Suppose you have $100.

Will you be able sustain yourself if you keep spending a dollar day, without any way of increasing your corpus?

On the other hand, if someone finds a way of increasing their wealth, it would secure their future while allowing them to spend the required amount daily.

It’s the same in oil and gas. The industry is running on limited resources and now the time has come to make a change.

The pressure to adopt sustainable energy management practices is mounting, driven by regulators, investors, and the public. At the same time, profitability remains the lifeblood of these giants, making the energy transition far from straightforward.

Leaders are grappling with how to embrace this change while maintaining the bottom line.

Why the Energy Transition is Inevitable for Sustainable Energy Management?

External Pressures on Oil & Gas

The oil and gas sector is now at the center of a complex web of external pressures—and it’s no longer business as usual.

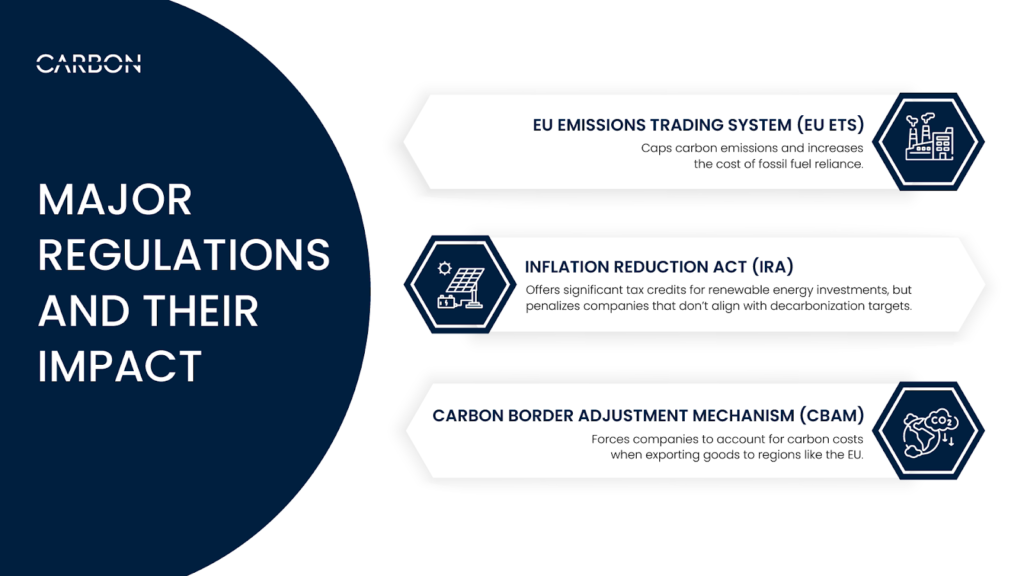

Similarly, in the U.S., the Inflation Reduction Act offers financial incentives for renewable energy investments, but it also escalates the financial risks for companies that fail to decarbonize.

What many oil and gas executives may underestimate is the shifting stance of institutional investors. Major asset managers, like BlackRock, are increasingly embedding Environmental, Social, and Governance (ESG) criteria into their investment decisions.

In 2021 alone, companies that lagged in ESG performance saw capital divestment worth billions of dollars. Oil and gas companies without a credible energy transition strategy are quickly losing favor with these investors.

The Economic Impact of Ignoring Sustainability

For oil and gas companies, the decision to resist or embrace sustainability and environmental management is more than an ethical dilemma—it’s a stark economic reality.

Companies clinging to outdated energy models risk missing out on emerging markets for hydrogen, solar, and wind energy, which are projected to see an explosion in demand over the next decade.

Meanwhile, the levelized cost of energy (LCOE) for renewables continues to fall, making fossil fuels an increasingly uncompetitive option in a market moving towards cleaner alternatives.

Ignoring these shifts isn’t just about risking regulatory fines or losing investor confidence. It’s about falling behind in an evolving industry that will soon favor those capable of balancing profitability with sustainability.

Regulatory Landscape in 2024 and Its Impact

The regulatory landscape in 2024 is more stringent than ever, forcing oil and gas companies to rethink their corporate strategies.

Governments around the world are tightening environmental regulations to accelerate the shift toward a low-carbon economy. These new rules not only focus on reducing carbon emissions but also demand greater transparency and accountability in energy management practices.

For companies in the oil and gas sector, non-compliance can result in hefty fines, operational disruptions, and reputational damage.

If you need help managing the latest regulations from ISO50001 to GRI, book a demo with CarbonMinus at www.carbonminus.com. We help you stay compliant and generate automated reports with proper documentation to become a sustainability leader.

Balancing Profit and Sustainability—A Tightrope Walk

How can oil and gas companies continue to profit while reducing their environmental footprint? The answer lies in strategically transitioning to cleaner technologies while leveraging existing operations to fund this shift.

For oil and gas giants, this means transforming their energy portfolios, not by abandoning fossil fuels overnight, but by integrating renewables into their long-term business models.

The Dual Approach: Fossil Fuels and Renewables

Companies like Shell and BP are leading this transformation by aggressively expanding into renewable energy sectors while responsibly managing their current oil and gas operations.

This shift requires deploying energy management software that tracks emissions reductions, energy consumption, and profitability across both traditional and renewable assets.

A Sustainable Model for the Long-Term?

However, this raises the question: Is this balanced approach sustainable in the long term?

While the strategy seems effective in the short run, it requires continuous investment in energy management solutions to stay ahead of regulatory demands and market dynamics. As more companies adopt renewables, competition will increase, potentially driving down margins in the renewable energy market, much like what happened in oil.

For now, oil and gas companies that integrate renewables early and adopt advanced energy management systems are positioning themselves for success. Those that hesitate risk becoming obsolete in a rapidly decarbonizing world.

The Role of Technology in Navigating the Transition

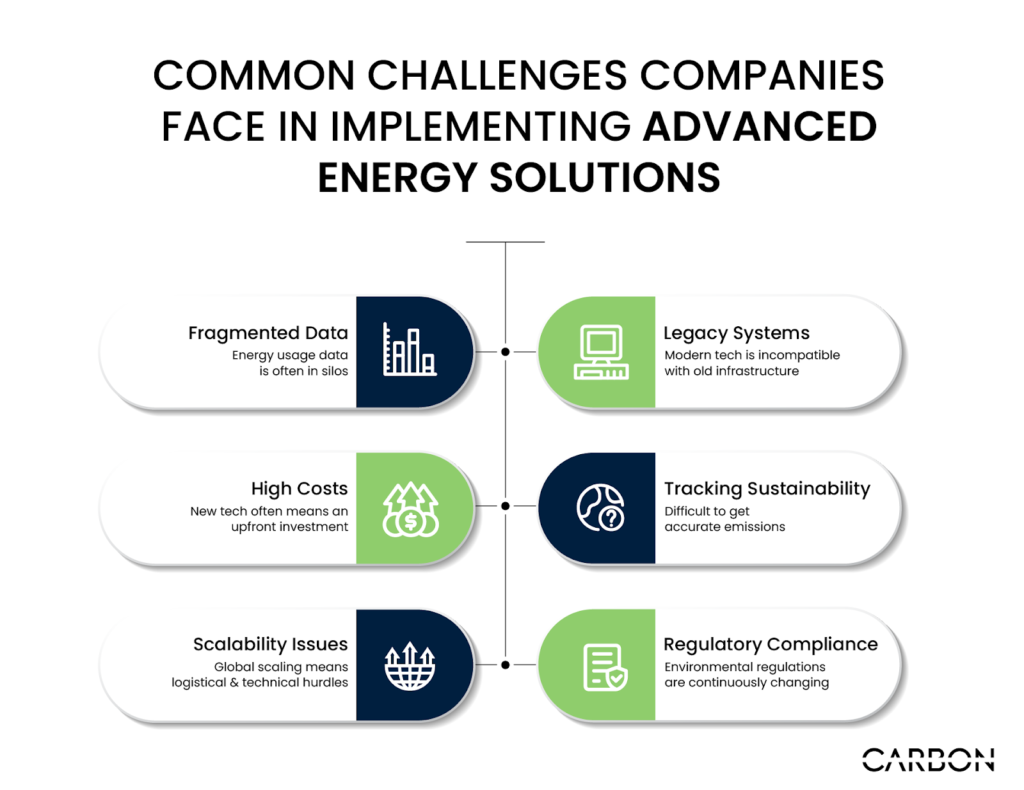

Navigating the energy transition comes with a range of challenges for oil and gas companies—particularly in integrating new technologies, tracking sustainability metrics, and managing complex operations.

For many, the real struggle lies in implementing advanced solutions that optimize both fossil fuel and renewable energy resources.

Key Challenges Companies Face:

- Fragmented Data: Energy usage data often resides in silos, making it difficult to gain a unified view of operations.

- Legacy Systems: Outdated infrastructure is incompatible with modern energy management software, hindering real-time tracking.

- High Costs: Deploying new technologies across multiple assets requires significant upfront investment.

- Tracking Sustainability: Accurately measuring carbon emissions and energy efficiency across operations remains a challenge for many companies.

- Scalability Issues: Implementing technologies at scale, especially across global operations, poses logistical and technical hurdles.

- Regulatory Compliance: Adapting to continuously changing environmental regulations demands agile, responsive systems.

The AI-Powered Solution

Advanced technologies like AI-powered energy management systems provide real-time monitoring, predictive insights, and optimization tools to streamline energy usage across both fossil fuel and renewable assets.

By harnessing AI, companies can efficiently track sustainability performance and ensure compliance with evolving regulations, all while minimizing operational costs.

CarbonMinus brings this cutting-edge technology to the forefront with its energy management software, offering:

- Real-time monitoring of energy usage.

- Predictive maintenance to identify and prevent inefficiencies.

- Integrated reporting to ensure compliance with sustainability standards.

Securing Profitability and Sustainability—The Time to Act Is Now

Book a consultation today and let us guide you through the complexities of the energy transition. Reach out to us at www.carbonminus.com.

As the energy landscape shifts, oil and gas companies face critical decisions that will shape their future. Balancing profitability with sustainability requires strategic investments and innovative solutions that we can provide.

Frequently Asked Questions

. What is the energy transition, and why is it important?

The energy transition refers to the global shift from fossil fuels to cleaner, renewable energy sources like wind, solar, and hydrogen. It’s critical for reducing carbon emissions, combating climate change, and ensuring long-term energy sustainability while aligning with global environmental targets.

2. How are oil and gas companies investing in renewables?

Oil and gas companies are diversifying by investing in renewables such as solar farms, offshore wind projects, and hydrogen production. Major players like Shell and BP are dedicating significant resources to renewable technologies while incorporating carbon capture and storage (CCS) to balance traditional and clean energy operations.

3. What challenges do oil and gas companies face in balancing profitability with sustainability?

The biggest challenge is the high cost of transitioning to clean energy while maintaining profitability. Striking a balance between meeting short-term financial goals and long-term sustainability targets is difficult, especially with ongoing reliance on fossil fuel profits. Regulatory pressure and investor expectations add complexity to this balancing act.

4. How can companies maintain profitability while reducing their environmental footprint?

Companies can leverage clean energy investments, such as hydrogen, wind, and solar, while capitalizing on tax incentives and government subsidies like those in the Inflation Reduction Act (IRA). Additionally, operational efficiencies and technologies like CCS help lower emissions without sacrificing financial returns.

5. What role does technology play in the energy transition?

Technology is a key driver of the energy transition. Advanced technologies like IoT sensors, AI-powered analytics, and carbon capture and storage (CCS) enable real-time monitoring, predictive maintenance, and emissions reduction, helping companies optimize operations while reducing their carbon footprint.

6. What is the regulatory landscape for oil and gas companies in 2024?

In 2024, oil and gas companies face stricter regulations aimed at cutting carbon emissions, driven by international climate agreements like the Paris Agreement. Laws such as the Inflation Reduction Act (IRA) offer tax incentives for clean energy investments, while imposing penalties for non-compliance with emissions reduction goals.