The Thinker.

A large statue seated on a rock — one arm on the left knee, and the other arm to support the chin. The male figure is leaning forward and thinking…

This statue created in 1904 by Auguste Rodin sums up what consumers and stakeholders are doing today. They are thinking more and more about sustainability.

81% of people expect companies to be environmentally conscious in their advertising and communications.

Meanwhile, 69% of people are making decisions to reduce their carbon footprint.

This means it’s time for your business to step up its game.

Navigating sustainability regulations isn’t a simple task. The rules are intricate, constantly evolving, and vary across regions and industries.

For founders, this can feel overwhelming. Missing a critical update or misinterpreting a regulation can lead to penalties, strained credibility, and missed growth opportunities.

The stakes are high, and the margin for error is slim.

This blog aims to equip you with the essential tools and strategies to ensure your business stays compliant. We’ll explore how proactive compliance management can safeguard your company from risks while positioning it as a leader in sustainability.

What are the Key Sustainability Regulations for Businesses?

1. Paris Agreement Compliance

The Paris Agreement, adopted in 2015, sets a global framework to limit global warming to well below 2°C, with efforts to keep it to 1.5°C. As part of the agreement, businesses must align their operations with national commitments (Nationally Determined Contributions or NDCs). They must focus on reducing carbon emissions through sustainable practices and energy-efficient technologies.

2. European Union Green Deal

The EU Green Deal is a comprehensive strategy aiming for Europe to become carbon neutral by 2050. Key components for businesses include

- The European Climate Law, which mandates net-zero emissions by 2050.

- The Fit for 55 package, which targets a 55% reduction in greenhouse gas emissions by 2030.

3. Corporate Sustainability Reporting Directive (CSRD)

The CSRD, effective in the European Union, requires companies to report on sustainability risks and impacts alongside financial data. This regulation aims to standardize sustainability reporting across industries, making businesses more transparent about their environmental and social practices.

4. ISO 14001 Compliance

ISO 14001 is an internationally recognized standard for Environmental Management Systems (EMS). It helps businesses manage their environmental responsibilities in a structured way, focusing on reducing resource use, waste management, and pollution prevention.

5. The Task Force on Climate-related Financial Disclosures (TCFD)

The TCFD framework, developed by the Financial Stability Board (FSB), guides companies in providing transparent climate-related financial disclosures. It requires businesses to report on how climate risks and opportunities impact their financial performance.

6. UK’s Net Zero Strategy

The UK has committed to reaching net-zero carbon emissions by 2050. The Climate Change Act 2008 sets legally binding targets for emissions reductions, requiring businesses to adopt energy-efficient technologies, reduce waste, and manage their carbon footprints.

What are the Upcoming Changes to Sustainability Regulations for Businesses?

1. Corporate Sustainability Reporting Directive (CSRD) Implementation in the EU (2024)

The CSRD, which expands on the existing Non-Financial Reporting Directive (NFRD), will come into full effect this year. This directive will require over 50,000 companies in the EU to disclose their sustainability practices.

The key changes include

- More detailed reporting on environmental, social, and governance (ESG) factors.

- Mandatory third-party audits.

- Alignment with EU Taxonomy regulations.

2. Carbon Border Adjustment Mechanism (CBAM) – Full Phase-In (2026)

The EU’s CBAM, a carbon tariff on imported goods, will fully phase in by 2026. This regulation aims to prevent carbon leakage by ensuring that imported products meet the same carbon standards as those produced within the EU.

3. Expanded Scope 3 Emissions Reporting in the U.S.

The U.S. Securities and Exchange Commission (SEC) is expected to finalize new climate disclosure rules in the coming years. One of the most significant potential changes is the mandatory reporting of Scope 3 emissions for publicly listed companies.

4. Mandatory Task Force on Climate-related Financial Disclosures (TCFD) Reporting Globally

More countries are moving towards mandatory TCFD-aligned reporting. In addition to the UK, countries like New Zealand, Japan, and Switzerland are expected to introduce or expand climate risk reporting requirements.

5. Strengthened Emission Trading Systems (ETS) Globally

Countries with established Emission Trading Systems (ETS), such as China, the EU, and South Korea, are expected to tighten caps on carbon emissions and expand the sectors covered. In particular, China’s ETS will likely expand to include more industries beyond energy, while the EU is also considering adding emissions from sectors like shipping.

6. European Union’s Sustainable Product Initiative (SPI)

The SPI, expected to be introduced in 2024, aims to make sustainable products the norm in the EU market. It will set mandatory sustainability criteria for various products, focusing on durability, repairability, and recyclability.

7. ISO 50001:2018 Energy Management Standard Updates

The ISO 50001:2018 Energy Management Standard is expected to receive updates to better align with global climate goals. This standard helps organizations improve their energy performance, and future revisions could include stricter requirements for energy efficiency and reporting.

If you need help aligning with the latest standards, contact CarbonMinus today. We understand your energy consumption patterns and fully automate the documentation process. Know more

What are the Essential Sustainability Reporting Tools for Ensuring Compliance?

Automated Compliance Reporting

Businesses can streamline the tracking and documenting of their compliance activities, reducing the risk of human error. Automated compliance reporting solutions provide accurate, up-to-date data, allowing you to focus on strategic decisions rather than getting bogged down by administrative tasks.

- You gain a reliable system

- Consistently meet regulatory deadlines

- Get accurate compliance data

- Be prepared for any regulatory audit

Real-Time Monitoring

With up-to-the-minute data on your operations, real-time monitoring allows you to spot potential issues before they escalate into significant problems.

Consider it an early warning system, identifying deviations from compliance standards immediately, and enabling swift corrective actions. This proactive approach helps you avoid penalties and maintain your business’s credibility.

Detailed Sustainability Metrics

By analyzing sustainability metrics, you can pinpoint exactly where your compliance efforts are succeeding and where they might be falling short. This level of detail supports a data-driven approach to compliance management solutions, ensuring that your strategies are effective and efficient.

What are the Business Strategies for Navigating Sustainability Regulations?

Proactive Compliance Management

Adopting a proactive approach to compliance management safeguards your business from potential penalties and significantly enhances your company’s credibility.

Proactive compliance means actively monitoring and anticipating regulatory requirements, rather than reacting to them.

- Minimizes the risk of non-compliance

- Protects your business from costly fines

- Strengthens your organization’s reputation

Risk Assessment and Mitigation

Navigating the regulatory landscape demands a thorough understanding of the risks associated with non-compliance.

Compliance risk assessment is the process of identifying, evaluating, and prioritizing risks that could impact your ability to meet regulatory requirements.

To conduct a comprehensive risk assessment…

- Start by identifying potential compliance risks within your operations.

- These could range from new regulations that your business is not yet equipped to handle, to gaps in your current compliance processes.

- Once identified, assess the likelihood and potential impact of these risks.

- Finally, develop and implement mitigation strategies to address each risk.

- This might include updating your compliance protocols, investing in new technologies, or increasing oversight in high-risk areas.

Training and Awareness

A well-informed team is essential for maintaining compliance across your organization. When your employees understand the importance of these regulations and how to comply with them, they become active participants in your compliance strategy.

Effective training should cover both the specifics of relevant regulations and the broader importance of sustainability in your industry. Regular workshops, e-learning modules, and practical exercises can help keep everyone up-to-date and engaged.

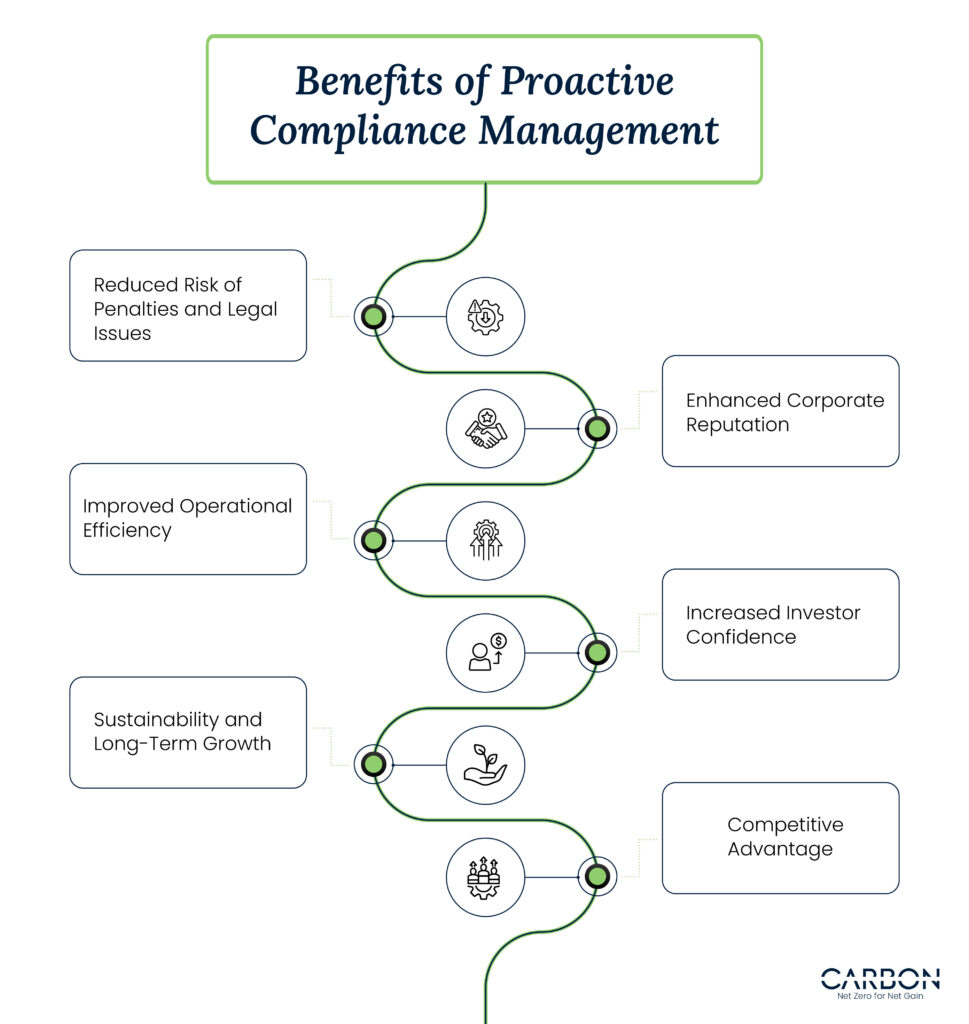

What are the Long-Term Benefits of Proactive Compliance Management for Businesses?

1. Reduced Risk of Penalties and Legal Issues

By actively monitoring and managing compliance with regulations, businesses can avoid costly penalties, fines, and legal disputes. Staying ahead of regulatory changes ensures that companies maintain continuous compliance, reducing the risk of business disruptions caused by non-compliance.

2. Enhanced Corporate Reputation

Proactively managing compliance builds trust with customers, investors, regulators, and the public. It demonstrates ethical responsibility and a commitment to sustainable business growth, enhancing brand loyalty and corporate goodwill.

3. Improved Operational Efficiency

Proactive compliance management involves implementing systems and processes that can streamline operations. By automating compliance reporting, tracking regulations, and integrating compliance into business workflows, companies often experience improved efficiency.

4. Increased Investor Confidence

Investors are increasingly focused on companies with robust environmental, social, and governance (ESG) practices. Proactive compliance management, especially regarding sustainability and corporate governance, can attract investors looking for low-risk, socially responsible investment opportunities.

5. Sustainability and Long-Term Growth

Proactive compliance management is closely linked with sustainability, particularly in industries affected by environmental regulations. By aligning compliance with long-term sustainability goals, businesses can

- Reduce their environmental footprint

- Improve resource efficiency

- Enhance their overall sustainability strategy

6. Competitive Advantage

Businesses that manage compliance proactively often gain a competitive edge. Early adoption of new regulations can position them as industry leaders, especially in sectors where regulations are evolving rapidly.

Steer Your Business Through Sustainability Regulations

Get in touch with us today to learn how CarbonMinus can become your trusted partner in navigating the regulatory landscape and enhancing your company’s reputation. Book a demo