The machines never stop. Deep inside chemical plants, massive reactors churn out plastics, solvents, and industrial compounds — the building blocks of everything from pharmaceuticals to packaging.

Steam hisses through pipelines, and the scent of hydrocarbons lingers in the air. This is the beating heart of modern industry.

But outside these walls, the world is changing.

Landfills overflow with discarded plastic. Rivers run thick with industrial runoff.

The very materials that fuel modern life are also clogging ecosystems, driving carbon emissions, and pushing global waste levels beyond control.

And the pressure is mounting.

The Urgent Shift: Why Circularity Can’t Wait

Inside boardrooms, executives study new government mandates, investor demands, and consumer expectations. and the message is clear: waste-heavy operations will no longer be tolerated.

Investors are shifting their money

- BlackRock’s $600M fund for sustainable chemical production is just the start—green finance is demanding low-carbon solutions.

- Consumer brands are rejecting fossil-based chemicals, demanding suppliers use recycled content and sustainable feedstocks.

The industry is running out of time

- By 2050, 50% of all chemicals must come from recycled sources to meet net-zero goals (McKinsey Report).

But here’s the problem—most “circular economy” efforts barely scratch the surface.

The Hidden Innovation Gap: Why Recycling Alone Won’t Work

Recycling bins fill up with plastic, but only 9% of global plastic waste is ever truly recycled.

The rest? Downcycled, incinerated, or dumped.

1. Mechanical recycling degrades plastic quality over time, every cycle weakens molecular structures, making the material harder to reuse.

2. Chemical supply chains aren’t designed for circularity. The infrastructure to recapture, break down, and regenerate molecules at scale simply doesn’t exist yet.

Companies tout “recyclable” labels on products, but without real molecular-level regeneration, they’re just moving waste around. The real breakthrough is in rebuilding them from the atomic level up.

This is where molecular recycling, CO₂-to-chemicals conversion, and AI-driven waste optimization come in. This is where the industry stops treating waste as a problem and starts treating it as a resource.

What This Blog Delivers

1. How the chemical industry is shifting from linear, waste-heavy production to regenerative, circular systems.

2. The most promising innovations are actually making a difference today.

3. The hidden failures slowing progress—and what needs to change.

4. How AI and next-gen chemistry will redefine sustainability in chemicals.

Waste is the opportunity. The chemical industry’s next revolution is about turning waste into wealth.

What’s Driving the Circular Economy Shift in Chemicals?

Inside a high-tech chemical lab, a researcher holds a small vial of liquid, not crude oil, not a petrochemical, but a fully recyclable polymer created from captured CO₂ emissions.

Across the world, a startup is turning waste plastic back into virgin-quality feedstock, making the dream of true circularity a reality.

Yet, for every breakthrough like this, there are mountains of chemical waste still being burned, buried, or dumped. And the chemical industry? It’s standing at a make-or-break moment.

Regulators, investors, and consumers are demanding change as you read this. And companies that fail to adapt are already seeing the financial consequences.

Here’s what’s pushing the industry toward circularity, whether it’s ready or not.

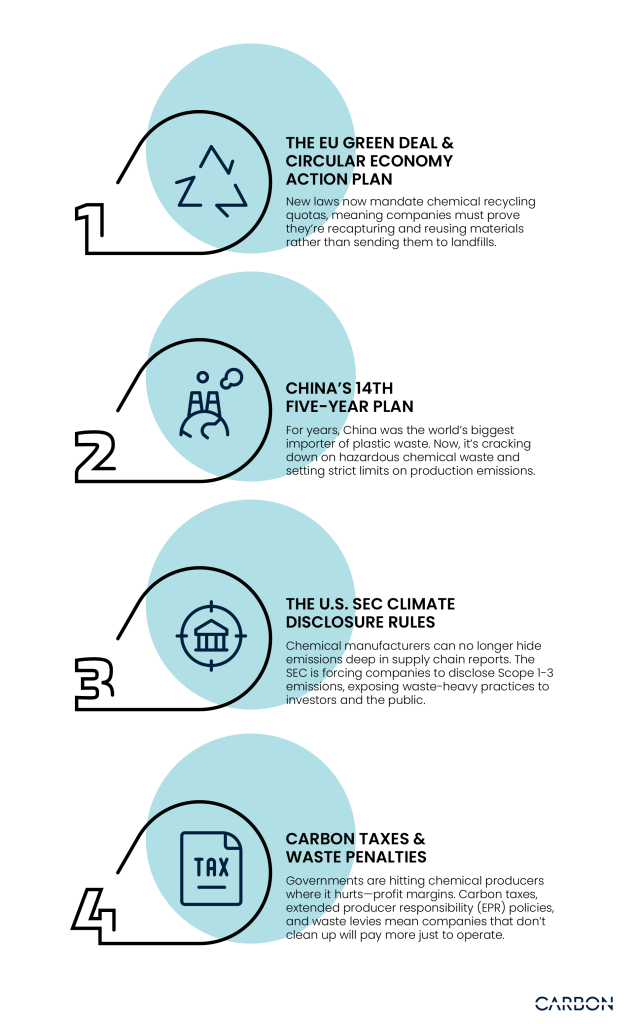

Regulatory Pressure & ESG Mandates

The days of unchecked waste are over. Governments around the world are forcing the chemical industry to rethink its waste-heavy production methods. And the penalties are getting steeper.

The only way for chemical companies to stay ahead is to embrace circularity before penalties eat into their bottom line.

Economic & Resource Constraints

Beyond regulations, the industry faces another reality. Fossil-based feedstocks are no longer cheap, and customers no longer want them.

Oil Price Volatility is a Ticking Time Bomb

For decades, chemical manufacturers relied on cheap oil and gas to produce plastics, solvents, and coatings. But with geopolitical instability and energy crises, those costs fluctuate wildly, forcing companies to look for cheaper, sustainable alternatives.

Demand for Low-Carbon, Recycled Chemicals is Surging

Global brands like Unilever, Adidas, and Tesla are making recycled-content materials a core part of their supply chains. Suppliers that can’t provide sustainable alternatives are getting cut.

For chemical manufacturers, circularity is now becoming a survival strategy.

Investor & Consumer Shifts

Money talks. And right now, investors are putting their money into companies that prove they’re serious about circularity.

The Rise of ‘Green Finance’

Venture capital firms and institutional investors are pouring billions into circular economy startups, seeing waste-to-resource chemistry as the next trillion-dollar industry.

Consumers Are Driving the Shift

From biodegradable packaging to low-carbon textiles, customers are ditching fossil-based materials for greener options. The chemical companies that adapt are winning contracts with global brands.

Those that don’t are losing relevance.

Why This Matters

1. Governments are regulating waste out of existence.

2. Fossil-based raw materials are no longer reliable or cheap.

3. Investors and customers are choosing circular solutions over traditional chemicals.

For chemical manufacturers, this is an ultimatum.

The next question? Which circular solutions are actually working and which ones aren’t?

Up next: The rise of circular chemistry and molecular recycling.

The Rise of Circular Chemistry & Molecular Recycling

At a waste processing plant, a robotic arm swiftly picks up a discarded plastic bottle. Instead of being shredded and melted down into a lower-grade material—a process that can only be repeated a few times before the plastic becomes unusable—this bottle is about to undergo something different.

Through chemical recycling, its molecules will be broken down and rebuilt into virgin-quality material, ready to be used in anything from medical-grade plastics to high-performance coatings. This is a step beyond recycling, it’s regeneration.

For decades, recycling in the chemical industry was little more than a Band-Aid. But today, new approaches are emerging that go beyond simply reducing waste, they’re redefining how waste itself is used.

Let’s break down what’s working.

Chemical Recycling of Plastics & Industrial Waste

Why Mechanical Recycling Falls Short

For years, the go-to method for recycling plastics was mechanical processing—collecting, sorting, melting, and remolding. But there’s a problem:

This is why most plastic waste never actually gets recycled. In fact, less than 10% of global plastic waste is effectively reused.

How Chemical Recycling is Changing the Game

Instead of melting plastic into lower-grade material, chemical recycling breaks it down to its molecular building blocks, restoring it to virgin-quality material that can be used indefinitely.

Processes like pyrolysis and depolymerization are turning plastics into raw feedstocks that can go straight back into chemical production, making true circularity possible.

Real-World Example: BASF’s ChemCycling Project

In Germany, BASF is leading the charge with its ChemCycling® project, which takes mixed plastic waste, including materials that would otherwise end up in landfills, and converts it into high-quality feedstocks for new plastics.

These materials are then fed directly into BASF’s production lines, reducing reliance on fossil-based feedstocks.

What this means: Chemical recycling is solving one of the biggest flaws in traditional recycling by giving plastics an unlimited life cycle.

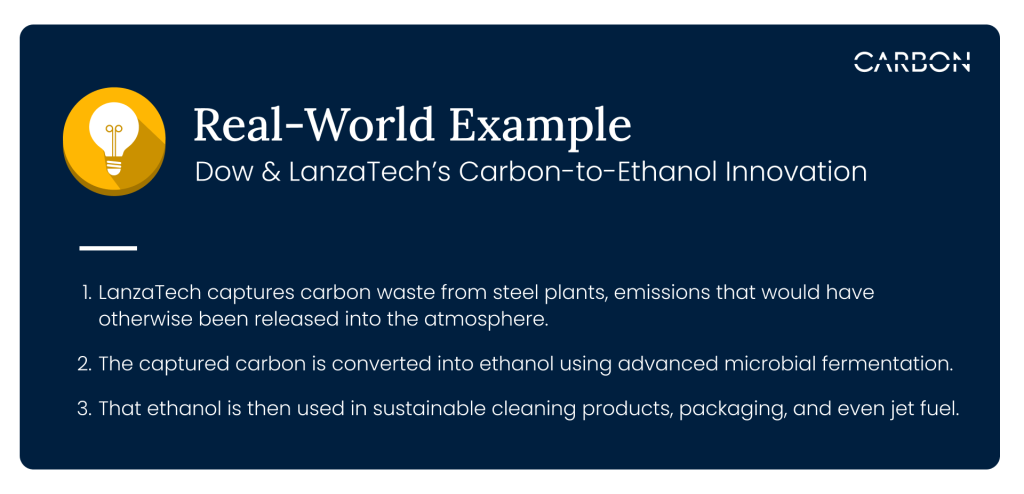

Industrial Symbiosis: Waste as a Feedstock

In a steel plant, carbon-rich emissions rise from the smokestacks, the unavoidable byproduct of high-temperature metal production.

But instead of dispersing into the atmosphere, these emissions are being captured and funneled into an entirely different industry, that of chemical manufacturing.

This is industrial symbiosis, turning one industry’s waste into another’s raw material.

How It Works

1. Carbon emissions, industrial byproducts, and chemical residues aren’t discarded—they’re repurposed.

2. AI-powered systems match waste streams with industries that can use them, reducing the need for virgin materials.

What this means: Instead of industries working in silos and generating waste, symbiotic production creates an interconnected system where waste is fuel for something else.

CO₂ Utilization: Turning Emissions into Chemicals

Not all emissions can be eliminated but they can be transformed.

The Problem: What Do We Do with Captured CO₂?

1. Carbon capture is growing, but storing CO₂ underground isn’t a long-term solution.

2. What if we could convert it into something valuable instead?

How AI is Driving CO₂ Conversion

1. AI-driven material science is accelerating the discovery of catalysts that can turn CO₂ into useful chemicals.

2. These catalysts are making it faster, cheaper, and more energy-efficient to convert carbon emissions into valuable products.

Real-World Example: Covestro’s CO₂-Based Polyurethane

1. Covestro has developed high-performance polyurethane made from captured CO₂.

2. Instead of using petroleum-based ingredients, they’re incorporating CO₂ into foam and coatings used in everything from mattresses to auto interiors.

What this means: Carbon doesn’t have to be a liability, it can be an asset.

AI in Waste Management: How to do Manage Waste Smarter?

Even with better recycling and waste repurposing, there’s still one problem. Waste sorting and tracking is still incredibly inefficient.

The Problem: How Do We Keep Waste from Slipping Through the Cracks?

1. Many recyclables never make it into proper processing streams because sorting technology is outdated and inaccurate.

2. Industrial waste streams are unpredictable, leading to excess disposal and inefficiencies.

How AI is Changing the Game

1. Predictive analytics allow companies to anticipate waste generation before it happens—so they can optimize usage in real time.

2. AI-powered waste sorting uses machine learning and robotics to identify, separate, and direct materials to the correct recycling stream, increasing efficiency.

Real-World Use Case

A European chemical plant can use AI-driven analytics to cut waste by 30%, not by recycling more, but by preventing waste in the first place.

What this means: AI is making waste avoidable rather than simply making recycling better.

The Big Picture: Waste is Becoming an Asset

1. Chemical recycling is giving plastics an unlimited lifespan.

2. Industrial symbiosis is turning waste into raw material across industries.

3. CO₂ utilization is transforming emissions into valuable chemicals.

4. AI is making waste reduction and sorting smarter than ever.

The future of chemical manufacturing will not be limited to minimizing waste. It will be about creating value from it.

But for all these breakthroughs, the industry still isn’t moving fast enough.

Next up: What’s failing and what’s stopping these solutions from scaling.

Why the Chemical Sector Is Still Falling Short

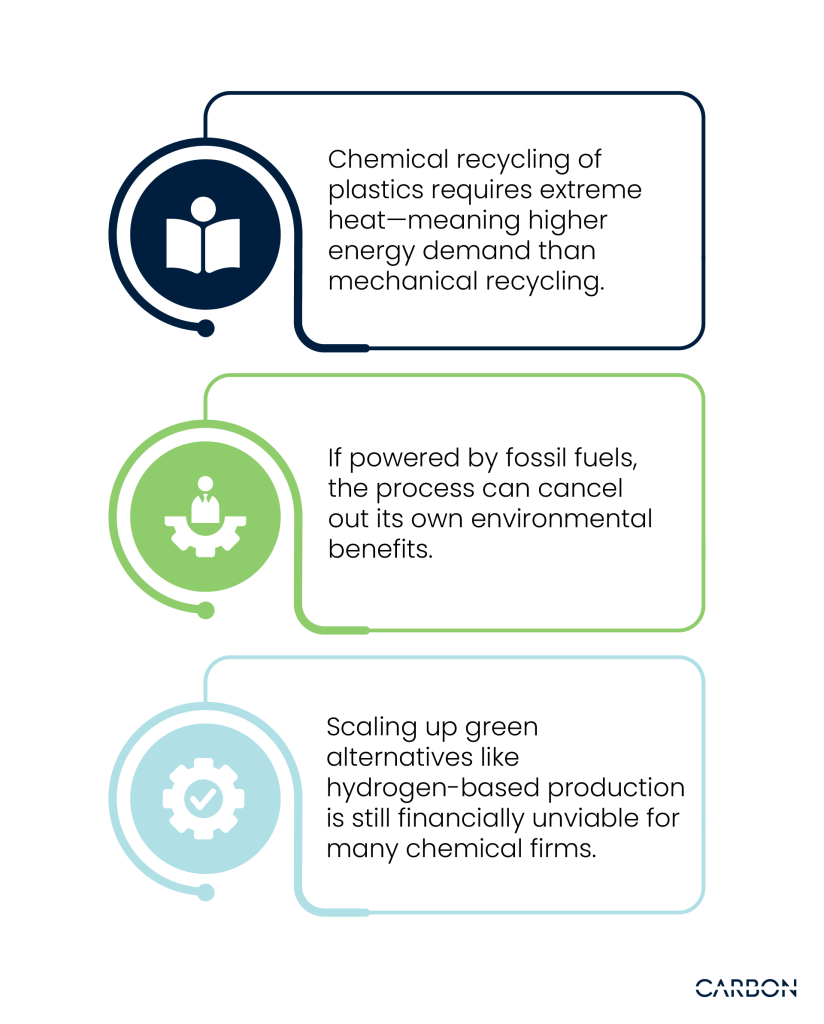

At a state-of-the-art chemical recycling plant, massive reactors churn through tons of plastic waste, breaking it down at the molecular level. But behind the scenes, there’s a problem no one talks about.

The plant’s energy bill is staggering. Despite the innovation, the process still consumes more power than fossil-fuel-based production.

Across the world, companies are promising circular supply chains, yet most plastic waste never even reaches a recycling facility. And on corporate sustainability reports, words like “recyclable” and “sustainable” appear frequently.

But how much of it is real, and how much is just greenwashing?

For all the breakthroughs in circular chemistry, the chemical industry is still struggling to scale real, impactful change. Here’s why.

High Costs & Energy Demands of Circular Solutions

The Economics of Recycling Are Still Broken

The idea of turning waste into wealth sounds great on paper, but in reality, chemical recycling remains an expensive process.

The Price of Green Hydrogen & Carbon Capture is Too High

Green hydrogen and carbon capture are supposed to help the industry phase out fossil fuels. But right now, they’re among the most expensive clean technologies available.

1. Producing green hydrogen costs between $500 to $1,250 per metric ton of CO₂ reduced, making it financially impractical for mass adoption (Harvard study).

2. Carbon capture technology is still costly—with expenses ranging from $100 to $1,000 per ton of CO₂ removed.

3. Government incentives aren’t strong enough yet to make these technologies the default choice.

Until renewable energy costs drop and government policies offer stronger financial backing, most chemical manufacturers won’t risk betting big on circular solutions.

Supply Chain & Infrastructure Gaps

We Can’t Build a Circular Economy Without a Circular Supply Chain

Imagine a factory designed to produce 100% recycled-content plastics. The technology is there, the demand is there, but there’s no stable, high-quality feedstock of waste plastic coming in.

1. Supply chain inconsistencies mean many recycling facilities operate below capacity, making the economics even harder.

2. Logistics networks are built for linear supply chains—raw materials go in, products go out. A circular system requires reverse logistics that most industries don’t yet have.

Example: Why Most Plastic Waste Never Makes It Back

Even in developed economies, the majority of plastic waste still ends up in landfills or incinerators rather than being fed back into a circular supply chain.

1. Municipal waste systems aren’t designed for industrial-scale chemical recycling.

2. Collection rates for recyclable plastics are low. In many regions, less than 30% of plastics even get sorted for potential recycling.

3. Without better tracking and sorting, recycled materials remain inconsistent and unreliable for manufacturers.

The industry is trying to close the loop, but right now, that loop is full of gaps.

The Greenwashing Problem

Are We Really Recycling… Or Just Rebranding?

Chemical companies love to market their products as “sustainable,” “recyclable,” or “green”. But how much of it actually delivers on those promises?

1. Some companies label their products as recyclable, even when there’s no infrastructure to actually recycle them.

2. Others claim to use recycled materials, but only a fraction of their products contain repurposed content.

3. Many sustainability goals are long-term targets with no accountability in the short term, letting companies appear green without making real progress.

Example: The Plastic Waste Alliance That… Created More Waste?

One of the most high-profile corporate sustainability initiatives—the Alliance to End Plastic Waste, backed by some of the largest chemical companies—pledged to divert millions of tons of plastic from the environment.

Yet, an investigation found that the member companies produced 1,000 times more plastic waste than they actually removed.

1. The backlash was swift, with consumers and investors calling out the discrepancy between promises and action.

2. Regulators are catching on. Governments are pushing for stricter definitions of recyclability and more transparency on emissions and waste.

The Chemical Industry is Losing Trust

1. Consumers are skeptical, people no longer believe every “recyclable” label on a product.

2. Investors are demanding real data. Companies that overstate sustainability claims are at risk of reputational and financial damage.

3. Regulations are catching up and governments are cracking down on false sustainability marketing, increasing compliance risks.

Why This Matters

1. Circular chemistry can’t scale until it becomes financially competitive with traditional production.

2. The supply chain gaps must be closed. Without a steady flow of waste materials, circular solutions won’t work.

3. Companies must back up their sustainability claims with real action, greenwashing is no longer an option.

Despite these challenges, change is coming and the companies that figure out how to solve these problems will be the ones leading the next phase of the chemical industry’s transformation.

So, what’s next? AI, blockchain, and advanced innovations in circular economy in the chemical industry could finally make waste-free chemical manufacturing a reality.

AI & Advanced Circular Economy Innovations

A polymer engineer stares at a molecular model on her screen, watching as an AI-powered algorithm rapidly tests thousands of chemical variations in seconds. She’s creating a polymer that can be broken down and reused indefinitely.

Across the world, a blockchain ledger logs the journey of a batch of recycled chemicals, from a waste facility in Germany to a manufacturer in Japan. For the first time, companies can track exactly where materials come from, ensuring real circularity instead of empty marketing claims.

And in a massive industrial plant, AI sensors detect inefficiency in the waste stream, predicting and correcting a process before excess materials even have a chance to become waste.

These are happening right now.

For all the roadblocks slowing down circular chemistry, AI, blockchain, and predictive analytics are finally unlocking solutions that can scale. Here’s how.

AI-Driven Molecular Engineering: Creating Circular Materials

For decades, chemical plastic recycling has been a race against material degradation. Every time plastic is reprocessed, its structure weakens, until it eventually becomes unusable.

But what if we could design materials that never degrade, no matter how many times they’re recycled?

How AI is Accelerating the Discovery of Circular Polymers

1. Traditional material science is painstakingly slow with scientists testing and refine materials manually.

2. AI can predict and simulate thousands of polymer structures in seconds, accelerating the process by years.

3. This means we can design plastics that are infinitely recyclable—solving the biggest flaw in today’s recycling system.

Real-World Example: IBM’s Hypertaste AI

Blockchain for Circular Supply Chains: Stopping Greenwashing

Right now, companies can claim to use recycled materials even if they only use a tiny fraction. The lack of supply chain transparency makes it nearly impossible to verify sustainability claims.

How Blockchain Fixes the Problem

1. Blockchain creates an unalterable digital ledger, tracking a material’s journey from waste to product.

2. Instead of relying on self-reported data, blockchain verifies exactly how much recycled content a company is using.

3. This technology forces accountability, companies can no longer mislead consumers with vague “recyclable” labels.

Real-World Example: Circularise’s Blockchain Solution

Circularise is working with major chemical firms like Asahi Kasei, Borealis, Neste, Trinseo, and Shell to digitally track certified sustainable materials using blockchain.

1. The system ensures accurate auditing of recycled content, preventing companies from overstating their sustainability efforts.

2. This approach will soon become an industry standard, as investors and regulators demand greater transparency in circular supply chains.

AI-Powered Predictive Waste Optimization: Eliminating Waste Before It Happens

But even the best recycling technologies won’t fix the problem if waste is generated in excess. The most powerful tool for circularity is preventing waste in the first place.

How AI is Making Industrial Waste Predictable

1. AI-powered sensors analyze production lines in real-time, identifying where material usage is inefficient.

2. Instead of waiting until waste piles up, AI prevents waste before it happens—reducing unnecessary production and raw material use.

3. Predictive analytics can optimize supply chains, ensuring factories only use the materials they actually need.

Why This Matters: The New Era of Smart Circularity

1. AI is accelerating material innovation, making fully recyclable chemicals a reality.

2. Blockchain is eliminating greenwashing, forcing companies to prove their circularity claims.

3. AI-powered waste optimization is shifting the focus from “recycling better” to “wasting less.”.

Circularity is about designing waste out of the system entirely.

And the companies that embrace these technologies will reduce their carbon footprint and gain a competitive advantage in a world where sustainability is no longer optional.

So, what’s next? The race to a waste-free chemical industry.

From Waste Reduction to Value Creation

For years, sustainability in the chemical industry has been framed as a cost, a problem to be managed, a risk to be minimized.

But the companies that thrive in the coming decade will be the ones that create value from it.

The next revolution is AI in chemical manufacturing, and turning waste into wealth. And the industries that move first will be leading markets.

The race is on.