The EU’s Carbon Border Adjustment Mechanism (CBAM) is turning into a global game-changer. By embedding carbon costs into imports, CBAM is set to reshape international trade and redefine competitiveness in a low-carbon economy.

For businesses operating in carbon-intensive industries, this marks a pivotal shift. The transition from voluntary sustainability initiatives to mandatory compliance means companies must not only measure their emissions but also account for them in the global market. The introduction of CBAM signals a new era where carbon costs are no longer externalities but integral components of trade dynamics.

The stakes couldn’t be higher.

Yet, while CBAM presents undeniable challenges, it also opens doors. Businesses that proactively align their operations with this new reality can position themselves as leaders in sustainable trade. Early adopters will not only ensure compliance but also attract environmentally conscious partners and investors, gaining a significant edge in an increasingly carbon-conscious marketplace.

In this blog, we’ll unpack what CBAM means for international trade and outline strategies for businesses to thrive in this evolving landscape. From compliance tools to emissions tracking, we’ll explore how companies can adapt and lead in a carbon-conscious economy.

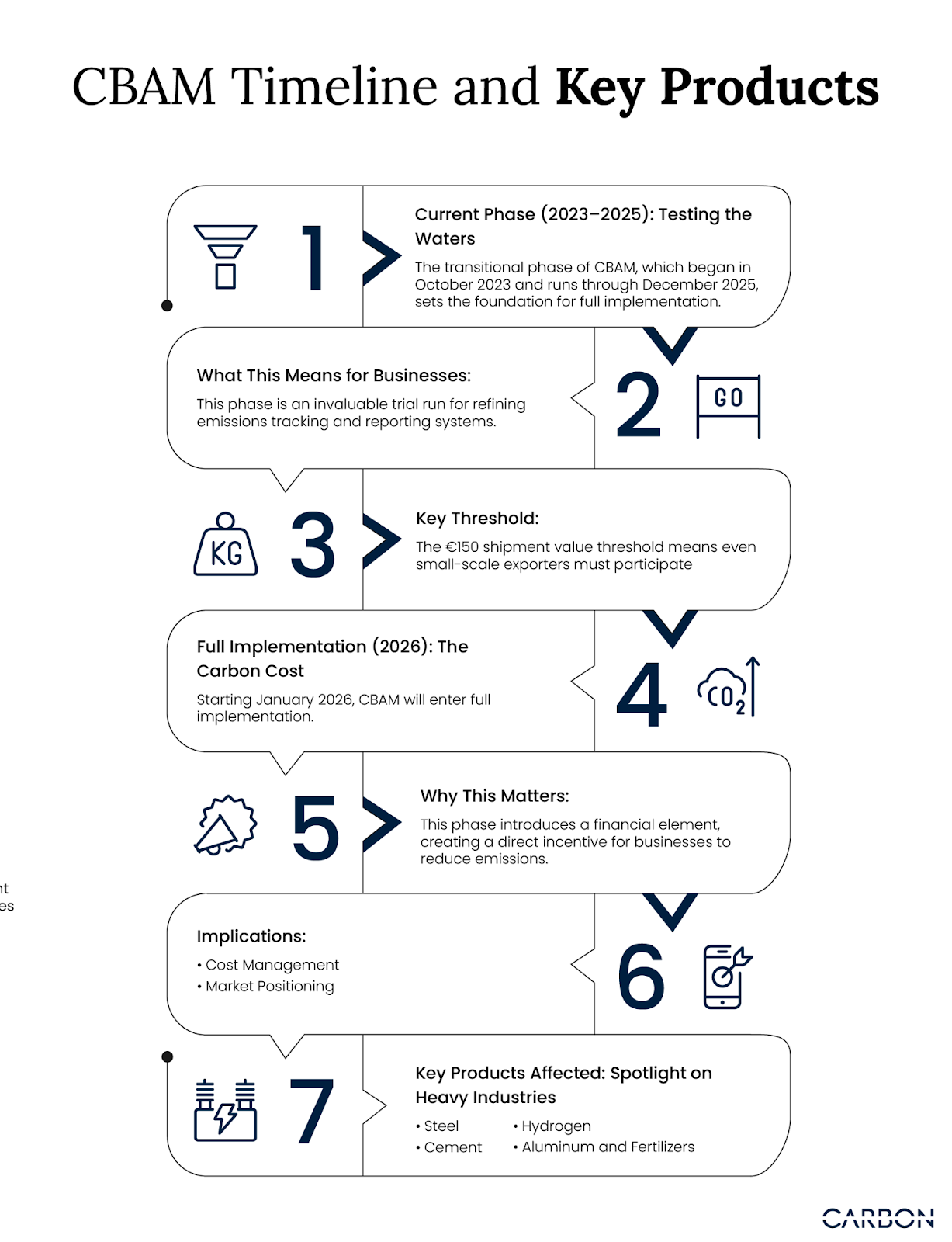

CBAM Timeline and Key Products

CBAM is a roadmap for how businesses can align with the future of carbon-conscious trade. By understanding its timeline and requirements, companies can turn compliance into a strategic advantage.

Current Phase (2023–2025): Testing the Waters

The transitional phase of CBAM, which began in October 2023 and runs through December 2025, sets the foundation for full implementation. During this phase, importers are required to submit quarterly reports detailing the embedded greenhouse gas emissions in their shipments, covering both direct and indirect emissions. However, financial payments are not yet required, making this a low-risk opportunity for businesses to prepare.

What This Means for Businesses:

This phase is an invaluable trial run for refining emissions tracking and reporting systems. It provides a window for companies to address data gaps, enhance transparency across supply chains, and identify potential compliance risks without immediate financial pressure.

Example:

A steel manufacturer could use this period to pilot emissions tracking software, uncovering inconsistencies in Scope 3 data from suppliers and rectifying these issues before 2026.

Key Threshold:

The €150 shipment value threshold means even small-scale exporters must participate, reinforcing the need for comprehensive systems to capture emissions data across all product lines.

Full Implementation (2026): The Carbon Cost

Starting January 2026, the Carbon Border Adjustment Mechanism (CBAM) will enter full implementation. Importers will be required to purchase CBAM certificates to cover the embedded emissions of their products. Certificate prices will be tied to the EU Emissions Trading System (ETS) weekly average, directly linking carbon costs to market fluctuations.

Why This Matters:

This phase introduces a financial element, creating a direct incentive for businesses to reduce emissions. High-carbon products will become more expensive to export to the EU, making decarbonized supply chains a critical competitive advantage.

Implications:

- Cost Management: Companies with carbon-intensive products will need to mitigate costs by adopting low-carbon production methods or sourcing from greener suppliers.

- Market Positioning: Businesses that reduce emissions proactively can position their products as cost-competitive and aligned with EU sustainability standards.

Key Products Affected: Spotlight on Heavy Industries

CBAM regulations focus on carbon-intensive goods, targeting industries foundational to global trade. Each sector faces unique challenges and opportunities:

- Steel: Supply chain emissions data often lacks granularity, making accurate reporting a significant hurdle. Businesses must invest in emissions tracking systems to ensure compliance.

- Cement: Innovations like low-carbon cement using calcined clay can help reduce embedded carbon and meet evolving procurement standards.

- Hydrogen: The high cost of green hydrogen production presents a barrier to widespread adoption, but early investment in this area could yield significant long-term rewards.

- Aluminum and Fertilizers: Companies must account for both production emissions and those linked to raw material sourcing.

The Bigger Picture:

These industries are not just compliance targets—they’re at the forefront of innovation. Companies that tackle these challenges now will be well-positioned to dominate low-carbon markets.

Act Now, Not Later: The Roadmap for Readiness

Waiting until 2026 means scrambling to adapt under financial pressure. Businesses that act now can refine their emissions tracking systems, adapt their supply chains, and align with the EU’s carbon-conscious market demands.

By treating this transitional phase as a proactive trial run, businesses can ensure compliance, mitigate costs, and position themselves as leaders in the global decarbonization effort.

Strategic Preparation for CBAM Regulations

CBAM’s requirements go beyond compliance—they demand strategic preparation. To navigate this new landscape effectively, businesses must focus on three key areas: data management, supply chain assessment, and scalable digital solutions.

Data Management: Building a Solid Foundation

Automating Emissions Tracking:

The first step in preparing for CBAM is establishing robust systems for automating emissions tracking. Businesses need tools that can integrate data from multiple sources, including non-EU suppliers, to ensure accuracy and transparency.

Example Tools and Methodologies:

EU-approved frameworks, such as ISO 14064 and the GHG Protocol, provide reliable guidelines for emissions calculations. Paired with AI-powered data aggregators, these methodologies streamline the collection of Scope 1, 2, and 3 emissions data, eliminating inefficiencies associated with manual tracking.

Why It Matters:

Accurate emissions data isn’t just a compliance necessity—it’s a competitive advantage. By identifying high-emission areas within their operations and supply chains, businesses can prioritize impactful reductions, improve reporting accuracy, and position themselves as leaders in sustainable trade.

Supply Chain Assessment: Driving Proactive Adjustments

Evaluating Carbon Footprints:

Supply chain emissions often represent the largest share of a company’s carbon footprint, making assessments and adjustments essential. Businesses must evaluate their suppliers’ carbon footprints and ensure transparent pricing documentation for imported goods—key to CBAM compliance.

Proactive Adjustments in Action:

- Use Case 1: A global food producer by partnering with suppliers to implement renewable energy solutions across its supply chain can achieve a reduction in embedded carbon.

- Use Case 2: A steel manufacturer transitioning to low-carbon material sourcing can reduce emissions and enhance its competitiveness in EU markets.

The CBAM Advantage:

Proactive supply chain adjustments not only minimize exposure to CBAM-related costs but also position businesses as sustainability leaders. By collaborating with environmentally conscious suppliers, companies can strengthen relationships and future-proof their operations.

Digital Solutions: Preparing for the CBAM Registry Upgrade

Scaling Digital Infrastructure:

The CBAM Registry upgrade, set to launch in 2025, will introduce enhanced capabilities for emissions data sharing and compliance tracking. To prepare, businesses must adopt scalable digital solutions that seamlessly integrate with their existing operations.

Practical Steps:

- Cloud-Based Platforms: Invest in systems that centralize emissions data, streamline reporting processes, and ensure compatibility with EU standards.

- Predictive Analytics: Leverage digital tools to forecast the financial and operational impacts of regulatory changes, enabling proactive decision-making.

Forward-Looking Insight:

Early adoption of digital infrastructure simplifies compliance and unlocks opportunities for innovation. By integrating predictive analytics, businesses can adapt to future regulations with agility, ensuring resilience in a dynamic global market.

Preparation as a Competitive Advantage

Strategic preparation is about using them as a springboard for innovation and leadership. By focusing on data management, supply chain assessment, and digital solutions, businesses can navigate CBAM’s challenges while building resilience and competitive strength.

Financial and Trade Implications

CBAM’s implementation is a financial shift that will ripple through industries and global trade. From price increases to evolving trade patterns, the implications are profound.

What Are the Costs of Compliance?

As CBAM integrates carbon costs into imports, businesses will face increased pricing pressures. Industries such as steel, cement, and aluminum—already operating on thin margins—are especially vulnerable to these changes.

Price increases won’t stop at the borders. Costs embedded in primary materials will cascade downstream, impacting pricing for end products and reshaping supply chain dynamics. For companies unprepared to manage these changes, the financial risks could be significant.

Managing Costs and Trade Shifts

Cost Projections and Financial Impacts:

CBAM-aligned goods could see price increases of up to 15%, with downstream products reflecting similar inflation. Companies that rely on carbon-intensive imports may find themselves at a competitive disadvantage unless they proactively address these costs.

Global Trade Shifts:

CBAM is also driving significant changes in international trade patterns. Exporters from regions with high-carbon manufacturing processes are facing financial disadvantages, incentivizing investments in decarbonization. Simultaneously, businesses sourcing from low-carbon suppliers are gaining a competitive edge, creating a clear divide between sustainable and unsustainable trade practices.

Strategies for Thriving Amidst Change

Managing Financial Impacts with Technology:

Businesses can mitigate financial risks by adopting advanced tools:

- Predictive Analytics: These tools simulate the financial impact of carbon pricing on supply chains, helping businesses anticipate cost increases and refine pricing strategies.

- Market Modeling Platforms: By assessing price elasticity and forecasting market responses, businesses can make data-driven decisions on cost absorption or pass-through strategies, balancing competitiveness and profitability.

Adapting Trade Strategies for a Low-Carbon Landscape:

To align with CBAM’s objectives and maintain market positioning, companies should:

- Transition to Low-Carbon Alternatives: Sourcing materials and goods with lower embedded emissions not only reduces CBAM-related costs but also demonstrates sustainability leadership.

- Optimize Trade Routes: Reevaluating logistics can minimize transportation emissions, contributing to overall compliance and reducing operational costs.

- Invest in Collaborative Decarbonization: Partnering with supply chain stakeholders to co-invest in low-carbon technologies or renewable energy projects spreads financial risk and accelerates progress.

Aligning for a Low-Carbon Future

CBAM’s financial and trade implications represent both challenges and opportunities. Businesses that leverage predictive tools, reimagine trade strategies, and invest in decarbonization will navigate this evolving landscape with confidence. Aligning with CBAM’s objectives offers a pathway to resilience and leadership in a low-carbon global economy.

Overcoming Implementation Challenges

While CBAM regulations offers significant opportunities for businesses, its implementation presents challenges that require thoughtful strategies. From complex emissions calculations to data verification, overcoming these hurdles is essential for compliance—and for long-term success.

Complex Emissions Calculations

Calculating emissions, particularly Scope 3, is one of the most daunting aspects of CBAM compliance.

Evidence:

For many companies, emissions data must be collected from disparate sources across the supply chain, often in inconsistent formats. Manual calculations not only consume time but also increase the risk of inaccuracies, leaving businesses vulnerable to compliance penalties.

Explanation:

Automated systems simplify this process by integrating data from multiple sources and applying standardized methodologies. AI-powered platforms can aggregate, analyze, and categorize emissions data automatically, ensuring alignment with frameworks like the GHG Protocol. These tools also allow businesses to identify high-emission areas, providing actionable insights for reduction strategies.

Link:

By leveraging automation, businesses can streamline calculations, improve accuracy, and allocate resources toward broader sustainability goals.

Data Collection and Verification

Reliable audit trails and robust supplier engagement are critical for CBAM compliance.

Evidence:

Without verifiable data, businesses risk non-compliance, penalties, and reputational damage. Engaging suppliers to provide accurate emissions data can be logistically challenging, particularly when supply chains span multiple regions with varying reporting standards.

Explanation:

Establishing clear audit trails through digital tools ensures every piece of data is traceable and verifiable. Additionally, fostering supplier collaboration through shared platforms or co-developed initiatives encourages transparency and accountability.

Use Case Example:

A global electronics manufacturer can implement a supplier engagement program requiring vendors to upload emissions data into a centralized system. This approach not only improves data accuracy but also creates a shared responsibility for compliance, reducing risks and strengthening partnerships.

Link:

By building stronger supplier relationships and maintaining reliable audit trails, businesses can ensure the accuracy and integrity of their emissions reporting.

Digital Infrastructure Needs

Compliance with CBAM requires scalable digital solutions that integrate seamlessly with existing operations.

Evidence:

Platforms like CarbonMinus play a vital role in ensuring compliance readiness by centralizing data management, automating reporting processes, and enabling predictive analytics for future regulatory changes.

Explanation:

Investing in digital infrastructure early allows businesses to not only meet current CBAM requirements but also adapt to future changes. For example, CarbonMinus enables real-time emissions monitoring, ensuring companies are always audit-ready and aligned with EU standards. These platforms also simplify compliance by generating automated reports and integrating with existing enterprise systems.

Link:

Adopting robust digital infrastructure now ensures a smoother transition into full CBAM compliance, reducing risks, enhancing operational efficiency, and unlocking opportunities for innovation.

Turning Challenges into Advantages

Overcoming implementation challenges is more than about meeting CBAM requirements—it’s about building resilience and adaptability into your business. By addressing emissions calculations, enhancing data verification, and adopting advanced digital tools, companies can turn these hurdles into stepping stones for leadership in sustainable trade.

Adapting to a Carbon-Conscious Trade Era

CBAM is a chance to redefine your business for a carbon-conscious era. By aligning with its requirements, businesses can not only ensure compliance but also gain a competitive edge in global trade.

Decarbonization and data-driven strategies are tools for compliance that also offer pathways to resilience and leadership. Early adopters who embrace emissions tracking, supply chain transparency, and digital solutions are already setting benchmarks in sustainability and operational excellence. These companies are positioning themselves as trusted partners in a rapidly evolving marketplace, securing investor confidence and strengthening customer loyalty.

Preparing for CBAM is about building a business that thrives in a low-carbon economy. Companies that invest in emissions tracking and adopt transparent supply chain practices are better positioned to attract eco-conscious stakeholders and stay ahead of competitors who delay their decarbonization efforts.

The time to act is now. With 2026 just around the corner, businesses must prioritize investments in emissions tracking, supply chain transparency, and digital infrastructure. By taking proactive steps today, your business can lead the transition to a carbon-conscious trade era—stronger, smarter, and more competitive.

Know more about how to achieve your sustainability goals and stay compliant. Book a demo at www.carbonminus.com.