out-of-pocket investment drops to ₹25-40 lakh for most operations.

How long does it take to get ISO 50001 certified?

Traditional manual implementation requires 18-24 months. Automated energy management platforms compress this to 8-12 months through hardware-agnostic integration and real-time monitoring. The U.S. DOE’s 50001 Ready program reduces timelines to 4-18 months per site. Using automated platforms, expect 8-12 months from kickoff to certification completion.

What’s the difference between ISO 14001 and ISO 50001? Do I need both?

ISO 14001 addresses broad environmental management (waste, pollution, resources); ISO 50001 focuses exclusively on energy consumption with granular tracking requirements. Key advantage: ISO 50001 unlocks sustainability-linked loans, green bonds, and government energy incentives that ISO 14001 doesn’t directly access. You don’t need ISO 14001 to obtain ISO 50001, they’re independent certifications.

Can I qualify for sustainability-linked loans before completing ISO 50001 certification?

Yes. Some lenders offer sustainability-linked loans (SLLs) to facilities actively pursuing ISO 50001, not just those certified. Requirements include measurable KPIs tied to energy intensity reduction, ambitious Sustainability Performance Targets (SPTs), and third-party verification. Many banks structure tiered pricing: initial rates during implementation, improved rates after Stage 1 audit, best rates upon full certification.

Will ISO 50001 work with my existing foundry equipment and SCADA systems?

Yes. ISO 50001 is a management standard, not a technology specification, it works with existing equipment regardless of manufacturer or age. Modern platforms use hardware-agnostic integration connecting to existing sensors, meters, PLCs, and SCADA through standard protocols (Modbus, OPC-UA, BACnet). You’re aggregating data from equipment you already own, not replacing functional systems.

What happens if we fail to meet sustainability targets in our loan agreement?

Interest rates increase by the agreed-upon margin (typically 5-25 basis points). Example: base rate 8% with 10 bps adjustment; failing targets raises rate to 8.10%, meeting targets maintains 7.90%. Most SLL agreements allow annual performance reviews with rate adjustments at each period, not immediately upon missing quarterly targets. ISO 50001’s systematic approach dramatically reduces risk of missing SPTs.

Does ISO 50001 also satisfy PAT scheme compliance requirements in India?

ISO 50001 significantly streamlines PAT (Perform, Achieve, Trade) compliance but doesn’t automatically fulfill all requirements. Both mandate energy intensity reduction and systematic management. ISO 50001’s energy baseline, EnPIs, and continuous monitoring generate documentation PAT audits demand. However, PAT has specific reporting formats requiring data mapping, automated platforms handle this translation automatically.

Which customers actually require supplier ISO 50001 certification?

Tier-1 automotive OEMs increasingly include energy management certification in supplier sustainability questionnaires during RFPs. European automotive manufacturers (Volkswagen, BMW, Mercedes-Benz) prioritize certified suppliers for Scope 3 emissions reduction. Other sectors: electric vehicle manufacturers, renewable energy equipment producers, LEED-certified construction contractors, EU buyers subject to Carbon Border Adjustment Mechanism (CBAM) regulations.

Can smaller foundries (under 100 employees) realistically afford ISO 50001?

Yes, small foundries achieve faster ROI because energy represents higher percentages of total costs. Cost-reduction strategies: MSME subsidies cover 75% of certification costs (up to ₹75,000 in India), foundry clusters benefit from shared consultants reducing individual costs 30-50%, and automated platforms eliminate need for dedicated energy managers. A 50-person foundry spending ₹80 lakh annually on energy saves ₹8 lakh with 10% reduction, covering implementation costs in Year 1.

What are common reasons foundries fail ISO 50001 audits?

Documentation gaps where stated procedures don’t match operational practices. Other failures: inadequate energy baseline or EnPIs not aligned with production variables, missing energy reviews analyzing consumption patterns, lack of measurable improvement proof, insufficient management commitment, and inadequate training documentation. Automated energy management platforms prevent most failures by generating documentation directly from operational data.

How quickly can we access financing benefits after certification?

During implementation (Months 3-8): some lenders offer preliminary SLL terms for facilities actively pursuing certification. After Stage 1 audit (Month 9-10): documentation-complete facilities qualify for intermediate SLL pricing tiers. Upon certification (Month 10-12): full ISO 50001 certification unlocks maximum financing advantages including best SLL rates, green bond eligibility, government incentive capture. Initiate lender conversations during Month 6-7 to close financing immediately after certification.

What’s the typical energy savings foundries achieve with ISO 50001?

Foundries achieve 10-20% energy consumption reductions within the first few years of implementation. Documented examples: Marelli Motherson (India) achieved 22% energy intensity improvement saving $248,524, Changshin Inc. (Indonesia) achieved 13% efficiency improvement saving $808,382 over 3 years, and Schneider Electric achieved 26% energy cost reduction. For a foundry spending ₹2.8 crore annually on energy, 10% reduction saves ₹28 lakh/year.