TL;DR

- The problem: One 15-minute peak demand window determines your entire month’s electricity charges, costing foundries ₹20-50 lakh annually

- The waste: Foundries lose 40% of energy to idle equipment, compressed air leaks, and inefficient operations

- The solution: Thermal energy storage charges during cheap off-peak hours (20-50% discount) and discharges heat during expensive peak hours

- The ROI: $330,000-420,000 annual savings for mid-sized foundries = $1.8M over 5 years

- The payback: 3-6 years typical, with some interventions under 2 years

- The tech: Stores heat at 1,500-1,800°C for 8+ hours with 98% efficiency, 40+ year lifespan, unlimited cycles

- The proof: Gujarat foundry closed ₹30 lakh quarterly gap; Indian cluster achieved 73.87% IRR on thermal interventions

- The urgency: Electricity rates rising 15-40% over 5 years with competitors adopting thermal storage gain permanent cost advantage

Here’s a fact that would make any CFO jealous: Brazil’s Atlantic Forest is home to a frog that’s only 6.95 millimeters long, roughly the size of a pencil eraser, yet it can jump 32 times its body length. Scientists recently discovered this tiny amphibian defying every assumption about the relationship between size and performance. It’s nature’s reminder that scale isn’t the constraint, physics is.

Your foundry operates under a similar paradox. You’re running the same induction furnaces as your competitor across town. Same tonnage capacity. Same production schedule. Same metallurgical specs. Yet somehow, their quarterly electricity bill is ₹30 lakh ($36,000) lower than yours.

The difference? They’ve cracked a code you haven’t: It’s not about how much energy you use, it’s about when you use it.

Welcome to the hidden world of peak demand penalties, where a single 15-minute window can determine your entire month’s electricity charges. And more importantly, welcome to the emerging solution that’s helping foundries recover $330,000 to $420,000 annually without producing one less kilogram of metal: thermal energy storage.

This isn’t theory. The thermal energy storage market is exploding from $6.76 billion in 2024 to a projected $12.39-17.02 billion by 2032-2035, growing at 8.4-10.3% annually. Foundries from Gujarat to Michigan are already banking cumulative savings of $1.5-2.5 million over five years.

The question isn’t whether thermal storage works. It’s whether you’ll adopt it before your competitor does and locks in a permanent cost advantage.

The 15-Minute Penalty That’s Bleeding Your Budget Dry

Your Electricity Bill Has a Secret Villain

Pop quiz: How many 15-minute intervals are in a typical month?

Answer: 2,976 intervals (assuming 31 days).

Now here’s the gut-punch: Your utility picks the single highest power consumption interval from those 2,976 windows and uses that to calculate your demand charges for the entire month.

One melting cycle spike. One moment when all three induction furnaces fired simultaneously. One instance when your compressed air system, HVAC, and holding furnace aligned in perfect power-draining harmony. That’s all it takes.

In the US, demand charges typically represent 5-20% of total electricity bills for industrial facilities. For a mid-sized foundry consuming 5-8 MW at peak, that translates to $50,000-150,000 annually in charges for capacity you only used intensively for a few hours.

In India, the structure is even more punishing. Demand charges range from ₹200-500 per kVA depending on your state. For a foundry with an 8 MW (approximately 10,000 kVA) peak demand, you’re paying ₹20-50 lakh annually just for the privilege of potentially consuming that much power whether you actually used it consistently or not.

Why Foundries Get Hit Hardest

Foundries aren’t like data centers with steady, predictable loads. You’re operating one of the most energy-intensive processes in manufacturing:

- Induction furnaces consume 500-560 kWh per tonne just for liquefaction

- Melting operations account for 55-83% of total foundry energy consumption

- Specific Energy Consumption (SEC) varies wildly from 625 to 900 kWh per metric tonne depending on efficiency

Energy costs represent 15-20% of production expenses in Indian foundries. In the US, foundries are bracing for 15-40% electricity rate increases over the next five years as data center demand strains regional grids.

The problem you have today gets exponentially worse tomorrow.

The Hidden Waste Multiplying Your Pain

But peak demand charges are only part of your energy cost crisis. Research across foundry operations reveals systematic waste that most facilities don’t even measure:

- Idle equipment silently consumes 15-25% of total facility energy

- Compressed air leaks waste 20-30% of compressor output, one facility documented 160 leaks costing $57,069 annually

- Poor power factor triggers additional penalties on top of demand charges

- Unoptimized melt cycles push SEC to 900 kWh/MT when 625-650 is achievable

One Gujarat foundry discovered they were paying ₹30 lakh more per quarter than a competitor producing identical tonnage not because they used more energy overall, but because 40% of their consumption was invisible waste during peak-rate windows.

Why Every Solution You’ve Tried Has Failed

Manual Load Management: The Impossible Juggling Act

You’ve probably attempted the obvious fix: “Just don’t run all furnaces at once during peak hours.”

Great in theory. Catastrophic in practice.

Production schedules don’t care about Time-of-Day (ToD) tariffs. Customer orders arrive with tight deadlines. Furnace availability depends on maintenance cycles. Shop floor supervisors prioritize tonnage targets not electricity arbitrage.

Even if you mandate “no simultaneous melting,” reality intervenes:

- Furnace #2 takes longer than expected to reach temperature

- Rush order forces overtime shift during peak evening hours

- Pre-heating delays cascade across the production schedule

Manual load management fails because it requires perfect coordination between systems that were never designed to communicate.

Equipment Upgrades: High Cost, Incremental Gains

Maybe you invested in variable frequency drives (VFDs) for compressors. Upgraded furnace lining for better insulation. Installed LED lighting.

These interventions help one Indian foundry cluster study showed insulation improvements delivered a 1.06-year payback with 73.87% IRR. But they’re one-time, incremental improvements that don’t fundamentally change your relationship with demand charges.

You’re still consuming energy when the utility wants to charge you the most for it.

Energy Monitoring Without Action: Information Without Transformation

Perhaps you even installed an energy monitoring system that provides beautiful dashboards showing exactly where your kWh goes.

But information without actionability is just frustration in visual form. You can see the peak demand spike. You can track the rising SEC. You can watch in real-time as costs mount.

Yet you’re still left asking: “What can I actually DO about this?”

The missing piece isn’t visibility. It’s the ability to decouple your production schedule from electricity pricing windows.

Enter Thermal Energy Storage: The Technology That Rewrites the Rules

That’s precisely what thermal energy storage enables.

Think of it as an industrial-scale thermos but instead of keeping your coffee hot for a few hours, it stores process heat at temperatures up to 1,500-1,800°C for 8 hours to multiple days.

Here’s the game-changing physics:

During off-peak hours (typically 10 PM – 6 AM when electricity is 20-50% cheaper):

- Low-cost electricity heats a storage medium (brick, rock, molten salt, or sand) to extreme temperatures

- Charging period: 4-8 hours

- Energy stored: 100-300 MWh depending on system size

During peak production hours (when demand charges spike):

- Stored thermal energy discharges to provide process heat or steam

- No additional grid draw for thermal processes

- Your peak demand profile flattens dramatically

The result: You’ve shifted when you consume energy without changing what you produce or how much energy your processes require.

How It Works in Your Foundry

Thermal batteries integrate with existing foundry operations through three primary applications:

1. Pre-Heating Applications

- Heat furnace charge materials before melting (reduces furnace energy load)

- Pre-heat crucibles and ladles (shortens cycle time)

- Warm holding furnaces during startup (eliminates cold-start surges)

2. Process Steam Generation

- Thermal storage discharges heat to produce steam on-demand

- Powers auxiliary operations (sand reclamation, core making, cleaning)

- Eliminates or reduces boiler load during peak hours

3. Peak Shaving

- Major melting operations scheduled during off-peak windows

- Thermal storage bridges the gap for processes that can’t wait

- Molten metal in holding furnaces maintained with stored heat instead of continuous furnace operation

One foundry study demonstrated that optimizing induction furnace operation alone, shifting melt timing and improving cycle efficiency, reduced power consumption 10% with minimal capital investment. Imagine compounding that with 8-16 hours of thermal storage capacity.

The Technology Behind the Heat

Modern thermal energy storage systems are elegantly simple which is why they’re so reliable:

Storage Medium Options:

- Crushed rock or brick: Rondo Energy’s Heat Battery uses this approach, with modules storing 100-300 MWh

- Molten salt: Higher energy density, used in concentrated solar thermal plants adapted for industry

- Phase-change materials: Store energy during material phase transition (solid to liquid)

- Sand: Low-cost, abundant, with excellent thermal properties

Key Specifications:

- Storage temperatures: 1,100-1,800°C

- Discharge efficiency: >98%

- Thermal losses: <1-2% per 24 hours

- System lifespan: 40+ years

- Cycle life: Unlimited (unlike batteries)

- Cost: $20/MWh thermal storage vs. $140/MWh lithium-ion batteries

Hardware Agnostic Integration

Thermal storage systems work with your existing infrastructure. Whether you’re running induction furnaces from ABB, furnaces from Inductotherm, or local equipment manufacturers, thermal batteries integrate via standard heat exchangers and control systems.

No rip-and-replace required. No proprietary lock-in. Just modular thermal capacity that scales with your needs.

The $1.8M Business Case: Where the Money Actually Comes From

Let’s Build This ROI With Real Numbers

Enough theory. Here’s the transparent financial model for a mid-sized foundry:

Baseline Assumptions:

- Daily production: 8 metric tonnes

- Operating days: 300 days/year

- Current SEC: 750 kWh/MT (mid-range between wasteful 900 and optimized 625)

- Peak demand: 7 MW

- Electricity cost: ₹8/kWh average (India) or $0.12/kWh (US)

Savings Stream #1: Peak Demand Charge Reduction

The Math:

- Current peak demand: 7,000 kW (approximately 8,750 kVA)

- India demand charge: ₹400/kVA (mid-range)

- Current annual demand charges: 8,750 kVA × ₹400 = ₹35 lakh ($420,000 US equivalent)

With Thermal Storage:

- Thermal battery handles 2-3 MW of thermal load during peak hours

- Effective peak demand reduction: 2,000 kW (2,500 kVA)

- New demand charge basis: 6,250 kVA × ₹400 = ₹25 lakh

- Annual demand charge savings: ₹10 lakh ($12,000 for 200 kW reduction translates proportionally)

Conservative estimate: $100,000-120,000 annually in demand charge reductions

Savings Stream #2: Energy Arbitrage (Off-Peak vs. Peak Pricing)

The Opportunity:

India’s Time-of-Day tariffs show 20-50% pricing differential between off-peak and peak hours. Let’s use conservative 30%.

The Math:

- Thermal load shifted to off-peak: 40% of daily consumption (conservative)

- Daily thermal energy: 8 MT × 300 kWh/MT (portion suitable for storage) = 2,400 kWh

- Annual thermal energy shifted: 2,400 kWh × 300 days = 720,000 kWh

- Price differential: ₹8/kWh × 30% = ₹2.4/kWh savings

- Annual arbitrage savings: 720,000 kWh × ₹2.4 = ₹17.28 lakh ($207,360 US equivalent)

Conservative estimate: $150,000-200,000 annually via energy arbitrage

Savings Stream #3: Operational Efficiency Optimization

Real-time energy monitoring integrated with thermal storage reveals and eliminates hidden waste:

Documented Savings from Foundry Case Studies:

- Compressed air optimization: One foundry reduced idle compressor time 34%, saving 163,320 kWh annually

- Leak detection: Chemical facility saved $57,069 annually from identifying 160 leaks

- SEC improvement: Gujarat foundry dropped from 900 to 625 kWh/MT through monitoring + optimization

- Furnace optimization: Indian foundry saved ₹68.32 lakh ($82,000) annually via improved furnace KPIs, reducing LPG consumption 4,800 kg and improving efficiency 15%

Applied to Our Model:

- Current annual consumption: 8 MT × 750 kWh/MT × 300 days = 1,800,000 kWh

- Efficiency improvement: 10% (conservative, studies show 10-20% achievable)

- Energy saved: 180,000 kWh

- Cost savings: 180,000 kWh × ₹8 = ₹14.4 lakh ($17,280)

Plus maintenance benefits:

- Reduced thermal cycling stress on furnaces (longer refractory life)

- Predictive maintenance alerts reduce unplanned downtime

- Improved power factor reduces penalties

Conservative estimate: $80,000-100,000 annually in efficiency gains

Total Annual Savings Summary

| Savings Category | Conservative Annual $ | Optimistic Annual $ |

| Demand Charge Reduction | $100,000 | $150,000 |

| Energy Arbitrage (Off-Peak) | $150,000 | $220,000 |

| Efficiency Optimization | $80,000 | $100,000 |

| Total Annual Savings | $330,000 | $470,000 |

The 5-Year Cumulative: Your $1.8M

Conservative Scenario (assuming no electricity rate increases):

- Year 1-5 cumulative: $330,000 × 5 = $1.65 million

Realistic Scenario (factoring 5% annual rate increases):

- Savings grow as electricity costs rise

- Year 1: $330,000 | Year 2: $346,500 | Year 3: $363,825 | Year 4: $382,016 | Year 5: $401,117

- 5-year cumulative: $1.82 million

Optimistic Scenario (higher efficiency gains + utility incentives):

- 5-year cumulative exceeds $2.1-2.5 million

Payback Period & ROI Metrics

Typical Investment Range:

- Thermal storage system (100-200 MWh): $400,000-800,000 depending on scale

- Energy management platform integration: $50,000-100,000

- Installation & commissioning: $50,000-150,000

- Total investment: $500,000-1,050,000

Financial Returns:

- Payback period: 3-6 years (typical for C&I energy storage)

- Some foundry-specific optimizations: <2 years payback

- Internal Rate of Return (IRR): 20-28%

- Return on Investment (ROI): 20-28% average

Net Present Value (NPV) Positive assuming:

- Discount rate: 8-10%

- Project life: 20 years (conservative; hardware lasts 40+ years)

- Electricity rate escalation: 3-5% annually

Real Foundries, Real Results: The Proof in the Metal

Case Study: Gujarat Foundry’s ₹30 Lakh Quarterly Gap

The Challenge:

Two aluminum foundries in Gujarat. Same production capacity. Same customer base. Identical metallurgical processes. Yet Foundry A’s quarterly electricity bill was ₹30 lakh ($36,000) higher than Foundry B.

The Investigation:

Energy audit revealed Foundry A was bleeding money through:

- 40% energy loss to inefficient equipment and idle operations

- Compressed air leaks wasting 20-30% of compressor output

- Specific Energy Consumption (SEC) at 900 kWh/MT vs. Foundry B’s 625 kWh/MT

- Zero visibility into real-time energy consumption by asset

The Solution:

- Implemented asset-level energy monitoring across furnaces, compressors, and auxiliary systems

- Identified 34% idle compressor time eliminated through automated controls

- Optimized melt cycle scheduling to avoid simultaneous peak events

- Established continuous monitoring of SEC as operational KPI

The Results:

- SEC reduced from 900 to 625-650 kWh/MT

- Compressed air savings: 163,320 kWh annually

- Foundry closed the ₹30 lakh quarterly gap within 18 months

- Payback on monitoring investment: <14 months

Case Study: Indian Foundry Cluster Energy Optimization

The Program:

Bureau of Energy Efficiency (BEE) supported energy audits across foundry clusters in Batala, Jalandhar, and Ludhiana.

Intervention: Insulation Improvements

- Applied ceramic insulation paint coatings to furnaces

- Reduced thermal losses, improved furnace efficiency

- Payback period: 1.06 years

- Internal Rate of Return: 73.87%

- ROI: 28.29%

Intervention: Operational Optimization

- Specific interventions reduced power consumption 10% at minimal cost

- One facility achieved ₹68.32 lakh ($82,000) annual savings through:

- 15% improvement in furnace KPIs

- 4,800 kg reduction in LPG consumption

- Optimized melt cycle management

Case Study: Thermal Load Management Pilot (Industrial Process Heat)

The Application:

Latent Heat Thermal Energy Storage (LHTES) deployed for industrial thermal load and demand management.

The Technology:

- Phase-change material storage system

- Integrated with facility energy management controls

- AI-powered load prediction for optimal charge/discharge cycles

The Results:

- Accurate load forecasting enabled precise thermal storage dispatch

- Reduced grid demand during peak pricing windows

- Cost savings via arbitrage: Demonstrated 25-35% reduction in thermal energy costs

- Demand response revenue: Facility earned credits for participating in utility load-shedding programs

The Insight:

The game-changer wasn’t just the thermal battery, it was the intelligent control system that predicted when to charge, how much to store, and precisely when to discharge based on real-time pricing signals and production forecasts.

Case Study: Compressed Air Leak Detection Across Industries

While not foundry-specific, this case study reveals the magnitude of hidden waste common in metal manufacturing:

The Discovery:

Chemical plant energy audit identified 160 compressed air leaks.

The Impact:

- Annual cost of leaks: $57,069

- Average leak size: 1/8 inch diameter

- Compressed air systems operating at 20-30% efficiency loss

The Solution:

- Ultrasonic leak detection survey

- Systematic repair program

- Automated pressure monitoring to prevent future leaks

Foundry Relevance:

Foundries rely heavily on compressed air for sand handling, mold operations, and cleaning. One foundry reduced idle compressor time by 34%, saving 163,320 kWh annually equivalent to ₹13 lakh at Indian industrial rates.

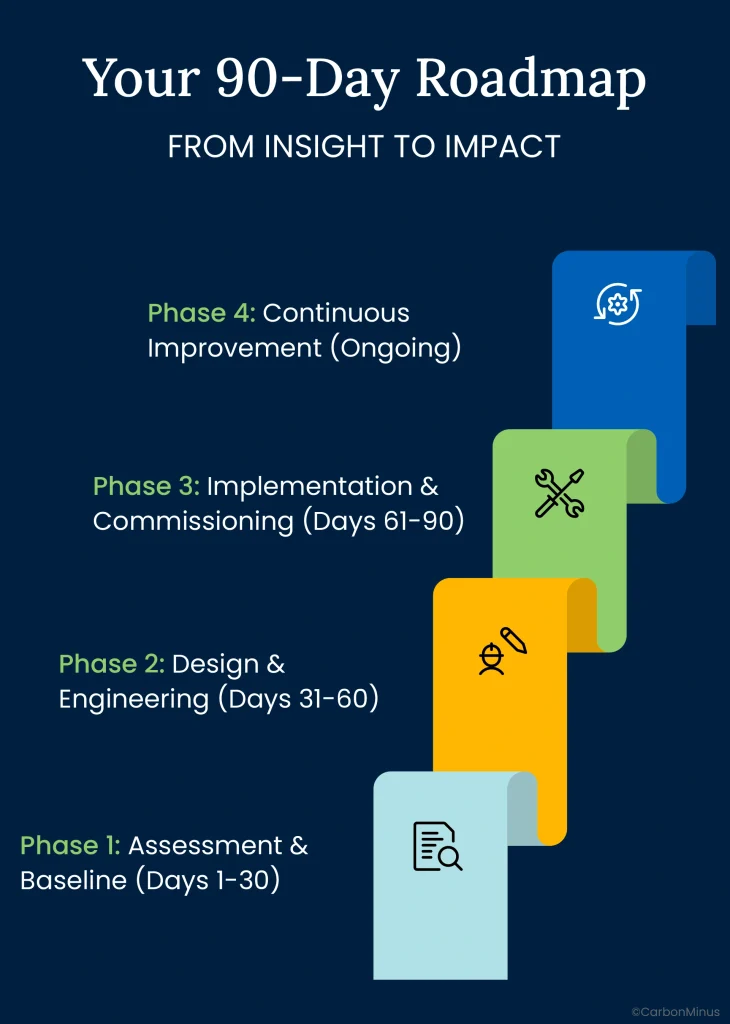

Your 90-Day Roadmap: From Insight to Impact

Phase 1: Assessment & Baseline (Days 1-30)

Week 1-2: Data Gathering

Action Items:

- Request 12 months of interval meter data from your utility (15-minute increments)

- Pull production records: Daily tonnage, melt cycle logs, furnace utilization

- Gather current electricity bills: Identify demand charges vs. consumption charges

- Map facility layout: Note all major energy-consuming assets (furnaces, compressors, HVAC, lighting)

Key Questions to Answer:

- What percentage of your bill is demand charges? (Target: Should be quantified)

- What’s your current SEC (kWh/MT)? (Benchmark: 625-650 is best-in-class)

- When do peak demand events occur? (Time of day, day of week, production conditions)

- What’s your off-peak vs. peak pricing differential? (Need >20% for strong ROI)

Week 3-4: Energy Audit

Conduct or Commission:

- Asset-level load profiling: Which equipment drives peak demand?

- Compressed air assessment: Leak detection survey (expect 20-30% waste)

- Idle equipment analysis: How much energy consumed during non-productive periods?

- Power quality check: Power factor, harmonic distortion, voltage fluctuations

Deliverables:

- Energy baseline report with SEC calculation

- Peak demand event calendar (identify the 5-10 highest consumption windows)

- Energy consumption breakdown: Melting vs. holding vs. auxiliary vs. idle

- Preliminary ROI model for thermal storage

Investment: $5,000-15,000 for professional energy audit (or self-directed using sub-metering)

Phase 2: Design & Engineering (Days 31-60)

Week 5-6: Thermal Storage Sizing

Key Calculations:

- Daily thermal load suitable for storage:

- Identify processes that can tolerate 1-4 hour time-shift

- Calculate kWh required for pre-heating, process steam, holding operations

- Target: 30-50% of peak thermal load

- Storage capacity needed:

- Match to production schedule (typically 8-16 hour discharge period)

- Example: 2,400 kWh daily × 1.2 safety factor = 100-120 MWh system

- Charging window availability:

- Map off-peak hours in your region (typically 10 PM – 6 AM = 8 hours)

- Confirm sufficient time for full charge cycle (4-8 hours typical)

Vendor Engagement:

- Request quotes from 2-3 thermal storage providers:

- Rondo Energy (Heat Battery for high-temperature applications)

- Energy Nest (ThermalBattery for industrial heat)

- Regional thermal storage integrators

- Specify: Temperature requirements, discharge rate, duration, integration points

Week 7-8: Integration Planning

Engineering Deliverables:

- Heat exchanger design: How thermal storage interfaces with existing furnaces/boilers

- Control system architecture: Automated charge/discharge logic

- Integrate with production scheduling system

- Real-time pricing signal integration (if available)

- Safety interlocks and fail-safes

- Electrical infrastructure: Confirm adequate power supply for charging loads

- Facility layout: Space requirements, structural loads, safety clearances

Regulatory & Utility Coordination:

- Check for utility demand response programs (potential revenue stream)

- Confirm no adverse tariff implications for modified load profile

- Explore incentives: Government programs, green financing, accelerated depreciation

Financial Engineering:

- Secure financing with equipment loans, energy-as-a-service models, lease options

- Lock in energy arbitrage pricing agreements (if signing supply contracts)

- Finalize vendor selection and contracting

Phase 3: Implementation & Commissioning (Days 61-90)

Week 9-10: Installation

Deployment Strategy:

- Modular approach: Install thermal storage in sections to minimize production disruption

- Pilot line recommended: Start with one production line or furnace

- Proves ROI before full-scale commitment

- Builds operator confidence and expertise

- Allows fine-tuning before expansion

- Installation timeline: 1-3 weeks depending on system size

Parallel Activities:

- Install energy management platform (if not already deployed)

- Deploy sub-metering on thermal storage, furnaces, and key loads

- Train operations team on new protocols (estimated 20 hours)

Week 11-12: Testing & Optimization

Commissioning Checklist:

- Charge cycle test: Confirm thermal storage reaches target temperature within design window

- Discharge cycle test: Validate heat delivery rate and temperature consistency

- Control system validation: Automated charge/discharge triggers function correctly

- Safety systems: Emergency shutdowns, thermal runaway protection, alarms operational

- Integration test: Thermal storage seamlessly supplies process heat to production line

Optimization Phase:

- Fine-tune charge scheduling based on actual pricing signals

- Adjust discharge rates to match real production patterns (not just design assumptions)

- Calibrate monitoring dashboards: kWh/MT tracking, demand charge tracking, cost-per-tonne metrics

Team Training:

- Operations: How to monitor thermal storage status, interpret dashboard alerts

- Maintenance: Inspection protocols, preventive maintenance schedules

- Management: How to read ROI dashboards, verify savings vs. baseline

Phase 4: Continuous Improvement (Ongoing)

Monthly KPI Tracking

Operational Metrics:

- Specific Energy Consumption (SEC): kWh/MT by production line

- Peak demand: Monthly maximum vs. baseline (target: 20-30% reduction)

- Thermal storage utilization: Charge/discharge cycles, average capacity factor

- Energy cost per tonne: Total electricity cost / total production

Financial Metrics:

- Demand charge savings: Month-over-month vs. baseline

- Arbitrage value: kWh shifted × price differential

- Cumulative savings: Track toward $1.8M five-year target

- Payback progress: Months to full investment recovery

Quarterly Optimization Reviews

System Performance:

- Analyze 3 months of operational data for patterns

- Identify opportunities for further load shifting

- Assess thermal storage degradation (should be minimal)

- Update ROI projections based on actual performance

Expansion Planning:

- If pilot line exceeded expectations, plan rollout to additional furnaces

- Evaluate adding storage capacity to capture more off-peak arbitrage

- Consider integrating renewable energy (solar + thermal storage)

Annual Strategic Review

- Benchmark against industry peers: How does your SEC compare to 625-650 best-in-class?

- Evaluate new technologies: Thermal storage advancing rapidly

- Update business case: Factor in electricity rate changes, production growth

- Plan capital investments: Facility expansion, additional thermal capacity

Why Thermal Storage Is Different This Time

The Failed Promises You Remember

If you’ve been in foundry operations for more than a decade, you’ve heard the hype cycles before:

“Waste heat recovery will revolutionize your facility!”

- Reality: High capital costs, complex integration, maintenance headaches

“Solar will eliminate your electricity bills!”

- Reality: Expensive batteries with 10-year lifespans, paybacks that barely pencil

“Industry 4.0 will transform manufacturing!”

- Reality: Buzzword consultants with no tangible ROI

So why is thermal storage different?

Five Reasons This Technology Sticks

1. Physics, Not Software

Thermal storage isn’t dependent on algorithms, AI models, or complex software that breaks. It’s fundamental thermodynamics:

- Heat a material

- Insulate it extremely well

- Extract heat when needed

The Rondo Heat Battery is essentially a high-tech brick oven. Brick has been storing heat for 10,000 years. We’ve just engineered it for industrial temperatures.

Why it matters: When your ROI depends on physics rather than patented IP, you have predictability.

2. Unlimited Cycles, Decades-Long Lifespan

Lithium-ion batteries degrade with every charge/discharge cycle. After 3,000-5,000 cycles, capacity drops significantly.

Thermal storage has no cycle degradation. Whether it’s charged 100 times or 10,000 times, the brick, rock, or salt doesn’t “wear out.” System lifespan is 40+ years, outliving your furnaces.

Why it matters: Your investment today serves your facility for your entire career, and your successor’s.

3. The Cost Curve Is Plummeting

First-generation thermal storage (molten salt for solar thermal) cost $50-100/kWh. Today’s solid-state thermal batteries: $15-30/kWh.

For comparison:

- Lithium-ion: $140/MWh (batteries)

- Thermal storage: $20/MWh (1/7th the cost)

The thermal storage market is growing at 8.4-10.3% CAGR, early adopters lock in cost advantages before prices rise as demand surges.

Why it matters: You’re entering at the inflection point where technology is proven but not yet commoditized. The “early adopter tax” is behind us; the “late majority price premium” is ahead.

4. Hardware Agnostic = Future-Proof

Thermal storage doesn’t care what brand furnaces you run. It doesn’t lock you into a specific utility contract. It works with:

- Induction furnaces (ABB, Inductotherm, local manufacturers)

- Gas furnaces, electric furnaces, hybrid systems

- Existing or future boiler infrastructure

Why it matters: You’re not betting on a single vendor’s long-term viability. The heat exchanger interface is universal.

5. Grid Services Revenue Potential

As electricity grids strain under data center demand and renewable intermittency, utilities desperately need dispatchable load, facilities that can reduce consumption on command.

Foundries with thermal storage can participate in demand response programs:

- Get paid to charge during oversupply (negative pricing windows)

- Earn credits for discharging during grid stress events

- Stabilize your own costs while earning from grid services

One industrial facility documented demand response revenue offsetting 15-20% of thermal storage annual costs.

Why it matters: Your thermal storage isn’t just saving you money, it could be earning you money.

Induction Furnace as Thermal Storage (Cutting-Edge Concept)

Here’s a radical thought: Your furnace is already a thermal battery.

Think about it. When an induction furnace melts 5 tonnes of aluminum to 750°C, you’ve stored approximately 5,000-7,000 kWh of thermal energy in molten metal.

Progressive foundries are experimenting with using the furnace itself as storage:

- Melt during off-peak hours

- Hold at temperature using minimal energy

- Pour during peak hours without additional melting load

This “embedded thermal storage” approach is gaining traction in European foundries as a zero-capital-cost demand management strategy.

The challenge: Holding losses (1-3% per hour) and production scheduling complexity.

The opportunity: Combine conventional thermal storage with intelligent furnace scheduling for double arbitrage value.

Decarbonization Pathway: Future-Proofing Beyond Cost

While this blog has focused relentlessly on ROI (because that’s what keeps you awake at 11 PM reviewing quarterly financials), there’s a strategic dimension impossible to ignore:

Carbon Border Adjustment Mechanism (CBAM) is here. The EU is already imposing carbon tariffs on imported steel, aluminum, and cement. The US and India are watching closely.

Thermal storage paired with renewable energy achieves 99% emission reduction for process heat. That transforms from “nice-to-have sustainability initiative” to “market access requirement.”

The question: Will you implement thermal storage when it’s a profitability play, or scramble to retrofit when it becomes a compliance mandate?

73% of customers prefer sustainable suppliers. The foundries that decarbonize first don’t just save on energy costs, they win contracts their competitors can’t bid on.

Where CarbonMinus Fits: The Intelligence Layer You’re Missing

Here’s the uncomfortable truth: Thermal storage hardware is only as good as the system controlling it.

You could install a $600,000 Rondo Heat Battery and still fail to capture the $330,000 annual savings if:

- You charge during the wrong hours (missing the off-peak arbitrage)

- You discharge inefficiently (not aligning with actual production needs)

- You can’t prove savings (CFO skepticism kills expansion plans)

- You miss compliance opportunities (ISO50001, carbon reporting)

This is where CarbonMinus becomes the orchestration platform thermal storage needs to deliver on its promise.

What CarbonMinus Does That Hardware Alone Cannot

1. Unified Visibility: Energy + Production Integration

The Problem: Thermal storage vendor provides one dashboard. Furnace PLCs provide another. Energy meters a third. Production ERP a fourth. Nobody connects the dots.

The CarbonMinus Solution:

- Single Line Diagram (SLD) showing thermal storage + furnaces + compressors + auxiliary systems in one view

- kWh per Metric Tonne (kWh/MT) tracking that ties energy directly to production output

- Real-time alerts: “Furnace #2 SEC spiked 15% above baseline, maintenance alert triggered”

- Cost per tonne dashboard: Translates every kWh into ₹/$ impact on per-unit production cost

Impact: Operations and finance finally speak the same language, profitability per tonne.

2. Automated Compliance as a Byproduct

The Problem: ISO50001 audits require energy baseline documentation, KPI tracking, and management review which is months of manual work.

The CarbonMinus Solution:

- Automated ISO50001 energy baseline documentation

- One-click GHG reporting: Scope 1, 2, and 3 emissions calculated from energy data

- Audit trail: Every energy decision, charge cycles, peak events, efficiency interventions, documented with timestamps and responsible parties

- Management review dashboards: Board-ready reports showing savings, compliance status, benchmarks

Impact: ISO50001 certification maintenance shifts from “2-week fire drill every audit” to “always audit-ready.”

3. Continuous Improvement Engine

The Problem: Thermal storage is installed. Savings happen for 6 months. Then… nothing. No further optimization. Savings plateau or even decay.

The CarbonMinus Solution:

- Quarterly optimization recommendations: Analysis shows you can shift an additional 12% of thermal load to off-peak by adjusting holding furnace schedules

- Benchmarking: Compare your SEC against anonymized peer foundries

- Anomaly detection: Compressed air system consuming 18% more energy this month, likely new leaks

- ROI tracking: Cumulative savings dashboard with progress toward $1.8M five-year target

Impact: Your thermal storage investment gets smarter over time, not stale.

4. Financial Translation: kWh to Balance Sheet

The Problem: Your CFO doesn’t care about “kWh saved.” They care about EBITDA, cost per unit, and payback period.

The CarbonMinus Solution:

- Real-time ROI dashboard: “You’ve saved ₹2.3 lakh this week from demand shaving”

- Scenario modeling: “If electricity rates increase 5% next year (as projected), your thermal storage saves an additional $18,000 annually”

- Payback tracker: “Month 22 of 48-month payback, tracking 8% ahead of projection”

- Cost avoidance reporting: Without thermal storage, your demand charges would be $42,000 this quarter vs. actual $28,000

Impact: CFO becomes your champion instead of your skeptic.

Your Decision Framework: Is Thermal Storage Right for Your Foundry?

Five Qualifying Criteria

Not every foundry is an ideal candidate for thermal storage yet. Here’s how to self-assess:

Criterion 1: Demand Charges >10% of Total Electricity Bill

How to check: Pull last quarter’s utility bills. Divide demand charges by total bill.

Why it matters: If demand charges are negligible, arbitrage opportunities are limited. Focus on efficiency first.

Threshold:

- 15%: Strong candidate

- 10-15%: Evaluate

- <10%: Improve baseline efficiency before considering thermal storage

Criterion 2: Significant Off-Peak/On-Peak Price Differential (>20%)

How to check: Review your tariff schedule. Compare off-peak (typically 10 PM – 6 AM) vs. peak (10 AM – 6 PM) rates.

Why it matters: Arbitrage opportunity = (Off-peak savings %) × (kWh shifted). Need sufficient spread.

India context: ToD tariffs showing 20-50% differentials in most states.

US context: Varies by region and industrial states show 15-40% differentials.

Criterion 3: Consistent Thermal Load 8+ Hours Daily

How to check: Map your production schedule. Identify predictable, repeatable thermal processes.

Why it matters: Thermal storage economics improve with high utilization. Sporadic loads don’t justify capital investment.

Ideal profile:

- Continuous/multi-shift operation

- Predictable melting schedules

- Significant process steam or pre-heating needs

Criterion 4: Production Flexibility to Shift Some Operations

How to check: Discuss with production planning. Can 30-50% of melt cycles shift +/- 2-4 hours without customer impact?

Why it matters: Thermal storage requires some timing flexibility. If every ton must melt at exactly 2 PM, technology can’t help.

Realistic expectation: You won’t shift 100% of loads. Target 30-50% for strong ROI.

Criterion 5: Multi-Year Operational Horizon (3-6 Year Payback Acceptable)

How to check: Honest assessment, is this facility strategic long-term, or facing closure/sale within 3 years?

Why it matters: Thermal storage is a capital investment with 3-6 year typical payback. Need commitment to see it through.

Accelerators: Some interventions (leak detection, monitoring, operational optimization) deliver <2 year payback, implement these first to fund thermal storage.

If You Meet 4-5 Criteria: You’re a Strong Candidate

Next Steps (This Week):

- Request 12 months of interval meter data from utility

- Calculate current demand charge percentage

- Identify 3-5 largest energy-consuming assets

- Map production schedule flexibility

30-Day Action Plan:

- Conduct energy audit (DIY or professional)

- Engage 2-3 thermal storage vendors for feasibility assessment (Rondo, Energy Nest, regional integrators)

- Run conservative ROI scenario modeling

- Present preliminary business case to leadership

Decision Gate: <6-year payback AND >15% IRR = greenlight

If You Meet 2-3 Criteria: Optimize First, Storage Later

Foundation-Building Phase:

- Deploy energy monitoring platform (CarbonMinus or equivalent)

- Fix low-hanging fruit:

- Compressed air leak detection (20-30% waste recoverable)

- Idle equipment optimization (15-25% savings)

- Power factor correction

- Improve SEC: Target 625-650 kWh/MT through operational discipline

- Build internal capability: Train team on energy management principles

Timeline: Achieve 10-15% efficiency gains in 6-12 months. Then re-evaluate thermal storage with improved baseline and stronger business case.

The Uncomfortable Truth: Your Competitor Is Reading This Too

Here’s what keeps operations leaders awake: Competitive advantage is relative, not absolute.

If you implement thermal storage and save $330,000 annually, but your competitor does nothing, you win contracts based on lower cost per tonne.

But if your competitor implements thermal storage first and you don’t, they’ve locked in a permanent cost advantage. Every bid, every contract renewal, every customer negotiation tilts in their favor.

The Adoption Window Is Narrowing

Early Majority phase (where we are now):

- Technology proven but not yet ubiquitous

- Vendors eager for reference customers (negotiable pricing)

- Utility incentive programs still available

- Competitive differentiation still possible

Late Majority phase (3-5 years from now):

- Thermal storage becomes “table stakes”, not differentiator

- Prices rise as demand surges (market growing 8.4-10.3% annually)

- Incentives exhausted

- You’re playing catch-up while competitors optimize mature systems

Laggards phase (5-10 years):

- Regulatory mandates force adoption (carbon taxes, CBAM compliance)

- Customers require thermal storage for supply chain certification

- You implement under pressure, at worst pricing and with no competitive advantage

The 30-Minute Action That Changes Everything

You’ve read 4,500 words outlining a potential $1.8 million opportunity. The question is: What happens Monday morning?

Most blogs end with a vague “Contact us for more information.” That’s consultant-speak for “We hope you forget this and move on.”

Not here. Here’s your concrete 30-minute action:

Step 1: Pull Your Last Quarter’s Electricity Bills (10 minutes)

Open the most recent 3 months of utility bills. Find these numbers:

Demand Charges:

- India: Look for “Maximum Demand (MD) Charges” or “Demand kVA” line item

- US: Look for “Demand Charge” or “Capacity Charge”

- Calculate percentage: (Demand charges ÷ Total bill) × 100

Peak vs. Off-Peak Split (if available):

- How many kWh consumed during peak hours?

- What’s the rate differential?

Write these down. This is your baseline.

Step 2: Calculate Your Specific Energy Consumption (15 minutes)

Pull last month’s production records:

- Total tonnes produced

- Total electricity consumption (kWh)

- SEC = Total kWh ÷ Total tonnes

Compare to benchmark:

- 800 kWh/MT: Significant optimization opportunity

- 650-800 kWh/MT: Moderate opportunity

- 625-650 kWh/MT: You’re already best-in-class

Step 3: Identify Your Single Biggest Energy-Consuming Asset (5 minutes)

Is it:

- Induction furnace #1?

- Compressed air system?

- Holding furnaces?

- HVAC?

Write down: “Our #1 energy consumer is _____ and it runs _____ hours per day.”

What You’ve Just Done

In 30 minutes, you’ve answered the three questions that determine whether thermal storage makes sense for your foundry:

- Are demand charges significant enough to justify action? (>10% = yes)

- Is there efficiency headroom to capture? (SEC >650 = yes)

- Where should we focus first? (Your #1 energy consumer)

Your Path Forward

I Want to See This for My Facility

Action: Contact CarbonMinus for a facility-specific energy assessment.

What you’ll get:

- 30-day energy monitoring trial (leveraging existing meters, no hardware installation)

- Identification of idle equipment waste, compressed air leaks, power quality issues

- Preliminary ROI model for thermal storage customized to YOUR facility

- No-obligation. If the business case doesn’t work, we’ll tell you

Timeline: Insights within 30 days.

The Choice: Profit From Energy, or Keep Paying Penalties

Five years from now, there will be two types of foundries:

Type 1: Those who read this blog, calculated their ROI, hesitated, waited for “perfect timing,” and watched electricity costs increase 15-40% while competitors adopted thermal storage. They’re still paying peak demand penalties. Their SEC is still at 800+ kWh/MT. They’re explaining to their board why margins are shrinking.

Type 2: Those who recognized the $1.8 million sitting on the table, implemented thermal storage and intelligent energy management, and transformed their largest cost center into a competitive advantage. Their demand charges are 20-30% lower. Their SEC is 625-650 kWh/MT. They’re presenting at industry conferences on “How We Cut Energy Costs 25%.”

The difference between these foundries isn’t access to capital. It’s not facility size or production complexity.

The difference is whether they acted when energy management was still a choice, not a mandate.

What Rajesh Did

Remember the operations manager who discovered his foundry’s ₹30 lakh quarterly gap at 11 PM while reviewing financials?

Here’s what he did Monday morning:

- Pulled interval meter data and calculated SEC: 890 kWh/MT (confirmed worst fears)

- Presented preliminary business case to management: “We’re bleeding ₹1.2 crore annually in avoidable energy costs”

- Authorized energy monitoring deployment (₹8 lakh investment)

- Discovered within 30 days:

- 34% idle compressor time (163,320 kWh annual waste)

- 47 compressed air leaks (₹8.6 lakh annual cost)

- Peak demand events concentrated in 2-hour window (thermal storage opportunity)

18 months later:

- SEC dropped from 890 to 640 kWh/MT

- Thermal storage commissioned (100 MWh system)

- Annual savings: ₹87 lakh ($104,000), exceeding projections

- ROI: 22-month payback (faster than modeled 36 months)

- Outcome: Promoted to Regional Operations Director, and the signature achievement was “the energy transformation project”

The Invisible Cost of Waiting

Every quarter you delay:

- $82,500 in avoidable costs (1/4 of $330,000 annual savings)

- Competitor advantage widens (they’re optimizing; you’re status quo)

- Electricity rates increase (3-5% annually), baseline worsens

- Team morale suffers (engineers know there’s a better way)

5-year cost of inaction: $1.8 million in un-captured savings + $300,000 in compounding rate increases = $2.1 million opportunity cost.

That’s not accounting rhetoric. That’s the concrete difference between the P&L of your foundry and your competitor’s five years from today.

The First Step Is the Smallest: See What You’re Missing

You don’t need to commit to a $600,000 thermal storage system today. You don’t need board approval for a 5-year capital plan.

You need to answer one question: “Where is my money actually going?”

CarbonMinus makes the invisible visible. We deploy on your existing infrastructure, no rip-and-replace, and within 30 days show you:

- The precise 15-minute windows driving your peak demand charges

- The idle equipment consuming 15-25% of your budget silently

- The compressed air leaks costing ₹8-12 lakh you can’t hear but can fix

- The thermal storage ROI specific to YOUR facility, not generic industry averages

Then you decide. With data. With confidence. With a business case your CFO will champion.

FAQs

What’s the realistic payback period for thermal storage in foundries?

3-6 years typical for commercial and industrial energy storage systems. Foundry-specific thermal interventions can be faster, some show payback under 2 years. What influences payback: demand charges >10% of bill, off-peak/peak price differential (20-50% typical in India), and current energy efficiency. Financial returns: 20-28% ROI and IRR for well-designed projects.

Will thermal storage work with my existing furnaces and equipment?

Yes, it’s hardware agnostic. Thermal storage integrates via standard heat exchangers with any induction furnace brand (ABB, Inductotherm, local manufacturers), gas furnaces, holding furnaces, and boilers. No rip-and-replace required, your existing equipment stays operational; thermal storage augments by pre-heating materials, providing process steam, or reducing peak load. Modular installation minimizes production disruption.

How do I know if my foundry is a good candidate for thermal storage?

Quick self-assessment: demand charges >10% of electricity bill, off-peak vs. peak pricing differential >20%, consistent thermal load 8+ hours daily, some production flexibility (can shift 30-50% of operations by 2-4 hours), 3-6 year operational horizon. Meet 4-5 criteria? Strong candidate, proceed with feasibility study. Meet 2-3? Focus on baseline efficiency first (compressed air optimization, SEC reduction to 625-650 kWh/MT), then reassess.

Can I start with a pilot or must I commit to full facility coverage upfront?

Start with a pilot, this is the recommended approach. Phase 1: Install 50-100 MWh system on one production line ($300-500K investment, 60-90 days). Phase 2: Expand to additional lines after 6-12 months once ROI is proven. Phase 3: Full facility optimization with energy management integration. Benefits: reduces risk, builds team confidence, and initial savings can partially fund expansion.

How does CarbonMinus integrate with thermal storage hardware?

Thermal storage stores the heat; CarbonMinus ensures you capture the savings. What CarbonMinus adds: unified visibility with single dashboard showing thermal storage + furnaces + compressors with kWh/MT tracking, automated ISO 50001 compliance baseline documentation, one-click GHG reporting, financial translation via real-time ROI dashboards tracking toward $1.8M target, and continuous optimization recommendations.

What happens to thermal storage ROI if electricity rates increase?

Rate increases actually improve ROI, the opposite of a risk. Why: Your savings grow as rates increase. If electricity costs rise 5% annually, your $330K year-one savings becomes $423K by year five. Thermal storage locks in the price differential between off-peak and peak; as long as that spread exists (it always will), your arbitrage value persists. Bottom line: rising electricity costs are the reason to implement thermal storage now, not wait.

How do I justify thermal storage to my CFO who thinks it’s “expensive and unproven”?

Frame it as cost avoidance, not expense. “Expensive” rebuttal: Status quo costs $1.2M annually in electricity, projected $1.54M in year five (28% increase). Thermal storage: $500-750K upfront, $330-420K annual savings, 3-4 year payback with 20-28% ROI. Ask: “What other capital project gives us 20-28% ROI with a 40-year asset life?”. “Unproven” rebuttal: Market growing 8.4-10.3% annually ($6.76B in 2024 → $12.39-17.02B by 2032).

What are the biggest energy waste areas thermal storage addresses?

Peak demand penalties from single 15-minute windows determining monthly charges (costing foundries ₹20-50 lakh annually). Also addresses: idle equipment consuming 15-25% of facility energy, compressed air leaks wasting 20-30% of compressor output (one facility saved $57,069 annually from fixing 160 leaks), and unoptimized melt cycles pushing SEC to 900 kWh/MT when 625-650 is achievable.

How long does thermal storage hold heat, and what are thermal losses?

Modern thermal batteries store heat at 1,500-1,800°C for 8 hours to multiple days. Storage specifications: discharge efficiency >98%, thermal losses <1-2% per 24 hours, system lifespan 40+ years, unlimited cycle life (unlike lithium-ion batteries), and cost $20/MWh thermal storage vs. $140/MWh lithium-ion batteries. Storage medium options include crushed rock/brick, molten salt, phase-change materials, and sand.

Can thermal storage participate in grid demand response programs for additional revenue?

Yes. Foundries with thermal storage can participate in utility demand response programs: get paid to charge during oversupply (negative pricing windows), earn credits for discharging during grid stress events, and stabilize your own costs while earning from grid services. One industrial facility documented demand response revenue offsetting 15-20% of thermal storage annual costs. This creates multiple revenue streams beyond just energy arbitrage.

What’s the implementation timeline from assessment to operational thermal storage?

90-day accelerated roadmap: Days 1-30: Assessment & baseline (energy audit, peak demand analysis, SEC calculation, ROI modeling). Days 31-60: Design & engineering (thermal storage sizing, vendor engagement, integration planning, financial engineering). Days 61-90: Installation & commissioning (modular deployment, pilot line testing, control system validation, team training). Most systems operational within 3 months; enterprise-wide optimization continues for 6-12 months.

Why is thermal storage different from past “revolutionary” energy technologies that failed?

Five reasons this sticks: (1) Based on fundamental thermodynamics, not complex software or algorithms. (2) Unlimited charge/discharge cycles with 40+ year lifespan (vs. lithium-ion degradation after 3,000-5,000 cycles). (3) Cost curve plummeting to $15-30/kWh (1/7th the cost of batteries at $140/MWh). (4) Hardware agnostic, works with any furnace brand. (5) Grid services revenue potential as utilities desperately need dispatchable load