In our last conversation, I talked about how harmonizing ESG reporting across global frameworks is helping businesses turn compliance into a strategic advantage. But harmonizing is only the beginning.

The biggest shift in ESG reporting? Moving from static reports to real-time insights. Businesses can no longer afford to wait months for compliance updates—by then, the risks have already materialized.

I’ve seen how static, periodic ESG reports leave businesses struggling to keep up with the pace of change. Regulations shift overnight, risks emerge without warning, and opportunities can slip through the cracks before anyone even notices.

Today, you can’t wait months for insights anymore.

Real-time monitoring changes the game. It shifts ESG from reactive to proactive, turning data into a tool for growth and resilience. This is the way to meet today’s standards and stay ahead of tomorrow’s challenges, leading with confidence.

In this article, I’ll explore how real-time monitoring transforms ESG reporting from a compliance requirement into a strategic advantage—helping businesses anticipate risks, optimize decisions, and position themselves as leaders in a dynamic world.

Why Static ESG Reporting Is Holding Companies Back

I’ve seen it time and again—static ESG reports leave businesses stuck in the past while the world races forward.

Regulations like Europe’s CSRD evolve continuously, rendering quarterly or annual reports outdated before they’re even finalized. By the time static ESG data is compiled, businesses may already be out of compliance.

But it’s not just compliance that suffers—it’s your entire operation. Static reports might highlight inefficiencies in energy use or reveal gaps in supply chain performance, but by the time you act, the moment to make a meaningful impact has passed. That’s wasted time, resources, and opportunities.

In my experience, the businesses that thrive are the ones anticipating them. With static reporting, you’re always one step behind, whether it’s catching a spike in emissions or mitigating supply chain disruptions.

Here’s the bottom line: ESG reporting should push you forward. Real-time insights give businesses the ability to adapt, act, and lead in the moment. To me, that’s the kind of smart strategizing that’s needed to stay competitive in a world that’s constantly changing.

How Real-Time Monitoring Delivers Strategic Value

Here’s the challenge I see: collecting ESG data is one thing—knowing what to do with it in the moment is another entirely. That’s where real-time monitoring changes everything.

Let me give you an example. Imagine noticing a sudden spike in emissions from a supplier. With static reporting, that issue might not show up for months—by then, the damage is done. But with real-time monitoring, you catch it immediately, adjust your operations, and avoid costly penalties.

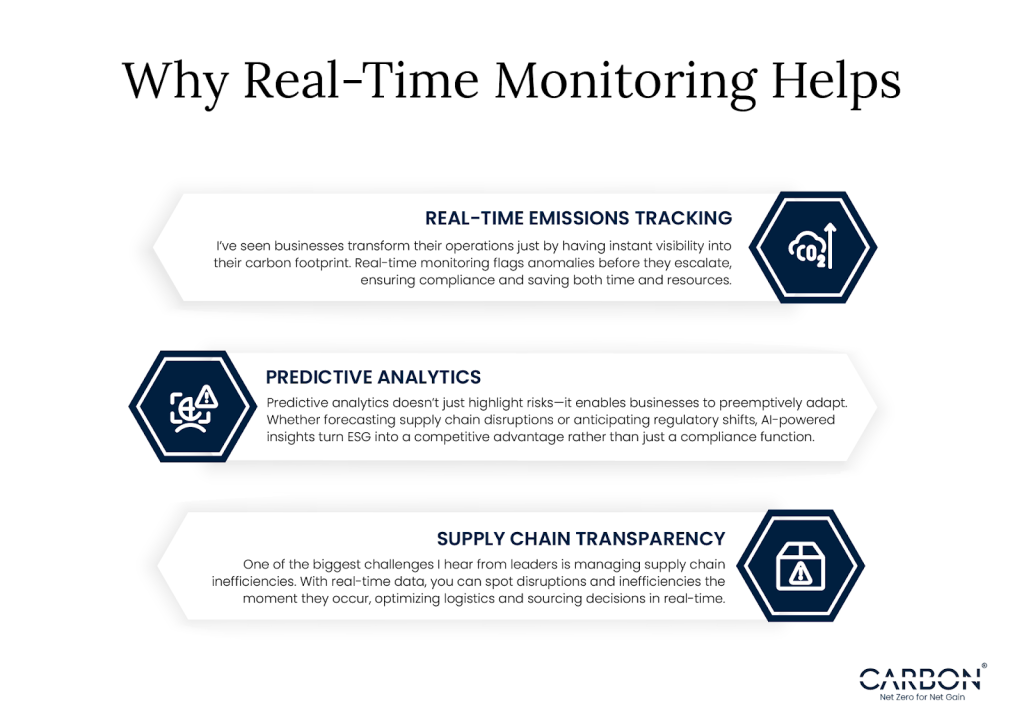

Here’s how real-time monitoring creates value:

But the real value goes beyond these capabilities. Real-time monitoring is about operating smarter, building trust with stakeholders, and using ESG data to drive strategy.

When I see businesses embrace real-time sustainability, they become resilient and set themselves apart as leaders.

Moving From Compliance to Strategy Through Real-Time Insights

To me, real-time sustainability goes beyond meeting today’s standards—it’s about reshaping how businesses operate, invest, and grow.

I’ve seen how leaders are using real-time ESG insights to move beyond compliance and make smarter, faster decisions. They are seizing opportunities currently available.

- Guiding Big Investments

When I talk to CEOs, they agree that data drives decisions. Real-time insights give you the clarity to prioritize big moves, like renewable energy projects. You can show stakeholders live emissions data alongside long-term savings projections. Suddenly, it becomes a story of environmental impact and financial ROI, all backed by real-time evidence. - Building Trust with Stakeholders

In my experience, trust comes from transparency. Investors want accountability. Customers expect progress. Real-time ESG monitoring gives leaders the confidence to answer tough questions —whether it’s about supply chain emissions or progress on sustainability goals. - Staying Ahead of Competitors

I’ve seen how businesses use real-time insights to outpace their peers. More than benchmarking, it’s about finding opportunities to lead, whether it’s cutting emissions faster or running operations more efficiently.

The shift to real-time ESG monitoring is no longer optional—it’s a necessity. Businesses that embrace it will gain a strategic edge in risk management, stakeholder trust, and long-term sustainability leadership.

For me, that’s the ultimate goal—using data to navigate today’s challenges and shape the future of your industry.

Overcoming Barriers to Real-Time Monitoring

I’m a firm believer in the power of real-time monitoring, but I also know that implementing it isn’t without its challenges. From scaling operations globally to aligning leadership teams, I’ve seen businesses wrestle with these hurdles firsthand.

Here’s what I’ve learned about overcoming the most common barriers:

The path to real-time monitoring may not be simple, but the payoff is undeniable. I’ve seen businesses emerge stronger and more efficient when they embrace these tools fully.

Where Real-Time Sustainability Meets Leadership

The way I see it, real-time sustainability is changing how businesses lead.

When your decisions are guided by live, transparent data, you’re no longer reacting to the challenges of the moment—you’re creating opportunities for the future. Real-time insights give businesses the clarity to prioritize, adapt, and lead with purpose.

Next time I’ll explore how AI-driven predictive analytics are taking things even further. From forecasting risks to spotting opportunities before they arise, these tools are helping businesses plan ahead and make decisions with confidence.