TLDR: What You Need to Know

- California’s SB 253 requires companies with $1B+ revenue doing business in California to report Scope 1 & 2 emissions by June 30, 2026.

- Non-compliance carries up to $500,000 annual penalties.

- Here’s the hidden advantage: your existing energy monitoring infrastructure already captures 80% of required compliance data.

- Smart manufacturers are transforming this regulatory requirement into competitive differentiation.

Key Facts

- Deadline: June 30, 2026 (229 days from today)

- Who’s Affected: 5,400+ US companies with California operations

- Penalty Risk: $500,000 per year for non-compliance

- Hidden Opportunity: Energy management = automated emissions reporting

- Implementation Timeline: 90 days using existing infrastructure

In the humid forests of Florida, something extraordinary happens when a carpenter ant gets injured.

When an ant’s leg is wounded, nestmates don’t panic. They don’t call for help. They assess the injury location with precision that would make a trauma surgeon envious.

If the wound is at the thigh? They perform a complete amputation, spending 40 minutes carefully removing the entire limb at the base. If it’s lower on the leg? They meticulously clean the wound instead. The success rate? A stunning 90% of amputated ants survive and return to full duty.

Scientists call this the most sophisticated medical system in the animal kingdom outside of humans.

Here’s what makes this remarkable: carpenter ants don’t have the antimicrobial glands that other ant species use to fight infection. So they adapted. They developed an entirely different solution using tools they already had.

That’s exactly what smart manufacturers are doing with SB 253 compliance.

You don’t need an entirely new infrastructure. You don’t need to build something from scratch. You need to adapt what you already have, your energy monitoring systems, into a compliance advantage.

The ants that survived weren’t the ones with the most resources. They were the ones that assessed the situation accurately and acted decisively with existing capabilities.

Your June 30, 2026 deadline is approaching. Let’s talk about how to adapt.

The SB 253 Reality Check: You’re Probably Already on the List

Who California Actually Expects to Report

If your manufacturing company generates over $1 billion in annual revenue and does business in California, you’re subject to SB 253 regardless of where your headquarters sits.

“Doing business in California” is broader than most operations directors realize. It doesn’t mean you need a facility in Sacramento or a warehouse in Los Angeles.

In September 2025, CARB released a preliminary list of 4,160+ companies subject to SB 253 and the majority were surprised to find themselves included.

What You Must Report (And When)

Scope 1 Emissions (Direct energy consumption from your facilities):

- Natural gas combustion in boilers and furnaces

- Diesel generators and backup power systems

- Process heating equipment

- Company vehicle fleet operations

- On-site fuel storage and usage

Scope 2 Emissions (Purchased electricity):

- Grid electricity consumption across all facilities

- Purchased steam or heating

- Cooling systems powered by external sources

The Timeline:

- June 30, 2026: First Scope 1 & 2 report due (covering 2025 calendar year data)

- 2027: Scope 3 requirements begin (supply chain emissions)

- 2026 Only: Limited enforcement with “good faith effort” protection

CARB will not enforce against entities that demonstrate good faith efforts to comply during the first reporting cycle.

—CARB Enforcement Notice, December 2024

But here’s the catch: “good faith effort” is a one-time grace period. By 2027, full compliance becomes mandatory with penalties in force.

The Penalty Reality

Non-compliance carries up to $500,000 in annual penalties—but that’s just the beginning.

The real cost includes:

- Legal and audit expenses defending non-compliance

- Loss of supply chain partnerships (OEMs increasingly require SB 253 compliance)

- Competitive disadvantage in sustainability-conscious procurement processes

- Potential securities violations if your company is publicly traded

One operations director at a mid-size automotive parts manufacturer told us: “We thought California compliance was someone else’s problem. Then our largest customer—based in Michigan—told us they won’t renew contracts with suppliers who can’t demonstrate SB 253 readiness. That conversation happened in September 2025. We have nine months.”

The Energy Data Goldmine You Already Own

Here’s the uncommon sense that’s transforming SB 253 from burden to advantage:

Your existing energy monitoring infrastructure already captures 80% of required compliance data.

Most manufacturers treat energy management and emissions reporting as separate challenges. That’s expensive and inefficient.

The Hidden Connection

Every kilowatt-hour your facility consumes has a direct emissions equivalent. Every cubic foot of natural gas burned translates precisely to Scope 1 emissions. The GHG Protocol that SB 253 requires? It’s simply applying standardized emission factors to energy consumption data you already track.

Scope 1 Reporting = Energy Data × Emission Factors

Your natural gas meters? They’re emissions sensors.

Your electricity sub-meters? Scope 2 compliance tools.

Your SCADA system? An emissions monitoring platform waiting to be activated.

Why Most Manufacturers Are Overcomplicating Compliance

We’ve watched operations directors make the same expensive mistake: hiring carbon accounting consultants to manually collect data that their energy management systems already capture automatically.

The Consultant Trap:

- $150K-$300K in annual consulting fees

- Manual data collection processes prone to errors

- Dependency on external experts for ongoing reporting

- No operational benefits beyond compliance checkbox

The Integration Opportunity:

- Leverage existing energy monitoring infrastructure

- Automate continuous compliance data collection

- Real-time visibility drives both efficiency and reporting

- Single investment delivers operational optimization + regulatory compliance

The Manufacturing Advantage

Manufacturers have an inherent edge over other industries for SB 253 compliance:

1. Existing Infrastructure: You already monitor energy consumption for cost control

2. Operational Discipline: Manufacturing precision applies perfectly to emissions tracking

3. Technical Capability: Your maintenance and operations teams understand metering, sensors, and data systems

4. Cost Control Culture: Energy efficiency equals emissions reduction equals compliance all driving bottom-line improvement

The operations directors who recognize this connection first are positioning their companies for strategic advantage while competitors burn budget on consultants.

Beyond Compliance: The Competitive Advantage Play

Let’s be direct: avoiding a $500,000 penalty is table stakes. Smart manufacturers are using SB 253 compliance to differentiate in ways their competitors haven’t considered.

Supply Chain Preference

Major OEMs are already requiring SB 253 readiness from suppliers—even those not directly subject to the law.

Why? Because sophisticated procurement teams understand that supply chain transparency is coming fast. They’re preemptively requiring compliance to:

- Prepare for their own Scope 3 reporting requirements (starting 2027)

- Reduce supply chain risk from non-compliant partners

- Meet corporate sustainability commitments with verifiable data

One automotive Tier 1 supplier reported: “Three of our top five customers added SB 253 compliance language to 2026 contract renewals. We’re based in Ohio, but California compliance became a competitive requirement nationwide.”

Investment Appeal

ESG-conscious investors are increasingly screening manufacturing operations for climate transparency.

Companies with robust real-time emissions monitoring demonstrate:

- Operational sophistication

- Risk management capabilities

- Forward-looking strategic planning

- Data-driven decision making

This matters for capital access, valuation multiples, and strategic partnerships.

Export Readiness

Here’s a strategic insight most US manufacturers miss: SB 253 compliance infrastructure prepares you for EU CBAM requirements.

The Carbon Border Adjustment Mechanism requires manufacturers to report embedded emissions for all products exported to Europe. Those with real-time energy and emissions monitoring are already ahead of CBAM compliance deadlines, opening access to European markets while competitors struggle to close data gaps.

“We implemented SB 253 compliance infrastructure in Q1 2026. By Q3, we realized the same platform qualified us for CBAM reporting. That opened a $12M export opportunity we couldn’t have accessed otherwise.” —Director of Operations, Chemical Manufacturing

The First-Mover Advantage

In June 2026, thousands of companies will file their first SB 253 reports. Some will barely meet the “good faith effort” threshold. Others will demonstrate sophisticated, real-time compliance capabilities.

Who do you think sophisticated customers will prefer?

Early compliance signals:

- Operational excellence

- Proactive risk management

- Technology leadership

- Strategic thinking beyond minimum requirements

These aren’t sustainability talking points. They’re operational competencies that manufacturing customers actively seek in their supply chains.

The CarbonMinus Solution: Turning Energy Management into Compliance Infrastructure

This is where most compliance guidance ends with problems identified but solutions vague.

Let’s get specific about implementation.

The Integration Advantage

CarbonMinus connects directly to the energy monitoring infrastructure you already own:

Hardware Agnostic Platform:

- SCADA systems

- Energy meters and sub-meters

- Building management systems

- Utility data feeds

- Process control systems

- IoT sensors and smart devices

We don’t require you to replace existing equipment. We integrate with what you’ve already invested in.

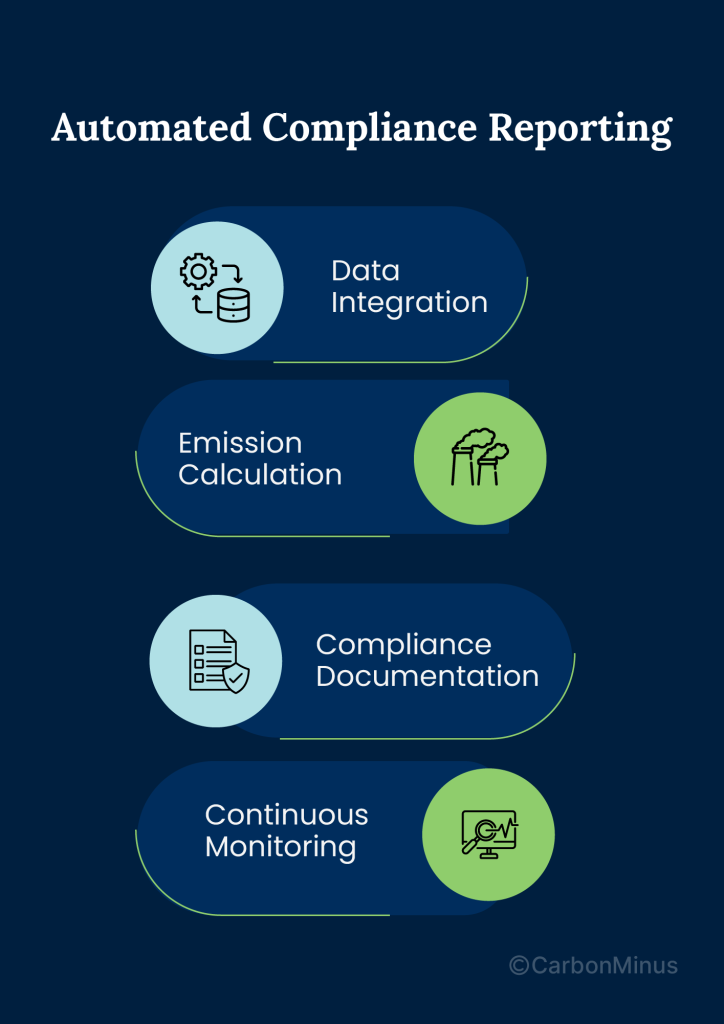

Automated Compliance Reporting

Here’s how it works:

1. Data Integration: We connect to your existing energy monitoring systems through secure APIs

2. Emission Calculation: Our platform automatically applies GHG Protocol emission factors to your real-time energy consumption data

3. Compliance Documentation: We generate CARB-compliant reports in the required format, ready for third-party assurance

4. Continuous Monitoring: Real-time dashboards show compliance status, emission trends, and optimization opportunities

No manual data collection. No spreadsheets. No monthly scramble to compile reports.

Beyond Compliance: The Operational Advantage

Here’s where it gets interesting: the same infrastructure delivering SB 253 compliance drives operational optimization.

Real-time energy monitoring enables:

- 15-25% energy cost reduction through waste identification

- Predictive maintenance preventing costly equipment failures

- Power quality monitoring protecting high-value assets

- Demand management reducing peak charges

- Process optimization improving production efficiency

The ROI from operational improvements typically pays for the compliance infrastructure in 12-18 months—then generates pure profit while maintaining automatic regulatory compliance.

Technical Specifications

For the engineering-minded operations directors:

- Data Security: SOC 2 Type II certified platform

- Integration Protocols: Modbus, BACnet, OPC UA, MQTT, REST APIs

- Update Frequency: Real-time to 15-minute intervals (configurable)

- Data Retention: Unlimited historical data for trend analysis

- Assurance Ready: Audit trail and verification documentation built-in

- Scalability: Single facility to multi-site enterprise deployments

Implementation Timeline

Days 1-30: Assessment & Integration Planning

- Energy infrastructure audit

- California revenue analysis confirming SB 253 applicability

- Gap identification for missing data sources

- Integration architecture design

Days 31-60: System Deployment

- Integration with existing energy monitoring systems

- Data validation and accuracy verification

- User training for operations and maintenance teams

- Dashboard configuration for key stakeholders

Days 61-90: Compliance & Optimization

- Trial Scope 1 & 2 calculation runs

- Third-party assurance preparation

- Operational optimization opportunity identification

- Full production deployment

90 days from start to compliant operations—using infrastructure you already own.

Your 90-Day SB 253 Readiness Plan

Let’s make this actionable. Here’s exactly what operations directors should do right now.

Week 1-2: Assessment Phase

Action Items:

- Confirm SB 253 Applicability

- Calculate total California-related revenue

- Review “doing business in California” criteria

- Consult with legal/tax team on revenue threshold

- Audit Existing Energy Infrastructure

- Inventory all energy meters and monitoring systems

- Document SCADA/BMS/EMS platforms currently deployed

- Identify gaps in facility-level energy visibility

- Stakeholder Alignment

- Brief executive leadership on compliance requirements and timeline

- Coordinate with sustainability, legal, and finance teams

- Establish compliance project ownership and budget authority

Deliverable: Assessment report identifying compliance requirements, infrastructure readiness, and resource needs.

Week 3-6: Integration Planning

Action Items:

- Technology Selection

- Evaluate compliance platform options (hardware agnostic, automated reporting, operational benefits)

- Conduct vendor demonstrations and reference checks

- Review integration requirements with IT/OT teams

- Data Architecture Design

- Map energy data sources to emission reporting requirements

- Design data flow from existing systems to compliance platform

- Establish data quality and validation protocols

- Budget Approval

- Quantify total investment required

- Build ROI model including operational efficiency benefits

- Secure executive approval and project funding

Deliverable: Integration plan with technical specifications, timeline, and approved budget.

Week 7-10: System Deployment

Action Items:

- Platform Integration

- Deploy compliance software and configure integrations

- Connect existing energy monitoring systems via APIs

- Validate data accuracy against utility bills and manual readings

- Team Training

- Train operations team on platform use and maintenance

- Train energy/sustainability team on compliance reporting

- Train management team on dashboard interpretation

- Process Documentation

- Document data collection and validation procedures

- Establish ongoing maintenance and monitoring protocols

- Create escalation procedures for data quality issues

Deliverable: Fully integrated system with validated data flows and trained team.

Week 11-13: Compliance Validation

Action Items:

- Trial Reporting

- Generate Scope 1 & 2 calculations for recent historical period

- Compare results against expected values and industry benchmarks

- Identify and resolve any data discrepancies

- Assurance Preparation

- Select third-party verification provider

- Compile documentation demonstrating data quality and methodology

- Conduct pre-assurance review to identify gaps

- Operational Optimization

- Analyze energy data for efficiency improvement opportunities

- Prioritize optimization projects by ROI potential

- Initiate high-impact efficiency improvements

Deliverable: Compliance-ready system with documented baseline emissions and optimization roadmap.

Ongoing: Continuous Improvement

Quarterly Actions:

- Review compliance data quality and completeness

- Update emission factors as GHG Protocol guidance evolves

- Report energy and emissions trends to leadership

- Implement operational optimization projects

- Monitor regulatory developments and adjust processes

Transform Burden into Competitive Weapon

You’re standing at a choice point.

Path 1: Reactive Compliance

- Wait until Q1 2026, scramble to hire consultants

- Pay $150K-$300K annually for manual data collection

- Submit bare-minimum “good faith effort” report

- Gain zero operational benefit

- Risk penalties in future reporting cycles

- Watch competitors position SB 253 readiness as procurement advantage

Path 2: Proactive Leadership

- Invest 90 days integrating existing energy infrastructure

- Automate continuous compliance with real-time monitoring

- Generate 12-18 month ROI through operational efficiency

- Position early compliance as competitive differentiation

- Prepare for expanding regulations (Scope 3, CBAM, etc.)

- Lead your industry in data-driven sustainability

The investment is comparable. The timeline is similar. The outcomes are dramatically different.

The Competitive Future

By 2027, SB 253 compliance will be table stakes, the minimum requirement to participate in sophisticated supply chains.

The companies investing now in intelligent energy management infrastructure aren’t just checking compliance boxes. They’re building operational advantages that compound over time:

- Lower energy costs (15-25% reduction typical)

- Better asset management (predictive maintenance)

- Supply chain preference (OEM compliance requirements)

- Investment appeal (ESG performance metrics)

- Export readiness (CBAM and international sustainability standards)

The Real ROI

One automotive parts manufacturer implemented integrated energy monitoring and compliance infrastructure in Q4 2025. By Q3 2026:

- $847K annual energy cost savings (18% reduction)

- $120K avoided in consultant fees (automated vs. manual reporting)

- $2.3M in retained contracts (OEM compliance requirements)

- Zero compliance penalties (automated, accurate reporting)

- 21% reduction in equipment downtime (predictive maintenance from monitoring)

Total investment: $385K

First-year return: $3.39M

ROI: 9.8x in year one

That’s not sustainability optics. That’s operational excellence with regulatory compliance as a byproduct.

Adapt Like the Ants

Remember those carpenter ants?

They didn’t have antimicrobial glands like other ant species. They could have let that disadvantage define them. Instead, they developed a completely different solution using capabilities they already possessed.

The result? A 90% survival rate and full operational capability after treatment.

You already have energy monitoring infrastructure. You already track consumption for cost control. You already have operations teams capable of managing data and systems.

SB 253 doesn’t require you to build something entirely new. It requires you to adapt what you have into something more powerful: compliance infrastructure that simultaneously drives operational excellence.

The deadline is approaching. The advantage goes to those who assess accurately and act decisively.

229 days until June 30, 2026.

The June 30, 2026 deadline is fixed. The competitive advantage window is closing.

What will you build with the capabilities you already have?

Schedule Your Compliance Assessment →

About CarbonMinus

CarbonMinus transforms manufacturing energy management into competitive advantage. Our hardware-agnostic platform integrates with existing infrastructure to deliver real-time operational insights and automated regulatory compliance. We help energy-intensive industries reduce costs, optimize assets, and navigate evolving sustainability requirements, turning operational efficiency into measurable business value.

Learn more at carbonminus.com.

FAQs

What exactly is California’s SB 253, and who does it apply to?

SB 253 (Climate Corporate Data Accountability Act) requires companies with total annual revenues exceeding $1 billion that “do business in California” to publicly disclose their greenhouse gas emissions. This applies regardless of where the company is headquartered—if you generate over $735,000 in California-related sales, you’re likely subject to the law.

Manufacturing companies across the United States are impacted, including those with California suppliers, customers, or distribution channels. CARB identified over 4,160 companies in its preliminary September 2025 list, with the majority surprised by their inclusion.

When is the first SB 253 report due, and what does it cover?

The first report is due June 30, 2026, covering Scope 1 and Scope 2 emissions from the 2025 calendar year. Scope 3 emissions reporting begins in 2027, covering 2026 data.

Key Timeline:

- 2026: Scope 1 & 2 emissions with limited third-party assurance

- 2027: Scope 3 emissions reporting begins

- 2030: Reasonable assurance required for Scope 1 & 2; limited assurance for Scope 3

What happens if we don’t comply with SB 253?

Non-compliance can result in penalties up to $500,000 per year, plus potential legal expenses, audit costs, and reputational damage. Beyond financial penalties, non-compliant companies risk:

- Loss of supply chain partnerships (OEMs increasingly require SB 253 compliance)

- Competitive disadvantage in sustainability-conscious procurement

- Potential securities violations for publicly traded companies

- Exclusion from California business opportunities

However, CARB has indicated it will not enforce penalties against companies demonstrating “good faith efforts” to comply during the first reporting cycle in 2026. This grace period is temporary and doesn’t extend to future reporting years.

What are Scope 1 and Scope 2 emissions, and how do they apply to manufacturing?

Scope 1 Emissions are direct emissions from sources your company owns or controls:

- Natural gas combustion in boilers, furnaces, and process heating

- Diesel generators and backup power systems

- Company-owned vehicle fleets

- On-site fuel storage and usage

- Process emissions from manufacturing operations

Scope 2 Emissions are indirect emissions from purchased energy:

- Grid electricity consumption across all facilities

- Purchased steam, heat, or cooling

- Electricity used by production equipment and facility operations

For manufacturers, these emissions directly correlate to energy consumption data already tracked through energy management systems, utility bills, and SCADA platforms.

Do we need to report Scope 3 emissions in 2026?

No. Scope 3 emissions reporting doesn’t begin until 2027, covering 2026 calendar year data. However, starting your Scope 3 assessment now is strategic because:

- Scope 3 represents 70-90% of most manufacturers’ total emissions footprint

- Supply chain data collection takes significantly longer than Scope 1 & 2

- Early preparation avoids last-minute scrambling in 2026

- Scope 3 compliance infrastructure supports CBAM requirements for EU exports

What exactly counts as “doing business in California” for SB 253 purposes?

CARB’s initial guidance proposes using the California Franchise Tax Board definition, based on Revenue and Taxation Code Sections 23101(a) and 23101(b). This includes:

- Physical presence (facilities, warehouses, offices, sales teams)

- California customers or suppliers

- Products sold or distributed in California

- Services provided to California entities

- Property ownership or rental in California

The threshold is broader than most manufacturers realize. If your annual California-related revenue exceeds approximately $735,000, you likely meet the “doing business” criteria.

Can we use our existing energy monitoring systems for SB 253 compliance?

Absolutely and that’s the strategic advantage most manufacturers miss. Your existing energy monitoring infrastructure already captures 80% of required SB 253 data.

The GHG Protocol that SB 253 requires is essentially applying standardized emission factors to energy consumption data you already track. Every kilowatt-hour and cubic foot of natural gas has a direct emissions equivalent.

Existing systems that support SB 253 compliance:

- SCADA and building management systems

- Energy meters and sub-meters

- Utility data management platforms

- Process control systems

- IoT sensors and smart monitoring devices

The key is integrating these data sources into a compliance platform that automates emission calculations and generates CARB-compliant reports.

What is “limited assurance” vs. “reasonable assurance,” and when do we need each?

Limited Assurance (required for Scope 1 & 2 in 2026):

- Plausibility check verifying nothing suggests data is materially incorrect

- Less intensive review of methodologies and controls

- Lower cost and faster process

- Similar to a financial review (not full audit)

Reasonable Assurance (required for Scope 1 & 2 starting 2030):

- Comprehensive verification including control testing and data validation

- Deeper scrutiny of calculation methodologies

- Higher confidence level (comparable to financial audit)

- More time-intensive and expensive

Scope 3 emissions require limited assurance starting in 2030. Third-party assurance providers must be independent, technically competent in GHG accounting, and follow recognized professional standards (ISAE 3000, CSAE 3410, AA1000AS, or ISO 14064-3).

What is the “good faith effort” protection, and how long does it last?

CARB announced in December 2024 that it will not enforce penalties against companies demonstrating “good faith efforts” to comply during the first reporting cycle in 2026.

“Good faith effort” likely includes:

- Documented assessment of SB 253 applicability

- Active data collection and system implementation processes

- Engagement with third-party assurance providers

- Transparent disclosure of data gaps or methodological challenges

Important limitations:

- This is a one-time grace period for 2026 only

- By 2027, full compliance becomes mandatory with penalties in force

- “Good faith” is not clearly defined—CARB will assess case-by-case

- Don’t rely on this as a long-term strategy

Smart manufacturers are treating 2026 as a learning year while building robust compliance infrastructure for ongoing requirements.

If we’re based outside California, why should we care about SB 253?

Three compelling reasons:

1. Supply Chain Requirements: Major OEMs are requiring SB 253 compliance from suppliers—regardless of supplier location—to prepare for their own Scope 3 reporting obligations starting in 2027. Non-compliant suppliers risk losing contracts.

2. Competitive Advantage: Early compliance signals operational sophistication, risk management capabilities, and technology leadership that sophisticated customers actively seek.

3. Global Regulatory Alignment: SB 253 compliance infrastructure prepares you for EU CBAM, SEC climate disclosure rules, and other emerging regulations worldwide. Investment in compliance systems serves multiple regulatory requirements.

How does SB 253 relate to other climate disclosure requirements like CSRD or SEC rules?

SB 253 uses the GHG Protocol framework, which aligns with most international climate disclosure standards. Companies already reporting under other frameworks (EU CSRD, ISSB, etc.) can leverage that existing work for SB 253 compliance, though California may require additional metadata or format elements.

Strategic synergies:

- EU CBAM: SB 253 Scope 1 and 2 data directly supports CBAM embedded emissions reporting for exports. Expanding this framework to include SB 253 Scope 3 ensures full value chain transparency, helping manufacturers capture upstream and downstream emissions for complete compliance readiness.

- ISO 50001: Energy management certification aligns with SB 253 monitoring requirements

- SEC Climate Rules: Although currently stayed, SEC proposals used similar GHG Protocol frameworks

A well-designed compliance platform serves multiple regulatory requirements simultaneously, reducing overall compliance burden.

Can SB 253 compliance actually improve our operations beyond just avoiding penalties?

Absolutely. Real-time energy monitoring infrastructure that enables SB 253 compliance simultaneously drives operational optimization:

Measurable operational benefits:

- 15-25% energy cost reduction through waste identification and optimization

- Predictive maintenance preventing costly equipment failures (35-45% reduction in unplanned downtime)

- Power quality monitoring protecting high-value manufacturing assets

- Demand management reducing peak electricity charges

- Process optimization improving production efficiency

Manufacturing companies implementing integrated compliance and operational systems typically achieve 12-18 month ROI through energy savings alone—then continue generating operational benefits while maintaining automatic regulatory compliance.

The question isn’t whether you can afford SB 253 compliance. It’s whether you can afford to miss the operational advantages that compliance infrastructure enables.